- CREAM’s trading volume surged 378.65% in 24 hours, raising the price to nearly $75.

- Almost all cryptocurrency holders are whales, but Cream Finance’s TVL was underwhelming.

CREAM, the native token of DeFi protocol Cream Finance, has blown the cryptocurrency market out of recognition with its price rising 65.25% over the past seven days. This surge comes at a time when most cryptocurrency prices are falling or consolidating.

At press time, CREAM’s price was $72.25 and its market capitalization was $133.4 million. However, considering that the cryptocurrency is not in the top 100, Cream Finance’s market penetration appears to be limited.

For those unfamiliar, AMBCrypto explains what the project entails in this article.

What is Cream Finance?

Cream Finance is part of the yearn.finance (YFI) ecosystem. However, Cream does not only work as a lending protocol for individuals. Instead, it allows institutions and other protocols to access the network’s liquidity.

Cream Finance is a permissionless, open-source network and operates for users of Binance Smart Chain, Ethereum, Polygon, and Fantom blockchains.

Not many people know this, but CREAM was born after the hard fork of COMP (Compound Finance) in 2020. In cryptocurrency, a hard fork is a change to the protocol of a blockchain network.

If this happens, previous blocks as well as transactions become invalid. Users and nodes also upgrade to the latest version to maintain compatibility with upgrades.

Sometimes hard forks come with new tokens. Sometimes it doesn’t. For Cream Finance, its 2020 split led to the development of the CREAM cryptocurrency.

CREAM allows users to stake, lend, and borrow assets on the network. However, tokens are not the only assets available on the network. Cryptocurrencies such as COMP, ETH, YFI, some stablecoins and other tokens can interact with Cream Finance.

“This group” is driving prices up.

Following the recent price increase, AMBCrypto found that Cream Finance has not announced any major developments. However, using data from IntoTheBlock, we observed an increase in whale activity.

Whales own larger amounts of cryptocurrency. In most cases, the tokens held by this cohort represent 1% of the total circulating supply.

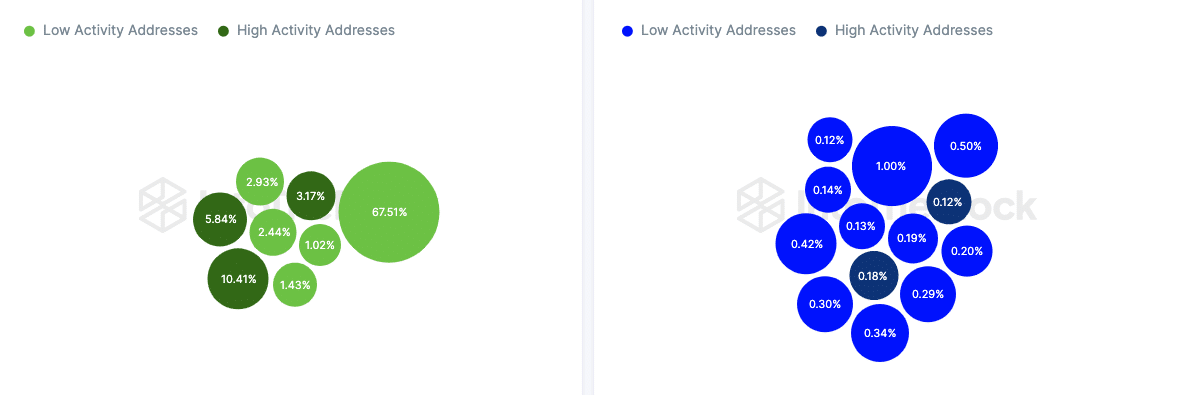

According to press time data, approximately 94.74% of CREAM holders are whales. Of this group, 19.42% participated in 1,362 transactions in the last 24 hours.

Source: IntoTheBlock

This number is considered high whale activity and is enough to move prices significantly. The reason why Cream Finance achieved better results than other projects appears to be because whale activity was active.

