- Pyth Network’s recent $36 billion volume surge and price surge signal a potential bullish trend ahead.

- Increased public attention and social dominance strengthens market confidence, further driving Pyth’s price upward.

PYTH Network (PYTH) It has established itself as a dominant player, with trading volume reaching $36 billion in the last 30 days. Chainlink (LINK).

This impressive growth highlights the growing adoption of Pyth’s innovative pool-based oracle model, especially in the decentralized finance (DeFi) sector.

At press time, Pyth is trading at $0.4038, up 5.63% over the last 24 hours. Therefore, this momentum suggests that Pyth can gain more market share and attract new investors.

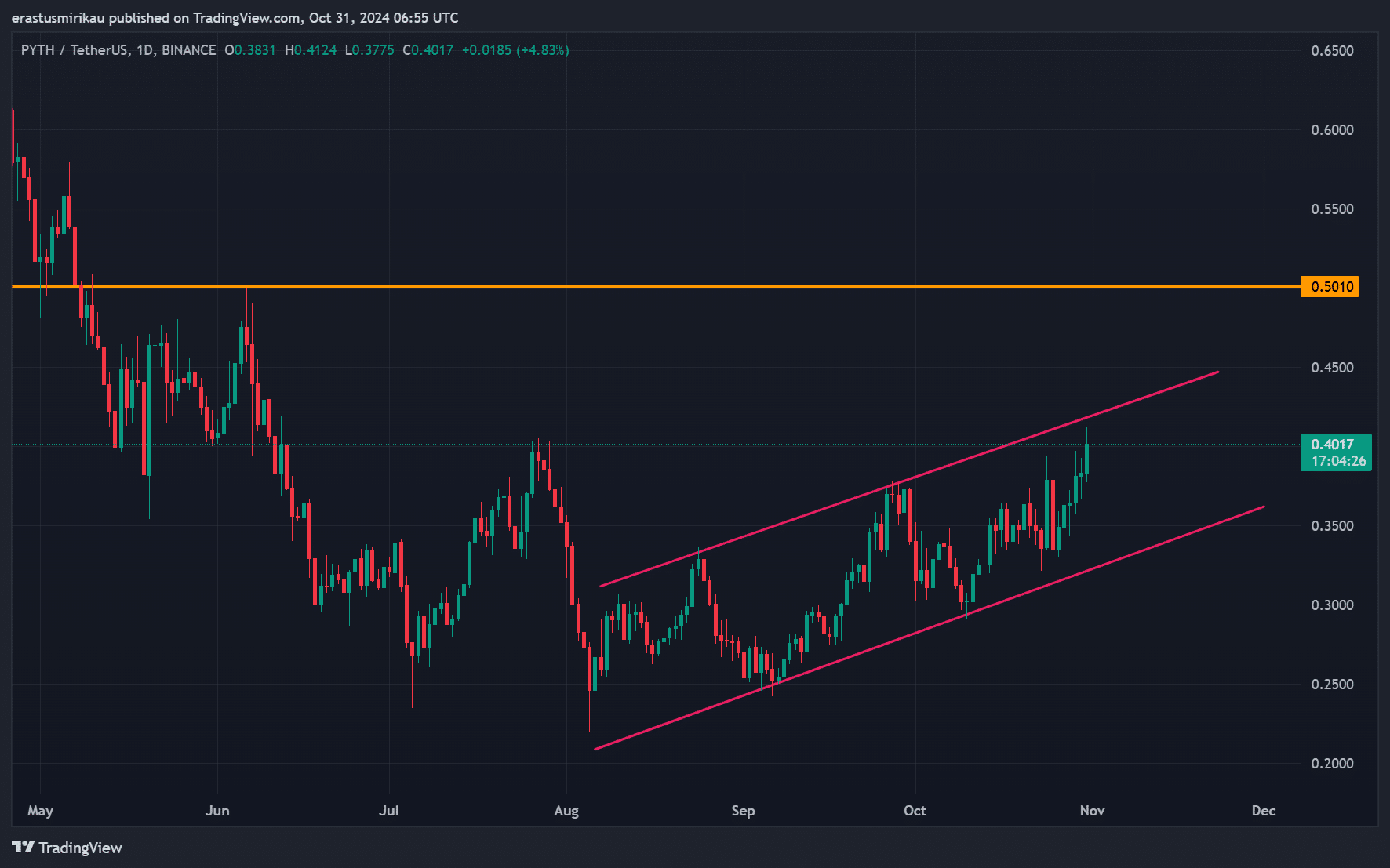

Are we seeing a breakout? Chart Analysis on Pyth Network

The current price action indicates that Pyth has broken out of its well-defined upward channel. This breakout signals a change in momentum and suggests that upward pressure may continue. Analysts identify $0.5010 as an important resistance level.

If this barrier is broken, it could spark more optimism. As a result, observing price action within this channel strengthens the likelihood of a sustained upward movement in the near term.

