- The ETH/BTC ratio of Fresh Lows has created a new discussion about ETH investment.

- The speculators are still expecting ETH to record $ 4K in 2025.

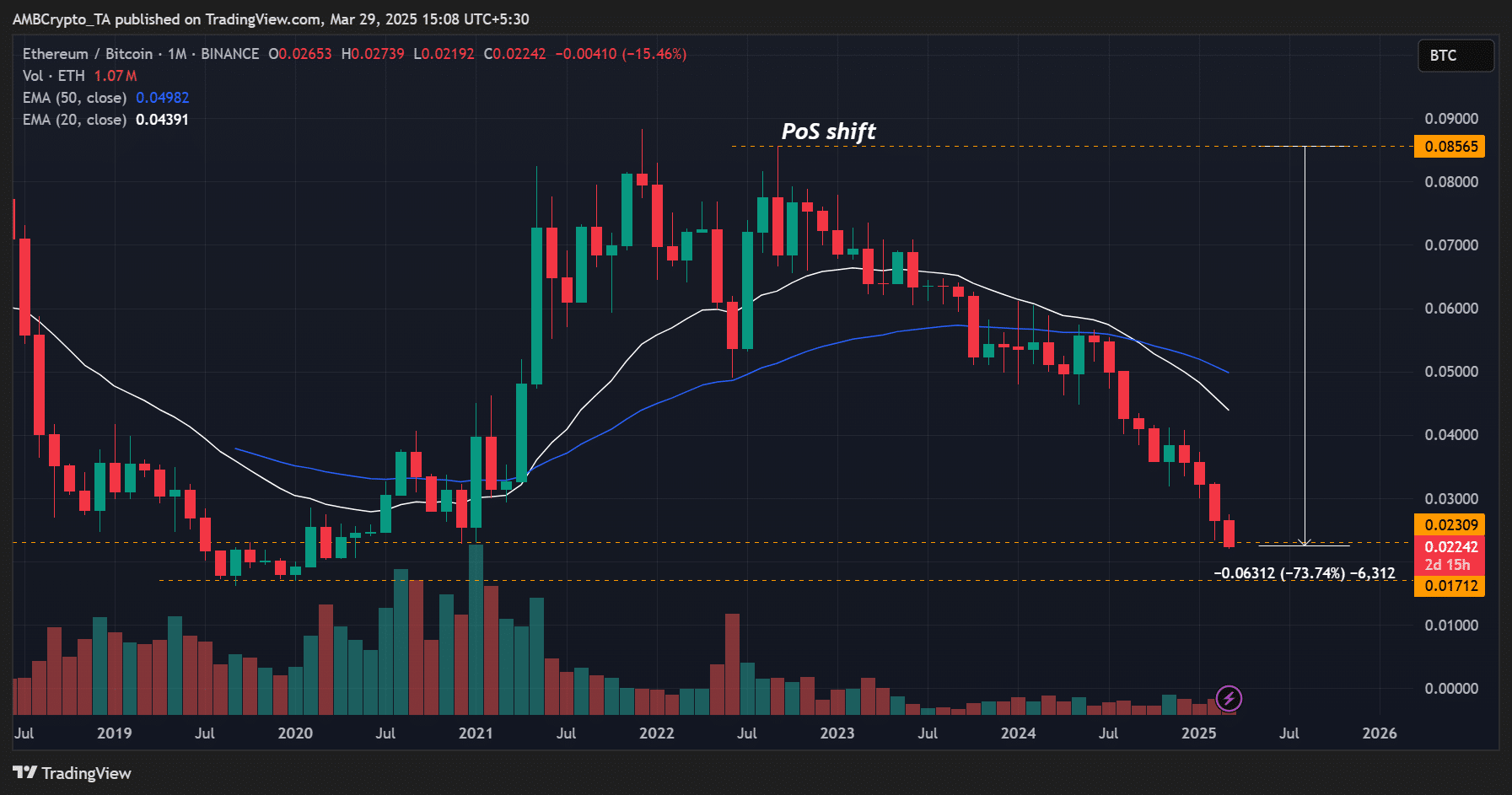

Ether Leeum (ETH) It has been weakened for more than three years. This can be proven at the ETH/BTC ratio, an indicator of ETH’s relative price performance for BTC. Recently, the new lowest value 0.022 has been displayed.

Mention of extended decline, Alex Thorn, Galaxy Digital Research Officer, stated,,,

“Ether has been reduced by 74% for Bitcoin since it switched from work proof to steak proof.”

Source: ETH/BTC, TradingView

In fact, some community members are even ~ Called ~ It is assumed that Altcoin’s value can be generated again so that a network like BTC can return to POW (Work-of-Work).

Is ETH worth betting?

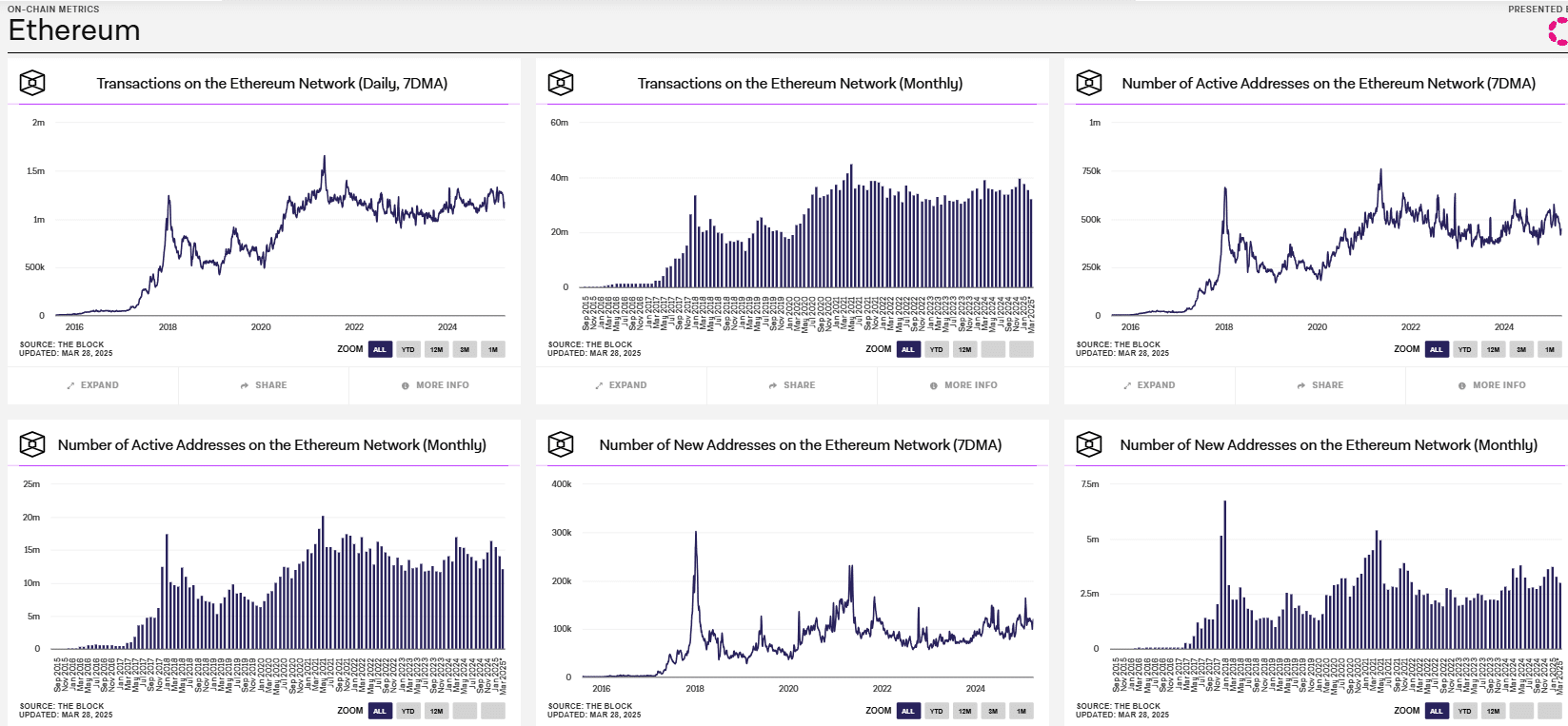

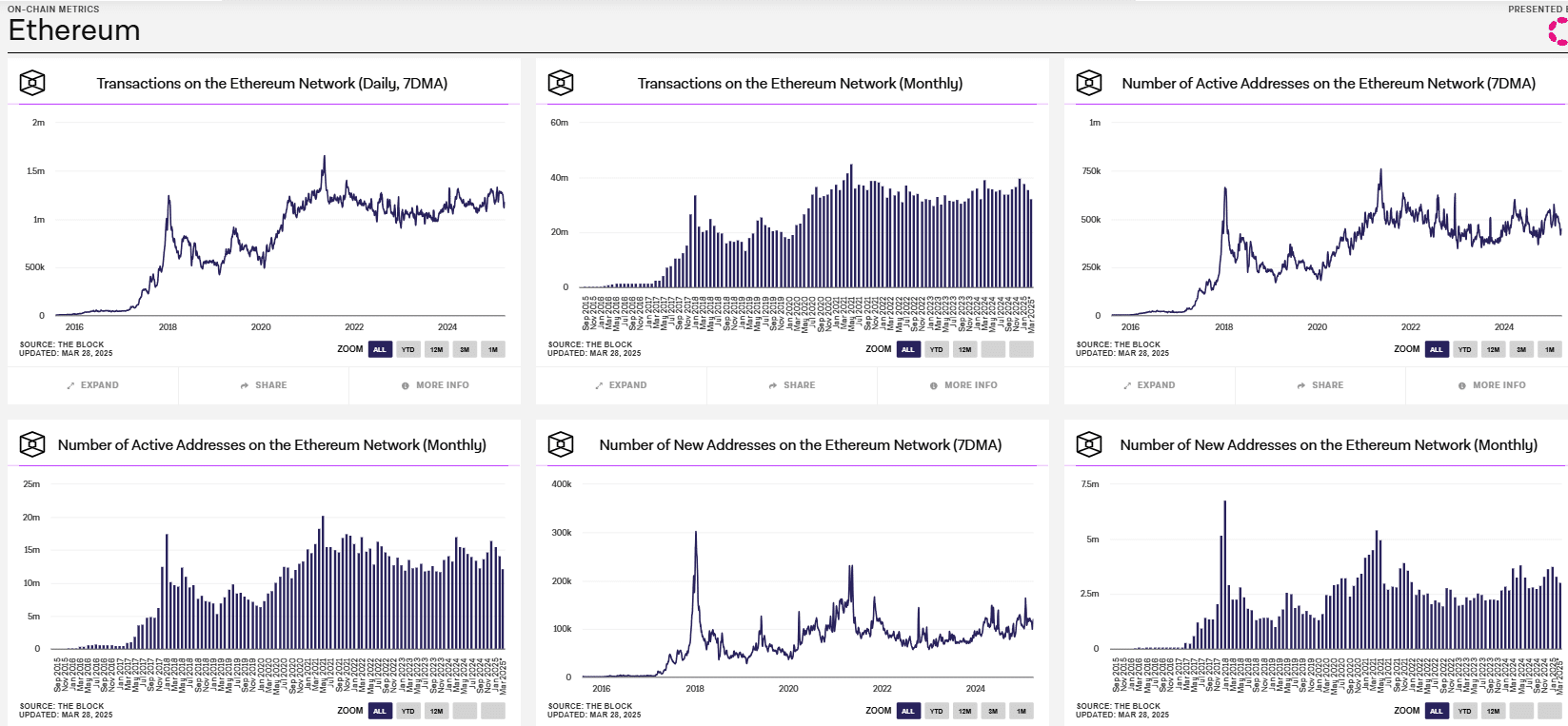

Macrocated HEDGE Fund vc Lekker Founder Quinn Thompson, Quinn Thompson, I believe The ATH is “not worth investment.” He quoted a decrease in network activities for other reasons.

“Do not make a mistake. The $ ETH as an investment has completely died. It is a market cap of $ 120 billion, with a decrease in trading activities, user growth and commissions/profits. There is no investment in this.”

Source: Block

He added that the network has a privilege as a utility but is not investment. Nic Carter, a partner of Castle Island Ventures and a co -founder of Data Aggregator Coinmetrics, reflects this feeling.

In fact, Carter stated,,,

“The #1 cause is the greedy ETH L2S siphon value of L1, and the excessive token creation is a social consensus called A-OK. ETH is buried in his token’s eyes. He died with his own hands.”

According to Thompson, the ETH/BTC ratio has been reduced to double digits during the 2023-2024 bull cycle and can be worse during the bear cycle.

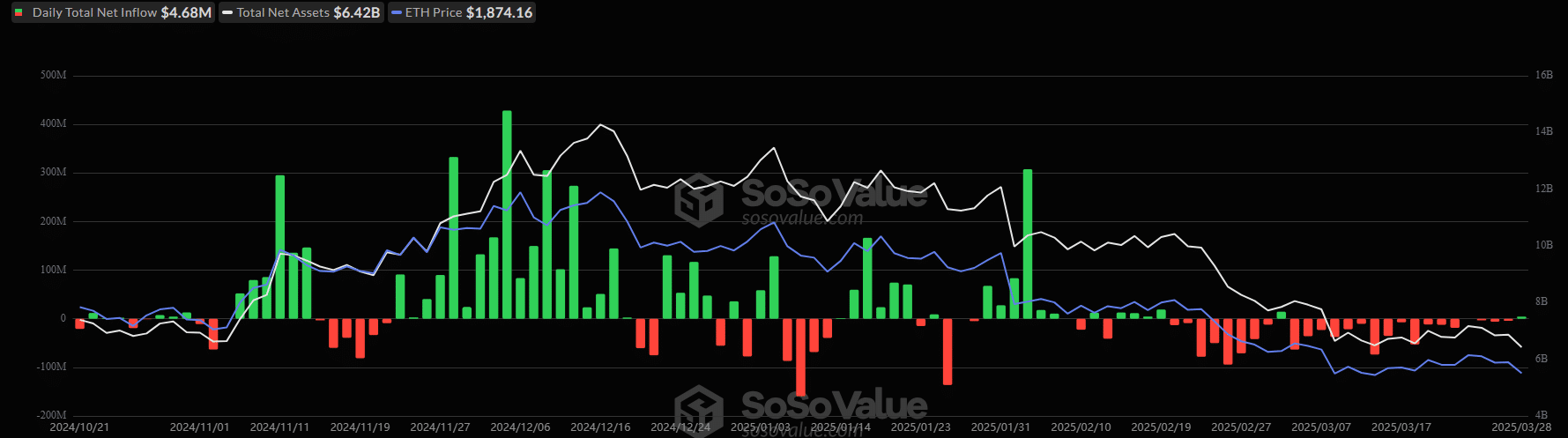

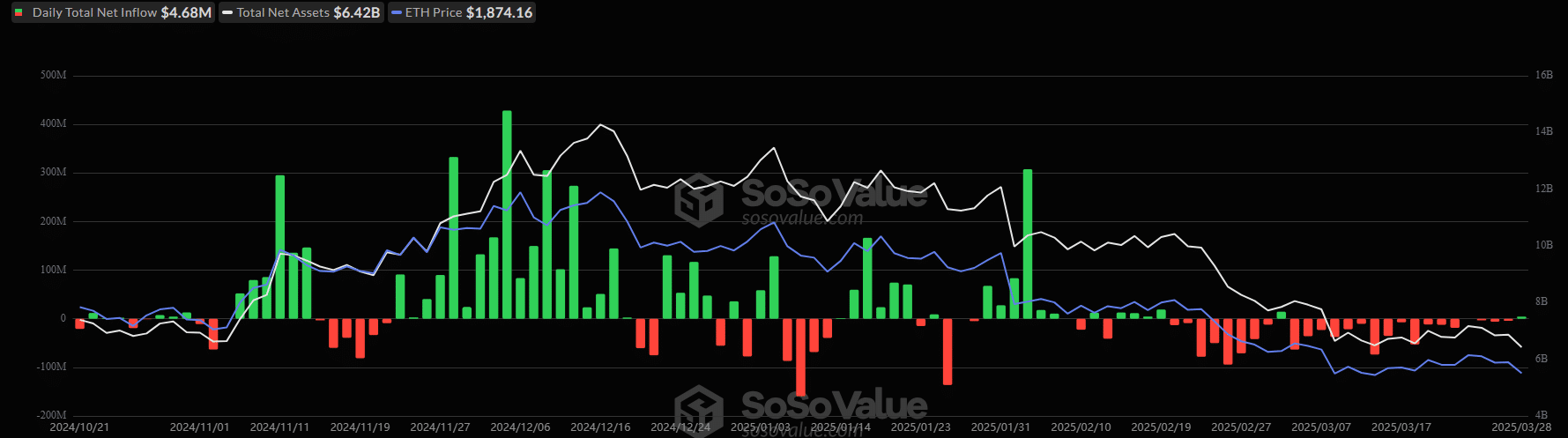

The recent ETF flow also showed dislocations between the two upper encryption assets. For the BTC ETFS, this product has a $ 1 billion inflow for 10 consecutive days (apart from last Friday, $ 9.3 million leaked).

On the other hand, the US Spot ETF was consistent with only two days entering the 20th of February. In March they saw more than $ 400 million leak.

Source: SOSO value

