- In July, cryptocurrency markets saw two-way volatility as investors reacted to events.

- The Federal Reserve has kept its benchmark interest rate at its highest level in 23 years for the eighth straight time.

Bitcoin (BTC) traded virtually flat on the last day of July, immediately following the Federal Open Market Committee’s interest rate decision.

In line with market expectations, Fed policymakers kept the benchmark federal funds rate at a range of 5.25% to 5.50%. With the June FOMC meeting postponed, traders are now looking at the first rate cut of the year, in September.

In remarks after the FOMC meeting, Chairman Jerome Powell hinted that discussions about a September rate cut were continuing, saying the likelihood of one would depend on strong economic growth numbers.

Lower interest rates are likely to increase market liquidity, which would be beneficial for cryptocurrencies overall.

Trends in July

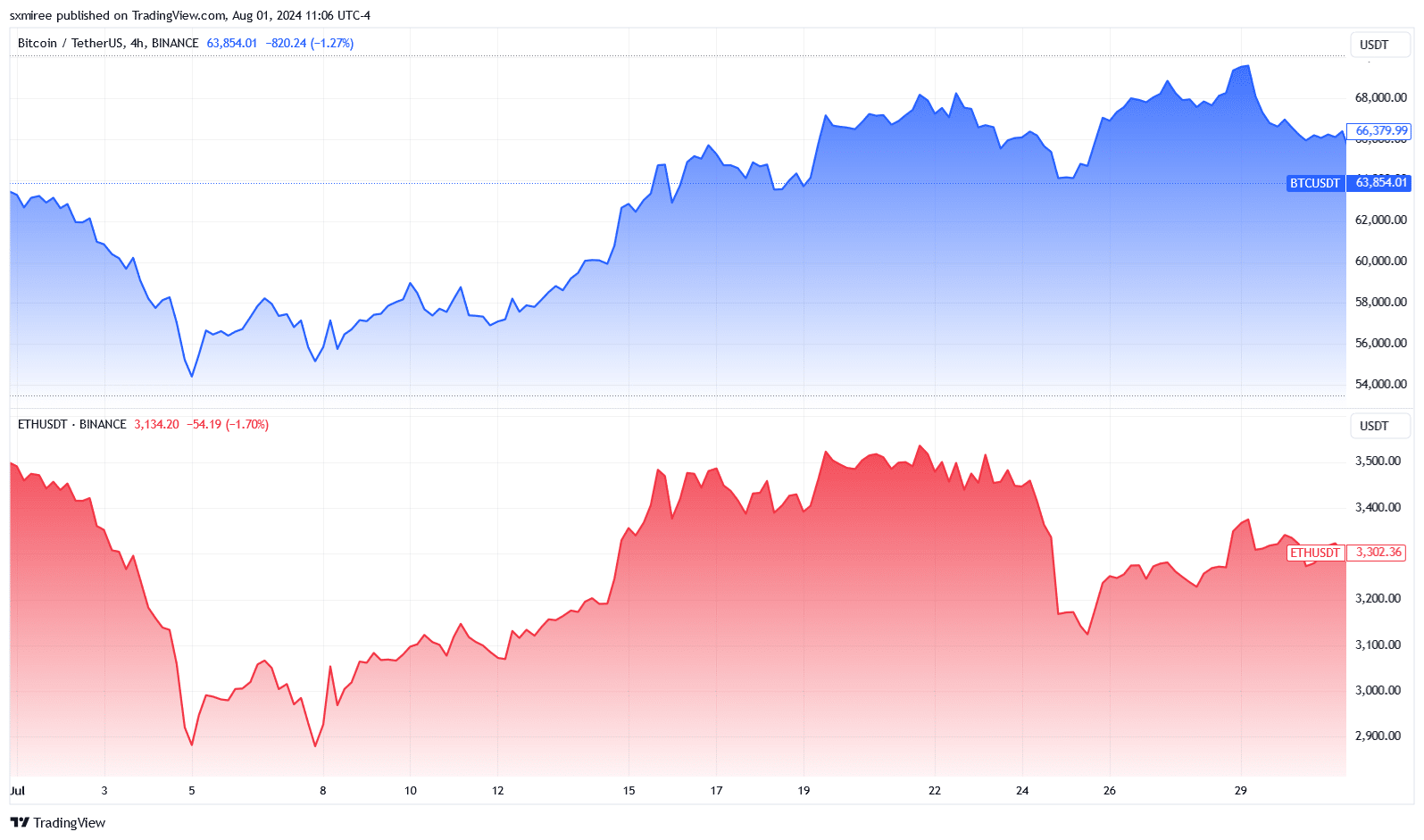

A slight drop before the monthly close erased some of Bitcoin’s gains, with the flagship cryptocurrency returning just 2.95% in July, according to Coinglass.

