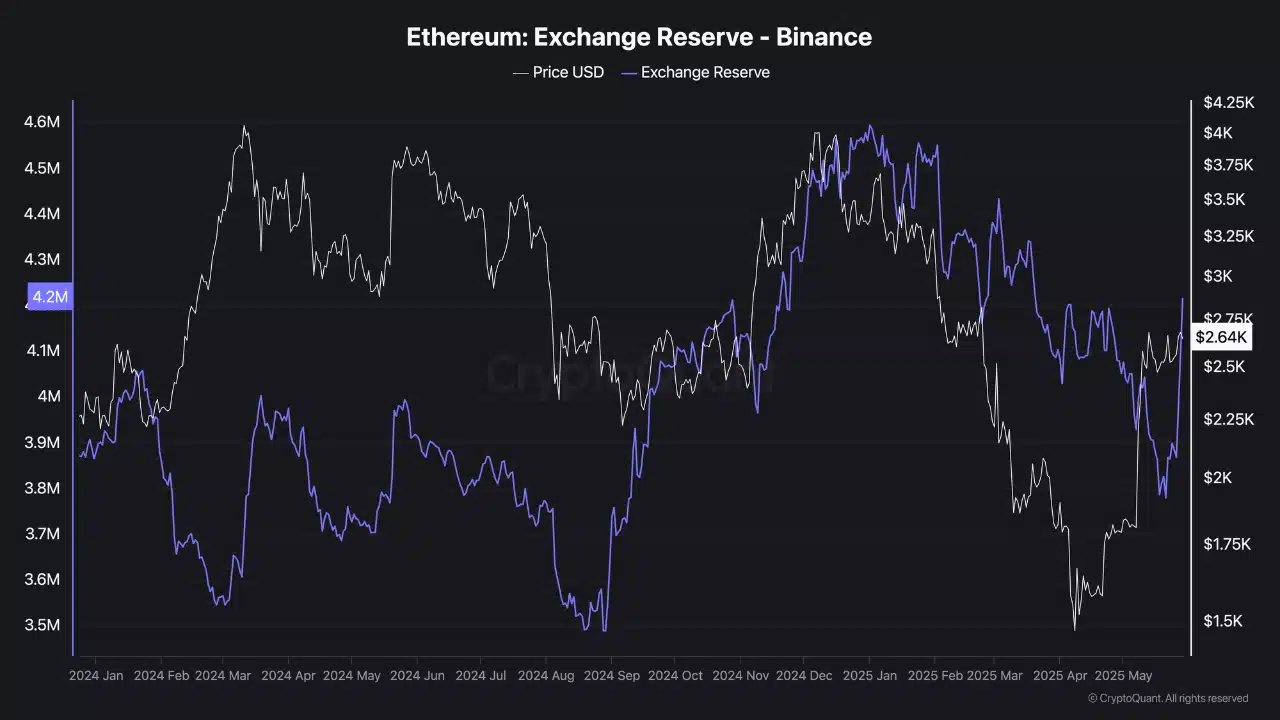

- Ether Lee’s Exchange Reserves for Binance rose sharply, suggesting an increase in sales pressure.

- The ETH caps the upward momentum in the face of a dense liquidation resistance between $ 2,700 and $ 2,830.

Ether Leeum (ETH) It was submerged in a narrow range between $ 2,400 to $ 2,700, but Binance On Chain Data had a risk of mounting under the surface.

In fact, Binance Exchange points out that token is transferred to the last level before the previous sale.

This is complicated by steady leaks even if the price is over $ 2,600. At the time of writing, ETH was traded at $ 2,623.84 after a 3.60% decline every day.

Source: cryptoquant

Why does negative net flow continue on the side?

Ether Lee’s net flow has been recorded in -248.83K ETH in the last seven days and -60.9k ETH for 30 days and was kept tightly negative.

This generally suggests accumulation of refrigerated storage or withdrawal of investors, but fixed price measures means that these withdrawals follow pre -sales activities.

The 24 -hour Netflow also showed a small reduction in -4K ETH and strengthened that capital outflow was not accelerated.

Therefore, the price is over $ 2,600, but this trend reveals a fundamental hesitation. Without the renewed inflow or buyer trust, the price may not be maintained at the current level.

Source: INTOTHEBLOCK

The weight of merchants and liquidation barriers is very high.

In the last 24 hours, merchants moved away from both sides of the market, and the public interest decreased to $ 181.4 billion, down 8.99%.

Low OI generally signals that there is a lack of conviction, and volatility tends to be compressed before failure or failure without aggressive positioning.

However, Binance’s ETH/USDT liquidation archipelago shows a dense wall between $ 2,700 and $ 2,830.

This cluster creates a resistance area that repeatedly triggers sales pressure to absorb strong momentum. Each failed attempt to violate the area led to a rapid reversal, as shown in the 24 -hour chart.

Source: COINGLASS

Unless the ETH increases to a significant amount to remove these barriers, the bull may be trapped under it. teaThe HESE liquidation zone acts as a ceiling until the market conviction changes to the buyer.

Ether Lee’s side movement hides deeper market weaknesses.

OIs, negative net flowers and powerful liquidation reductions suggest that sales pressure will be an upper limit.

If the bulls can’t be convincing $ 2,700, the $ 2,480 support can be pressed next. At present, the ETH sails a solid range with limited momentum, and now cautions remain.