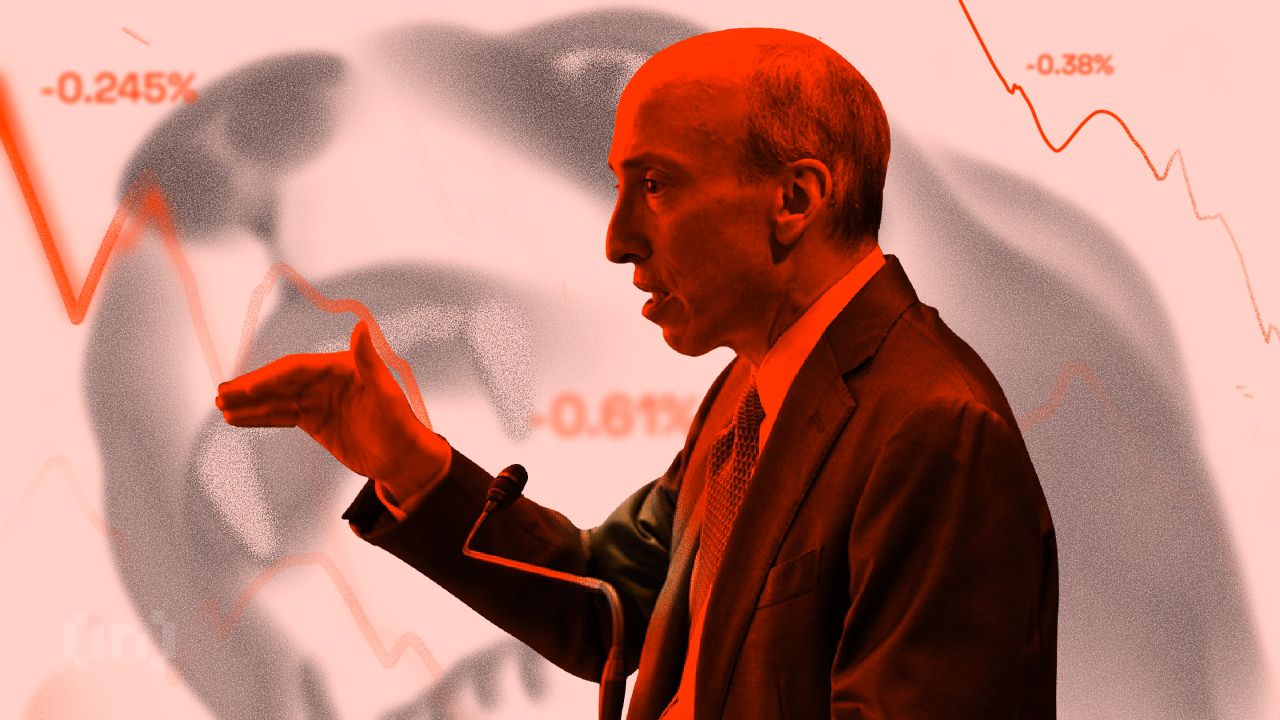

David Schwarz, Ripple’s chief technology officer, expressed disgust over the “shocking actions” of the U.S. Securities and Exchange Commission (SEC) in its lawsuit against cryptocurrency company Debt Box. The judge accused the SEC of “misrepresenting the facts” to secure a temporary restraining order that could tarnish Gary Gensler’s legacy.

SEC v. Debt Box said the court was “concerned that the Commission made materially false and misleading statements that violated Rule 11(b) and undermined the integrity of the proceedings.” As a result, the SEC needed to motivate why it should not be subject to court sanctions.

Ripple CTO enrages over lies in debt box incident

Earlier this year, the SEC argued that Debt Box’s move to Dubai meant Debt Box was moving out of U.S. jurisdiction. The claim was later found to be materially incorrect. The SEC now has two weeks to respond to a judge’s request to show why it should not be punished for making false claims.

Last July, the agency accused Debt Box of selling “node licenses” that were not registered as securities. The SEC alleged that the company falsely marketed the license as a tool that enabled mining, but instead used the software to generate more cryptocurrency.

Read more: Top 7 ICOs to watch in 2023

Schwarz, Ripple Labs’ CTO, said the SEC’s apparent attempt to “cringe several businesses” and misrepresent facts amounted to “shocking” actions. Stuart Alderoty, who is leading Ripple’s defense against the SEC’s claims that it sold unregistered securities, said last week that the Debt Box controversy was the SEC’s latest attempt to elevate its opinion above the law. .

Read more: Everything you need to know about Ripple and the SEC

Congress should subpoena the SEC: Deaton

An editorial last week said the numerous controversies surrounding the SEC’s disregard for the law could tarnish Gensler’s legacy. Gensler has also previously ignored requests from the U.S. Congress to comply with liability rules.

Cryptocurrency advocate John Deaton encouraged the House Financial Services Committee to issue a subpoena to the SEC. It is the first time the government has taken such action against the agency, but it should not be a deterrent, Deaton argued.

“Trust the court. You will win, and the precedent you set will blow a gaping hole in the wall that protects the excessive influence of the administrative state.”

Republican members of the U.S. House of Representatives’ Financial Services Committee recently accused Gensler of colluding with artificial intelligence (AI) companies to draft new climate disclosure rules. AI companies could benefit from these rules, which suggests questionable behavior on Gensler’s part.

have There’s something to be said about how the SEC lied in its lawsuit against Debt Box. or whether Gensler and the SEC may receive a subpoena from the U.S. Congress; Or something else? Write to us or join the discussion in our Telegram channel. TikTok, Facebook or X (Twitter).

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts.