DUBAI, UAE, Aug. 18, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, concluded a record-breaking month in its Private Wealth Management (PWM) unit, revealed in the latest Bybit PWM newsletter for July 2025.

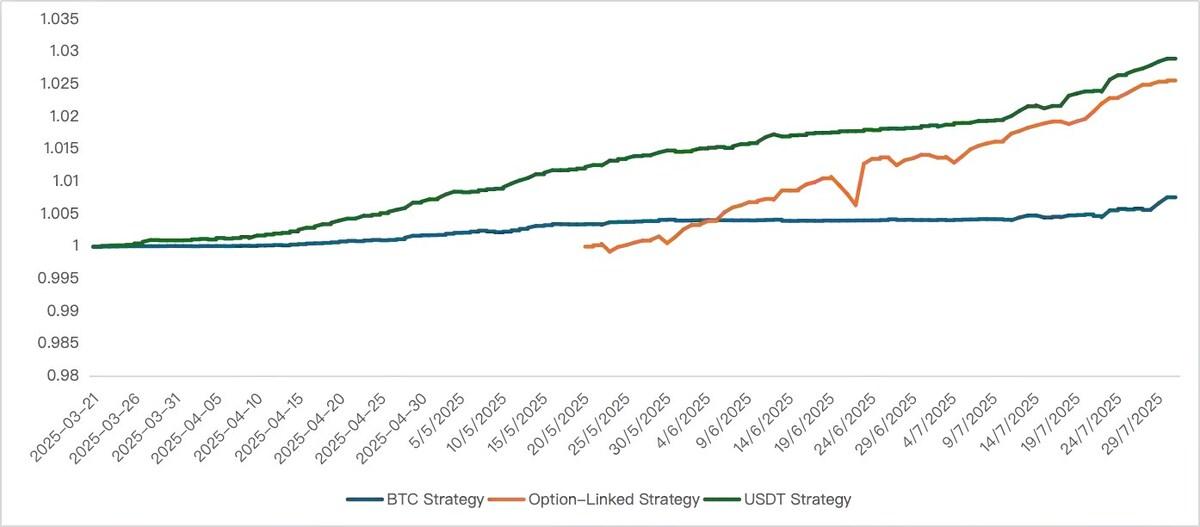

Capturing the rapid tides of crypto and global markets in July, Bybit PWM delivered exceptional results with average APR across all funds surging over 160% month on month. The standout achievement came from its flagship high-yield USDT-based strategy, which generated an impressive 19.77% APR, demonstrating the power of strategic asset allocation in volatile markets.

“In July, BTC’s new highs, strong inflows to ETH ETFs and positive regulatory developments energized the markets. Bybit PWM was able to reap the benefits of the movements and achieve demonstrable returns for our clients,” said Jerry Li, Head of Financial Products & Wealth Management at Bybit. “While crypto’s long-term potential remains promising, we are staying alert: regulatory signals and rapid news cycles remain game-changers—but solid fundamentals and growing institutional participation suggest brighter days ahead.”

Bybit PWM turns seasoned analysts’ and investing professionals’ trading expertise into measurable yield for high-networth investors. With sophisticated product and strategy offerings, the trusted service has achieved over $200 million in subscription volume.

Fig. 1 Strategy Return Trend

Launched in December 2024, Bybit PWM empowers visionary wealth builders who prioritize smart strategy over quick wins. The division’s expert team—seasoned veterans in quantitative trading, asset management, risk control, and blockchain innovation—crafts resilient portfolios designed to capture lasting value in the dynamic digital asset landscape.

For details of Bybit PWM’s July performance, users may visit: Bybit Private Wealth Management: May 2025 Newsletter

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Bybit Private Wealth Management’s Standout USDT Yield Strategy Set New Bar in July