- Sonic Traders can sell potential bounces for a long time instead of using price bounce.

- Trend reversal was not possible during the media time.

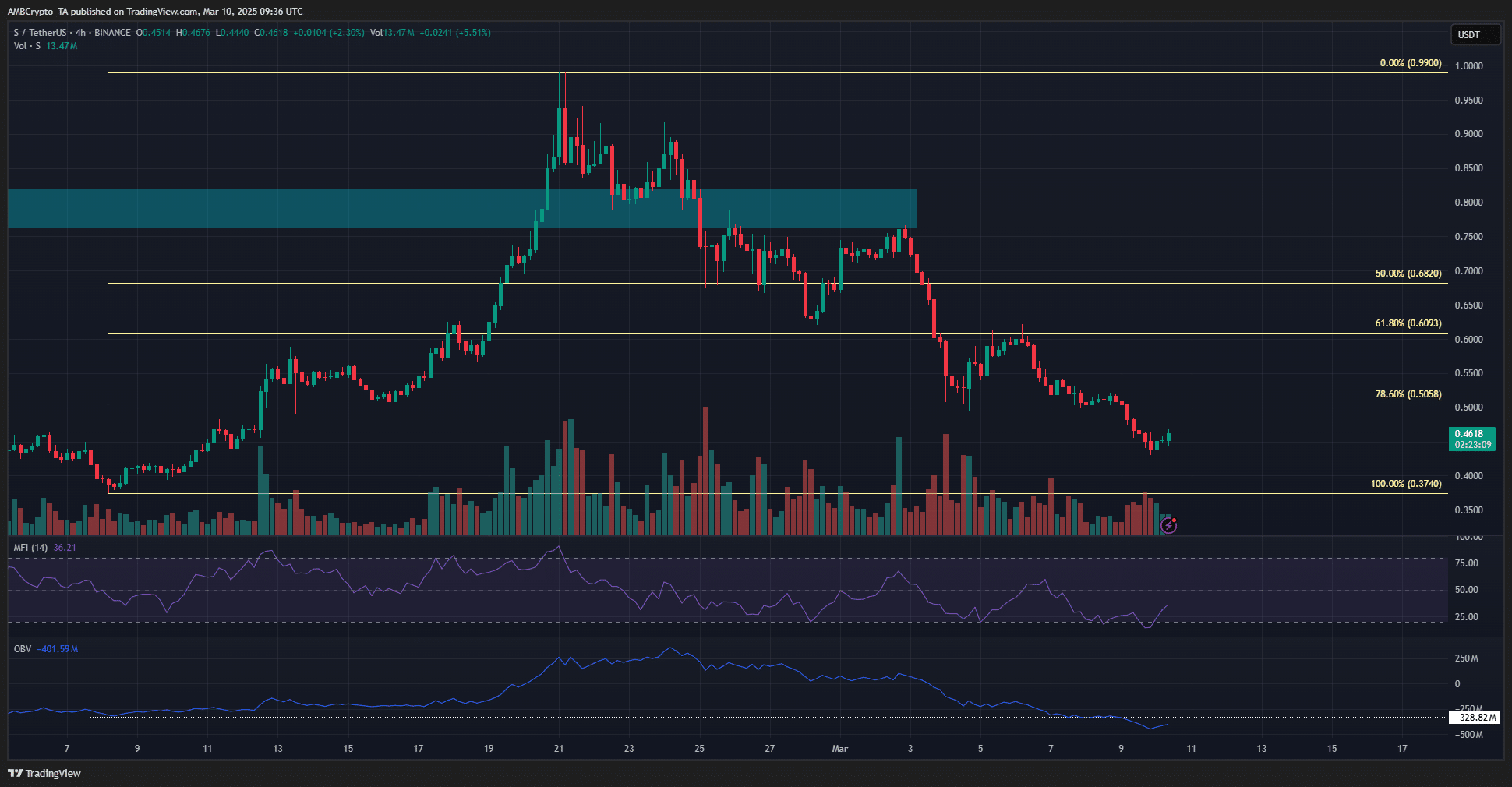

SONIC (S) did not defend 78.6%of the return level based on the rally in February. The token suggested that prices soared in early March, which could continue to rise.

Instead, it was changed to the re -examination of the previous support by resistance.

The weak flag pattern emphasized in the previous analysis was tested and the level of $ 0.448 was tested. The indicator showed that the weak feelings are widespread.

Sonic was set to move to the lowest point in November.

Source: TradingView’s S/USDT

The four -hour chart showed a strong weakness. The price has set a low low since the last week of February. The loss of 36-48 hours has been accompanied by a surge in trading volume.

As a result, the increase in sales pressure has strengthened the idea that the seller is dominant. This idea confirmed this idea that falls below the lowest point in which the meeting began in February. This has shown a lot of sales in recent weeks.

MFI has fallen to less than 20 and I see the bounce with the price, but this will be short. There was no sign of trend reversal yet, and it was likely to move to $ 0.374.

Source: Coinalyze

Last week, public interests are dying while struggling to increase prices. This showed that there was a lack of strong beliefs among derivatives.

But in recent hours, SPOT CVDs have begun to increase, and the OI has increased almost $ 4 million in two hours of press time.

Source: COINGLASS

Such development can open the way of small price bounce, but it is not practical. The liquidation heat map showed that the area of more than $ 0.5 is the next liquidity goal.

The $ 0.522 level was well suited to technology analysis, but I was not sure if SONIC was preparing for 13% price bounce.

Indemnity Clause: The information presented does not make up financial, investment, transactions, or other types of advice, and is entirely the artist’s opinion.