Source: TradingView

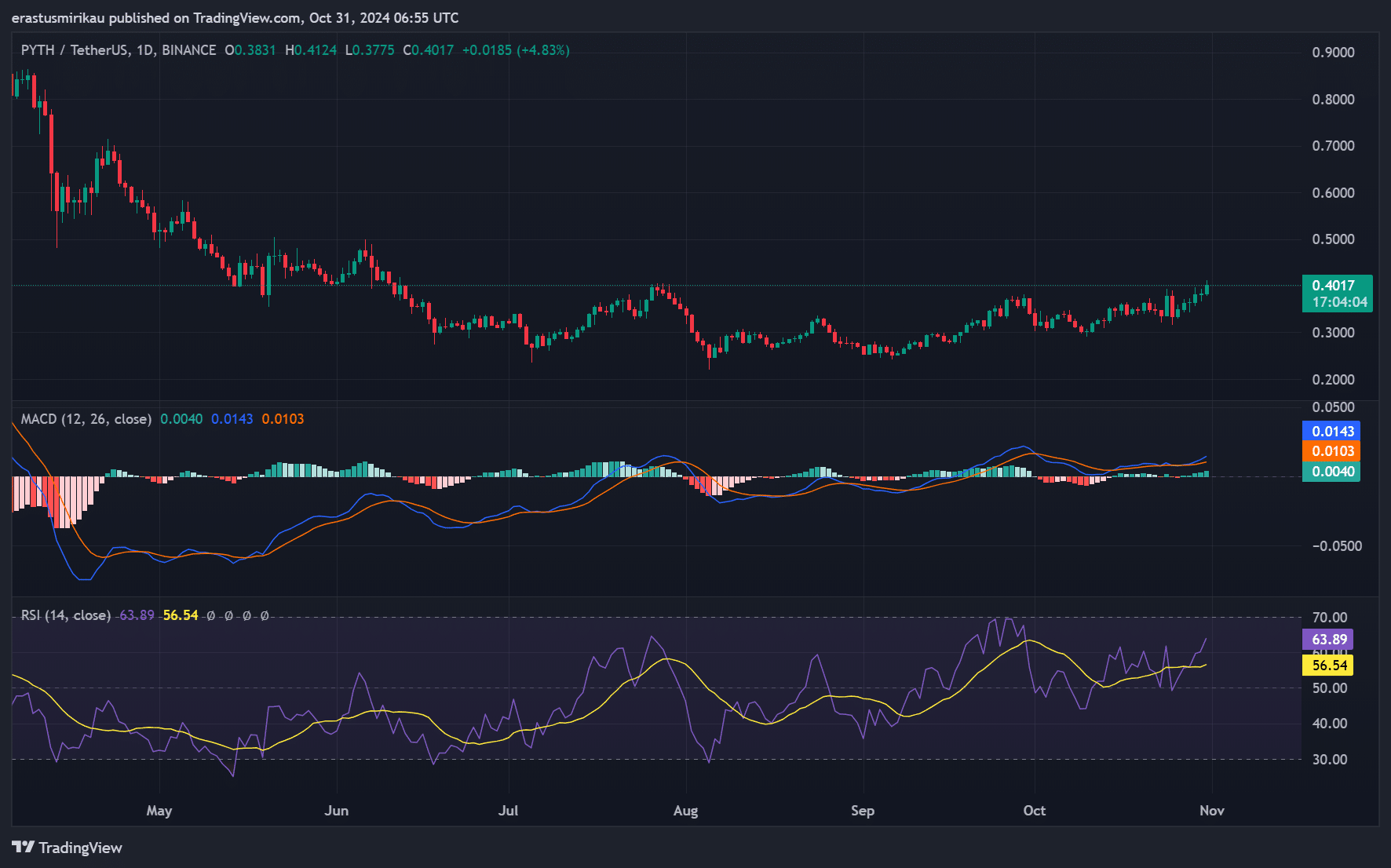

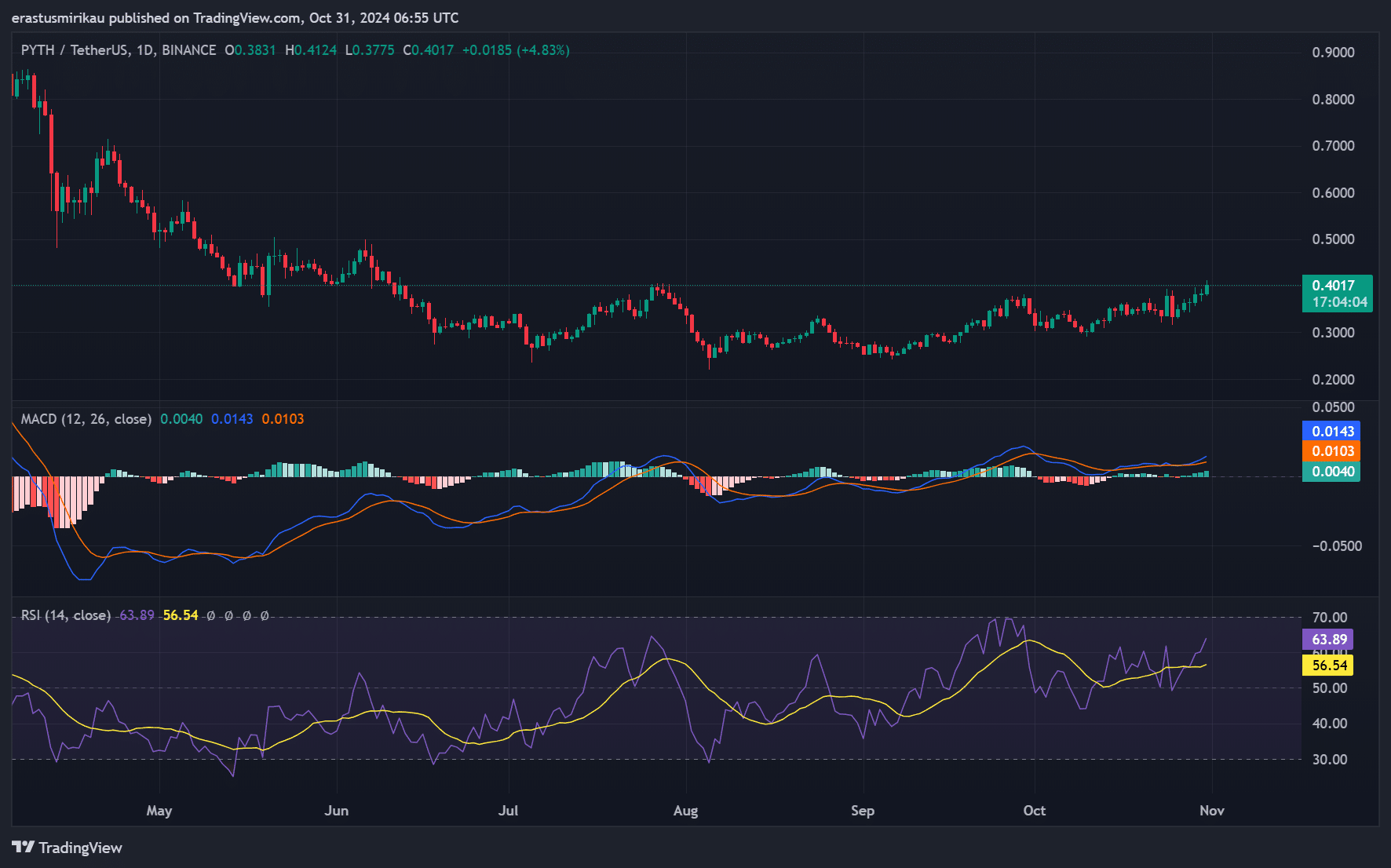

What do the indicators say? RSI and MACD analysis

Looking at technical indicators, the Relative Strength Index (RSI) is at 63.89, which indicates that Pyth is approaching overbought territory, which could lead to a price correction. However, it maintains enough momentum to push the price higher.

Additionally, the MACD indicator shows a bullish convergence, indicating that recent price action is consistent with continued upward momentum. Both indicators provide a balanced view, indicating that caution is warranted but the overall trend remains bullish.

