- Coin Holdings of PI Network has argued for centralization and validation control control.

- Short -term price predictions were firmly weak.

Since the strong rally on March 12 increased 26.28% a day, the PI network (PI) has been seriously declining.

The 82 billion PI coin of the project raised concerns about the centralized characteristics and long -term sustainability of the network.

The PI has been 54%since it surged all day. Technology analysis shows the level of support for the bull to force the price bounce. Investors who want to buy can wait for the trend to be strong.

The PI market structure remains weak during the period.

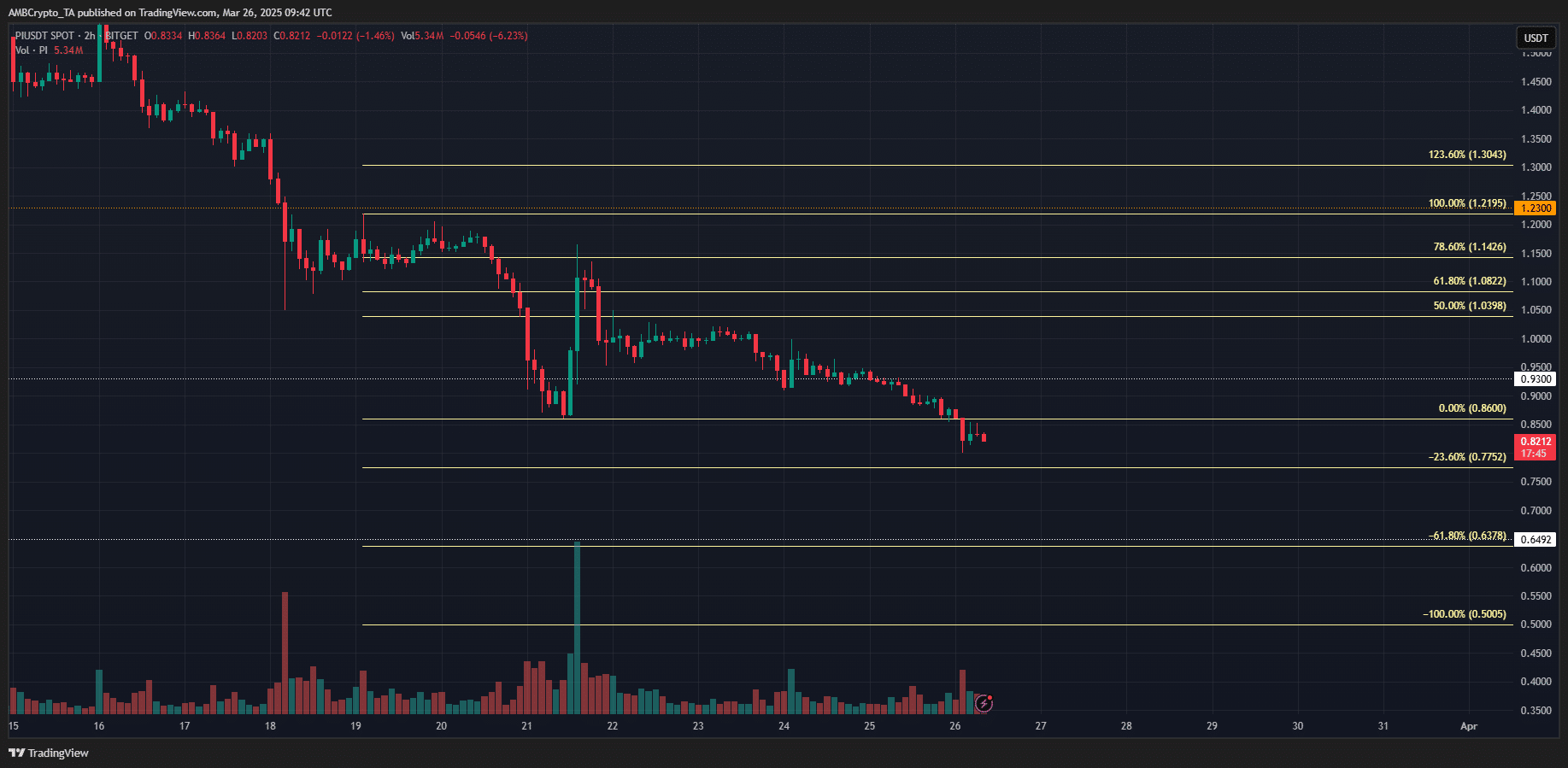

Source: TradingView’s PI/USDT

The four -hour chart reflects a firm decline. CMF shows steady capital outflow in the market last week, less than -0.05. This reflects the sales pressure.

