- Despite Ripple’s latest SEC coat victory, the XRP is maintained at less than $ 2.50 and is faced with resistance at the main movement average.

- The XRP ledger’s address reached 6.7m to reflect long -term interest, but there was no major short term.

Ripple (XRP) recently secured a favorable development in a long battle with US Securities and Exchange Commission (SEC), but the market’s response was relatively muted.

Victory injects temporary optimism, but XRP’s price performance and address activities suggest a more enhanced response.

XRP moves slowly despite legal progress

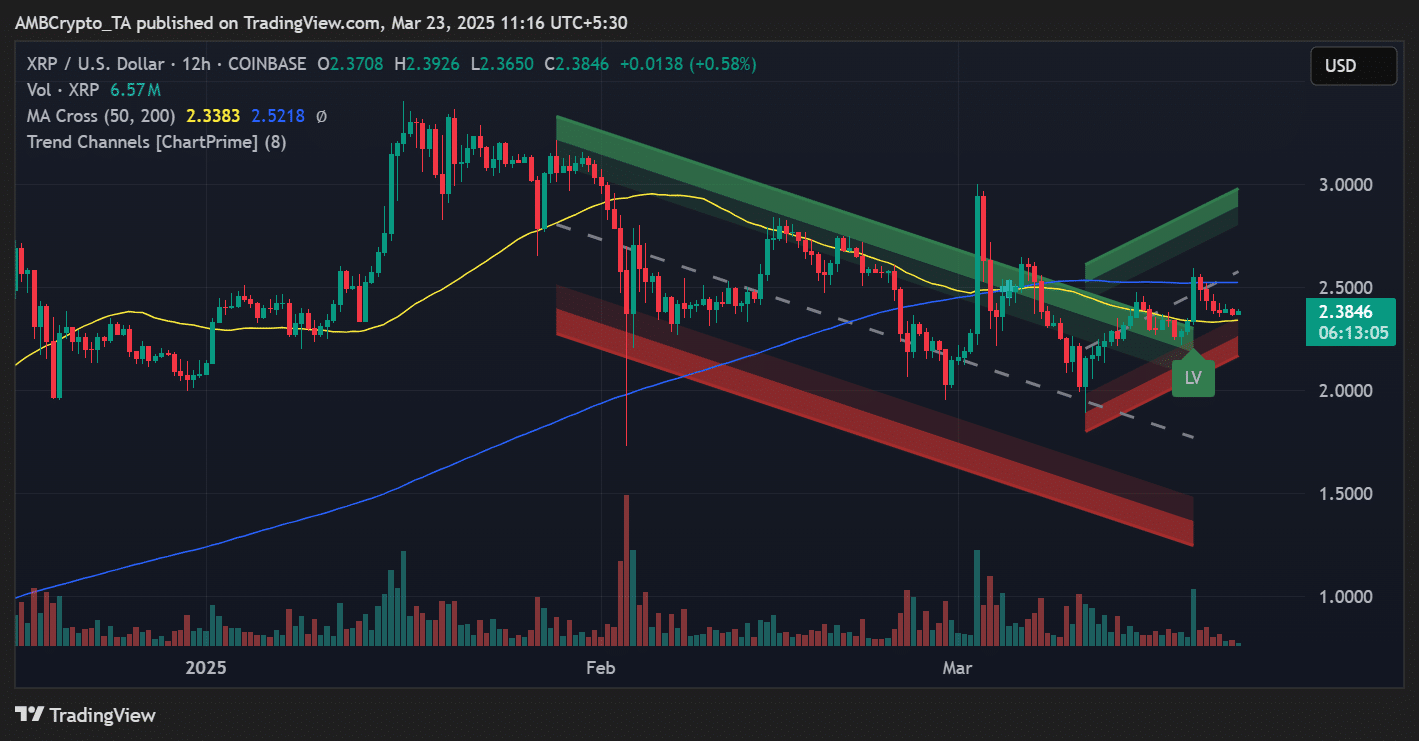

Following the positive SEC -related news, XRP has been up to $ 2.43 for a while, but has been stabilized about $ 2.38 since then.

In the 12 -hour chart, assets were maintained above the 50 -day moving average ($ 2.33), but it was still traded over the 200 -day moving average ($ 2.52), and it was a signal that it did not occur.

Source: TradingView

Trend channel indicators showed that XRP tried to fry in a narrow uphill.

If the price does not recover $ 2.50 soon, there may be a risk of returning to the descending order, which is struggling throughout March.

