- Solana faces another rejection after hitting a two-month high.

- The buying trend was steady but did not reach the breakout level.

Solana (SOL) failed to break the $163 resistance level for the third time since August. It has seen short-term price volatility over the past two days, falling 3.4% from the local high of $161.8.

Increased whale holdings and increased social media activity signaled an optimistic outlook for Solana going forward. On the other hand, a decline in spot demand could be an early sign of a larger downturn.

Solana price action remains bullish

Source: SOL/USDT on TradingView

Bulls were fighting for control of the intermediate level of $154, which coincides with the 50% retracement level. However, the trend strengthened in September after breaking the $140 resistance level of the lower period.

The A/D indicator has been showing a steady upward trend since July, which is a sign of strong buying momentum over the past three months. Daily RSI also showed strength.

However, swing traders looking to go long should wait for the $162-$165 resistance line to be broken. If this happens, bulls could target the high of $187 next.

Despite the positive signs of accumulation/dispersion, volume is still around the average of the last 6 weeks. Lack of volume was a concern as SOL approached key resistance levels.

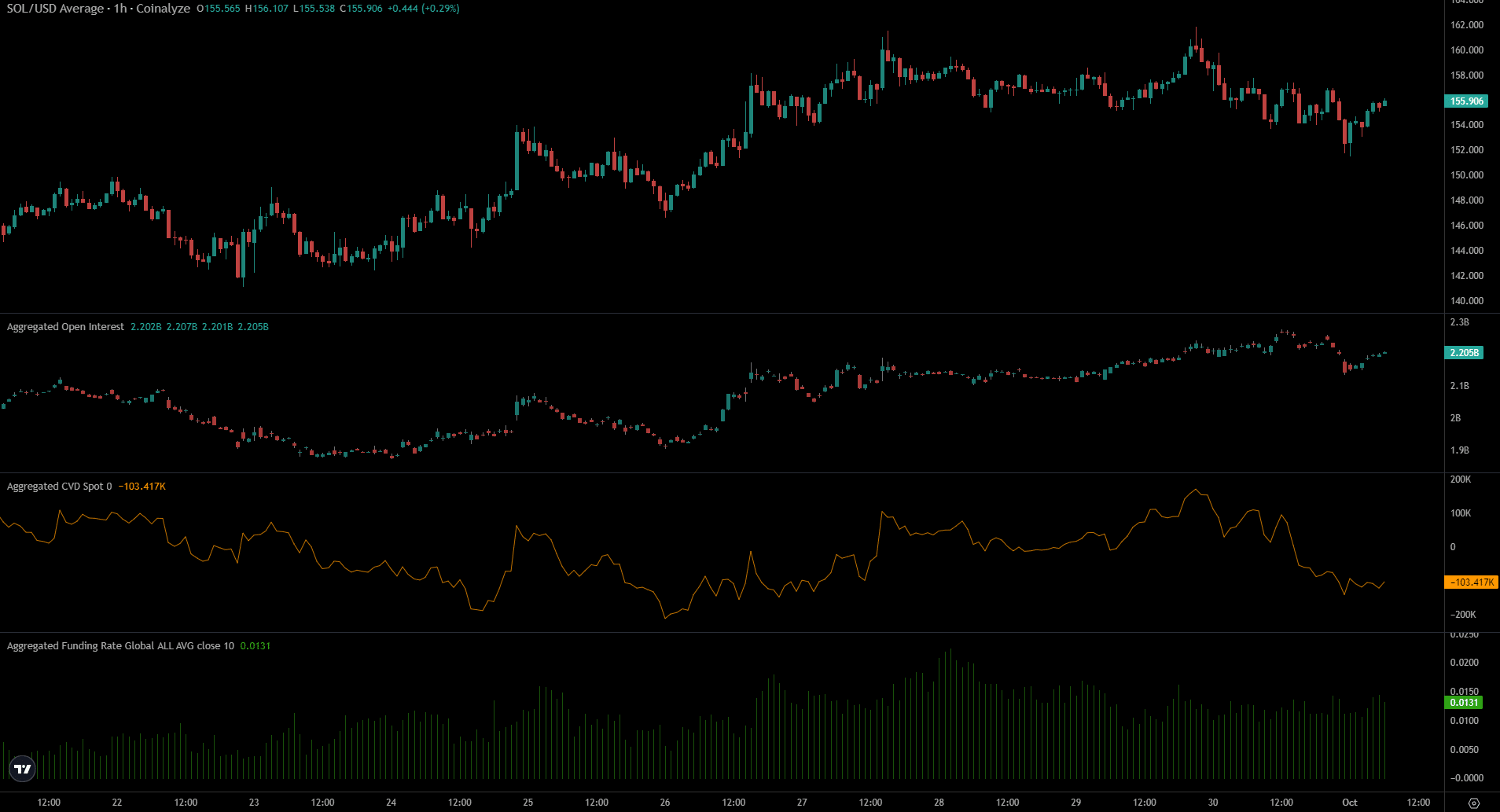

Coin analysis trends indicate increased volatility.

Source: Coin Analysis

AMBCrypto found that the CVD spot price has been falling at the same time as it has fallen from $161.8 over the past two days. Increasing selling near the resistance zone indicates a reduced likelihood of a near-term breakout.

Read Solana (SOL) price prediction for 2024-25

Funding rates remained positive and open interest trends remained upward. The decline also affected OI, but it has started to recover in recent hours.

Overall, a drop below $154 is likely due to volume.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.