Bitcoin is under pressure and struggling to recover losses from earlier this week. Despite the price stabilization on the last day, the path of least resistance is currently to the south. A convincing close above the local resistance level around $66,000 is needed for the trend to change.

Bitcoin Active Addresses “Anemic”

Data shows a worrying decline in on-chain activity as prices cool and consolidate within a bear breakout formation. Moving to X, one analyst said. Observe The number of active Bitcoin addresses has been decreasing over the past few months. The only time this indicator has increased was in late 2023 and early 2024.

Looking at the price data along with this expansion, the Bitcoin price went from under $30,000 to $73,800. After that, referring to the on-chain development, the number of active addresses has tilted towards the negative.

Typically, when network activity slows down, it can have a big impact on price movements, as it does now. As we have seen in past price movements, the number of active Bitcoin addresses increases with each price increase. The price is under pressure, and the volume of transfers from unique addresses is decreasing, indicating that public interest is decreasing.

Are Specific Bitcoin ETFs the Problem?

Analysts have singled out a possible explanation for this contraction: Looking at the trend of Bitcoin active addresses, it is easy to see that activity slowed down when the U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin ETF.

The product gave institutions exposure to the world’s most valuable coins, but it also brought a significant shift in ownership dynamics.

Unlike previous cycles, where prices were driven to new highs primarily by retail activity and sentiment, now prices are being driven by “big players” who can move millions of dollars at a time.

This explains why activity was comparatively higher in the first half of 2023 than it is now, even when prices were low, as previously it took many “small” addresses to move the price.

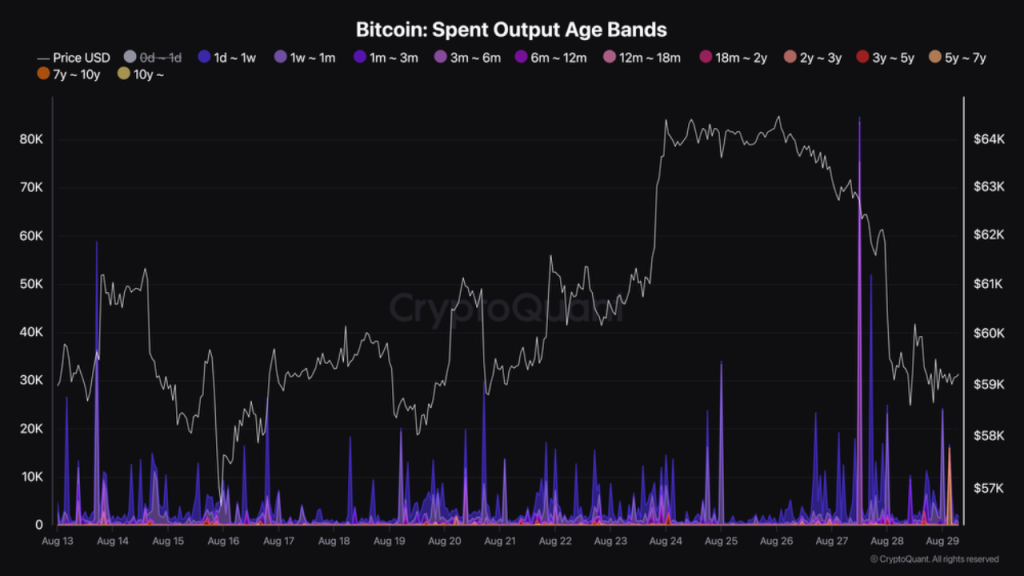

If this is the trend, then activity is likely to be further dampened as institutions and retail investors pull back as BTC breaks through key support levels. The situation could get even worse as long-term holders have been moving their coins in recent weeks.

An analyst Note 75,228 BTC ~ between On August 27th alone, 3 to 6 months were moved. Yesterday, August 28th, 1,614 BTC were moved between 18 months and 2 years.

Feature image from Canva, chart from TradingView