- In Q2 2024, 1.64 million BNB tokens worth approximately $970 million were burned.

- Recent price action is showing resistance around the $600 level.

Binance Coin (BNB) completed another large-scale token burn in Q2 2024. According to data from Bscscan, 1,643,698.8 BNB tokens were removed from circulation, worth approximately $969 million at the time of the burn.

BNB’s deflationary trend continues as supply decreases significantly.

source: BSC scan

The burn rate remains strong, which is consistent with Binance’s long-term strategy of reducing the total supply. Each quarter, the burn is aimed at reducing the circulating supply contracts, potentially putting upward pressure on the token value.

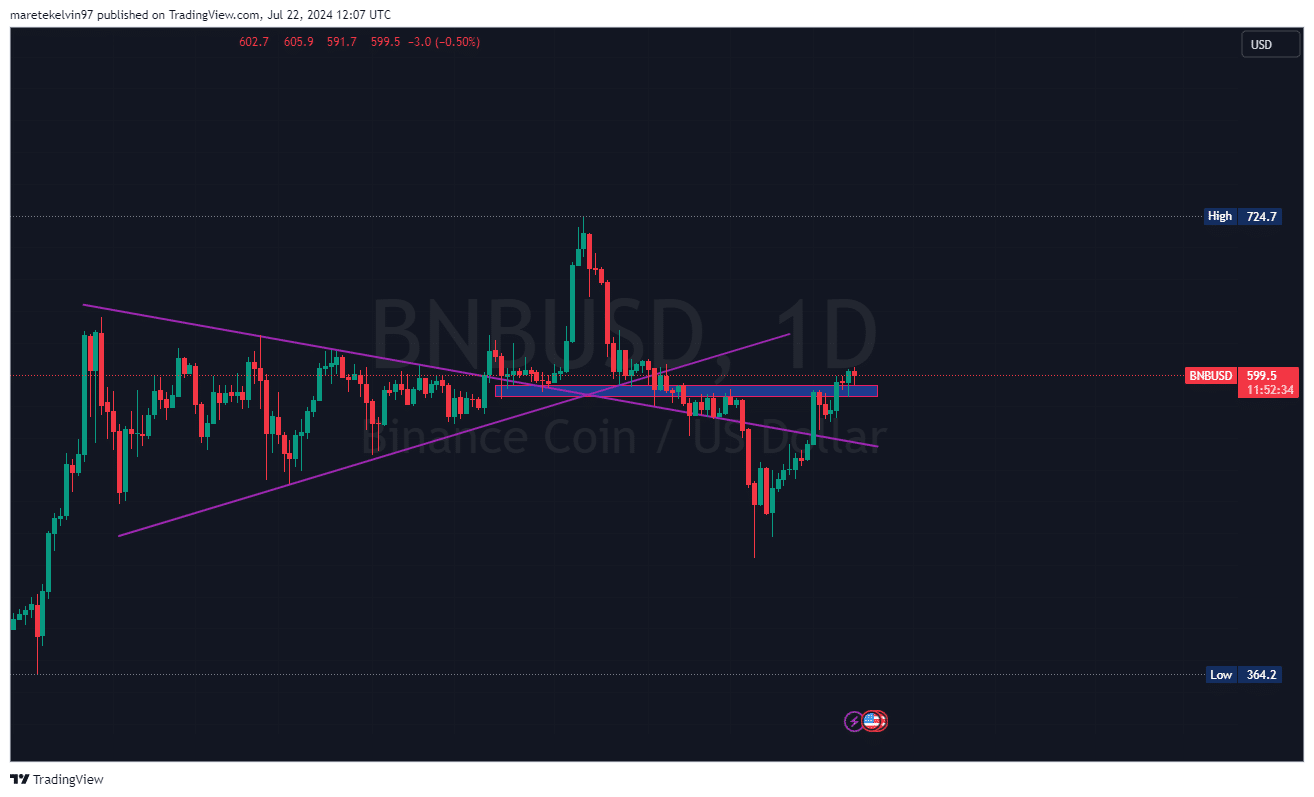

Despite the recent exhaustion, the price of BNB is still struggling to break above key resistance levels. At the time of writing, BNB was trading near $599. It is currently under selling pressure near $600.

There is a possibility that prices will plunge before a short-term correction and then a further surge.

Source: Tradingview

Liquidations surge as traders prepare for moves.

Coinglass liquidation data highlights significant long-term liquidations in recent weeks. It is important to note that these forced closures of leveraged positions often coincide with short-term price volatility.

After a massive liquidation in early July, prices recovered sharply.

Source: Coinglass

BNB supply shortage

The BNB supply is decreasing, creating the potential for a price rally, but market participants should compare this to the overall cryptocurrency market situation.

The role of token burning in promoting sustainable price appreciation remains a topic of debate within the cryptocurrency community.

Read Binance (BNB) Price Prediction 2024-25

Looking ahead to Q3 2024, it is expected that approximately 1,708,829 BNB tokens will be burned.

As the next exhaustion approaches, traders and investors should watch closely to see if the current supply decline can overcome current resistance levels and lead to new highs in the second half of 2024.