- Solana continues to be strong.

- Trying to catch exact highs can be counterproductive for traders.

Solana (SOL) bulls refused to succumb to bearish pressure. Even when Bitcoin (BTC) fell below the $70,000 level on March 15, SOL showed an upward trend. On this day, the stock price exceeded $180.

Data from DefiLlama shows that Solana’s total value locked (TVL) has surged more than 80% in the past month. It also recorded the highest DEX trading volume for two days in a row, surpassing Ethereum (ETH).

Should investors fear a pullback or follow the trend?

Source: SOL/USDT on TradingView

Solana’s major retracement has not occurred since falling to $79 in January. RSI on the daily chart hit 88, deep in overbought territory.

It doesn’t indicate an imminent downturn, but it does highlight a heated situation.

OBV has been trending upward since the end of January. Buying volume has been phenomenal and SOL has increased 26x since its 2022 low of $8. Above $180, resistance overhead was lacking.

The $259 and $276 levels were areas of interest, as was the $202 area. However, since the market has been parabolic recently, this area could be retested as support.

Analysis of the lower time frames shows that the $178 and $162 support levels will also be key.

A drop below this level would indicate a bearish structure on an hourly basis and a possible shift in momentum towards higher levels.

Speculative activity depicts maniacal bullishness.

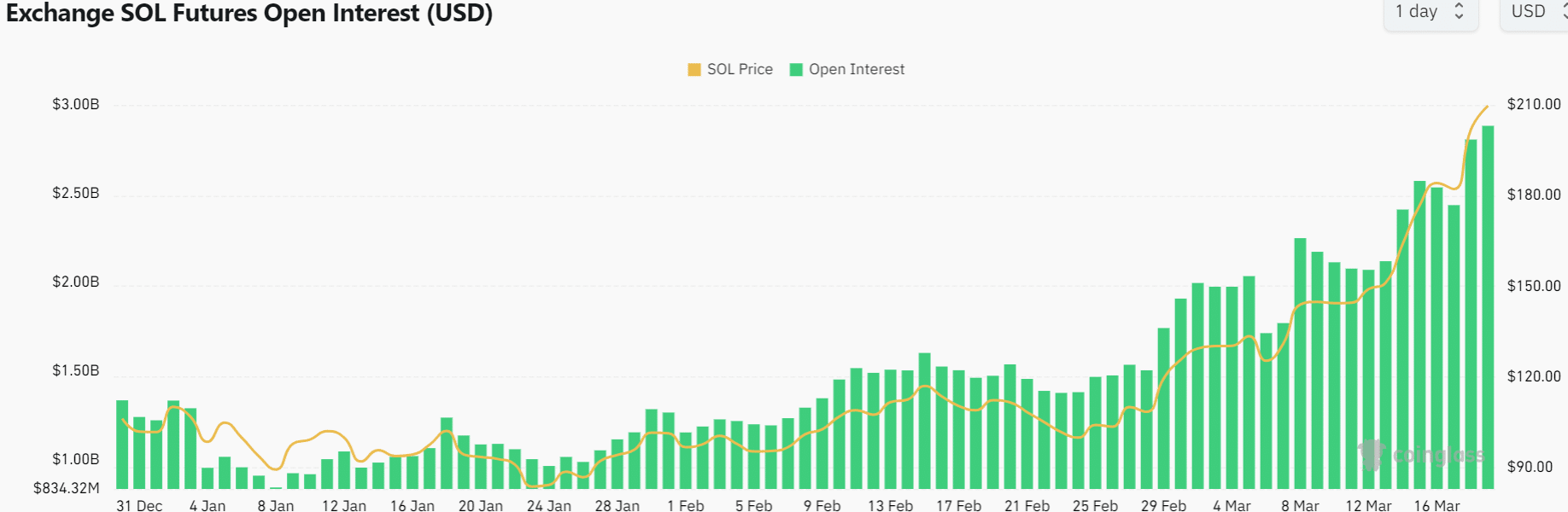

Source: Coinglass

The open interest chart showed no signs of slowing down. According to Coinglass data, Solana’s OI has reached never-before-seen highs. This comes alongside a price jump from $120 to $209 in just over a month.

Is your portfolio green? Check out our SOL Profit Calculator

OI jumped from $1.71 billion on March 6 to $2.88 billion at press time on March 18. This phenomenal rise indicated extreme greed, but did not encourage short selling.

There is also no guarantee that a decline is imminent. The region’s best is yet to come.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.