Source: TradingView

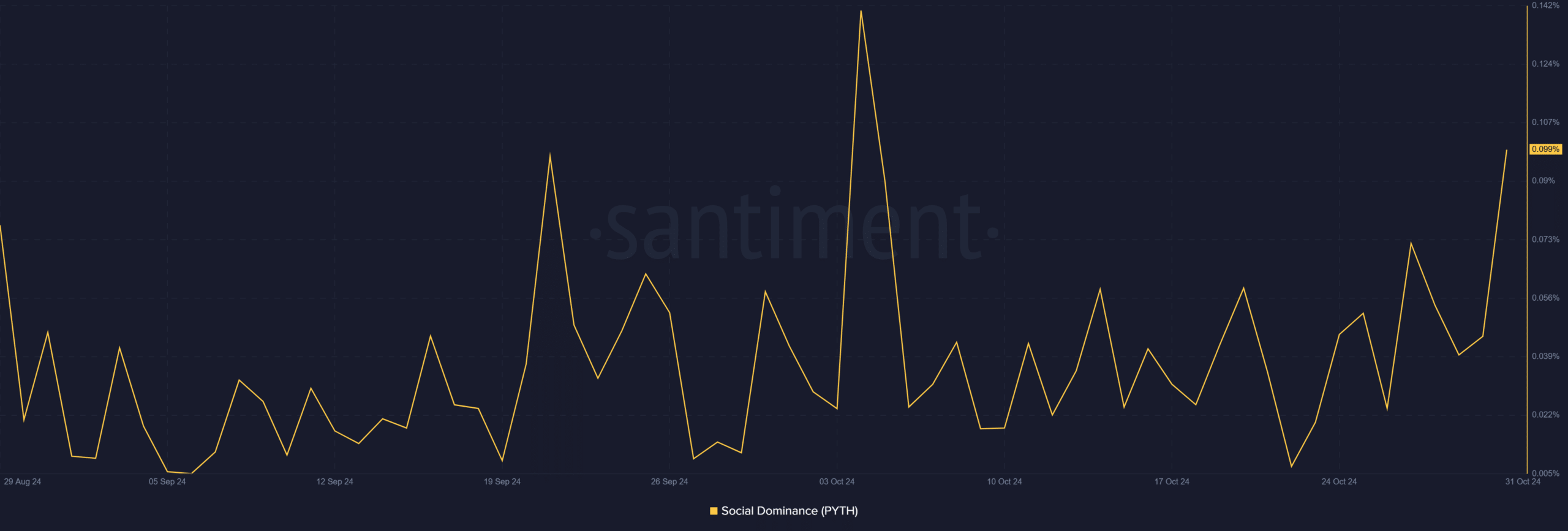

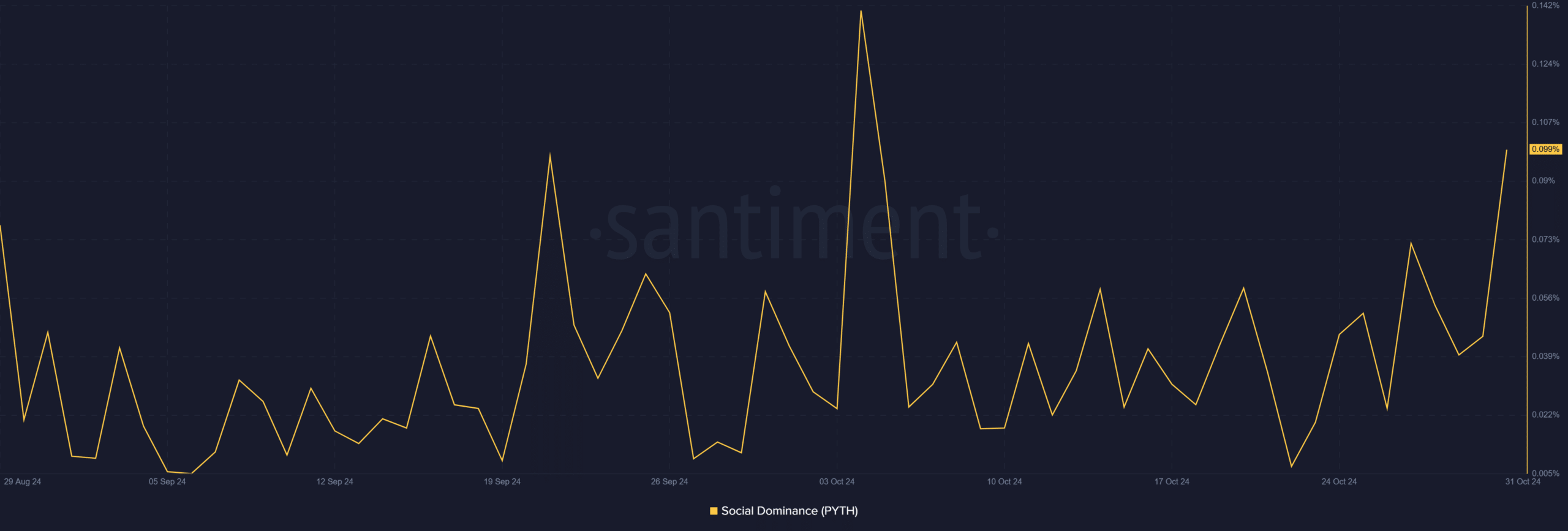

Social dominance in Pyth: How does it stack up?

Current social dominance is 0.0994%. This indicator reflects growing community interest and participation, which is critical to driving future price action.

High social dominance is often associated with increased trading volume, strengthening Pyth’s position in the market. So, as participation continues to grow, we may attract more investors looking to capitalize on the recent momentum.

