- PENDLE holders benefited from the exponential surge.

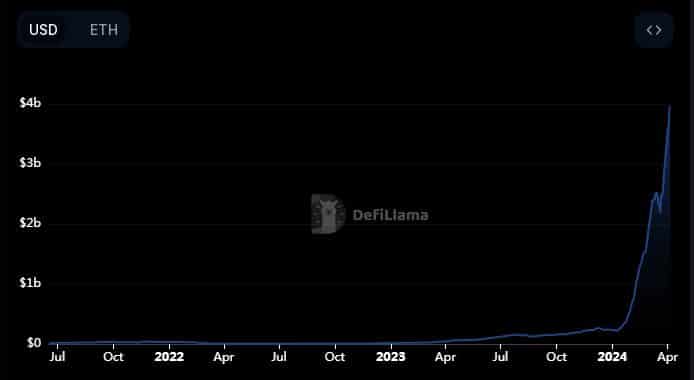

- The price rise can be linked to a surge in deposits on parent platform Pendle Finance.

PENDLE, the native token of decentralized finance (DeFi) protocol Pendle Finance, has emerged as a hot commodity due to its astronomical rise in value over the past few weeks.

Why is PENDLE in the news?

The altcoin is up nearly 50% in a week and a whopping 108% in a month, according to CoinMarketCap. Since the beginning of the year, PENDLE’s value has increased more than five-fold, boasting a market capitalization of more than $1 billion at press time.

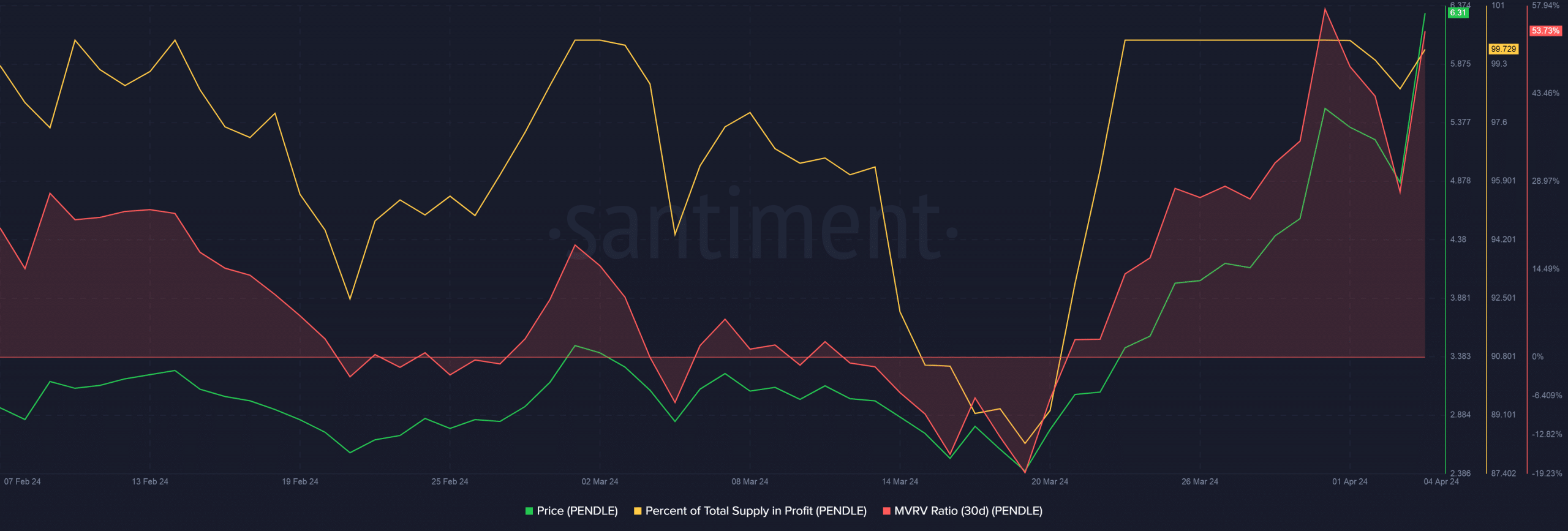

This upward trend has resulted in a rapid increase in profitability for coin holders. In fact, according to AMBCrypto’s analysis of Santiment data, approximately 99.73% of PENDLE’s total supply was profitable at press time.

Additionally, the average PENDLE holder can realize a 50% return on their investment, as seen in the 30-day MVRV ratio.

Source: Santiment

Moreover, holders are already finding it difficult to resist such temptations. For example – according to Spot on Chain, an on-chain tracking platform, traders have been seen moving a significant portion of their PENDLE holdings to cryptocurrency exchange Binance.

Investors transferred 200,000 tokens worth $1.25 million as of press time on Thursday. Just four days before this transaction, they deposited 162,000 tokens worth $919,000. Both transfers took place when PENDLE was at its peak.

Interestingly, they purchased this token in 2022-23, when the price of PENDLE was $0.147. There are still 200,000 PENDLE left in the whale’s wallet, so further price rises are expected.

Pendle Finance’s TVL surges

PENDLE is the governance token of Pendle Finance, a unique platform that allows users to trade and price tokenized yielding assets. The rally could be linked to a surge in deposits on the platform, which stood at nearly $4 billion at the time of press.

Source: DeFiLlama

A closer look at AMBCrypto shows that the recent increase in TVL is due to large inflows of USDe, Ethena Labs’ so-called synthetic stablecoin. The asset appeared to offer a 37% annual return at the time of press, encouraging users to deposit it into Pendle to increase their income.