The cryptocurrency market has undergone significant changes, causing many analysts to caution against investing in altcoins.

Historically, in bull markets, Bitcoin and Ethereum rose first, followed by altcoins. However, current events suggest a change in this pattern.

Why it’s dangerous to buy altcoins now

Quinn Thompson, founder of cryptocurrency hedge fund Lekker Capital, advises against investing in altcoins at this time. He pointed to several indicators of market instability, including high leverage and open interest, lack of panic buying, and stagnant stablecoin supply.

He believes the market is experiencing increasing selling pressure, particularly from venture capital funds needing to raise capital, which is leading to more selling than buying. This situation, combined with low summer trading volumes, makes it difficult for altcoins to gain traction.

“We believe there is a serious cascade risk in cryptocurrencies, especially in the case of most altcoins, where we expect them to be repossessed. The market seems to have lost the ability to bounce back even in the majors. At the same time, leverage and open interest remain high,” Thompson said.

Thompson gave two main reasons for his position. First, there is the impact of Bitcoin and Ethereum Exchange Traded Funds (ETFs) and the issue of altcoin supply inflation.

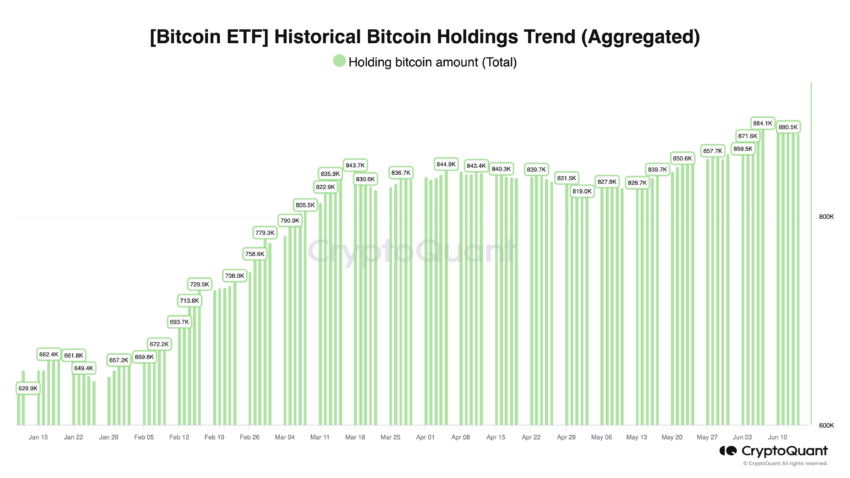

The introduction of Bitcoin and Ethereum ETFs has changed the market structure. In the past, during bull markets, capital flowed from major cryptocurrencies like Bitcoin and Ethereum to altcoins. However, with over $50 billion currently invested in Bitcoin ETFs, these funds do not have a similar mechanism for investing in altcoins.

These changes have limited the capital available for altcoins, making it more difficult for them to rise in value. Traditional market participants are increasingly focusing on Ethereum for tokenization, which is further marginalizing altcoins, according to Samara Epstein Cohen, chief investment officer at BlackRock ETFs.

Read more: How to Invest in Real Crypto Assets (RWA)?

The rapid launch of new altcoins is also flooding the market, putting significant inflationary pressure on them. Many projects aggressively release large quantities of tokens, resulting in supply far exceeding demand.

Thompson pointed out that there is not enough demand to support the expected monthly altcoin supply inflation of about $3 billion over the next year or two. Some altcoins may still perform well, but identifying these successful tokens will be more difficult than before.

“Altcoins are under continued selling pressure. As we head into the already low volume summer period, the combination of significant token supply unlocks and selling pressure from venture capitalists will likely make the uphill battle too strong for most tokens,” Thompson concluded.

Meanwhile, Will Clemente, co-founder of Reflexivity Research, reflected on how the market has matured. Investing in high beta altcoins was a profitable strategy in 2020. Because these assets have outperformed Bitcoin. However, this approach is no longer effective.

Many altcoins have underperformed Bitcoin in recent months, indicating a shift in market dynamics.

“If you go out on the risk spectrum in 2020, the beta for Bitcoin is going to be higher and all the bullshit and everything is going to go up. I didn’t see it this time. Many altcoin and Bitcoin pairs have been running out for months now, and it’s not as simple as buying vaporware altcoins. Then it will surpass Bitcoin,” Clemente emphasized.

Technical analyst Michaël van de Poppe emphasized that while Bitcoin is at or near all-time highs, most altcoins have not reached previous peaks. This discrepancy signals a lack of trust in altcoins, which continue to struggle in the current market environment, and suggests that the era of easy profits from altcoins may be coming to an end.

Read more: 10 Best Altcoin Exchanges in 2024

Investors should be aware of the increased risks and consider new conditions before making decisions in the cryptocurrency market.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.