Yearn Finance’s governance token YFI suffered further losses this week in a bearish correction that saw its price plummet 25%.

The YFI/USD exchange rate plunged more than 5% on Friday to an intraday low of $22,030, signaling a price increase of 328% between November 5, 2020 and December 3, 2020. Therefore, traders who benefited from YFI’s volatility decided to lock in their profits on the bullish side. This sentiment has driven down the price per unit of the token.

“Large corporations” that create

This is despite Yearn Finance’s growth in the decentralized finance (DeFi) ecosystem. Decentralized return aggregator strategically merges with SushiSwap (decentralized exchange), Pickle Finance (liquidity pool for top stablecoins), CREAM Finance (lending platform), Cover Protocol (smart contract insurance protocol) and Akropolis (decentralized annuity) started. accumulation).

The Yearn Finance partnership appears to have prompted traders to increase their bids for YFI, a token that gains value through project profits and voting features. So the price bounced back exponentially over the course of a month, but the upward momentum seemed to be overheating. As a result, YFI/USD has been on a downward trend this week.

Yearn Finance ecosystem is among the most emerging ones in the DeFi factor. Source: Electric Capital

That said, a correction seems like a natural response to increasing volatile momentum. But that doesn’t take away from Yearn Finance’s long-term growth prospects, as the project is now emerging as a large enterprise in its own right.

“In short, Yearn, the protocol, is a coordination mechanism for efficient capital allocation, while Yearn, the ecosystem, aims to become a conglomerate of growing symbiotic financial protocols,” Messari researchers Ryan Watkins and Jonathan Otto wrote in a recent report. Capital Efficiency Across DeFi.”

“As DeFi becomes more capital efficient, so does the opportunity for Yearn to scale its operations,” he added.

YFI Price Outlook

Yearn Finance aims to become the capital allocation hub of the DeFi industry if everything goes right. And key to the protocol’s growth is the adoption of YFI, a token that is currently in decline due to a psychologically triggered technical setup.

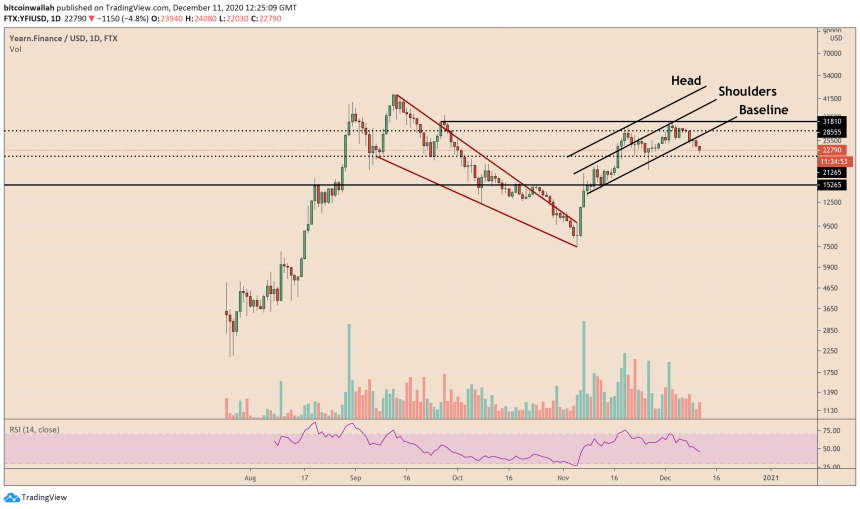

In fact, YFI/USD has now confirmed that it is pursuing a head and shoulders trade setup. Traders consider this pattern to be bearish. This is because the price generally goes down as the maximum height increases. By this logic, YFI/USD is now looking to extend its 25% corrective move by another 30%. This brings the target price to around $15,200.

Yearn Finance looks to fall towards $16K if the corrective sentiment sustains. Source: YFIUSD on TradingView.com

Meanwhile, support levels around $21,600 are trying to prevent the price from continuing to decline. If successful, YFI could reverse its rally, first hitting $28,555 and then moving towards $30,000 and eventually hitting a record high near $44,000.