In short, negative feelings about social media appear to reflect the appetite of weak institutional investors.

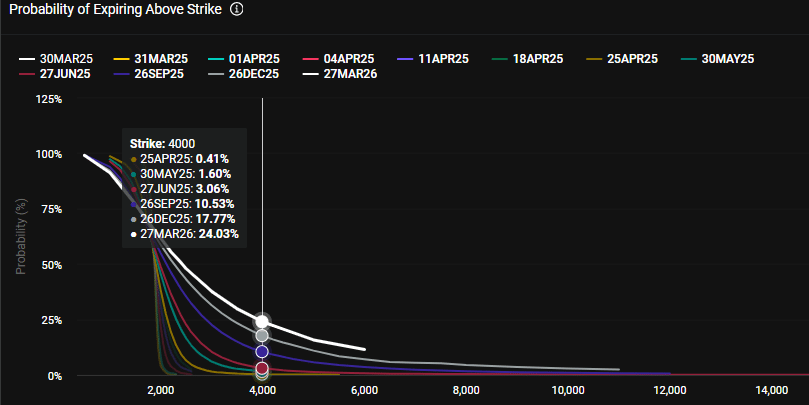

In other words, the weak flow could not derive the probability of ETH’s recovery. In predictions earth PolyMarket, an ETH price target of Better in 2025, is $ 4K (710K of the highest amount). The second highest volume is $ 5K.

In the case of Deribit’s optional trader, the 4K goal is not expected by September (10% probability). At the time of writing, ETH fell 54% from $ 4K in December, with $ 1.87K.

source: derivative