- Solana’s price has increased by 500% and is trading at over $150 at the time of writing.

- Technical analysis results have confirmed a bullish pennant, suggesting that prices are likely to continue to rise.

Solana (SOL), recognized as one of the largest cryptocurrencies by market cap, has shown remarkable performance since the beginning of the year.

With a gain of over 500% this year, SOL has soared to over $150. In the last 24 hours alone, SOL has gained 1.4% and was trading at $161.03 at press time.

This steady upward trajectory has not only established Solana as an exceptionally profitable company, but has also attracted increasing interest from traders and investors looking for solid growth opportunities.

A bullish pennant pattern emerges.

Recent market activity around Solana has caught the attention of cryptocurrency traders, particularly the bullish pennant pattern that has formed on the price chart.

Here is this technical formation on the 1-day chart: Exposed According to CryptoBusy, it is often considered an indicator of potential price increases.

Source: CryptoBusy

The emergence of this pattern follows an 18% increase in Solana’s price last week.

These patterns typically form as prices consolidate after a significant uptrend, indicating continued investor interest and the potential for additional profits.

Meanwhile, a prominent cryptocurrency trader known as Honey noted that Solana recently surpassed its “short-term price target.”

However, she advises caution, especially when it comes to using leverage at this point, which she describes as a key area.

honey famous,

“Short term target is at $160. This is a pivot zone and if you enter here, be careful about long positions. Recovery = next $192. Rejection = next $140. Be careful with leverage.”

Solana Market Fundamentals

Beyond the technical aspects, Solana’s market dynamics were equally promising from a fundamental perspective.

