- Ethereum price fell almost 10% in one week.

- Technical analysis suggested a near-term recovery, with key indicators indicating a decline in investor interest.

Ethereum (ETH) price has seen significant declines, falling nearly 10% over the past week and 1% over the past day, hitting a 24-hour low of $2,868.

This decline is even more pronounced compared to Bitcoin (BTC), which has broken notable price points despite current market conditions.

The decline in Ethereum market performance is due to several factors, including massive whale activity and selling pressure in the market, which has led to significant volatility.

Indicators of Declining Investor Interest in Ethereum

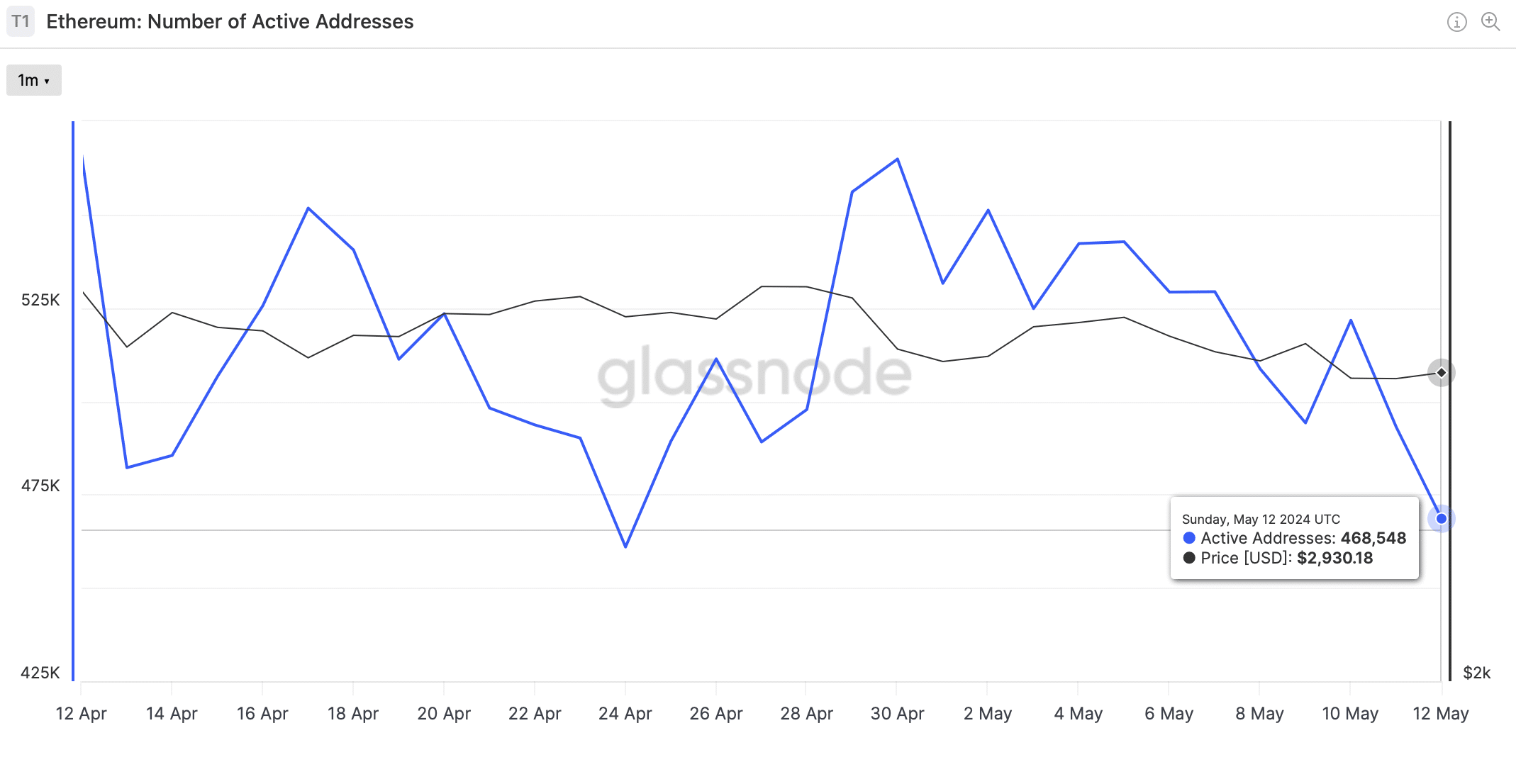

Further complicating Ethereum’s market problems is the decline in network activity metrics.