Source: TradingView

Nonetheless, the modest positive returns set the stage for Bitcoin to pursue new yearly highs.

Ethereum (ETH), on the other hand, performed worse, falling 5.88% over the same period, despite some positives, including the launch of a US-based spot Ethereum ETF.

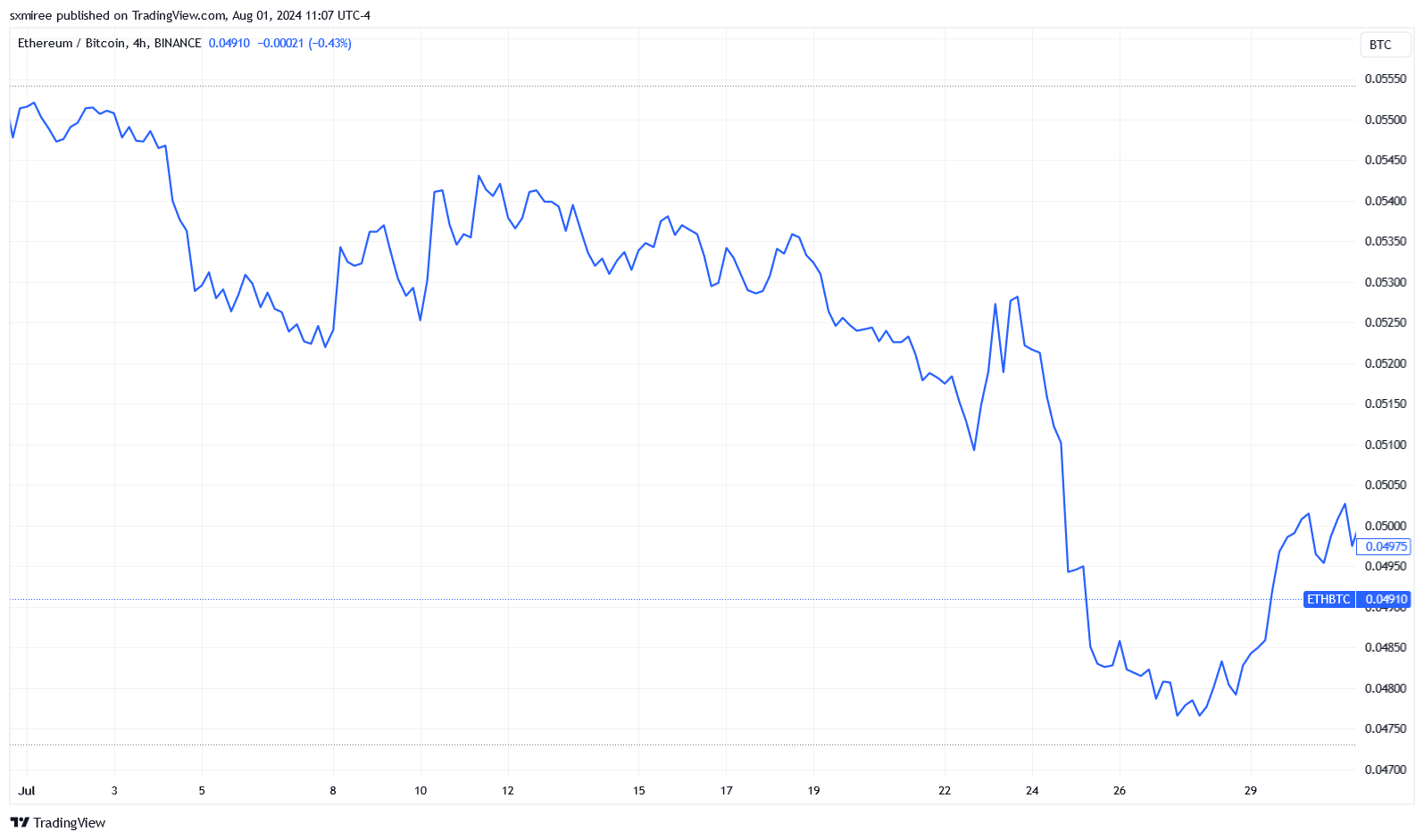

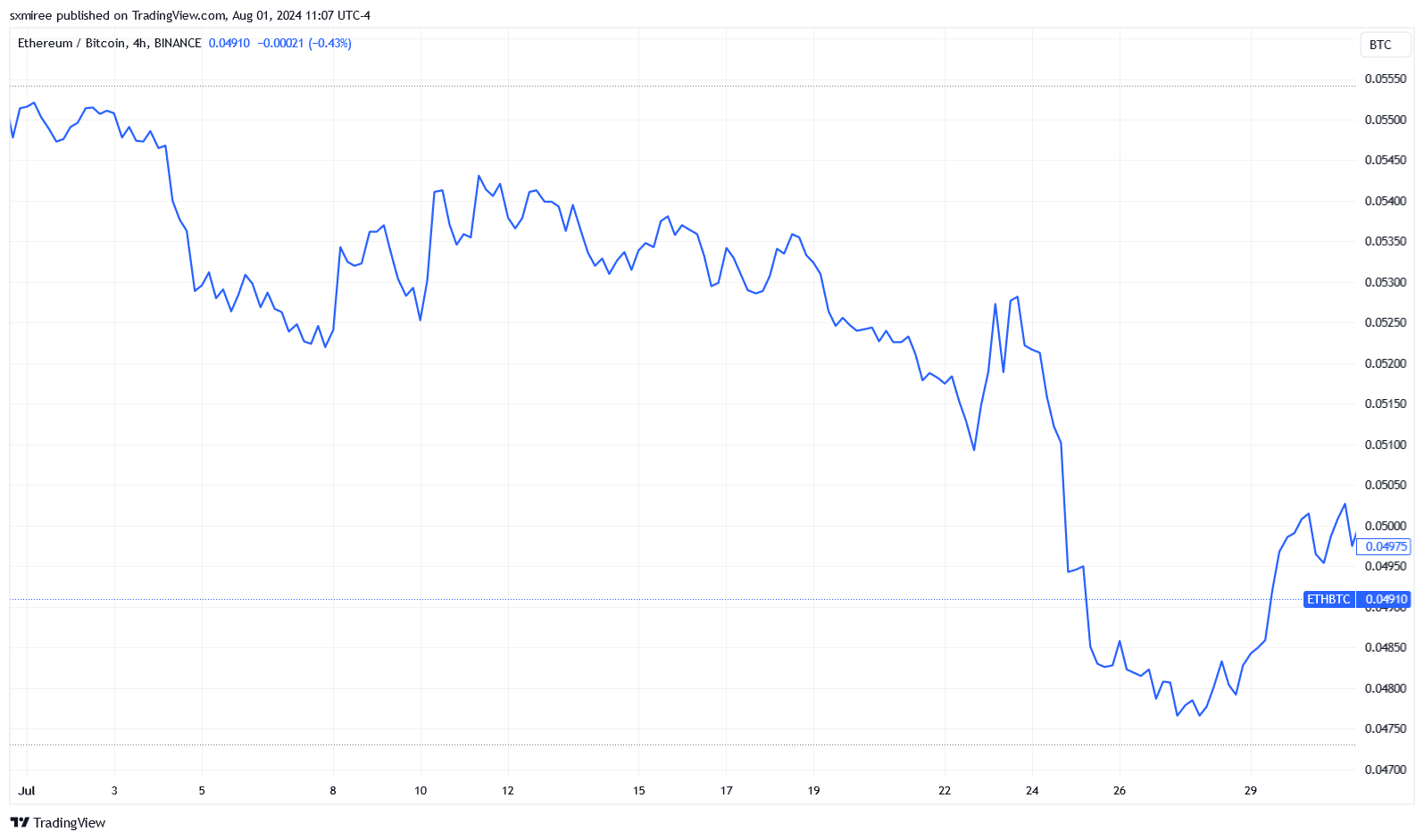

As a result, the ETH/BTC rate declined throughout July, ending the month down 10.72%.

Source: TradingView

Among large-cap altcoins, MANTRA (OM) and Helium (HNT) posted the highest returns in July, with returns of 44% and 36%, respectively.

On the other hand, Fantom (FTM), Flare (FLR), and Starknet (STRK) all recorded losses of more than 30%.

Expectations for August

The haggling continued last month, with addresses holding more than 0.1% of the circulating supply of BTC holding around 84,000 BTC, according to Bitcoin ownership data from IntoTheBlock.

This scoop has recorded its highest cumulative pace since October 2014.

