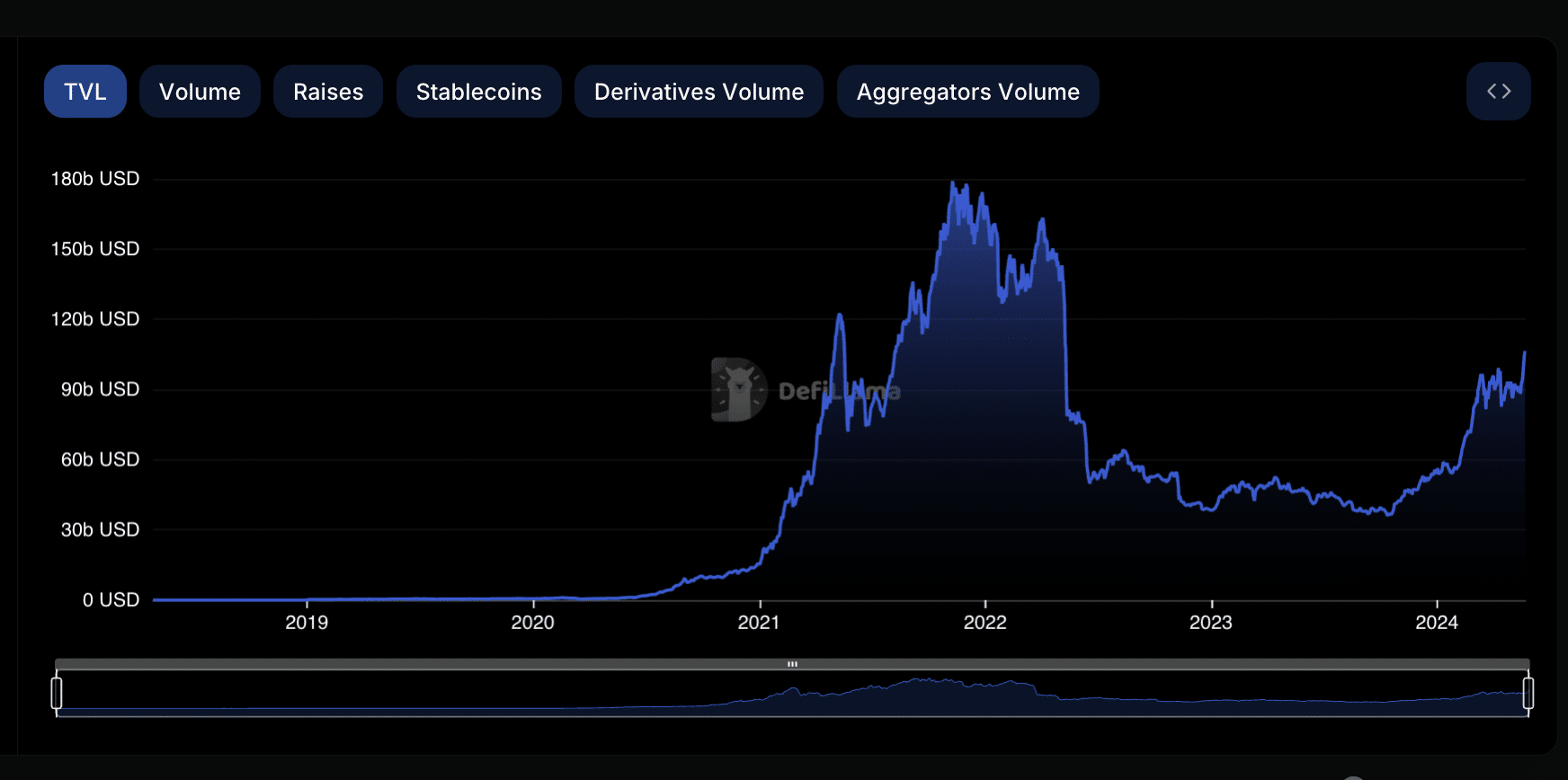

- DeFi TVL has now hit its highest since May 2022.