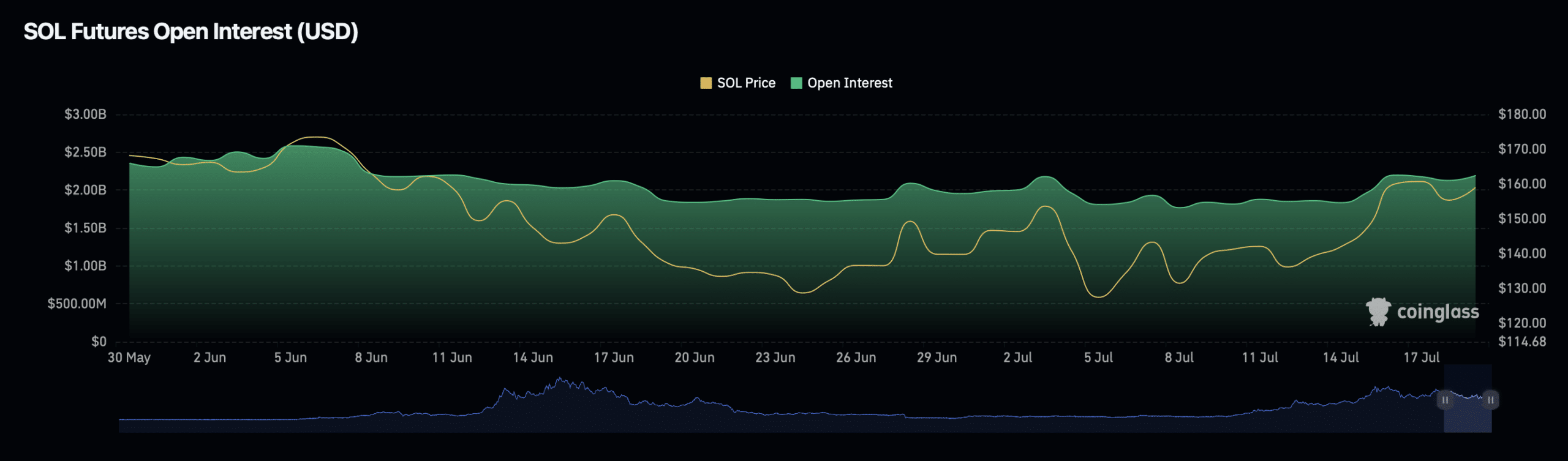

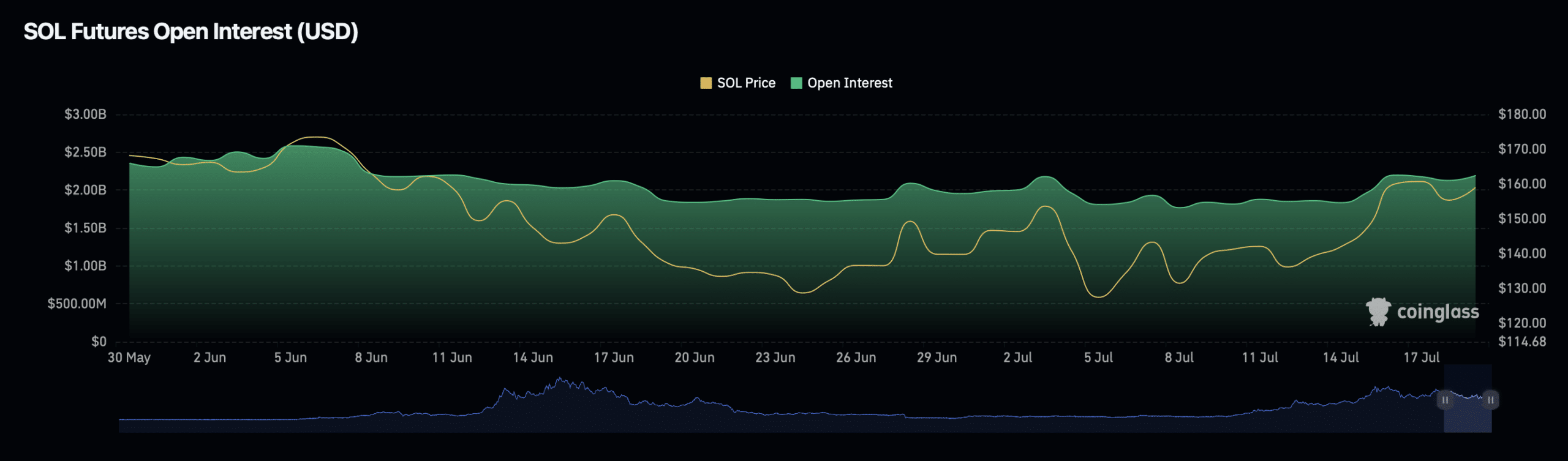

According to data According to Coinglass, there has been a noticeable increase in Solana-related futures trading activity, with open interest up 5.39% and volume up 7.45% over the last 24 hours.

Source: Coinglass

This surge has driven Solana’s open interest to $2.3 billion and trading volume to $6.82 billion, indicating increased market activity and investor confidence.

