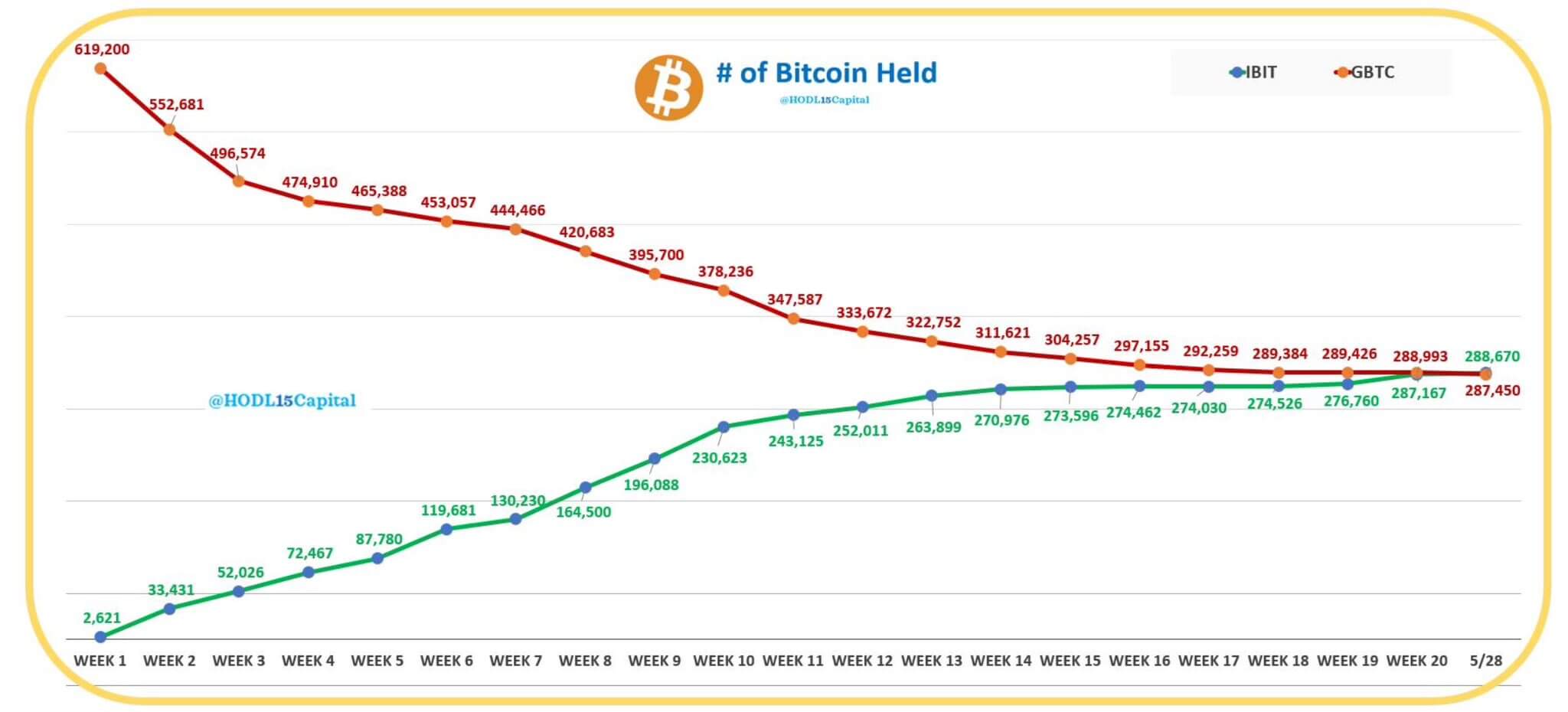

- BlackRock’s IBIT flips Grayscale’s GBTC in Bitcoin ETF holdings.

- IBIT holdings surged to 288,670 BTC compared to GBTC’s 287,450 BTC.

One of the top Bitcoin news headlines today is that BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed Grayscale’s Bitcoin Trust (GBTC) to become the world’s largest Bitcoin exchange-traded fund (ETF).

On May 28, inflows into IBIT reached $103 million, while GBTC recorded outflows of $105 million. Overall, the spot Bitcoin ETF market recorded net inflows for 11 consecutive trading days on May 28, totaling over $45 million.

IBIT Surpasses GBTC to Become Largest Bitcoin ETF

BlackRock’s IBIT recorded inflows of nearly $103 million, or 1,501 BTC, as Grayscale’s spot BTC ETF recorded outflows of $105 million, or 1,540 BTC.

BlackRock currently holds 288,670 BTC in its IBIT ETF, while Grayscale’s GBTC holdings have decreased further to 287,450 BTC.

Specifically, when the spot Bitcoin ETF launched in January, Grayscale’s ETF held 620,000 Bitcoin. However, according to HODL15Capital data, shared X shows that those numbers are shrinking quickly as BlackRock, Fidelity and others have ballooned over the past four months.

According to HODL15Capital, Grayscale’s outflow occurred amid fee issues (1.5% for GBTC and 0.2% for Peer).

“Grayscale held 620,000 BTC at the time of conversion (January 10, 2024), which was over 3% of the circulating supply, but refused to reduce its fees even after investors pulled 330,000 (1.5% vs. 0.2% for its peers). ). +BTC. This is how HODL15Capital explains its “differentiated” strategy.

bloomberg report According to data released on Wednesday, BlackRock’s BTC holdings reached $19.68 billion as of the close of trading on Tuesday, compared with Grayscale’s BTC holdings of $19.65 billion. Fidelity’s FTBC, which registered $34.3 million in inflows on May 28, now holds $11.1 billion.

IBIT’s GBTC flip came after BlackRock released a regulatory filing showing its funds had purchased IBIT shares.

In particular, BlackRock Strategic Income Opportunities Fund (BSIIX) purchased In the first quarter, IBIT stock was valued at $3.56 million. Meanwhile, Strategic Global Bond Fund (MAWIX) possession The ETF’s shares are worth $485,000.