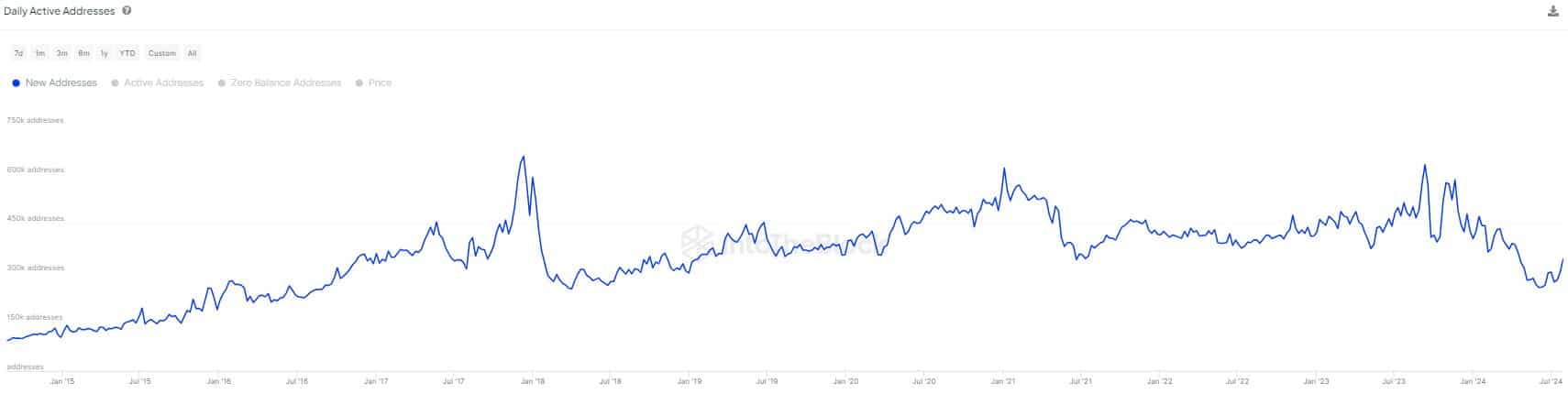

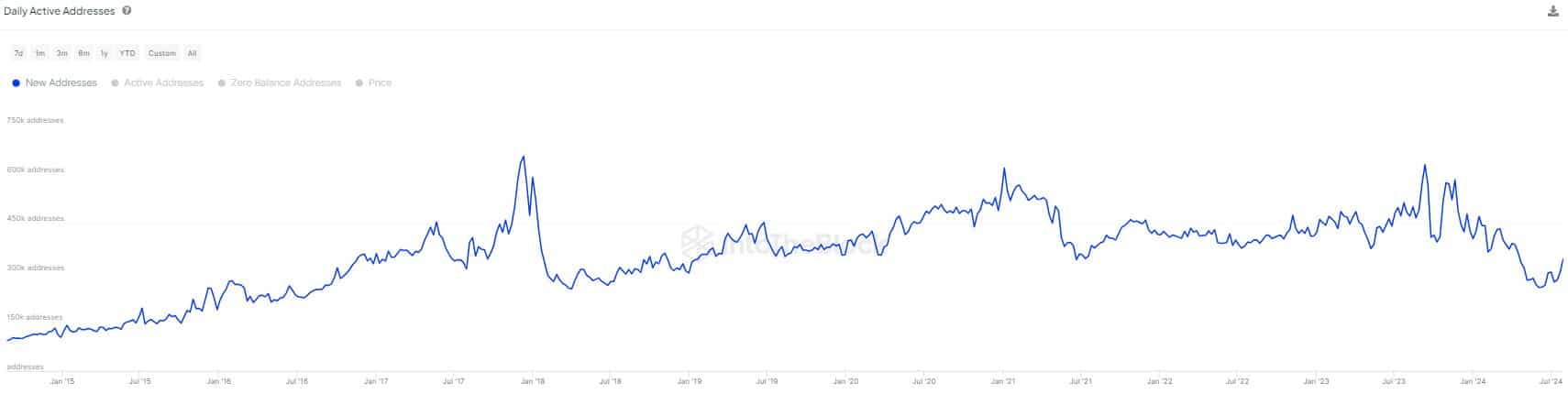

IntoTheBlock separately reported on X (formerly Twitter) that daily new addresses had increased 35% on July 30, after hitting a multi-year low in early June.

Source: IntoTheBlock

Strategic accumulation by whale and shark investors has historically signaled that an upside breakout from the current range is expected.

The bullish sentiment has been further strengthened by the return of capital into the cryptocurrency markets.

CCData noted in its latest Stablecoin and CBDC report that the total market capitalization of stablecoins increased by 2.11% in July, reaching $164 billion, the highest level since April 2022.

Technical Outlook

Bitcoin has been trading in a range of $58,000 to $70,000 over the past five months.

Bulls will be looking to flip the dominant resistance level at $69,600, which would represent the next major hurdle to challenge the March all-time high at $72,000.

Read our Bitcoin (BTC) Price Prediction 2024-25

So far, the bears have been fiercely defending the upper limit of the prevailing consolidation range, successfully preventing any attempts to break the $70,000 barrier.

The multiple rejections above $69,600 since March show that the BTC price needs a strong catalyst to overcome the hurdle.