- The NEAR protocol took a bearish turn after a bullish week as it broke below its 50-day moving average.

- The sharp decline in RSI towards oversold territory and the formation of lower lows highlighted the strong selling pressure.

NEAR Protocol (NEAR) has recently experienced a bearish reversal, and its strong performance the previous week has raised concerns among investors about a potential downside.

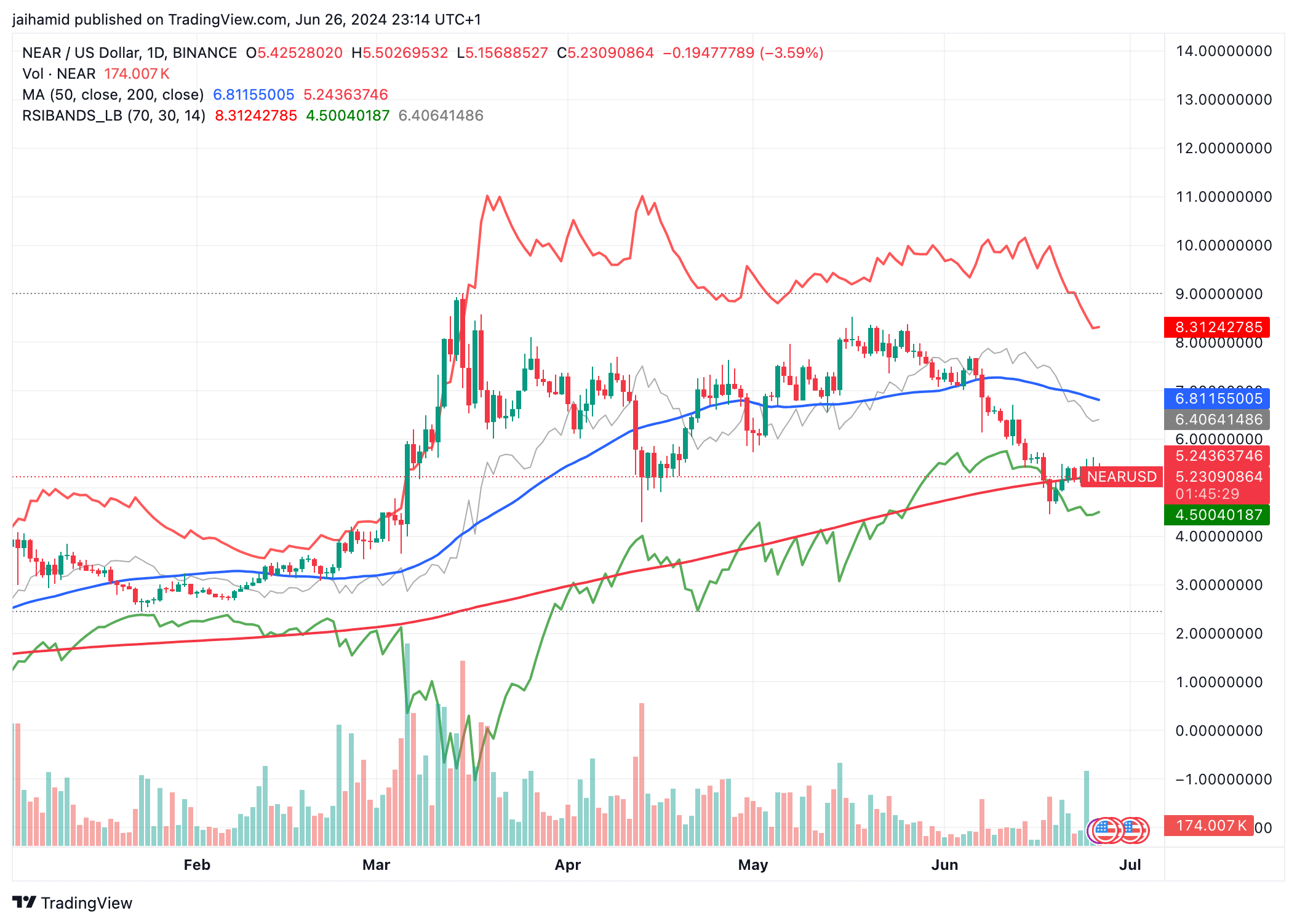

The 50-day moving average (blue line) has served as a dynamic support and resistance line. The price fell below this line and began a downward trend.

Source: TradingView

The 200-day moving average (red line) is above the price at press time, strengthening the area of resistance that could limit the upside.

Relative Strength Index (RSI) bands indicate that the price is likely to break out of overbought territory and head toward or enter oversold territory.

