- Activity in the spot market did not match expectations of weakness in the derivatives markets.

- Open contracts have increased and price increases are likely to continue.

Altcoins including Avalanche (AVAX) have been able to maintain their recent uptrend after a price crash a few days ago. However, AMBCrypto found that traders in the market have decided to bet in the opposite direction.

At the time of writing, AVAX’s long/short ratio was 0.88, which is evidence of this sentiment. The long/short ratio acts as a barometer of investor expectations.

To derive the result, you need to divide the number of long positions by the number of short positions.

No confidence in the uptrend

For context, a long is a trader who expects the price to rise and hopes to profit from it, while a short is a trader who bets on a decline.

A long/short ratio greater than 1 means that the average market participant expects prices to rise.

However, if the ratio is below the threshold, the broader expectation is that the price will fall, which was the case for the token.

Source: Coinglass

At the time of writing, AVAX was trading at $27.44, up 9.09% in the last 24 hours. Before that, it had fallen to $22.25. So the above data suggests that traders expect the value to trend back to this area.

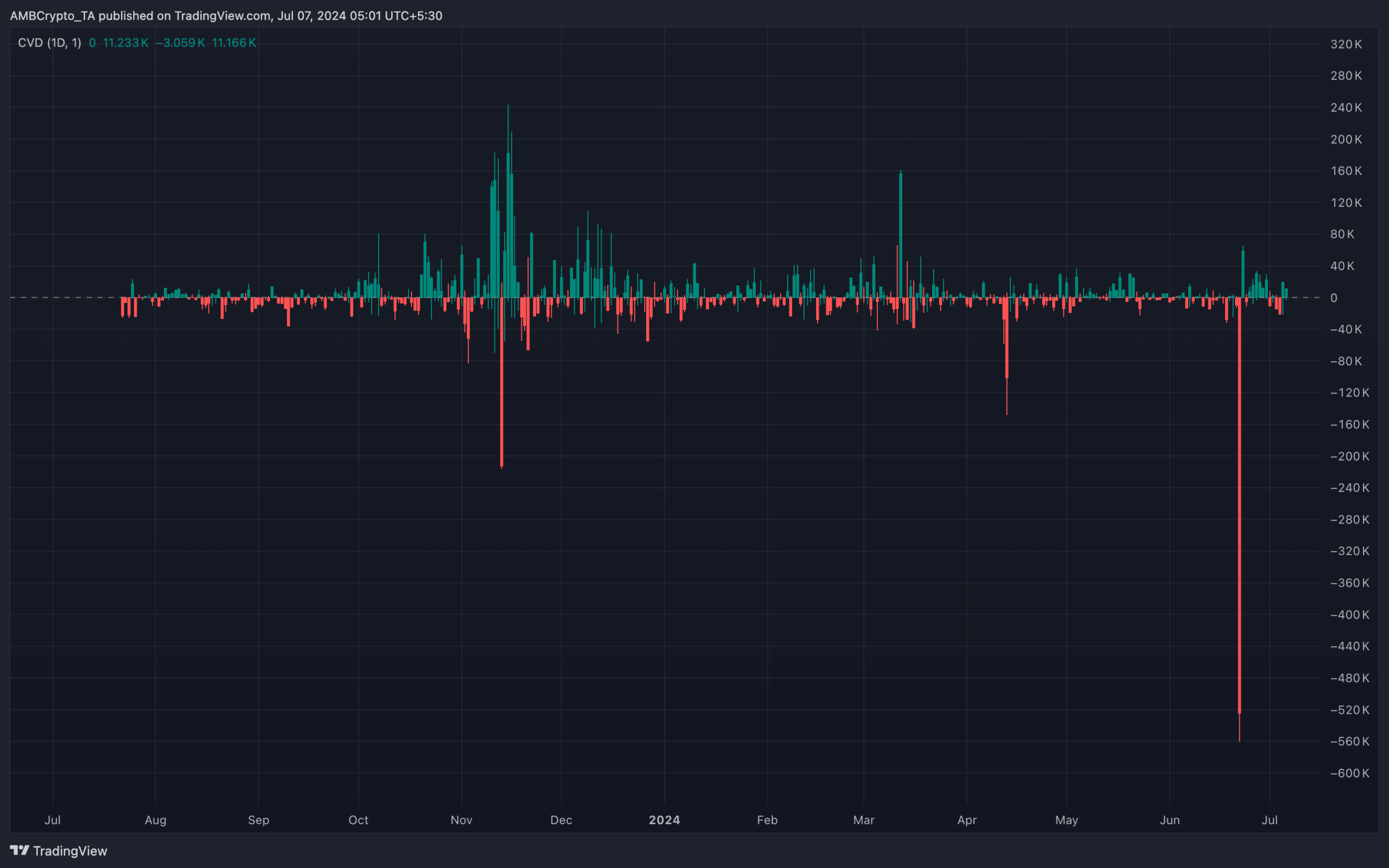

However, this may not happen, according to data from Cumulative Volume Delta (CVD), which shows the trading volume of a cryptocurrency based on buy and sell orders in the market.

