DFS requires Gemini to refund $1.1 billion to Earn users and pay $37 million in fines for oversight failures.

The New York State Department of Financial Services (DFS) announced a landmark agreement with Gemini Trust Company, LLC, a leading cryptocurrency exchange and custodian. The enforcement action, led by Superintendent Adrienne A. Harris, requires Gemini to return more than $1.1 billion to Earn program customers after it was implicated in the bankruptcy of Genesis Global Capital, LLC (GGC).

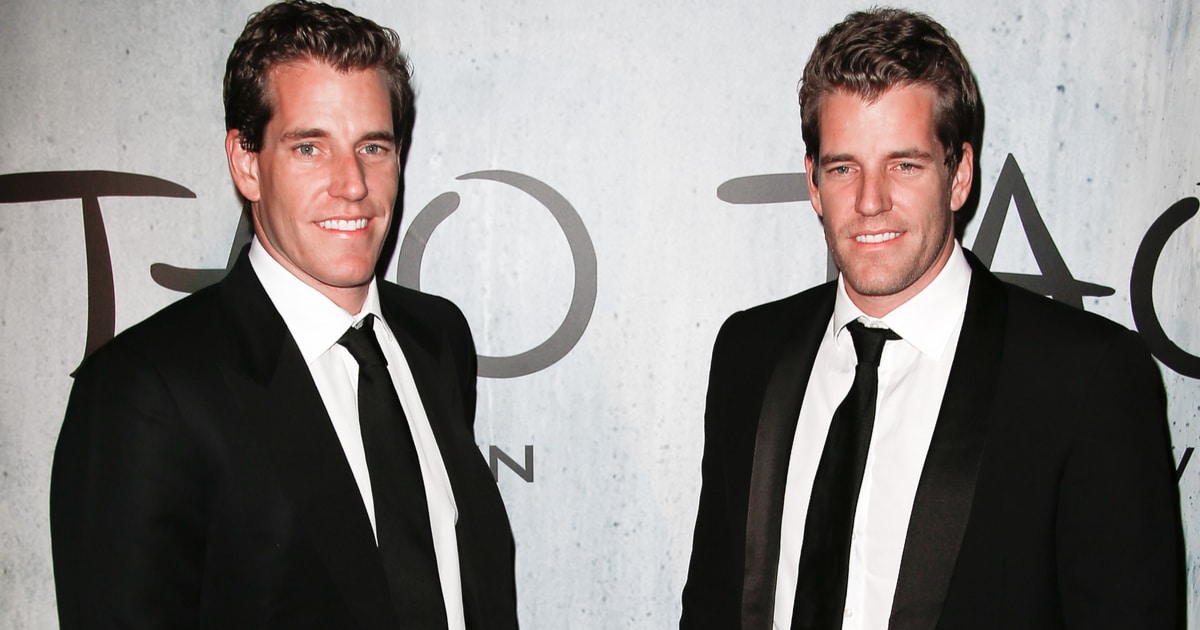

Gemini, co-founded by Cameron and Tyler Winklevoss, launched its Earn program on February 1, 2021, which allows customers to lend their cryptocurrency to GGC in exchange for interest payments. However, the platform suffered significant setbacks when GGC defaulted on about $1 billion in loans from Earn customers, halting withdrawals and resulting bankruptcy filing.

Superintendent Harris highlighted that Gemini’s lack of due diligence on unregulated third-party GGCs caused significant financial and reputational damage to more than 200,000 Earn customers, including approximately 30,000 New Yorkers. This settlement serves not only as a step to correct the harm done to these consumers, but also as a warning to the cryptocurrency industry regarding the importance of regulatory compliance and protecting customer assets.

As part of the settlement, Gemini will work with the bankruptcy court to contribute $40 million to GGC’s bankruptcy estate to facilitate the return of assets to Earn customers. Additionally, Gemini faces a $37 million fine for a series of compliance failures that compromised the safety and soundness of its operations.

A DFS investigation found that Gemini’s Earn program was marred by inadequate oversight and reserve management. Moreover, an unregulated affiliate, Gemini Liquidity, LLC, was found to have siphoned off hundreds of millions of dollars in customer fees, undermining Gemini’s financial health. These revelations highlight the complex financial and regulatory challenges that cryptocurrency companies face, especially when they intersect with the traditional financial system.

These developments have ripple effects across the cryptocurrency landscape as they highlight the strict stance regulators are taking on compliance and consumer protection. This settlement sets a precedent for the level of scrutiny and accountability cryptocurrency platforms will face going forward.

DFS affirms its commitment to protecting the integrity of financial markets and ensuring that licensed entities like Gemini operate within the bounds of state regulations and in the best interests of their clients. This case also demonstrates the complexities associated with virtual currency businesses and the need for a clear regulatory framework to govern their operations.

The Gemini settlement is poised to restore consumer confidence in the platform and the broader cryptocurrency market by demonstrating that regulators are actively working to protect investor interests. It could also lead other cryptocurrency companies to actively strengthen their compliance measures to avoid similar punitive actions.

Image source: Shutterstock