This means that there is significant selling pressure, leading to price declines.

Source: TradingView

Bearish signals dominate

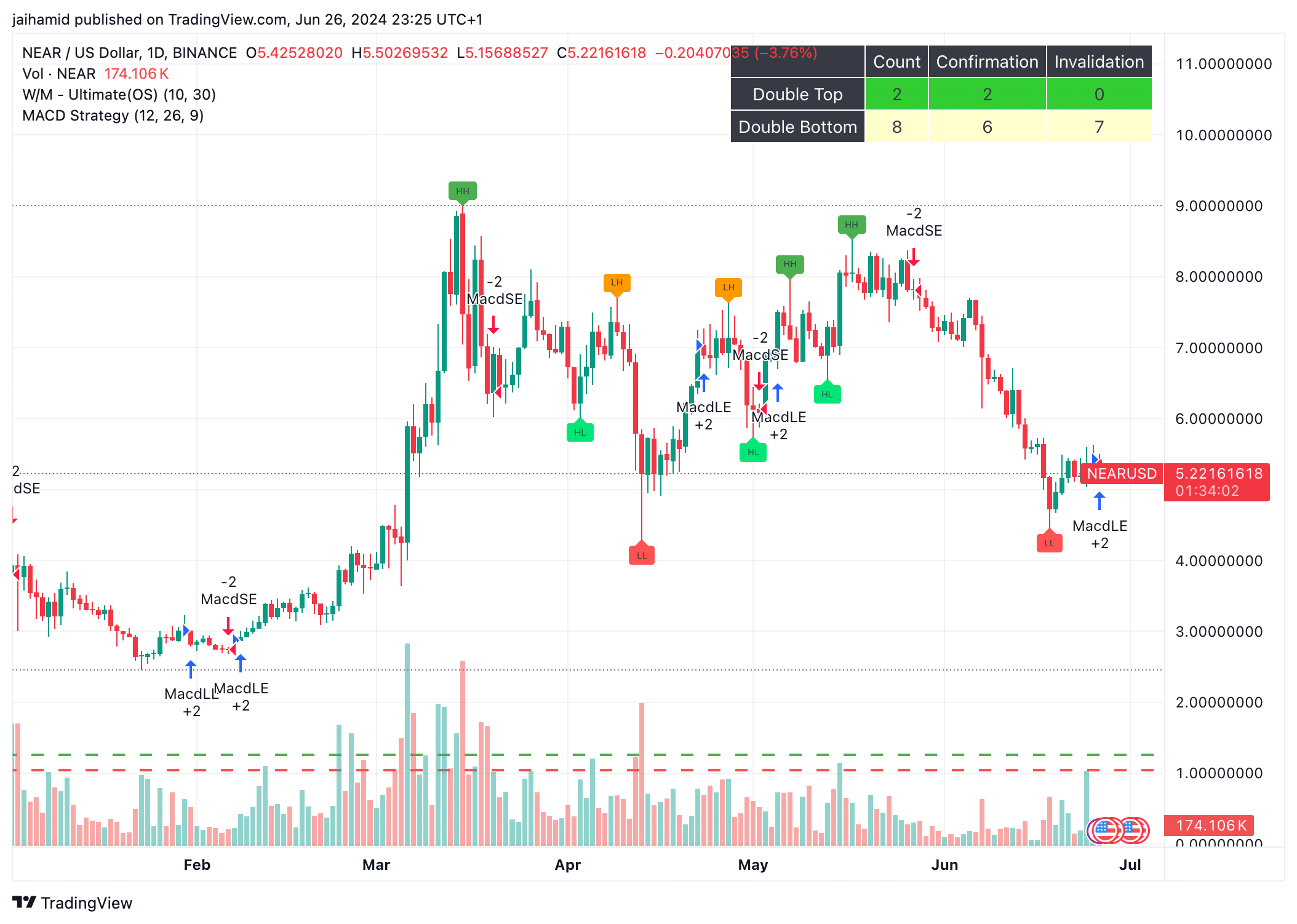

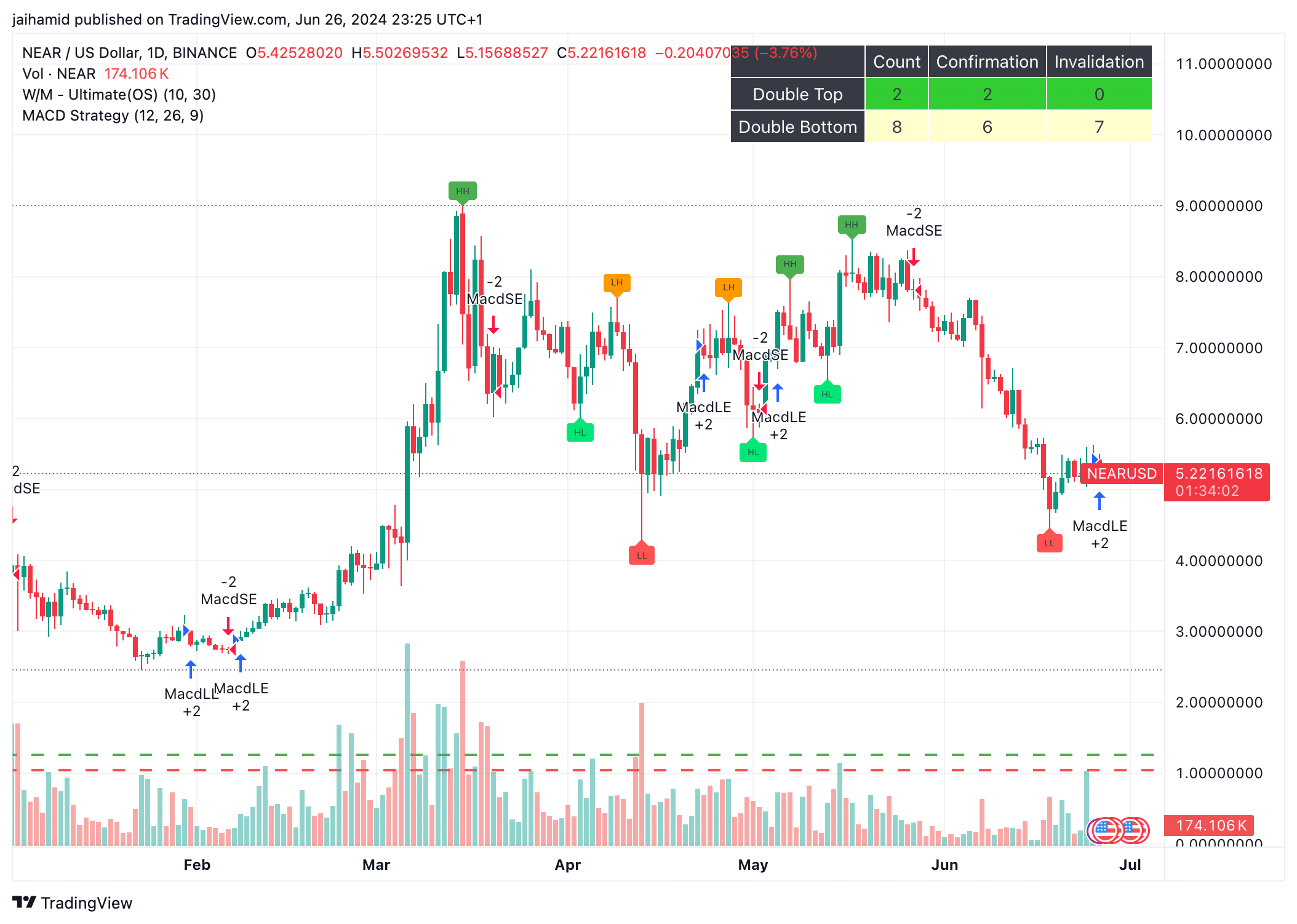

This bearish trend was further emphasized by the recent low (LL) being much lower than previous lows, indicating stronger selling pressure.

MACD buy and sell signals (MacdSE and MacdLE) show frequent changes in momentum. The latest signals show more selling pressure as seen in MacdSE, which means the bearish momentum is quite strong.

However, there are more double bottoms (indicating a possible reversal in a downtrend) than double tops. This could mean that there is underlying volatility and attempts at price recovery.

