- The price of PEPE has risen by more than 3% in the last 24 hours.

- Several market indicators were bearish on Mimecoin.

After a week of price declines, Pepe‘s price has once again gained bullish momentum. This recent uptrend could continue further as memecoin breaks through important levels. Let’s take a closer look at what’s happening in PEPE.

PEPE’s bullish breakout

CoinMarketCap’s data PEPE said it had suffered a major price correction last week, dropping more than 2% in value. However, things have improved in the last 24 hours.

The price of Mimecoin has surged by more than 3%. At the time of writing, PEPE is trading at $0.00001216 and has a market cap of over $5.8 billion, making it the 22nd largest cryptocurrency.

Thanks to this, more than 83% of PEPE investors have made profits, according to IntoTheBlock. data.

Meanwhile, Mimecoin managed to break out of the bullish pattern, suggesting continued price appreciation.

Popular cryptocurrency analyst World of Charts recently wrote: Twitter Highlights an interesting development. According to the tweet, PEPE has broken above the bullish pennant pattern, which could trigger a 30% bullish rally..

This pattern appeared on the PEPE chart in July and has been consolidating inside the pattern since then. If we believe this analysis, PEPE could reach $0.000017 in the coming weeks.

Source: X

What to expect from PEPE

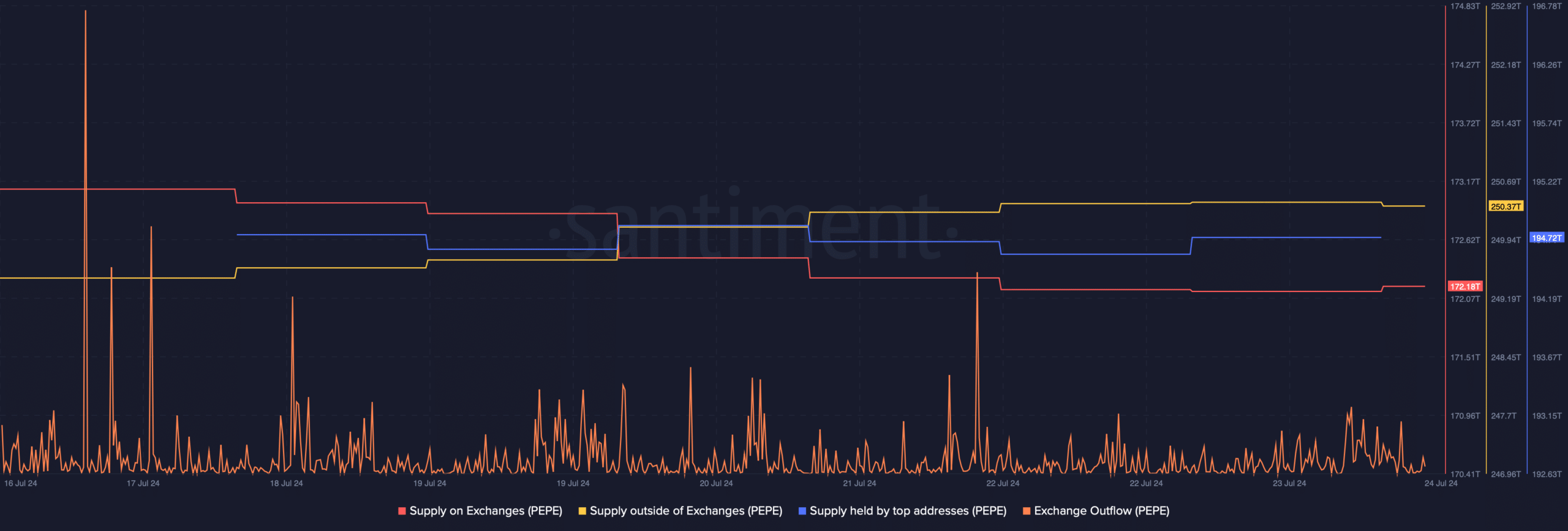

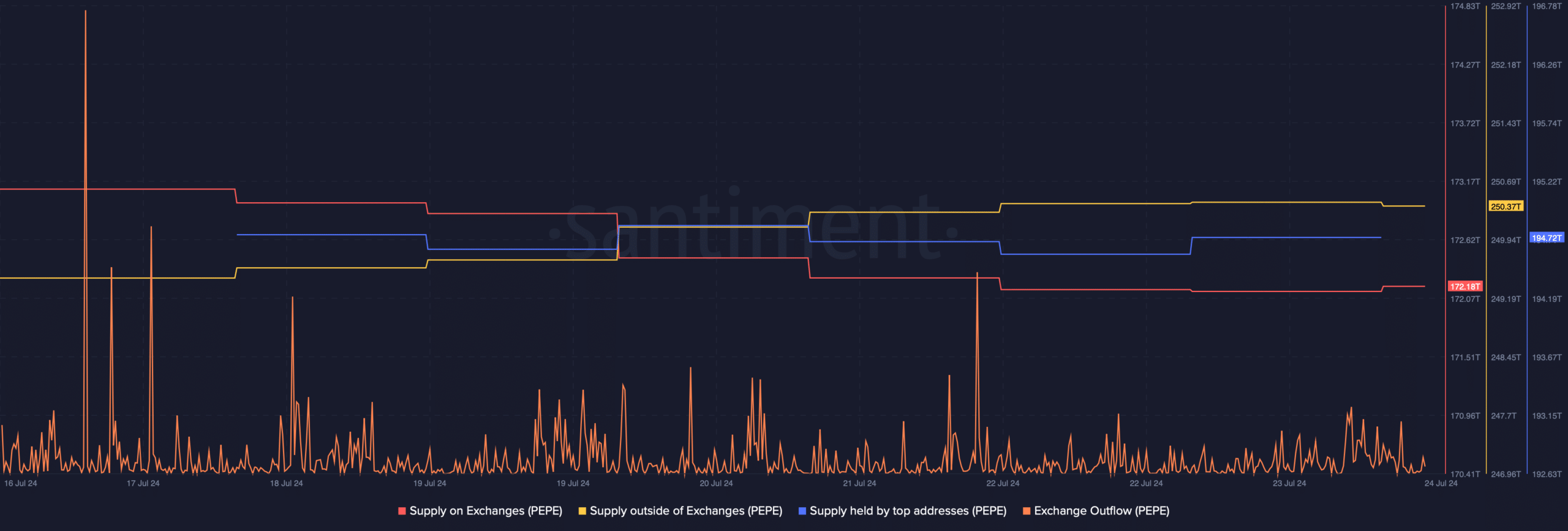

AMBCrypto looked at Santiment’s data to see what the indicators were telling us. According to the analysis, memecoin supply on exchanges has decreased, but off-exchange supply has increased, suggesting increased buying pressure.

Last week’s surge in MIMECoin exchange outflows further confirmed the growing buying pressure.

However, whales have not made any significant moves in the past week, as evident from the flat supply in the upper address chart.

