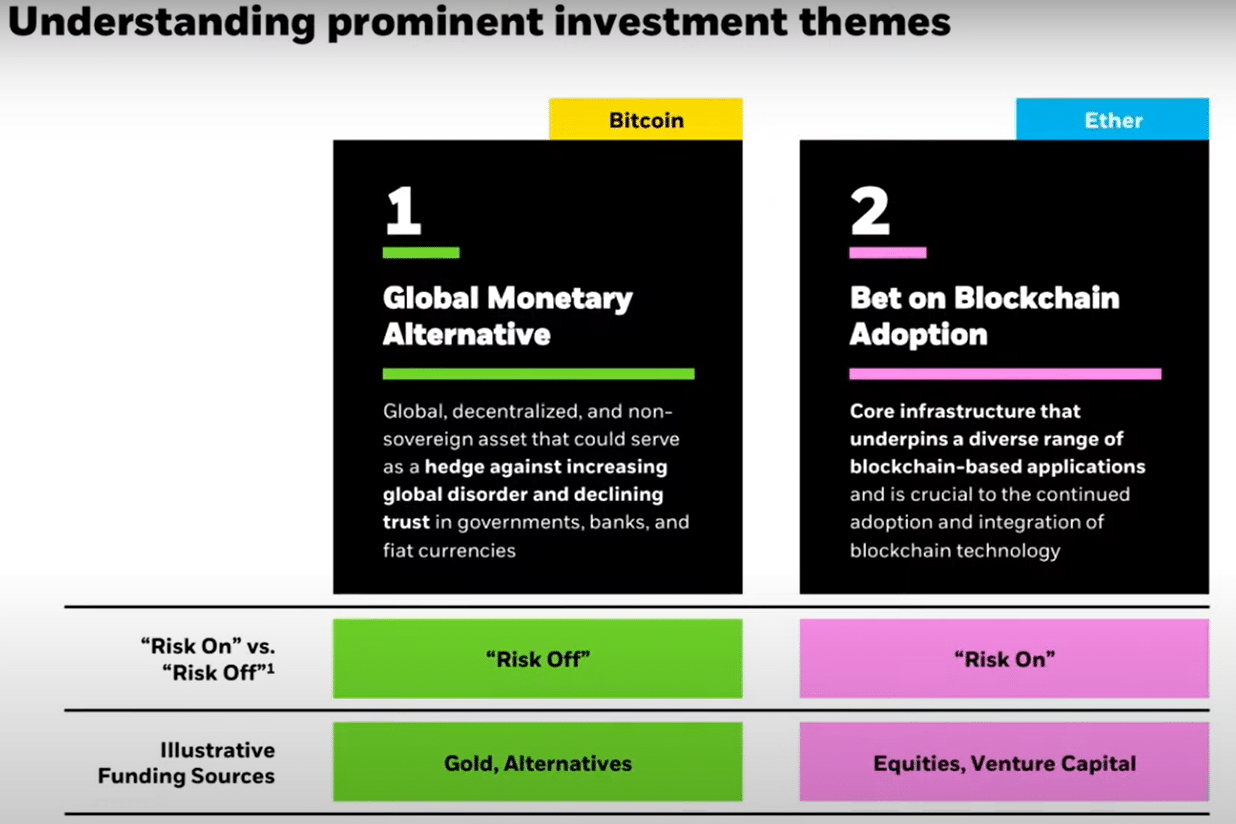

- According to BlackRock, BTC is sound money and a ‘risk-off’ asset.

- However, ETH is a speculative bet on the adoption of blockchain technology.

BlackRock, the world’s largest asset management company, recently introduced a unique and different pitch deck. Bitcoin (BTC) and Ethereum (ETH).

The dual pitch deck was presented at the Digital Assets Conference in Brazil. BlackRock’s Robbie Mitchnick has presented BTC as a ‘risk-off’ asset equal to or better than gold.

On the other hand, ETH, like US stocks, was introduced as a ‘risky’ asset.

BTC as money; ETH as a bet

Asset managers have evaluated BTC as a global currency alternative and an excellent hedge against declining trust in governments and fiat currencies.

Source: BlackRock

Rather, ETH was presented as a speculative bet on the adoption of blockchain technology, an investment that Michnick equates to U.S. stocks.

that famous,

“On the one hand, there is BTC, a commodity like gold and an alternative to stocks and bonds. As a long-term technology, Ethereum is confident that this blockchain will provide more use cases and more value to the economy in the future.”

Part of the cryptocurrency community echoed Mitchnick’s presentation emphasizes that BTC is ‘money’, subject to less inflationary pressures than fiat currencies, which lose value every year.

But it also settled a heated debate that had been going on for some time. ETH is not money. In fact, since the introduction of Blobs earlier this year, ETH’s inflation has increased, reducing its value as an “ultra-currency.”

If the prediction holds, BTC could rise further in future geopolitical tensions, while ETH could fall in such a scenario.

BlackRock’s perspective is very important because it is a trendsetter and a widely recognized company. The asset manager, along with Grayscale, is recognized as being responsible for the US movement and final approval of the US spot BTC ETF.

Since its launch, BlacRock’s ETFs have outperformed all alternatives and crossed key milestones.

At the time of this writing, the BTC ETF, iShares Bitcoin Trust (IBIT), had cumulative net flows of $21.5 billion and net assets of nearly $23 billion.

That said, since it began trading in July, BlacRock’s ETH ETF, ETHA, has seen total inflows of $1.1 billion.

As the world’s largest asset manager, Ergo can influence how other investors view the sector. According to some market observers, the message seems clear: Bitcoin is money and other cryptocurrencies are speculative.

Meanwhile, the value of BTC fell 5% to $62,000 on the weekly chart. On the other hand, ETH was valued at $2,400, down 8.5% during the same period.