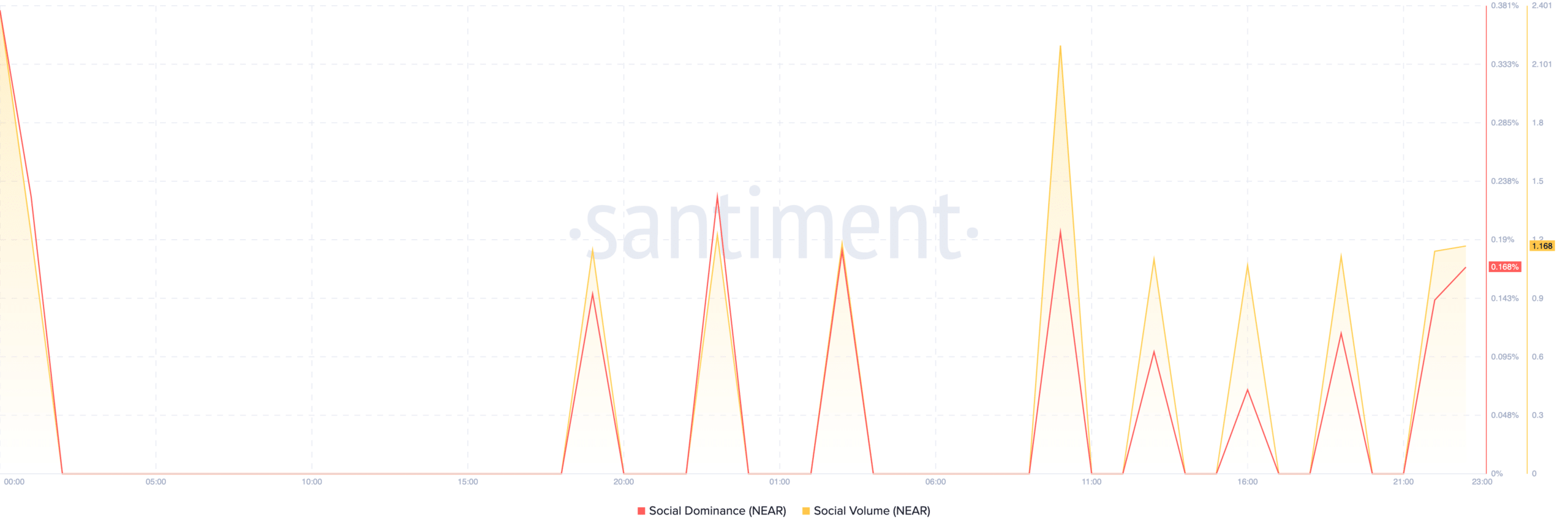

Source: Santiment

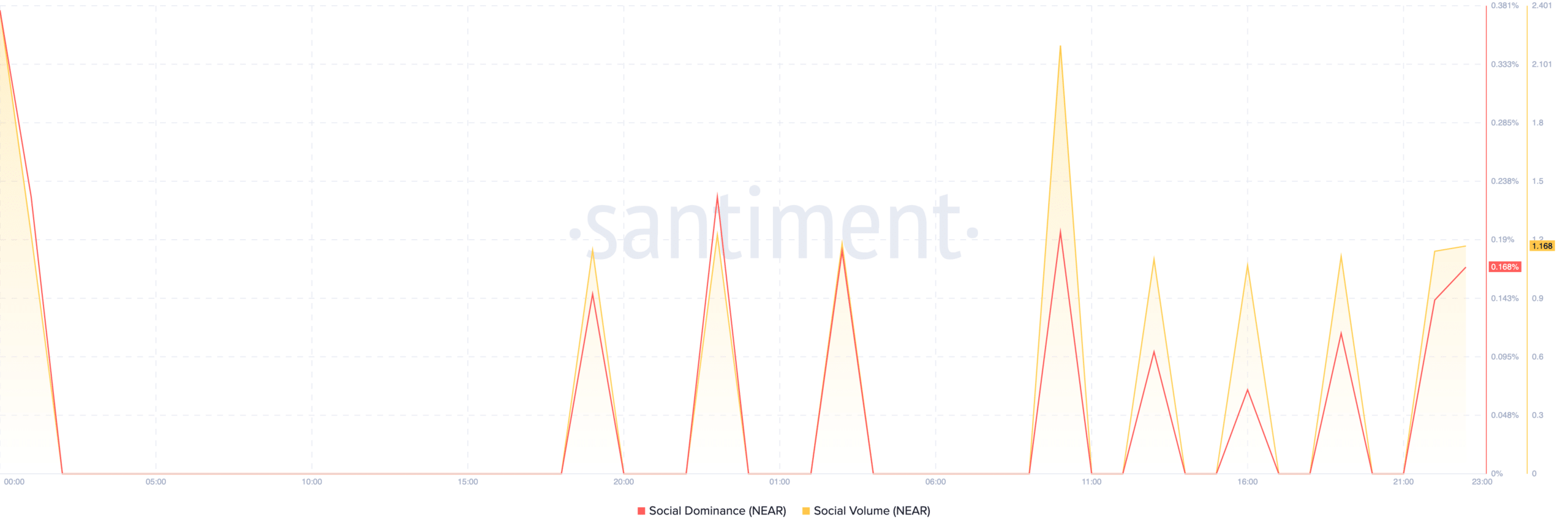

NEAR’s surge in social size and dominance signals a consensus or strong reaction among traders. NEAR’s derivatives markets offer no comfort.