Source: Santiment

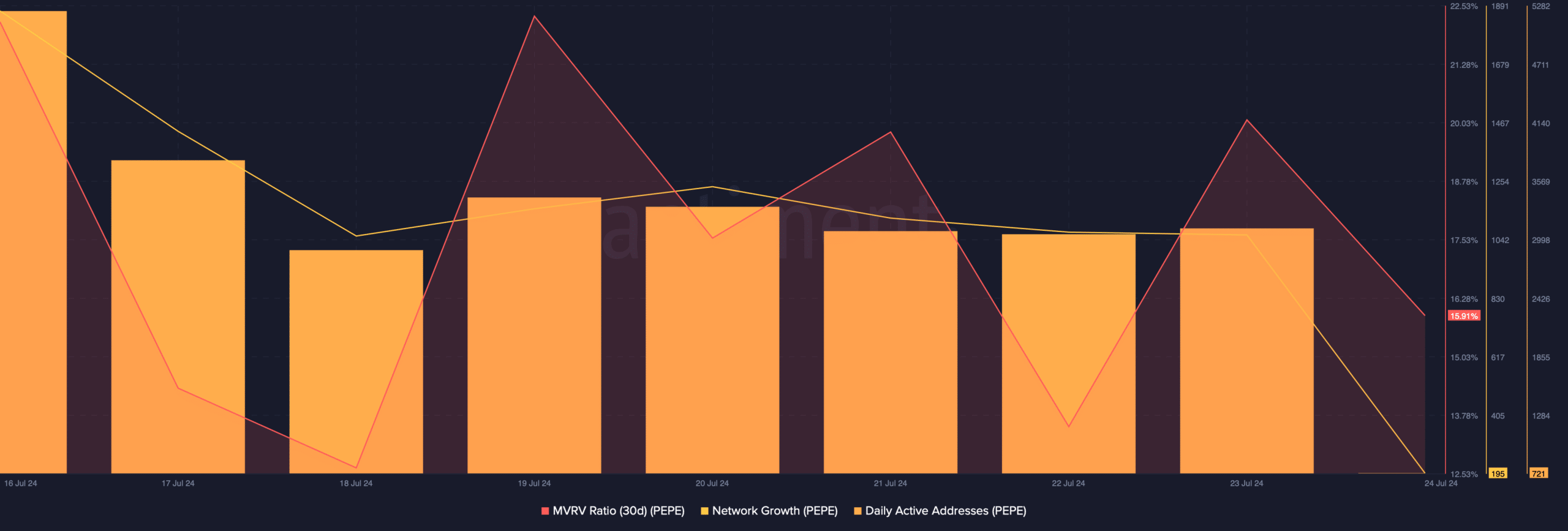

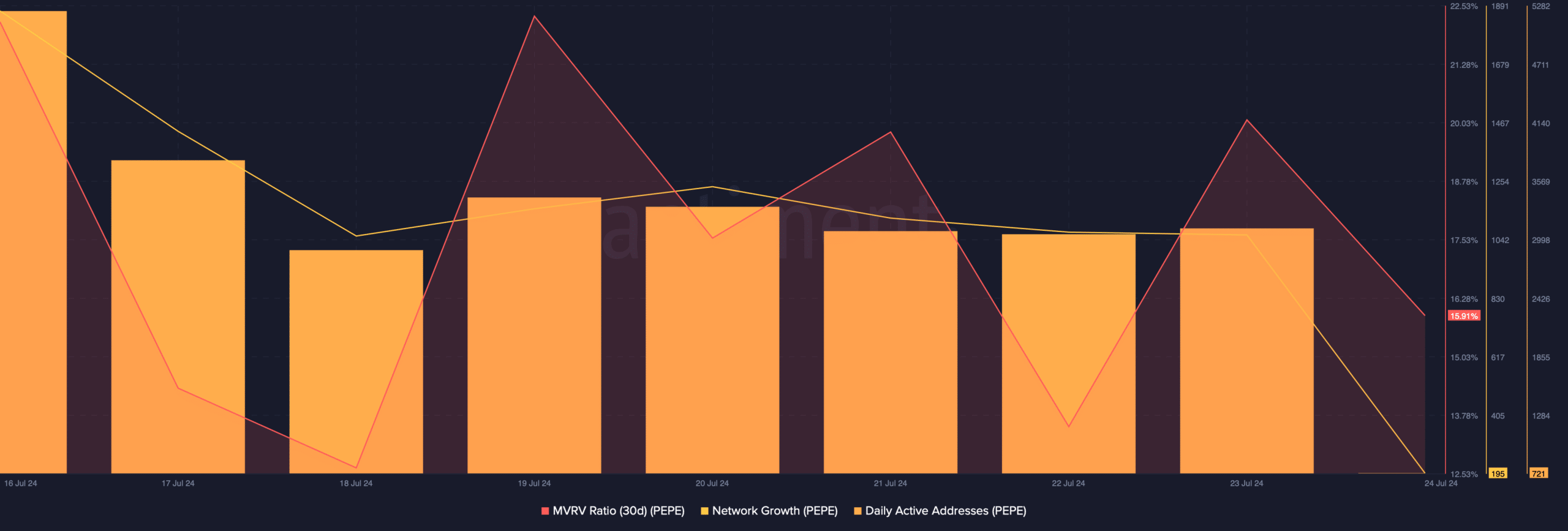

In addition to the increased buying pressure, another bullish indicator is the MVRV ratio, which remained high last week. Daily active addresses also remained fairly stable last week.

However, network growth has slowed, suggesting that fewer addresses were created to send tokens last week.

