- Demand for XMR has surged over the past few days.

- This happened despite proposed plans to shut down LocalMonero.

Monero’s native coin, XMR, appears poised to extend its seven-day rally despite negative sentiment over the closure of LocalMonero, a peer-to-peer trading platform for privacy coins.

May 7th, Local Monero presentation The platform reportedly disabled all new sign-ups and advertising postings for XMR. It added that new XMR transactions will be disabled on May 14 and the website will be shut down on November 7.

XMR looks the other way.

At press time, the popular privacy coin was valued at $132.52, up 8% over the past seven days, according to CoinMarketCap. This is despite the fact that the broader market has largely remained cautious in the past.

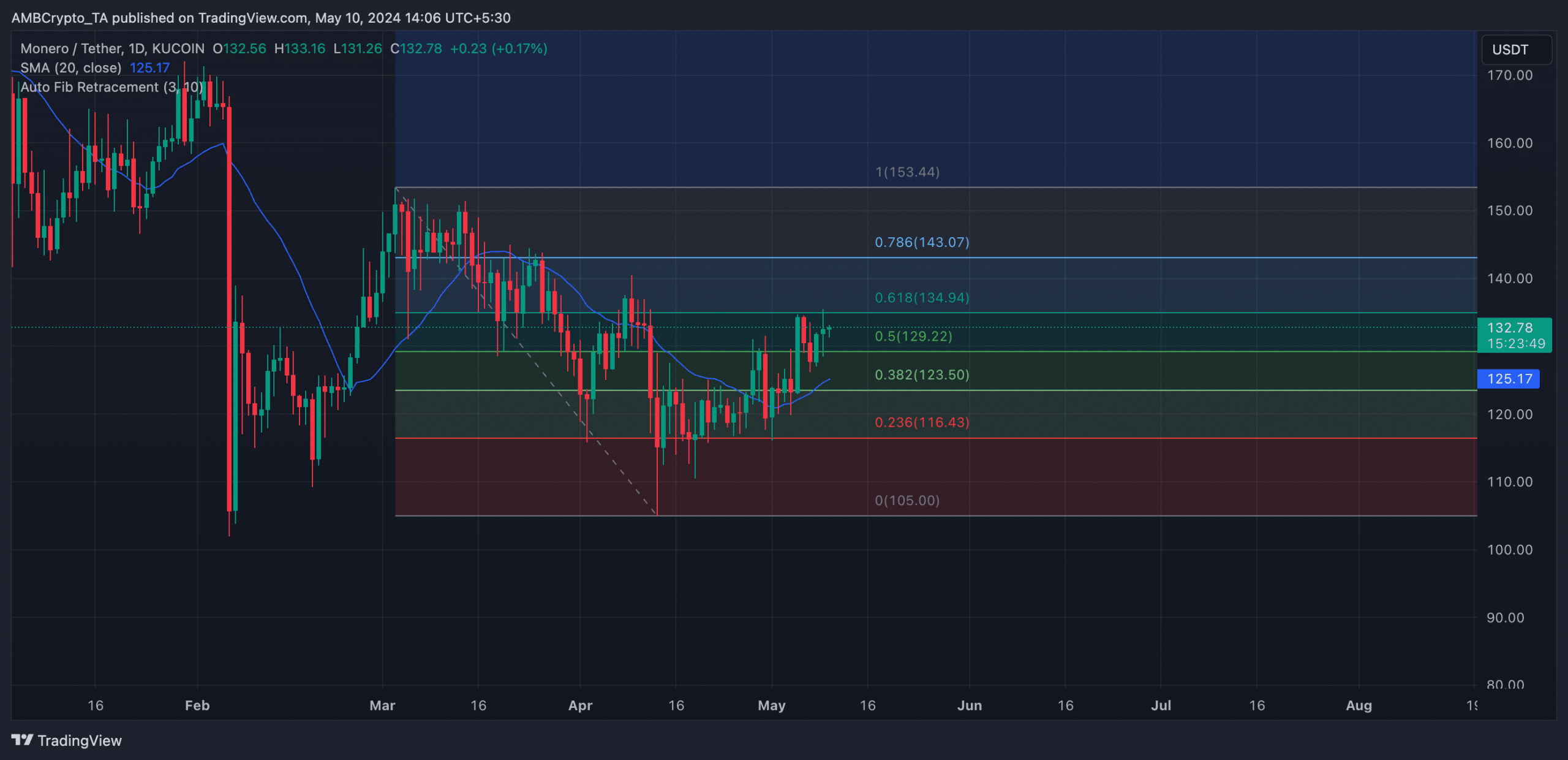

As a result of evaluating the price performance on the daily chart, the possibility of a long-term upward rally was confirmed in the short term. For example, at press time, altcoin prices were above the 20-day small moving average (SMA). An asset’s 20-day SMA is a short-term moving average that reflects the average closing price over the past 20 days.

A position below the price of an asset indicates that the short-term trend for that asset is upward. This is often seen as a sign that buyers are in control of the market and a sustained rally is possible.

An asset’s 20-day SMA is a short-term moving average that reacts quickly to price changes. It reflects the average closing price of the asset over the last 20 days.

Read Monero (XMR) Price Prediction for 2024-25

Additionally, XMR’s upward momentum indicator indicated high buying momentum across the market. At press time, the coin’s Relative Strength Index (RSI) was 57.13 and its Money Flow Index (MFI) was 71.69.

At these values, these indicators suggested that market participants prefer the accumulation of XMR over the distribution of XMR.

Chaikin Money Flow (CMF), which confirms liquidity inflows into the XMR market, is measured at 0.14 at the time of writing. This indicator measures the flow of funds into and out of an asset, and a positive CMF is considered a sign of positive market strength.

Regarding the next price range for XMR, the chart shows that it is targeting a trade at $143 if it successfully breaks the $134 price level via Fibonacci retracement.

Source: XMR/USDT on TradingView

However, if this is nullified and bears put pressure on the market, the altcoin price could fall below $125.