The 20 and 50 moving average has also been well captured.

The 20SMA of the last four -hour chart has been used as a dynamic resistance. Therefore, the re -examination of the two moving average can be seen that the price of PI is rejected in the future.

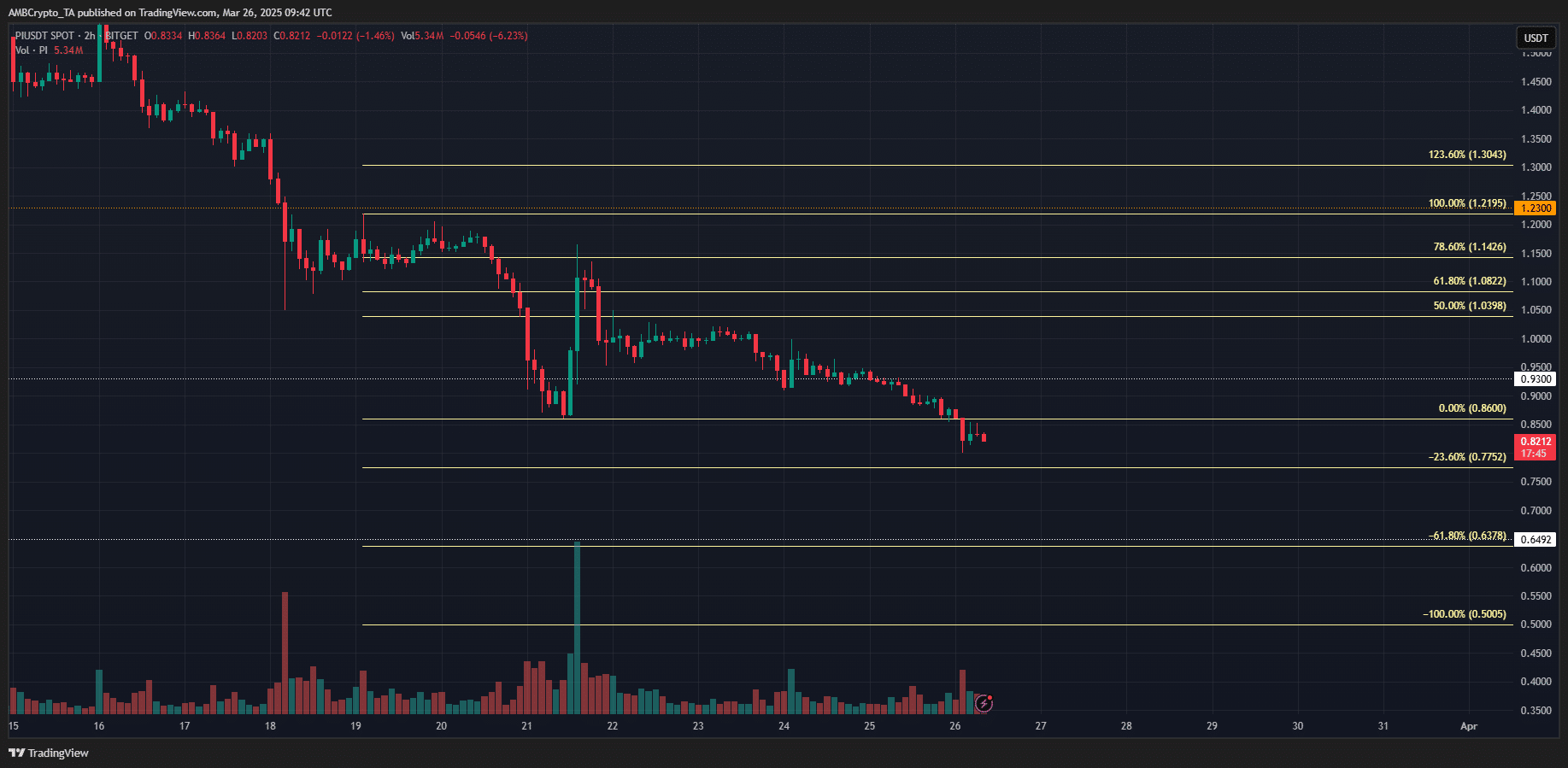

Source: TradingView’s PI/USDT

If you go from $ 1.22 to $ 0.86 a week ago, a series of Fibonacci Retression and Extension levels were drawn.