According to AMBCrypto’s view: Glassnode’s dataActive addresses on Ethereum have decreased from a high of 564,868 in late April to 468,548 as of press time.

Source: Glassnode

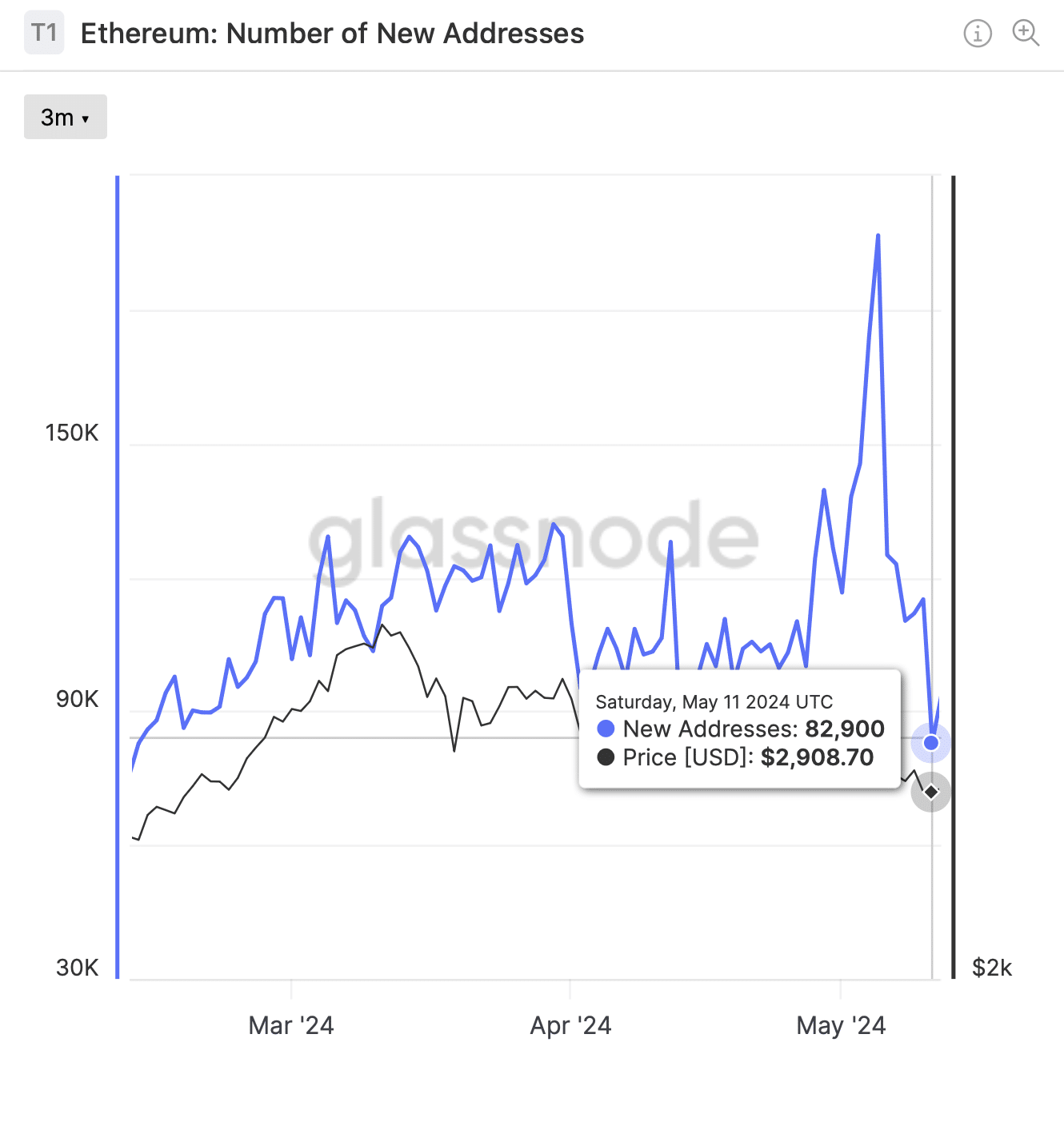

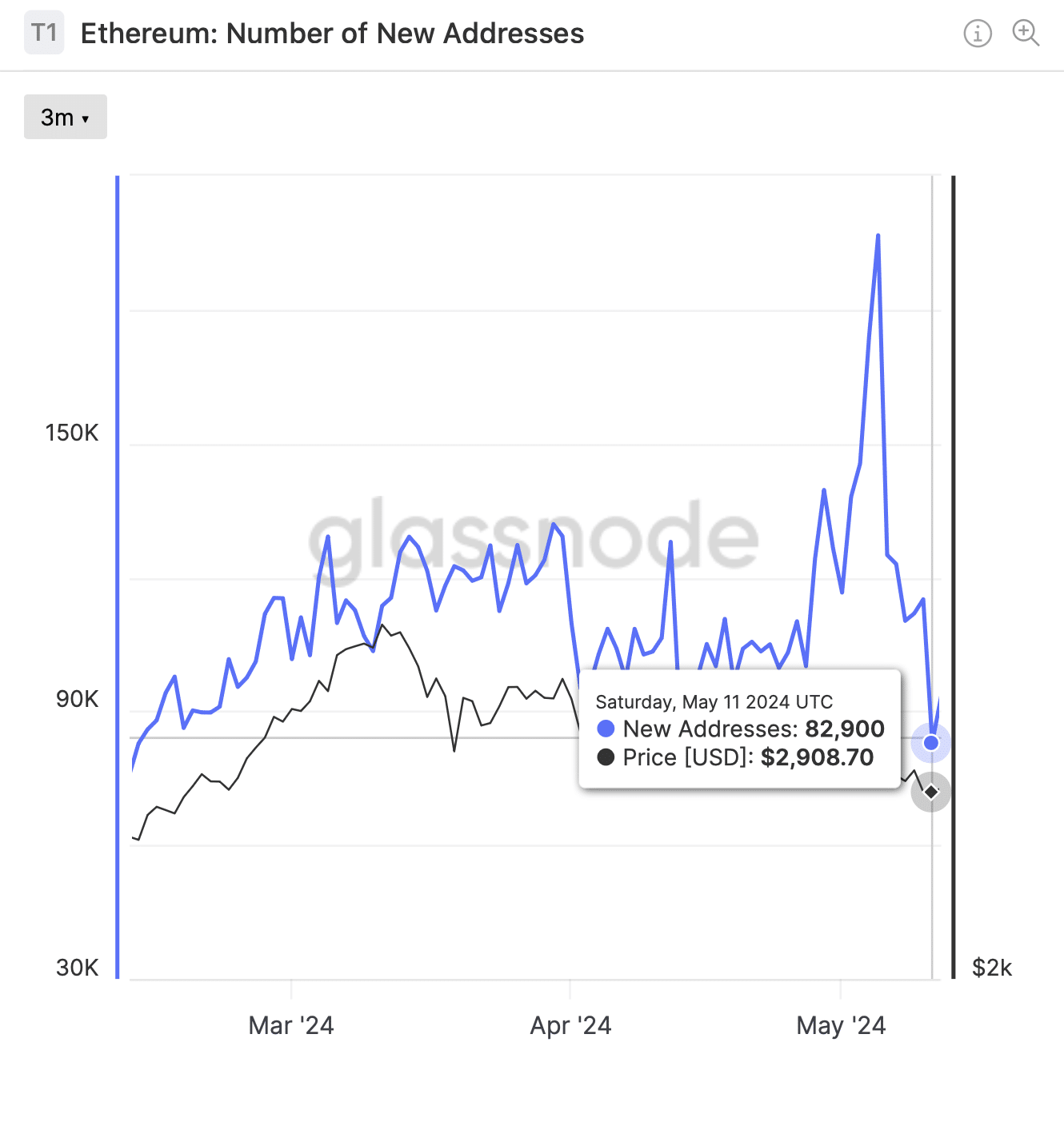

This decline in active addresses is paralleled by a decline in the number of new addresses, from 196,629 at the beginning of the month to less than 85,000 on May 11.

These indicators highlight the waning investor interest in Ethereum during this period.

