- Although 15 million LUNC tokens were burned, the price fell 4.19% amid declining market interest.

- Futures open interest decreased significantly, with trading volume plummeting 66.35% to $9.27 million.

The Terra Luna Classic (LUNC) ecosystem is witnessing various developments as price trends, token burns, and futures trading volumes unfold.

However, while recent token burns and price movements hint at a potential shift in the market, the latest price movements and open interest data indicate a complicated picture.

LUNC price updates and market activity

Terra Classic (LUNC) $0.00009008 At press time, it was down 4.19% in the last 24 hours. LUNC’s 24-hour trading volume was reported at $27,294,595.

Over the past seven days, LUNC has recorded a slight increase of 0.37%, showing some stability in a volatile market. The circulating supply of LUNC is estimated at approximately $5.7 trillion, with a market capitalization of approximately $513.1 million.

source: TradingView

This price change is burn On October 22nd, 15 million LUNC tokens were released. This is part of ongoing efforts to reduce supply and potentially spur price increases.

The deflationary approach aims to increase value over time, but has limited immediate impact, as evidenced by recent price declines.

Technical Analysis: Rising Support and Resistance Levels

The LUNC price chart shows an upward trend line, which indicates continued attempts by the bulls to drive the price higher. The trend line has provided support in recent weeks, creating higher lows.

If the price maintains this upward trajectory, it could signal further bullish momentum.

Key resistance is marked at the $0.00012740 level, which represents the next target for a potential breakout. A successful breach of this level could lead to further price increases if buying pressure persists.

source: TradingView

The downside is that support levels are identified at $0.00008850 and $0.00006390. These levels can act as a buffer against falling prices, especially if the upward trend line does not hold.

A fall below this support level could indicate a bearish trend reversal.

Futures Market: Open Interest and Volume Decrease

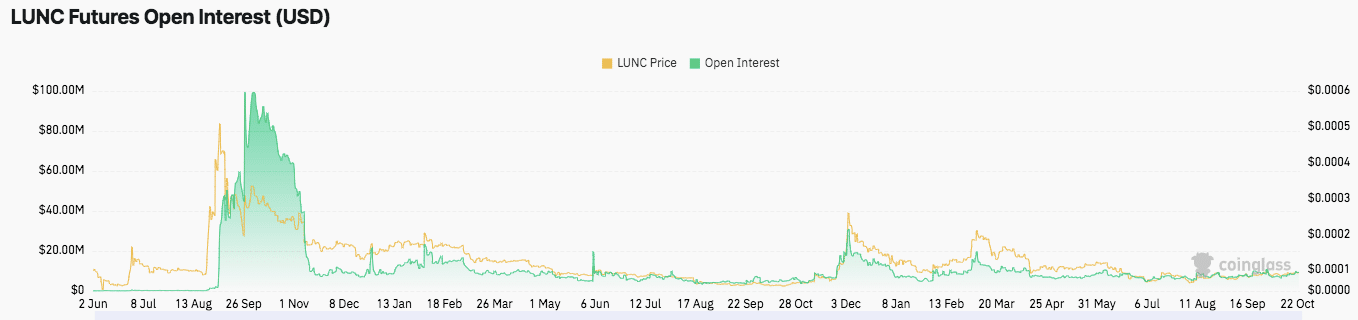

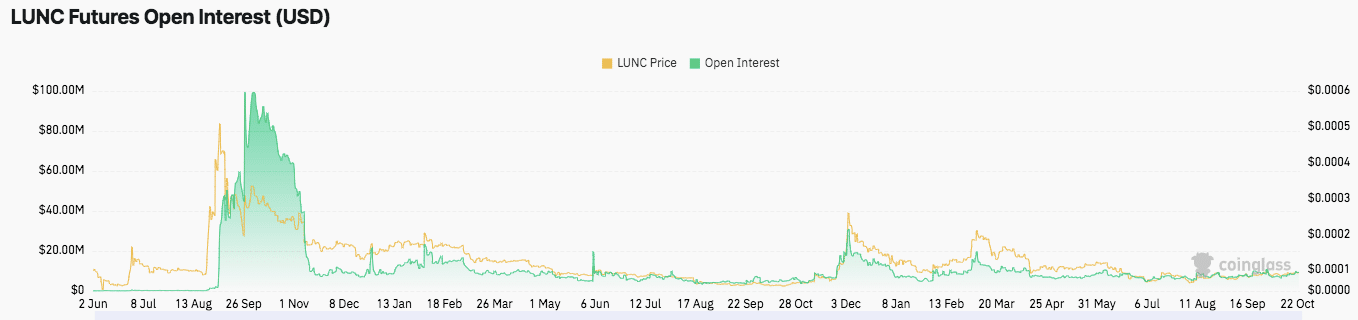

Open interest in the LUNC futures market currently stands at $9.27 million, down 4.68% from recent levels. Coin clock data.

This decline in open interest is consistent with the broader trend observed over the past year. Open interest peaked at nearly $100 million in September 2022 and has since trended downward.

Lower open interest means less market participation, potentially reducing volatility in the short term.

Source: Coinglass

Is your portfolio green? Check out the LUNC Profit Calculator

Additionally, trading volume in the LUNC futures market decreased by 66.35%, reaching $10.45 million.

This decline signals a decline in speculative interest, which can be caused by a variety of factors, including current price stability and market sentiment.