- Ether Leeum’s average order size for Binance has been back for the first time since December 2023.

- ETH was submerged from $ 2.4K to $ 2.7K without failure despite the purchase pressure.

Ether Leeum Whale may be preparing for a quiet return, especially in Binance.

If the price behavior for a few weeks disappears, fresh chain signals suggest that large buyers are returning to fold.

In early May, when ETH recovery, whale activities have soared to 10,000 transactions every day. But as the price stagnated, the number disappeared and fell to 3,000.

But now the situation seems to be changing.

According to Cryptoquant’s analyst Dark Frost, Ethereum Whales returns to Binance as proven to the average order size.

This metrics have been on fire for the first time since December 2023, just before the ETH surged from $ 2.2K to $ 4K.

Whale orders rise and Netflows are optimistic.

Source: cryptoquant

In fact, since May 19, whale orders for Binance have begun to emerge as the market trust grew.

This is especially important because the whale is located early when the macro trend begins to show signs of force.

Therefore, the change in this metrics shows that Binance’s large corporations are currently purchasing Etherrium.

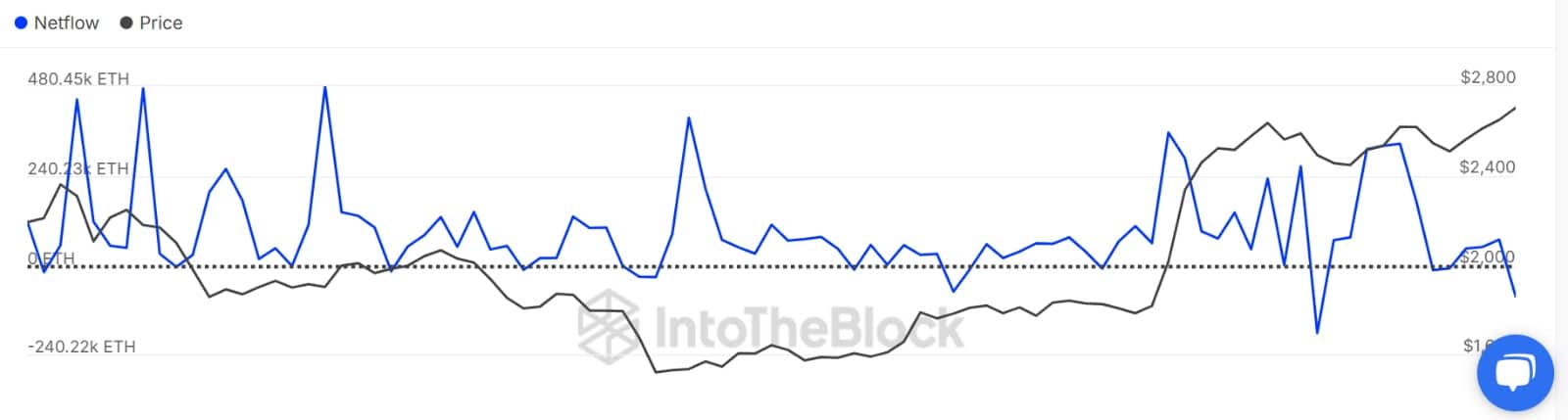

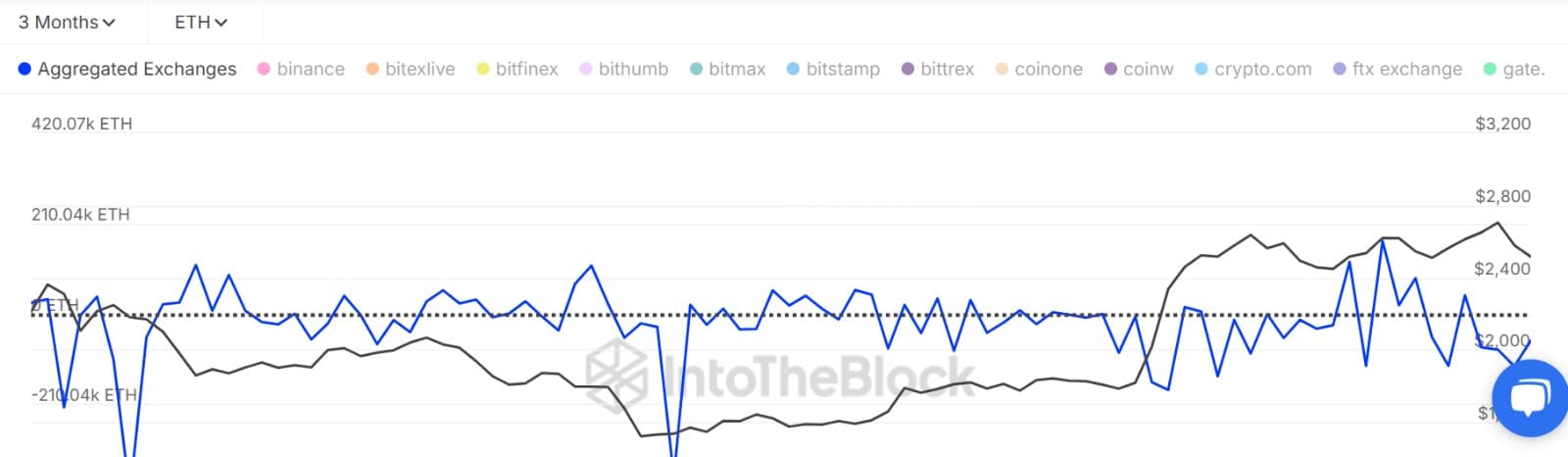

Source: INTOTHEBLOCK

If we look at the overall capital inflow of the whale, we can see that Ether Leeum Whale has accumulated 301K ETH tokens.

Altcoin’s large -scale holder Netflow SPIKING has soared to 108K ETH from negative values, and whales are purchased more than selling.

Spot buyers are dominant as retailers join movement.

In addition to purchasing whales, other market participants are purchasing Ether Lee.

In fact, small investors appear to join the momentum. The spot market activity showed a cumulative volume delta of +6.35K ETH. The buyer poured out 57.3K ETH to firmly dominate the seller.

Source: cryptoquant

As the purchase pressure of large holders increased, the inflow of Ethereum Exchange has significantly reduced.

After recording 42K ETH pumping values four days ago, Exchange Netflow sustainedly soaked in the voice during this period. Negative net flow means that the outflow comes from the exchange and reflects a significant accumulation.

Source: INTOTHEBLOCK

Effect on ETH?

Ether Leeum Whale has returned to Bynes, but whale activities have yet to have a positive impact on ETH price movement.

As of the press time, Ether Leeum was traded at $ 2,512, down 0.38% on the day. This shows that the four -day slide is extended, and the sales pressure still remains.

This means that Ether Lee is still experiencing a powerful battle between the bull and the bear in the market.

In fact, the current integration between $ 2.4K and $ 2.7K shows that the market is submerged in tug -of -war. Whale purchases absorb the exit, but the resistance does not break.

Therefore, the buyer is active in the market, but the same is true for the seller. Therefore, the market will not only absorb sales pressure but also surpass the sales pressure, the market will be trapped within this range.

Then you will have more than $ 2.7K breakout.