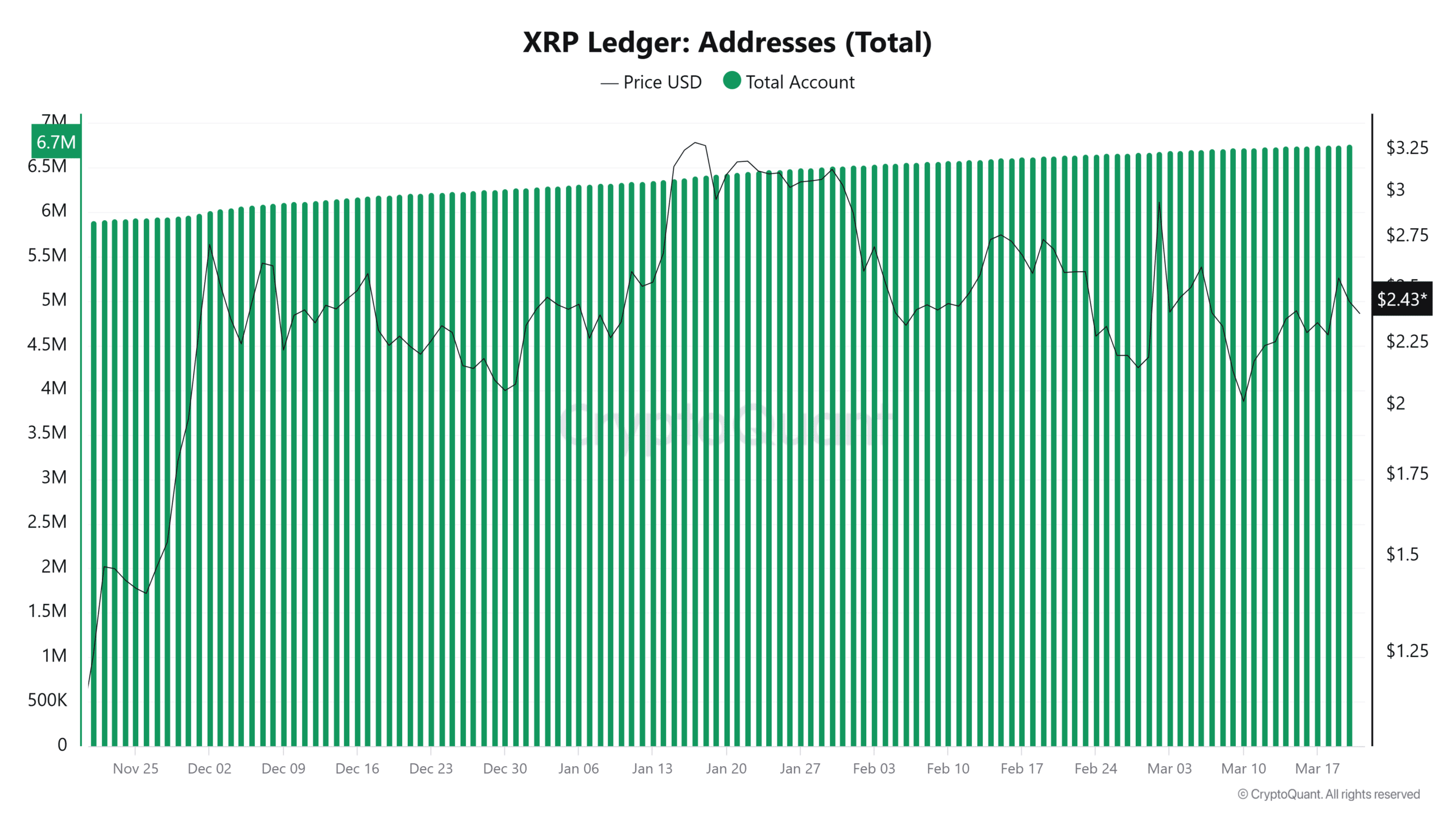

The active address increases, but growth is gradual.

According to the encryption data, the total number of addresses of XRP has steadily increased to 6.7 million.

This growth is positive but not explosive, and long -term interest is not damaged, but it suggests that the new participants in the ecosystem are not overwhelming.

Source: cryptoquant

This limited warmth growth is a long -term tail wind with a long -term clarity, but the market still strengthens the idea that it is still digesting its meaning.

This is the meaning of XRP, moving forward

In order for XRP to reclaim significant momentum, the price must be destroyed by more than $ 2.50, which must be built. Otherwise, the exercise can continue to the side, especially because the wider market feelings are kept careful.

According to the on -chain indicators, the XRP holder adopts a waiting approach. The number of upward addresses provides a solid foundation, but short -term profits can be limited without a surge in active users or volume.

Ultimately, Ripple’s legal clarity is a powerful story, but converting to price behavior and network activities depends on continuous investor trust.

It also depends on whether the buyer regards XRP as a long -term hedge or short -term play.