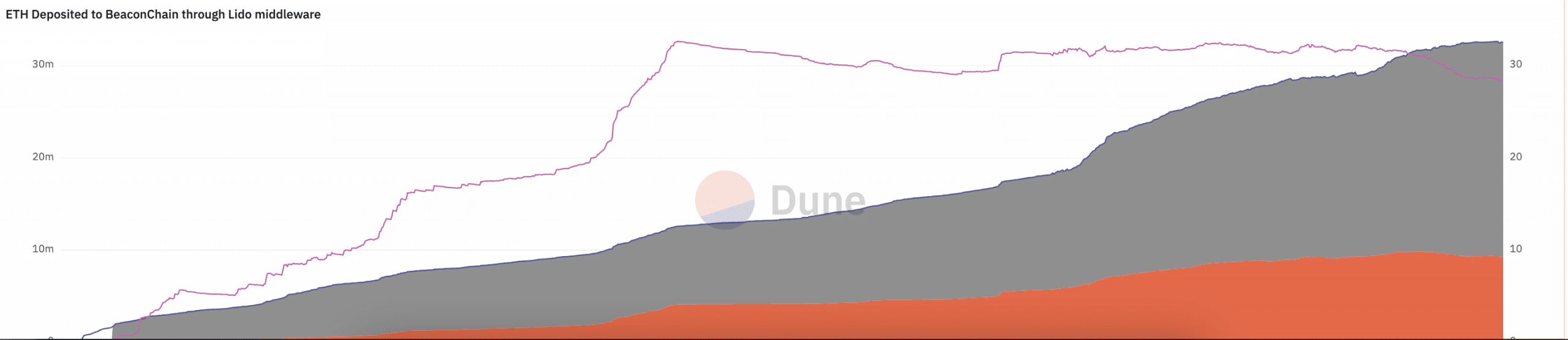

- Lido’s share of the ETH staking market is decreasing.

Total value locked (TVL) across decentralized finance (DeFi) protocols has risen to a two-year high amid a general market rally. DefiLlama’s data.

At press time, DeFi TVL was $106.45 billion. Evaluated on a year-to-date (YTD) basis, it is up 96% since the beginning of the year.

Source: DefiLlama

Lido’s market share declines

The value of assets locked across Lido Finance (LDO) pools, a leading Ethereum (ETH) staking provider and TVL’s largest DeFi protocol, has steadily surged since May 12.

Prior to this period, the protocol’s TVL had plummeted to $27.43 billion, its lowest in two months. However, as cryptocurrency asset values began to rise in mid-May, Lido’s TVL followed suit, growing by 30% since then.

Interestingly, Lido’s share of the ETH staking ecosystem has decreased. At the time of this writing, 28.6% of all ETH deposited on BeaconChain was created through Lido, according to data from Dune Analytics. The last time the occupancy rate of the liquid staking protocol was this low was on April 17, 2022.

Source: Sand Analysis

This decline comes amid a broader trend of declining ETH staked across multiple platforms over the past few days.

Information retrieved from The Block’s data dashboard shows that the overall supply percentage of staked ETH has decreased by 4% since hitting a YTD high of 27% on May 13th.

