CoinLedger research shows that the value of cryptocurrency portfolios has increased by an average of $2,804 this year as the industry races toward its previous 2021 peak.

The cryptocurrency tax and portfolio management software provider analyzed its database of over 500,000 investors to identify popular tokens and solutions being utilized amid the bull market driven by institutional interest and retail demand.

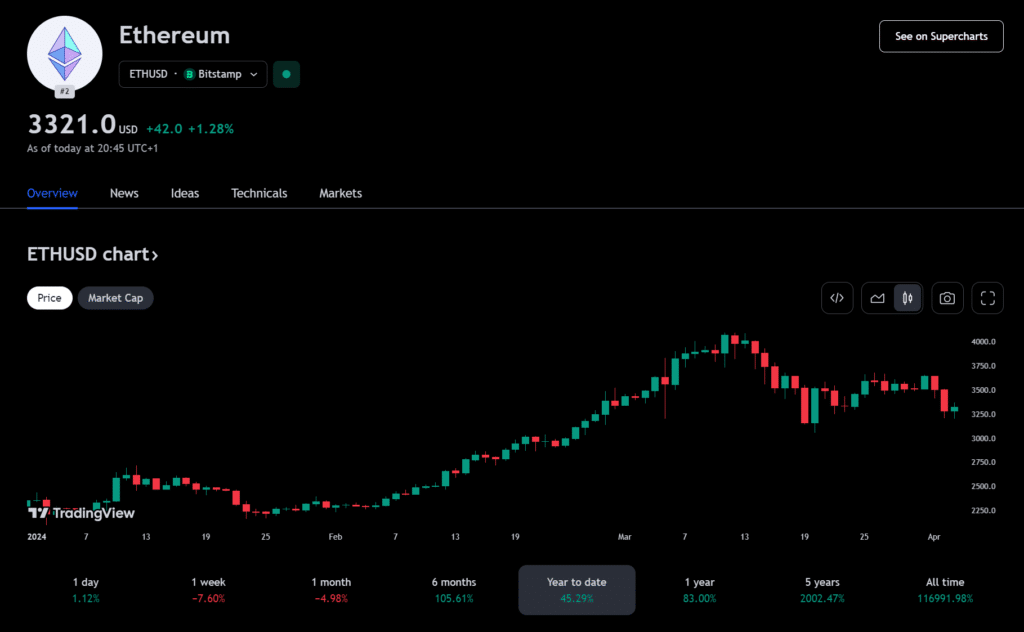

According to CoinLedger, users are reaping the most unrealized profits primarily from cryptocurrencies’ top two digital assets: Bitcoin (BTC) and Ethereum (ETH). Both tokens have grown by more than 57% and 45% year-to-date (YTD), as per TradingView.

Cryptocurrencies such as Solana (SOL), Cardano (ADA), Polygon (MATIC), and BNB were also ranked among the top six tokens with unrealized profits in 2024. SOL has recently enjoyed a renaissance thanks to the liquidity flowing into meme coins in the Solana ecosystem. BTC, ETH, and BNB are also the cryptocurrencies held the longest by investors.

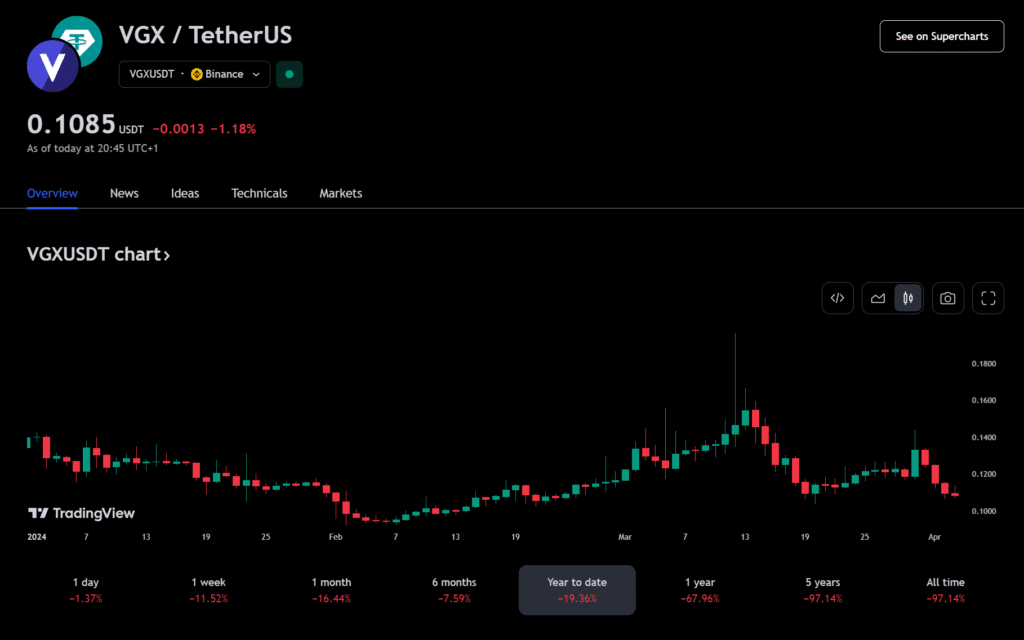

The native token of the bankrupt Voyager Exchange (VGX) topped the list of biggest losses in cryptocurrencies. VGX lost over 19% YTD. CoinLedger analysts added that other digital currencies set to suffer significant losses in 2024 include Chainlink (LINK), Luna (LUNC), Hedera (HBAR), and Tezos (XTZ).

Most popular exchanges and wallets

In cryptocurrency, exchanges and wallets are standard tools that almost every user interacts with at some point. Whether centralized or decentralized exchanges, custodial or non-custodial wallets, these solutions allow participants to trade digital assets.

CoinLedger’s report focused on centralized exchanges and non-custodial wallets, finding that Binance was the most used trading venue and that users preferred MetaMask most for storing their cryptocurrencies.

Ledger wallet, Coinbase wallet, Trust wallet, and Phantom were popular options for protecting digital assets, while Coinbase, KuCoin, Crypto.com, and Kraken ranked behind Binance.

CoinLedger CEO David Kemmerer said 2022 marked a resurgence of interest in Bitcoin and cryptocurrencies after heightened industry skepticism following the big crash.

Although the bankruptcy of exchanges such as FTX and Voyager was a major setback, the revival of cryptocurrencies such as Bitcoin and Ethereum resulted in significant profits for investors in 2024. The cryptocurrency market is coming back to life.

David Kemmerer, CoinLedger CEO