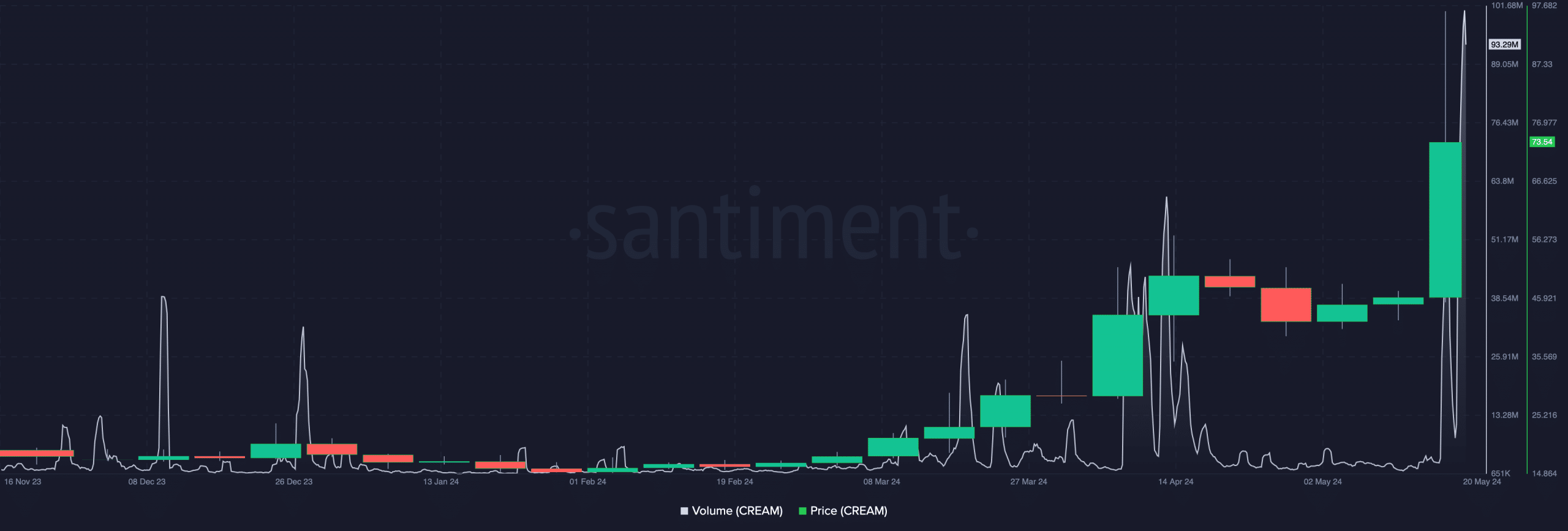

This increase was also confirmed in trading volume. As of this writing, CREAM’s trading volume has increased by 378.65% in the last 24 hours.

Trading volume surpassed $100 million on May 19, according to data from Santiment. With this trading volume, the price of CREAM closed at $75.

After a while, the price fell, indicating that some token holders took profits. Volume has eased slightly from this point, but it may not be enough to force a double-digit correction.

Source: Santiment

If sales continue to increase while prices are rising, CREAM could increase by another 15%, pushing the price up to $83.95.

However, a decline in trading volume may weaken the token’s power. In this case, the price could fall to $53.59, another area of interest.

Is CREAM trustworthy?

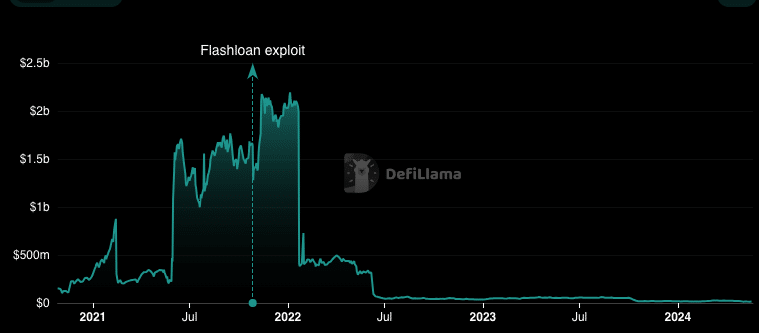

Despite the massive price rise, Total Value Locked (TVL) has signaled a bearish signal. TVL is an indicator of the state of the protocol.

When the indicator increases, it means market participants are depositing assets into the ecosystem. A drop in TVL means a surge in withdrawals.

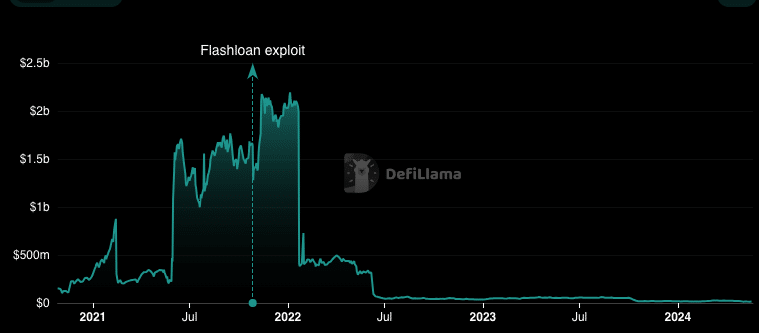

In this case, it may mean that participants no longer trust the system to provide good returns. Cream Finance’s TVL is over $2 billion in 2021, according to analysis by AMBCrypto using DeFiLlama.

Source: DeFiLlama

However, after the flash loan attacks of 2021, this indicator has become a shadow of its former self. For context, a Flash Loan attack occurs when an unsecured loan is taken out of a lending protocol by exploiting a flaw in the protocol.

Realistic or not, CREAM’s market cap in ETH is as follows:

The attackers in question use this to manipulate markets and steal assets owned by depositors. This ugly side of DeFi was experienced by Cream Finance, which had a TVL of just over $15 million at the time of press.

While TVL does not necessarily influence the price of a cryptocurrency, it serves as a signal that users are wary of interacting with the protocol.