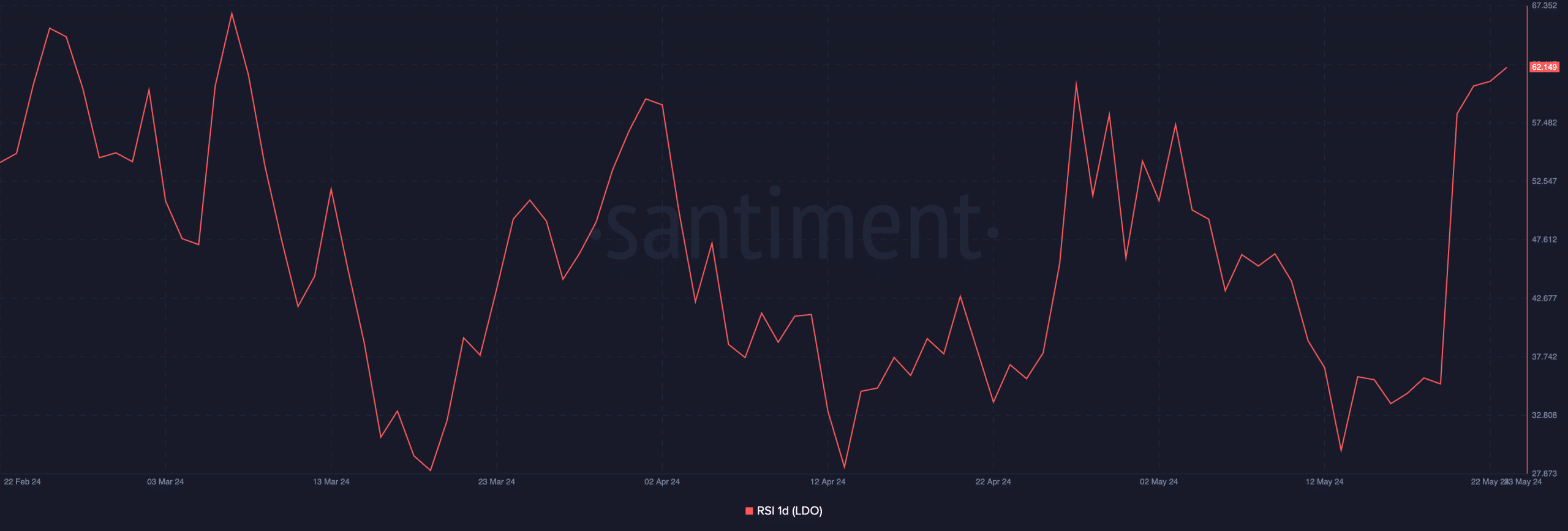

LDO demand surges

Regarding LDO, the protocol’s governance token, it was trading at $2.13 at press time. The value of altcoins has risen more than 30% in the past week, according to CoinMarketCap.

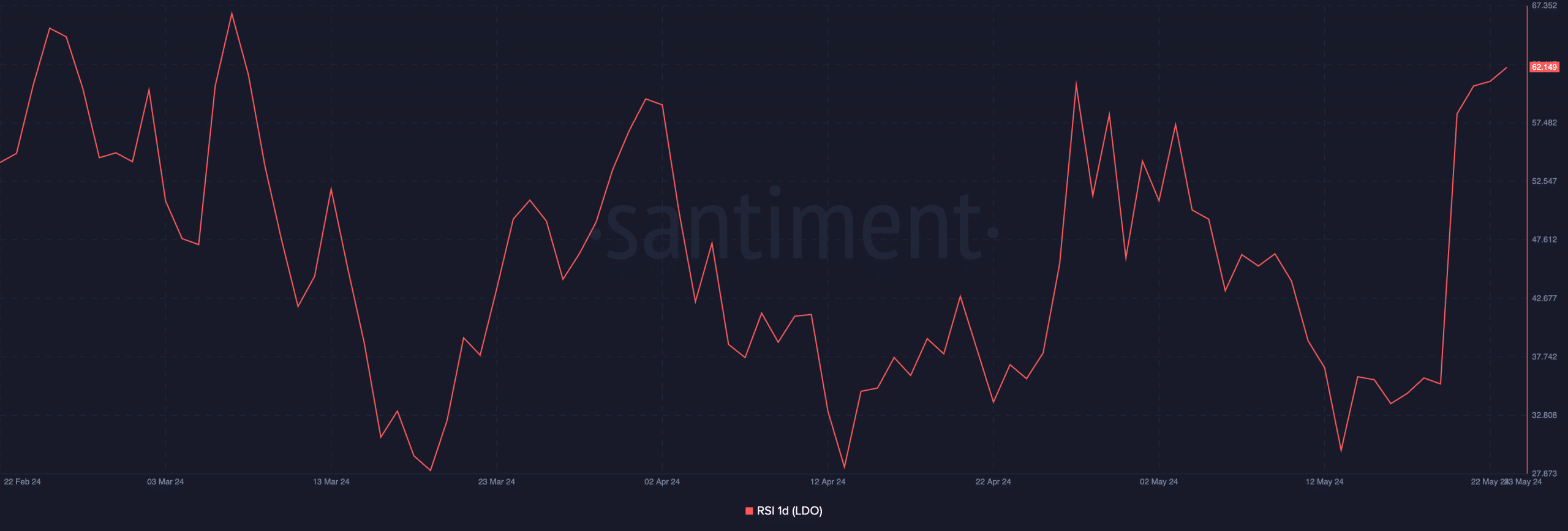

The surge in token value is due to increased demand during the period. Data from Santiment shows that the Relative Strength Index (RSI) has been on the rise since May 19th. LDO’s RSI, which hit 62.149 at press time, showed that buying momentum is more important than selling pressure.

Source: Santiment

Realistic or not, the market cap of LDO in BTC terms is:

