- Ether Leeum’s accumulation area signals investor signals despite the recent market volatility.

- The main price level of $ 2,632 and $ 3,149 can define ETH’s next main price movement.

Ether Lee (ETH) has recently experienced price turbulence, and market watchers make it uncertain what the future is. But the core indicators point out the steady and strong feelings among investors.

The ETH cost distribution is a low price, especially at about $ 2,632 and $ 3,149.

This area is especially rigid with a $ 2,632 mark, which shows the beginning of price stabilization after recent recent recent recent recent recent recent recent recent stagnations.

The question is now: How will this support be prepared for a wide range of market epidemiology?

What the data shows

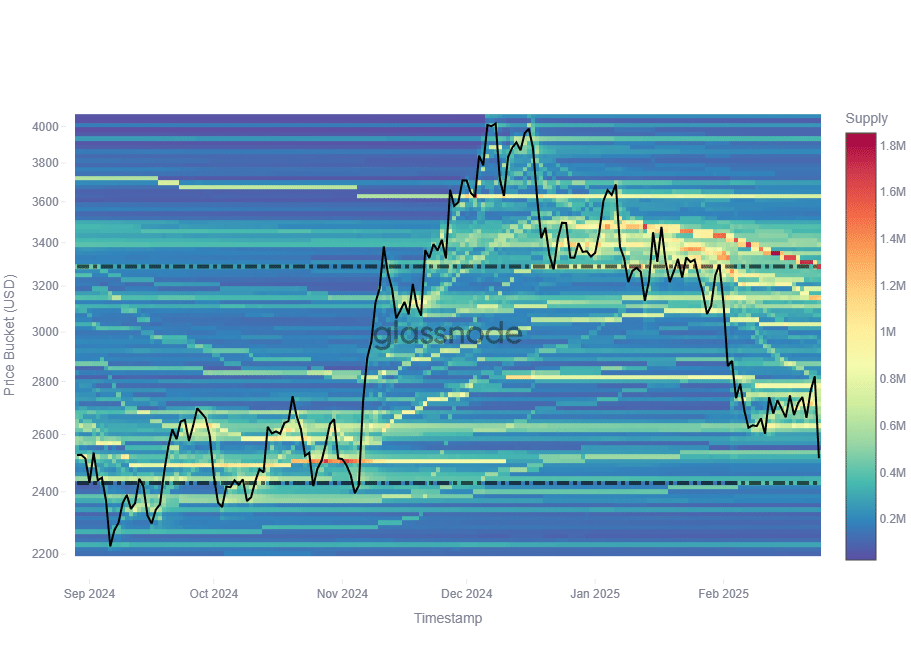

COST BAST DISTRIBUTION (CBD) traces the price level of investors acquired ETH, providing insight into market sentiment and accumulation trends.

The change in cost base suggests that investors have purchased in Deep to strengthen their major prices.

Recent glass node data shows a steady accumulation despite price volatility, with a lower cost base.

This suggests that investors consider it as a purchase opportunity, not the reason for the recent fall of ETH. If this trend continues, it can support price stabilization.

Accumulation

Ether Leeum’s accumulation area emphasized the main price level of investors actively building positions. The most powerful support area was $ 2,632, with 786.66K ETH accumulated.

This level showed a potential layer because the past trends showed that the buyer is actively stepping on the price of this price.

Source: Glass Node

On the contrary, the resistance accumulated 1.22m for $ 3,149. If there is Eth Rallies, this area acts as a barrier, which can cause selling when investors benefit.

Historically, strong accumulation levels indicate the market swing to make the area important for evaluating ETH’s next movement.

This is why ETH’s future is important

ETH’s recent price behavior pointed out an important moment for the future trajectory. The RSI of 33.30 indicates that ETH is getting closer to the overbidden area, which means that potential bounces may be on the horizon.

However, there is a risk of falling because it has not yet reached the lowest point.

Source: TradingView

The voice that overturns the MACD histogram strengthens the weak momentum, and the MACD and signal lines are widened, which is generally signs of continuous sales pressure.

The price of ETH is less than $ 2,500, which is important because it threatens to test the accumulation area of $ 2,632.

If you start supporting the buyer, you can recover from $ 3,149 resistance. However, failure can cause deeper modifications to make the following several trading sessions important.