Source: Santiment

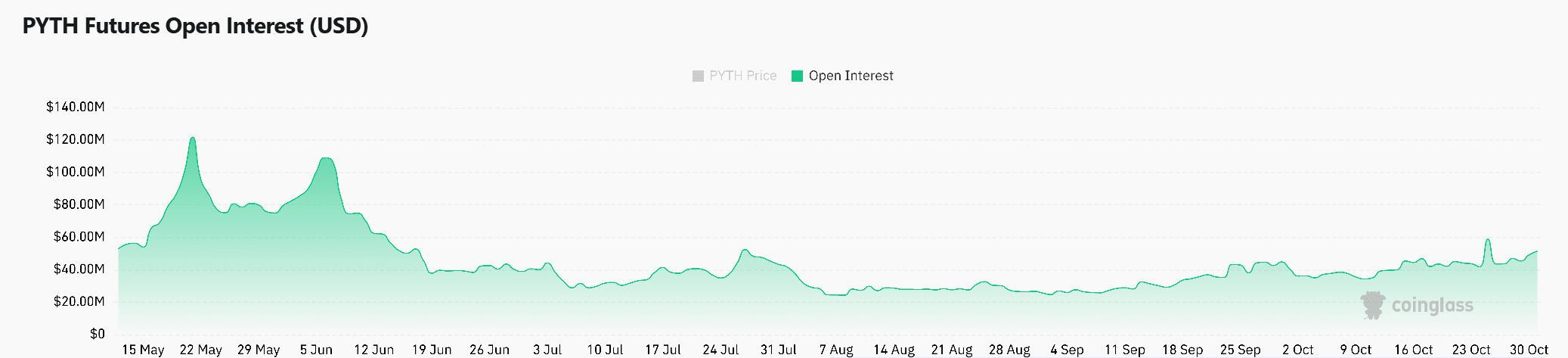

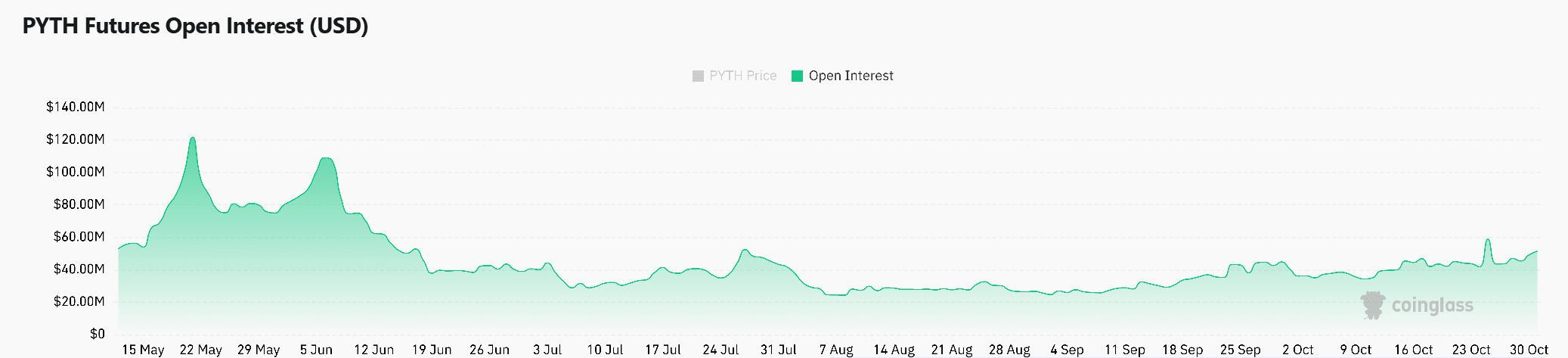

Market Sentiment: Is Open Interest Growing?

Open interests surged 30.77% to $66.39 million. This increase in open interest indicates that traders are still optimistic about price movements and have a high potential for profit.

As a result, increased open interest usually means more traders entering the market, resulting in improved price stability and growth.

Source: Coinglass

Realistic or not, here is the PYTH market cap in BTC terms:

PYTH is poised for a significant upward trajectory.

Pyth Network’s recent performance and technical indicators suggest a strong bullish trend going forward. With a significant increase in volume, a break from a rising channel, and increased social dominance, it is well positioned for further price growth.

Therefore, traders and investors should monitor Pyth closely as it aims to break key resistance levels and solidify its position as a leading Oracle provider.