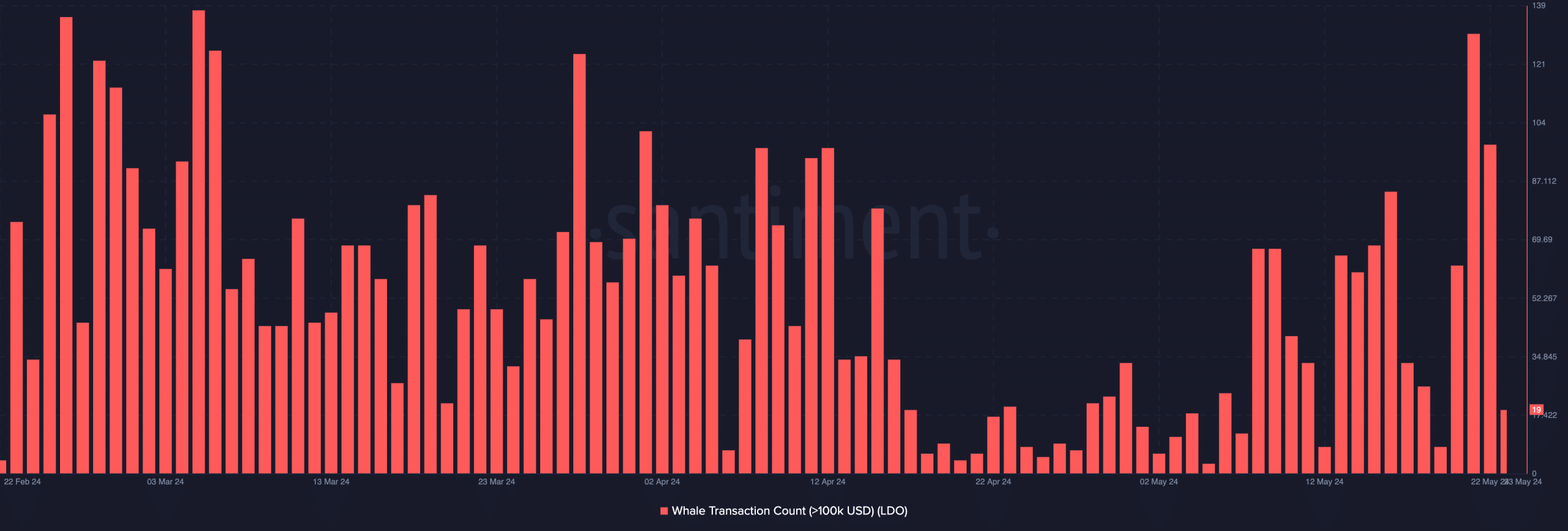

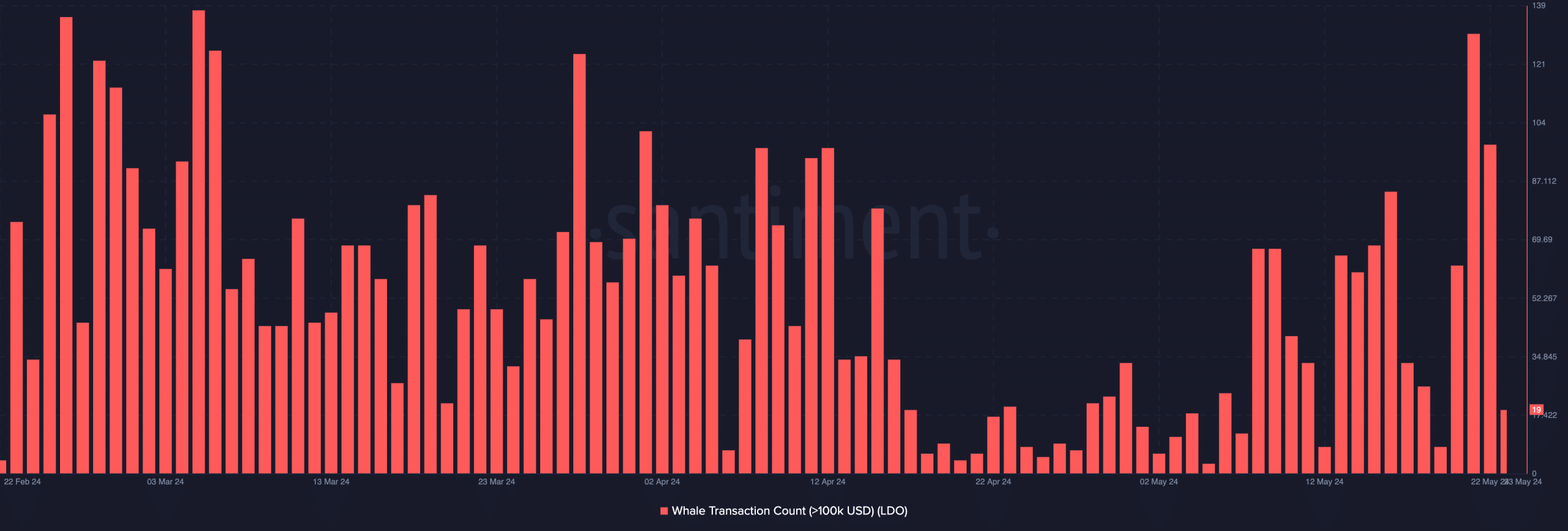

There has also been a surge in LDO whale activity over the past few days. In fact, daily LDO whale trading volume exceeded $100,000 on May 21, the highest since March 6.

On this day, 131 LDO transactions worth more than $100,000 were completed.

Source: Santiment