This article is also available in Spanish.

Bitcoin miners have been placing unusually high numbers of transactions on centralized exchanges recently, according to on-chain data.

Bitcoin miners on exchange trading indicator just saw a spike.

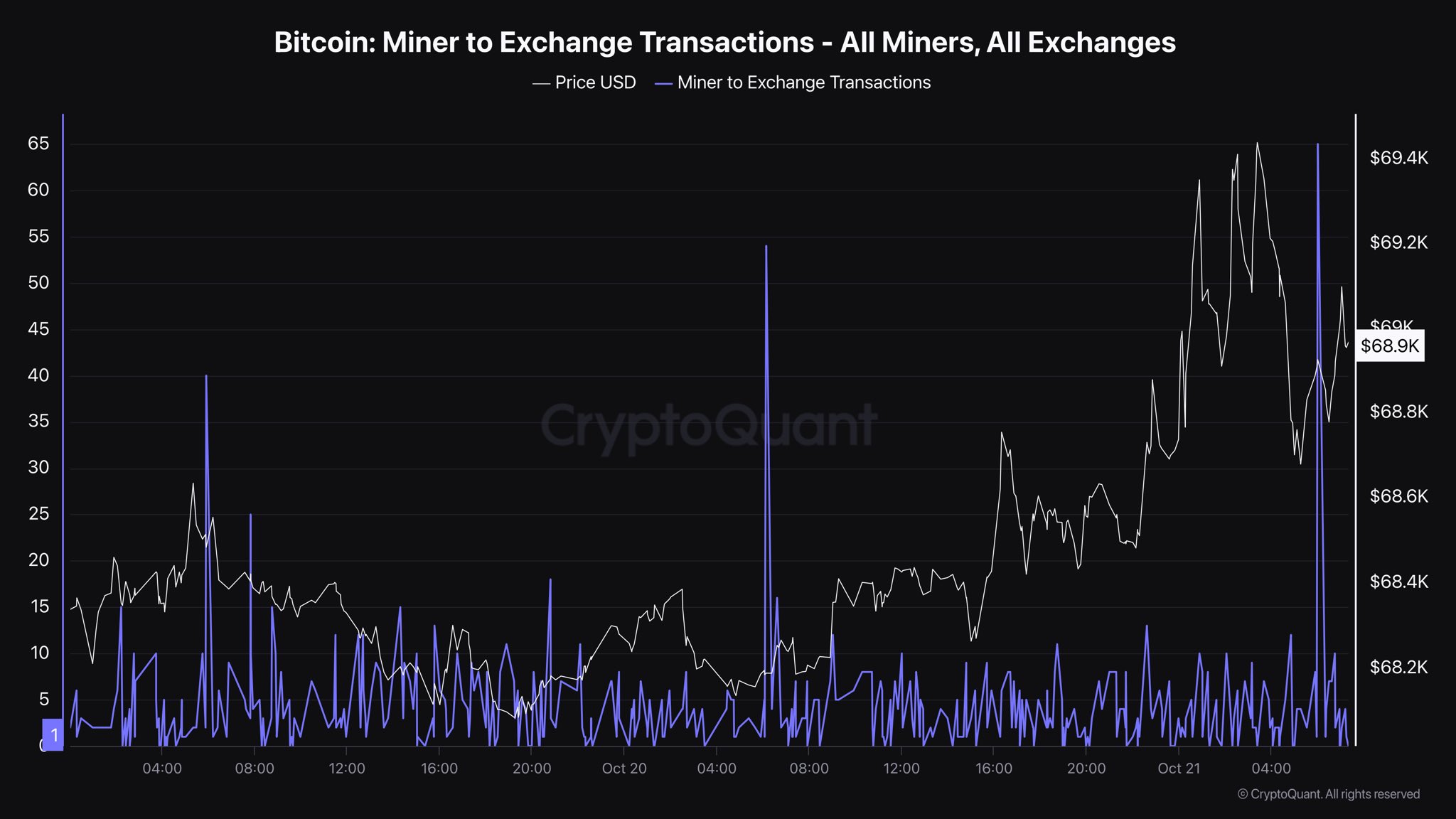

As CryptoQuant author IT Tech points out in a new post on X, miner-to-exchange trading indicators have been high recently. “Miner-Exchange Transactions” tracks the total number of transfers a miner-related Bitcoin wallet sends to an address associated with an exchange.

A high value of this indicator means that a lot of miners are moving to that platform. Since one of the main reasons these chain validators deposit on exchanges is for selling-related purposes, this trend could have a bearish impact on the BTC price.

Related Reading

On the other hand, a low indicator means that miners are planning to hold their coins for some time and therefore are not injecting funds into the exchange. Naturally, HODLing in this cohort could be a positive sign for the asset.

Now here is a chart showing the trend of Bitcoin mining vs. exchange trading over the last few days:

As shown in the graph above, Bitcoin miner-to-exchange transactions have recorded a large spike over the past day, suggesting a significant movement of miners to these platforms.

It’s possible that this represents a selloff of chain validators, but whether this potential selloff will actually impact the cryptocurrency will depend on the exact size of the coins involved in the transaction.

The analyst also shared data from a relevant informative indicator called Miner to Exchange Flow.

Looking at the chart, we can see that the value of this indicator has surged along with the surge from miners to exchange transactions. At its peak, this indicator reached 225 BTC, which is just under $15.4 million at current prices.

While not a small amount in itself, these exchange inflows are not that large when taken considering the size of the overall Bitcoin market capitalization. So even if miners plan to sell these coins, the market should be able to absorb the pressure well.

Miners tend to be frequent sellers as they are entities that incur ongoing operating costs in the form of electricity bills. In most cases, sales are limited so that the value from recent miners to exchange flows is up to standard.

Related Reading

However, the number of individual transfers made by miners to exchanges is certainly unusual, so these indicators may need to be kept watched over the coming days in case we see more spikes.

BTC price

Bitcoin surpassed the $69,000 level on Sunday, but today the asset appears to have fallen back to $68,200.

Dall-E, featured image from CryptoQuant.com, chart from TradingView