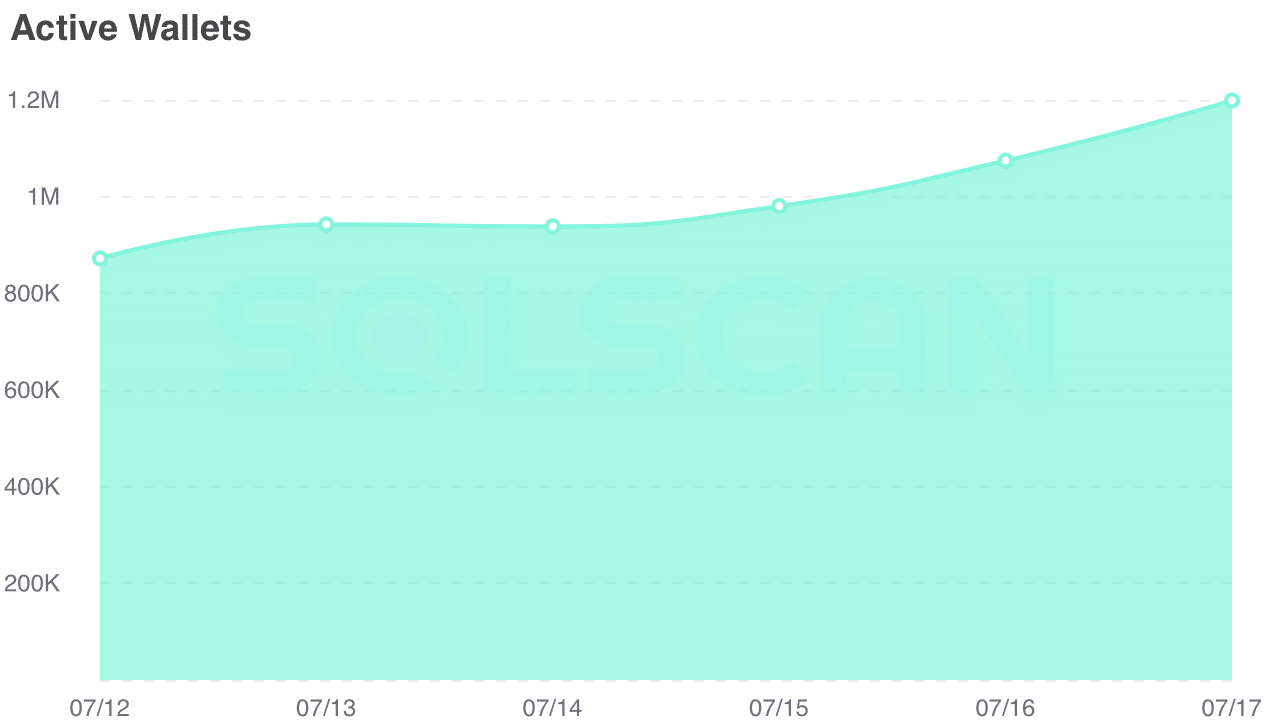

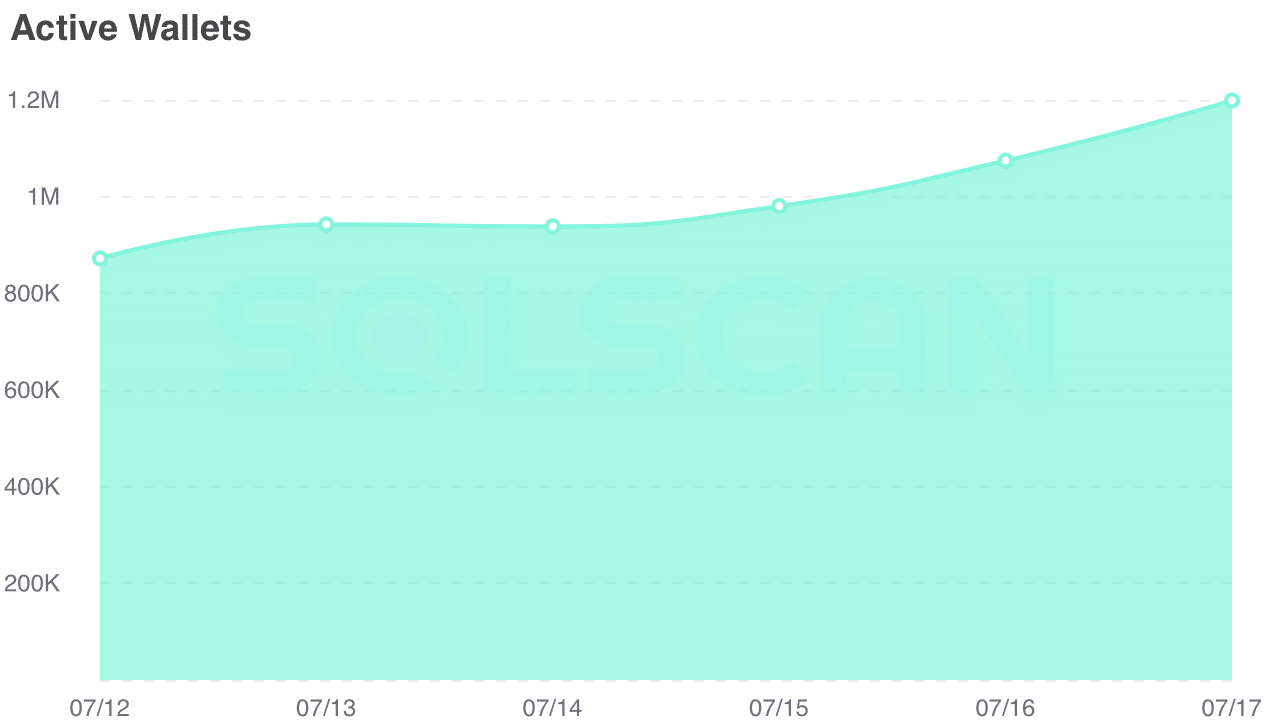

Additionally, Solana’s network activity saw In an upward trend, the number of active wallets has increased from less than 900,000 last week to 1.2 million.

Source: Solscan

Is your portfolio green? Check out the SOL profit calculator

This increase in active participation is significant as it is consistent with the bullish sentiment observed in the trading pattern.

It is worth noting that this strength in SOL is a result of recent developments. Pay attention to assets related to the spot Listed Index Fund (ETF).