Source: Glassnode

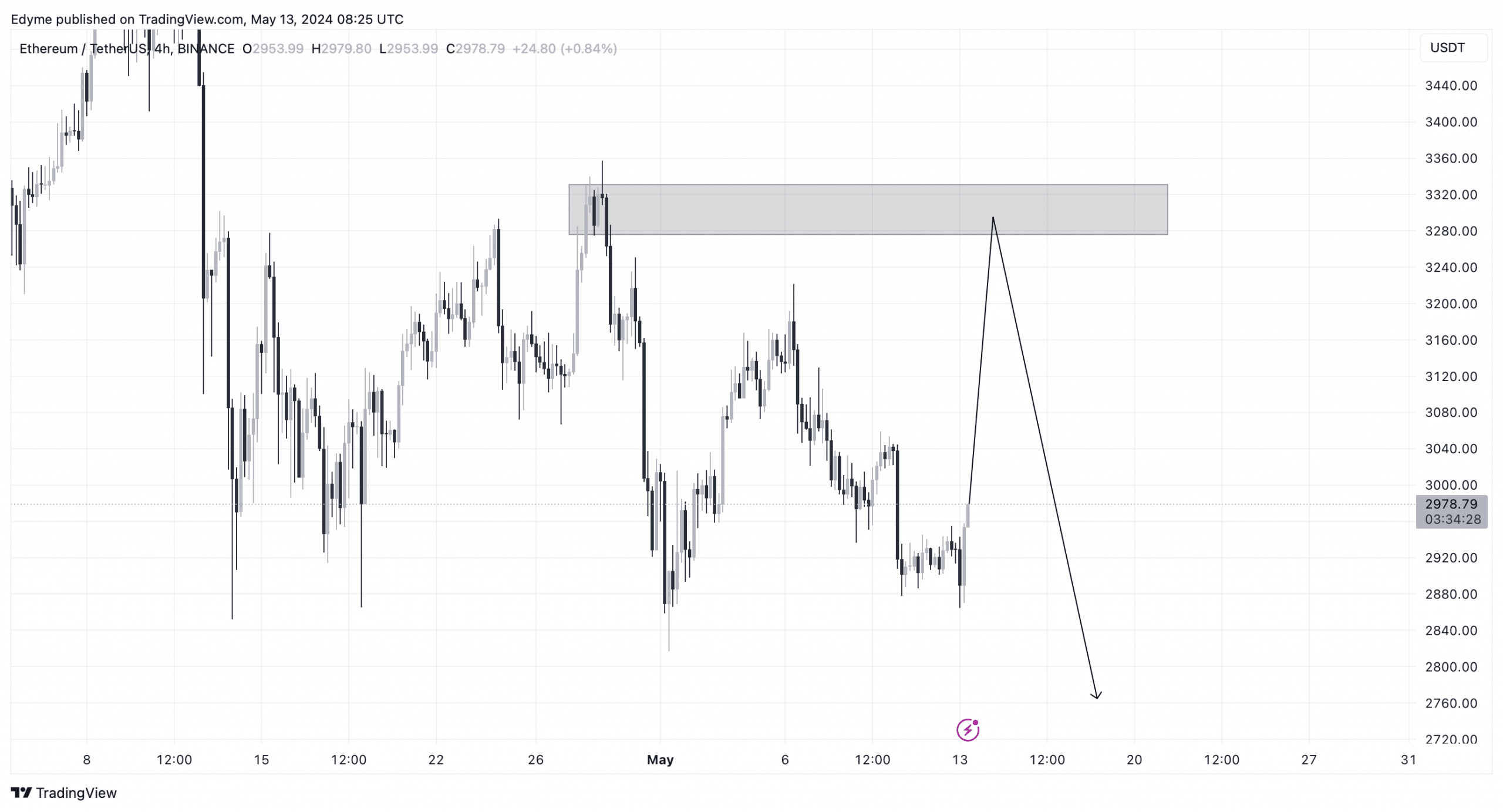

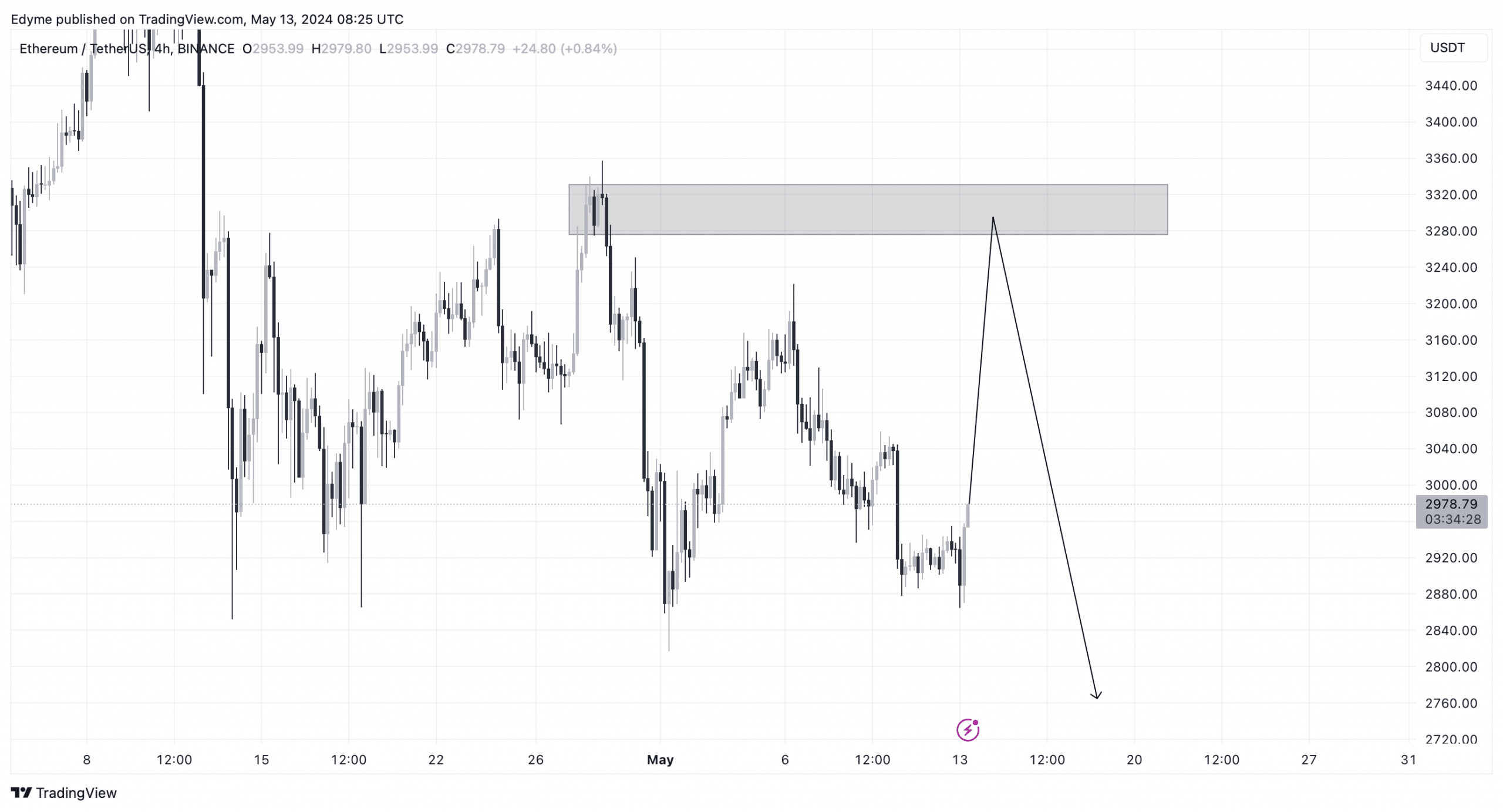

From a technical analysis perspective, Ethereum has broken an important support structure on the daily chart, indicating bearish pressure.

The 4-hour chart showed liquidity near $3,200 at press time, which would need to be secured before a major decline could continue.

This suggests that Ethereum could see a short-term rise above $3,000 before potentially falling to the $2,800 level, setting the stage for a potential rally later.

Source: TradingView

Read Ethereum (ETH) Price Prediction for 2024-25

Notably, the deposit of Ethereum onto the exchange coincided with the reactivation of two Bitcoin wallets that had been dormant for nearly 11 years.

Each wallet holds 500 BTC, We liquidated all of our holdings.This was another piece of bad news for investors.