AVAX demands $30 back

If CVD is positive, it means that there are more buying than selling in the spot market. On the other hand, if it is negative, it means that there is aggressive selling in the market.

According to AMBCrypto’s analysis, the CVD of AVAX on the daily chart was positive, which suggests that buying pressure has increased.

If this remains the same, the AVAX price could rise to $30, and traders who choose to short the cryptocurrency may not be compensated.

Source: TradingView

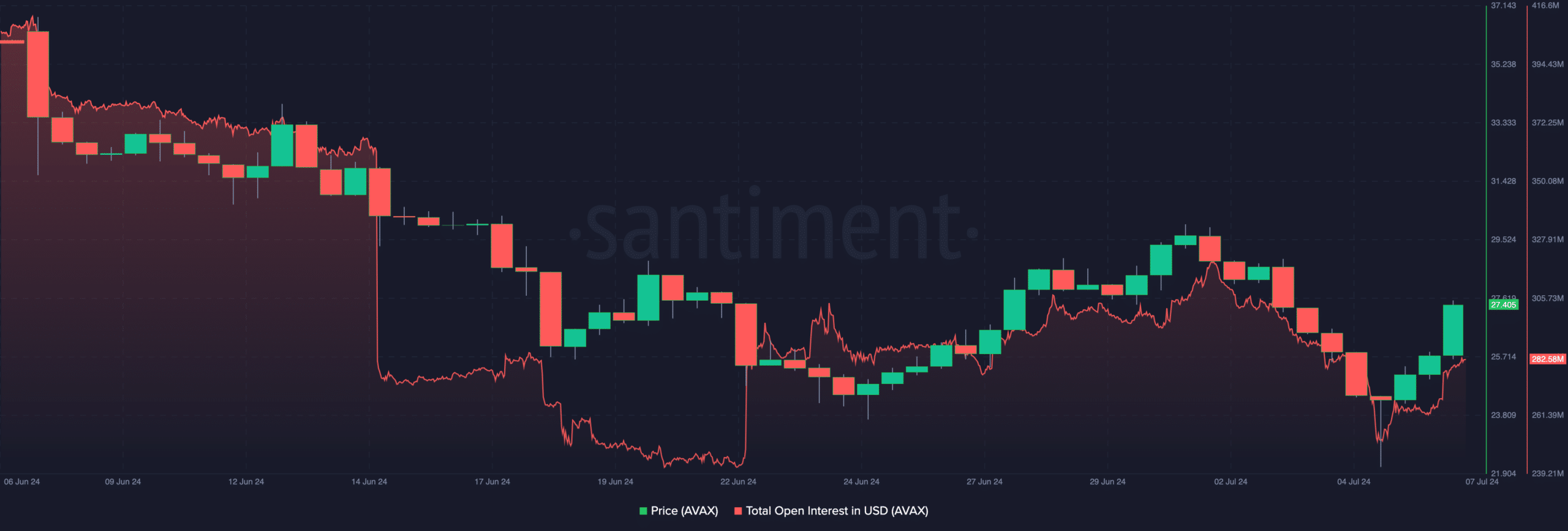

In addition to the above indicators, AMBCrypto also looked at the Open Interest (OI). The idea behind evaluating OI is to see if AVAX is truly behaving in line with the expectations of traders in the derivatives market.

At the time of writing, OI has increased by $267.12 million and is just inches away from reaching the $300 million market. Open interest is the sum of all open contracts in the market.

An increase means that money is coming into the market and the net position is increasing. However, a decrease means that traders are pulling liquidity out and the net position is decreasing.

For AVAX price, the rise is a good indicator of further upside, which will only happen if it continues.

Source: Santiment

Is your portfolio green? Check out the Avalanche Profit Calculator

Cryptocurrency prices are likely to continue to surge as capital flows into derivatives markets and buying pressure builds in spot markets.

If this is true, the token could hit $30 in a matter of days, meaning bears won’t get any rewards.