Source: Santiment

read PEPE Price Prediction 2024-25

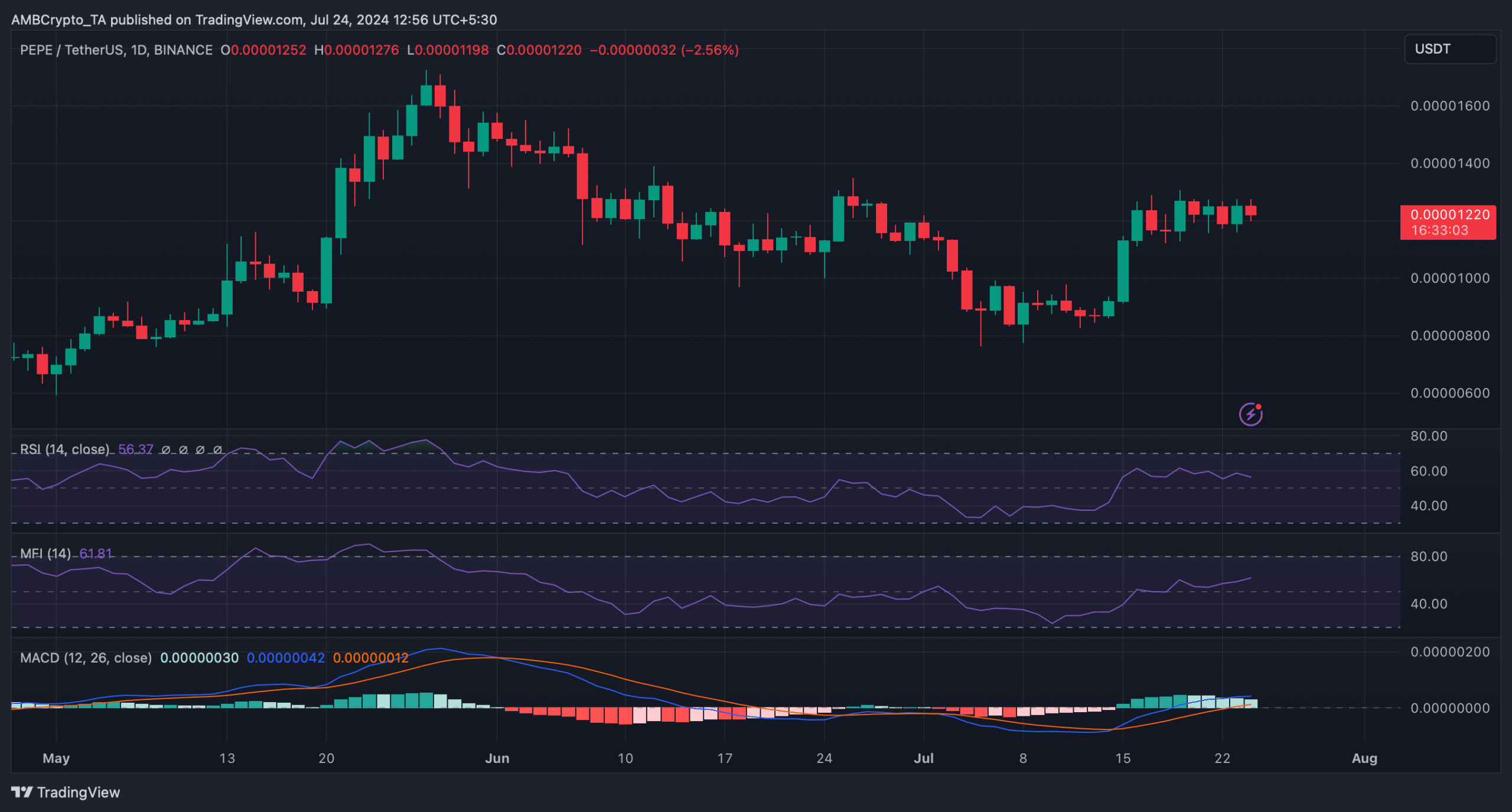

AMBCrypto planned to check out memecoi’s daily chart. According to the analysis, the MACD showed a possible bearish crossover.

The Relative Strength Index (RSI) was in a bearish trend, suggesting a possible price correction. Nevertheless, the Money Flow Index (MFI) was in an uptrend, suggesting a continued bullish rally.

Source: TradingView