The PI network token headed for $ 0.775 and $ 0.638 in the future, which was marked at a short price of a short seller.

The price bounce on March 21 was found to be rejected at $ 1.14 at a retreat level of 78.6%. Since then, PI has decreased 28.38%and has fallen to less than $ 0.86.

The support area of $ 0.65 was interesting because it showed the level of major support by standing on February 21’s lowest level and line.

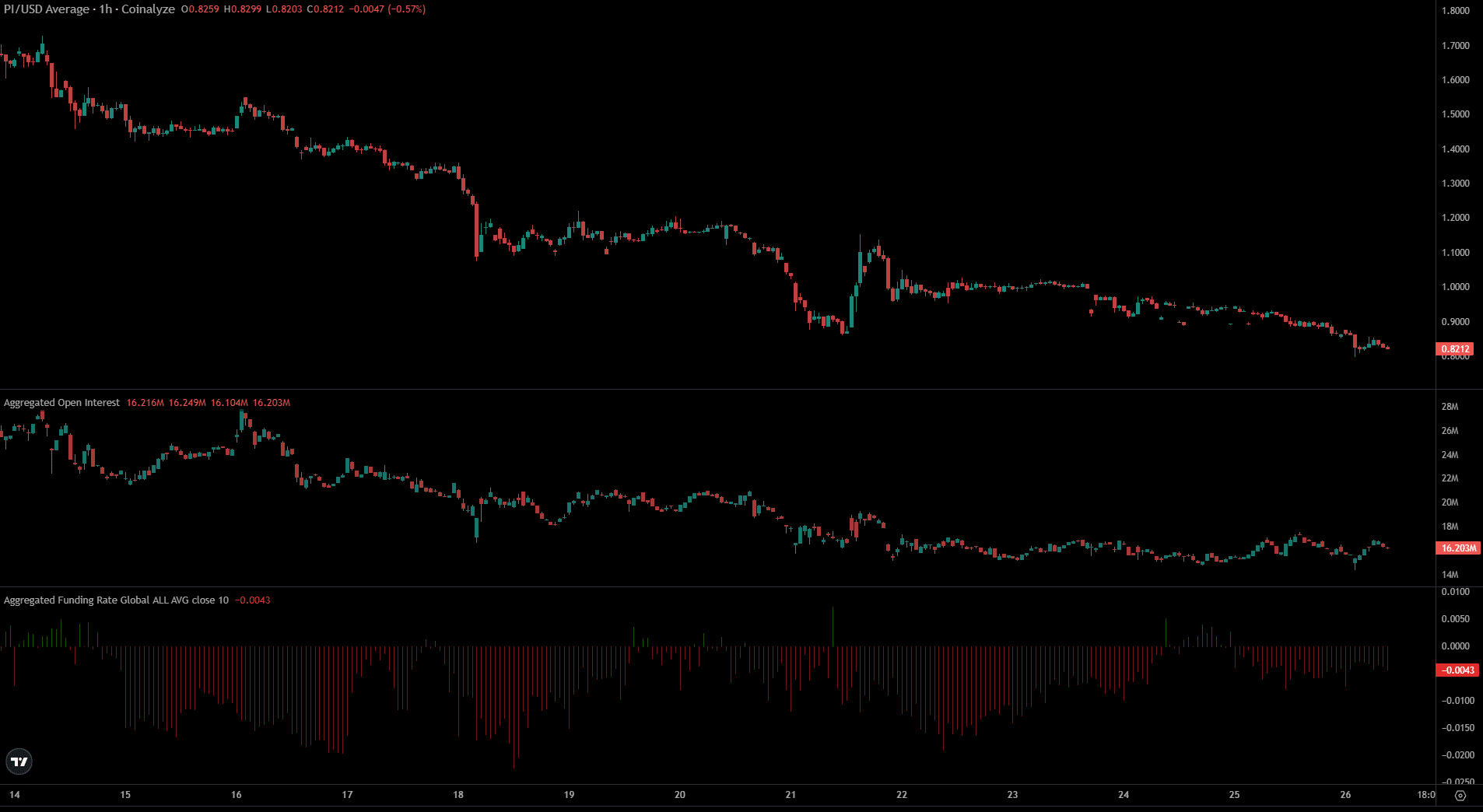

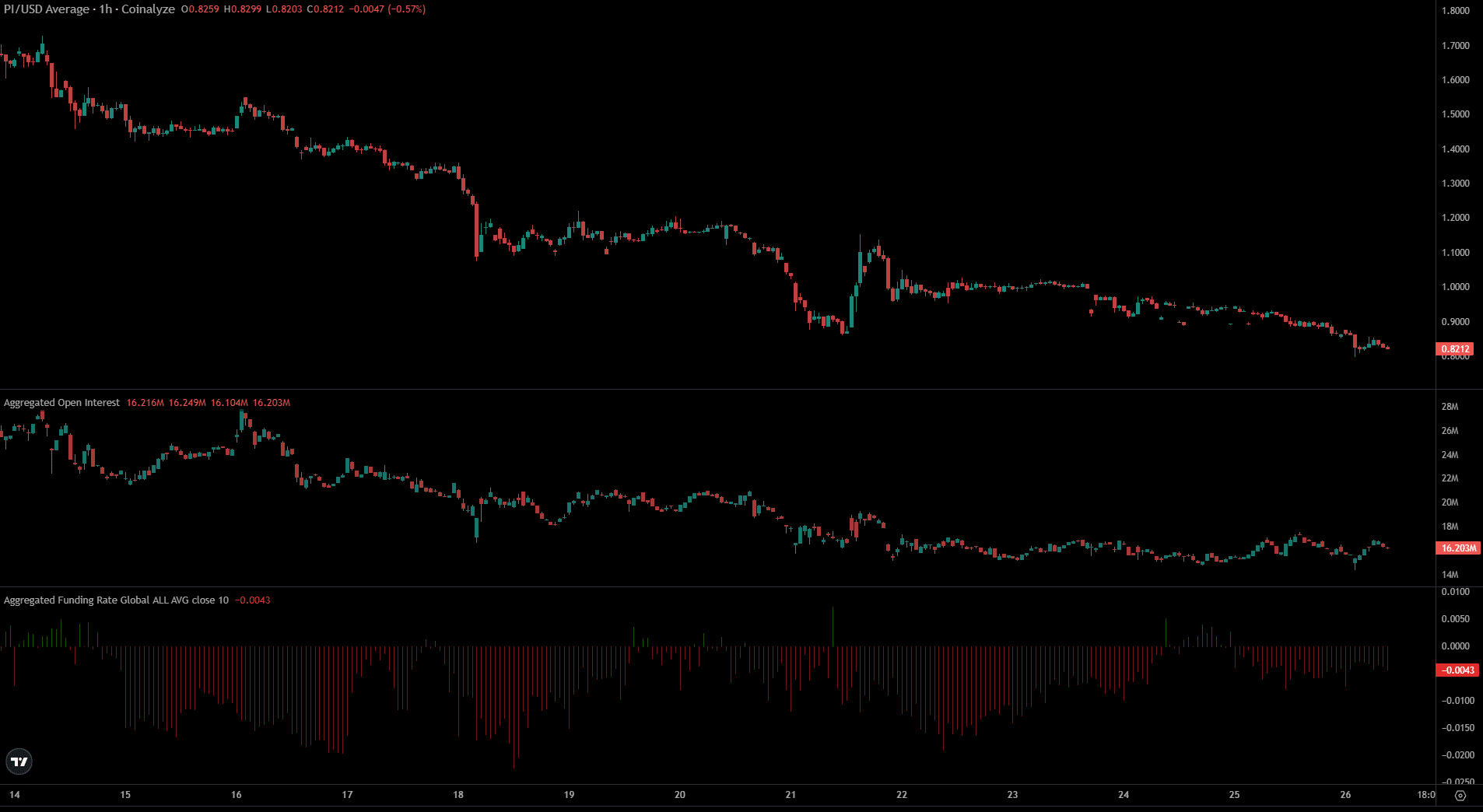

Source: Coinalyze

The rate of financing has been continuously negative over the past week. Short sellers have paid a premium in a long location, briefly explaining the weak feelings in the derivative market.

The interests held in the last four days have been flat. As the PI continued to decline, market participants seemed to maintain content.

The findings showed that the transition to $ 0.775 and $ 0.638 may have occurred in the future.

Indemnity Clause: The information presented does not make up financial, investment, transactions, or other types of advice, and is entirely the artist’s opinion.