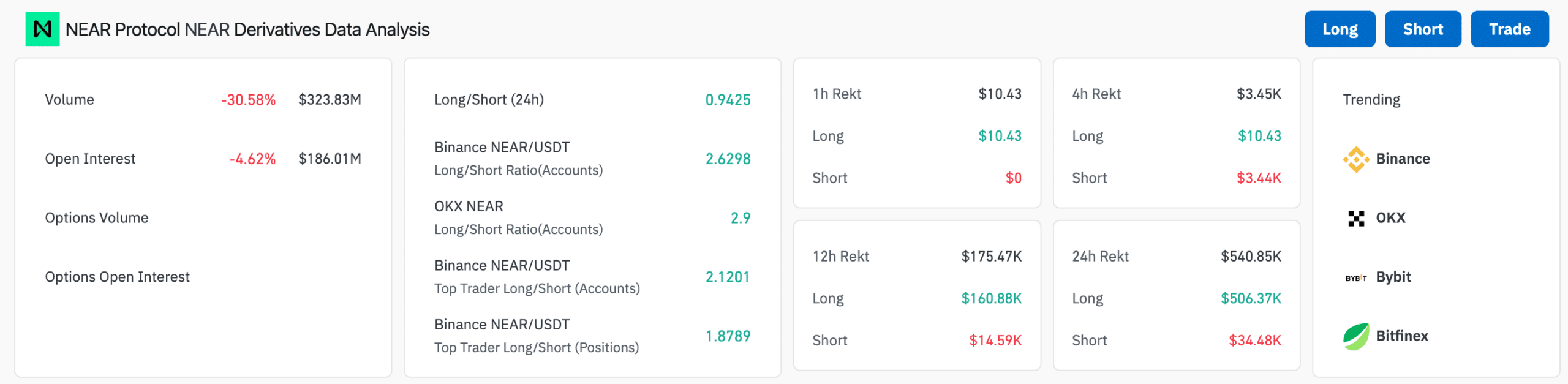

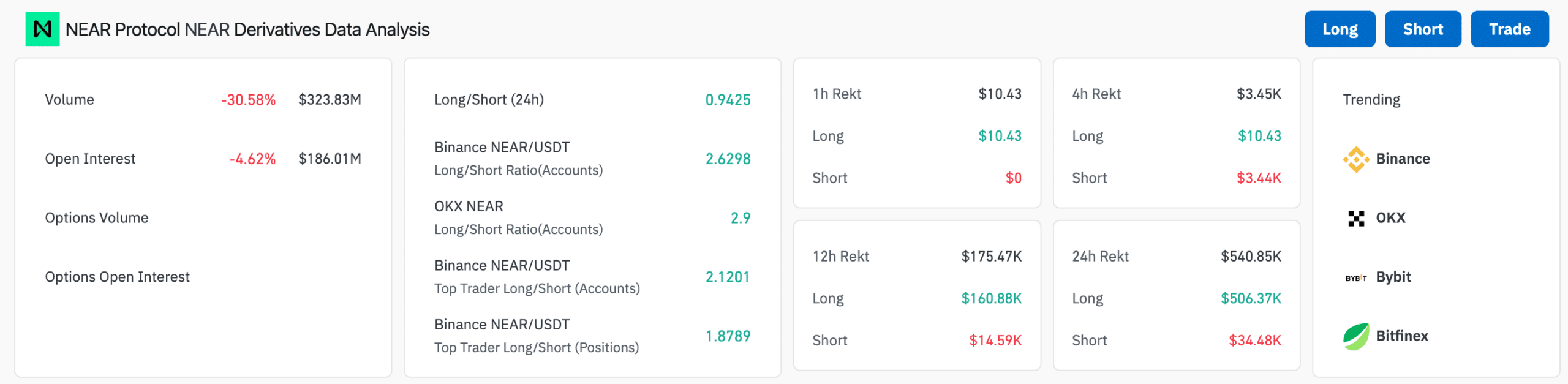

Trading volume has decreased by more than 30% in the last 24 hours. Open interest also decreased by 4%. This means that traders are closing their positions due to bearish signals.

Realistic or not, NEAR’s market capitalization in BTC is:

Although overall market activity decreased, certain indicators from major exchanges such as Binance (BNB) and OKX indicated bullish action or speculative attempts to capture a potential rebound.

Source: Coinglass

Given that the price is below both the Ichimoku Cloud and the major moving averages, and short-term trading has dominated recent movements, a bullish reversal seems unlikely in the near term.