- The entire Altcoin Market has been weak for the last three months.

- This reduced the trust of the investor and the inflow of Stablecoin.

According to CoinMarketCap, the total market capitalization amounted to $ 2.72 trillion at the time of writing and 61.2%of Bitcoin (BTC). This suggests that the total market cap is 28% decreased at the highest level in December, with a total market cap of $ 3.73 trillion.

The weak sentiment throughout the market is due to the relative weaknesses of most Altcoin events and most Altcoin. Including Leader Ether Rim (ETH). According to AmbCrypto, this altcoin tendency will continue.

Use tethers and volume to understand the Altcoin market.

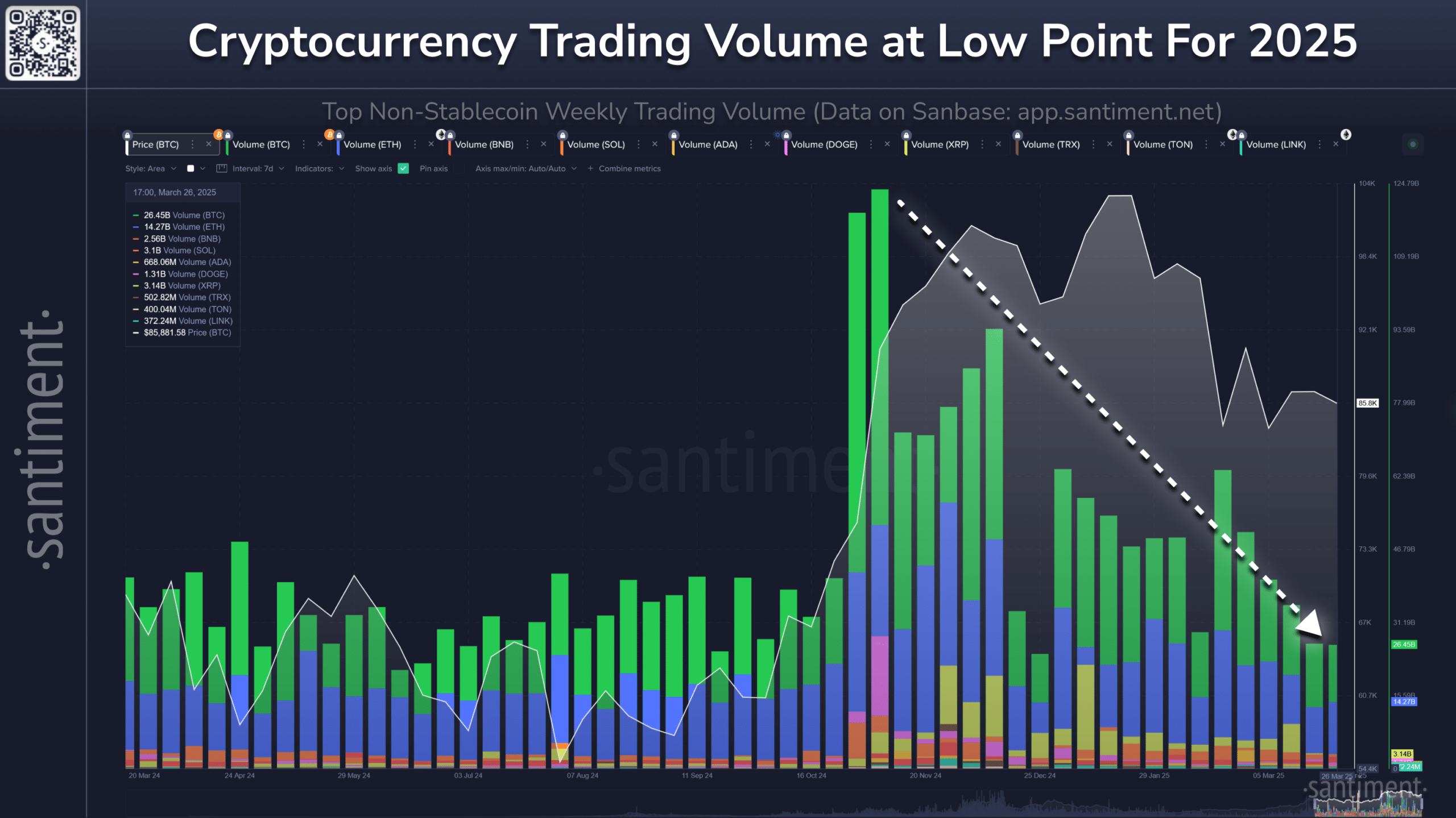

Altcoin hasn’t been good in recent weeks. The drop in the market cap of Altcoin has reduced the volume of trading in various major Altcoins.

Source: Santiment

In fact, according to the data shared by the encryption analyst BRIAN on Santiments, the current TOP 10 Crypto Assets is only one quarter of the amount that can be seen in early December.

This can increase the tendency to take profits or HODL from investors, while also suggesting the traders’ fatigue.

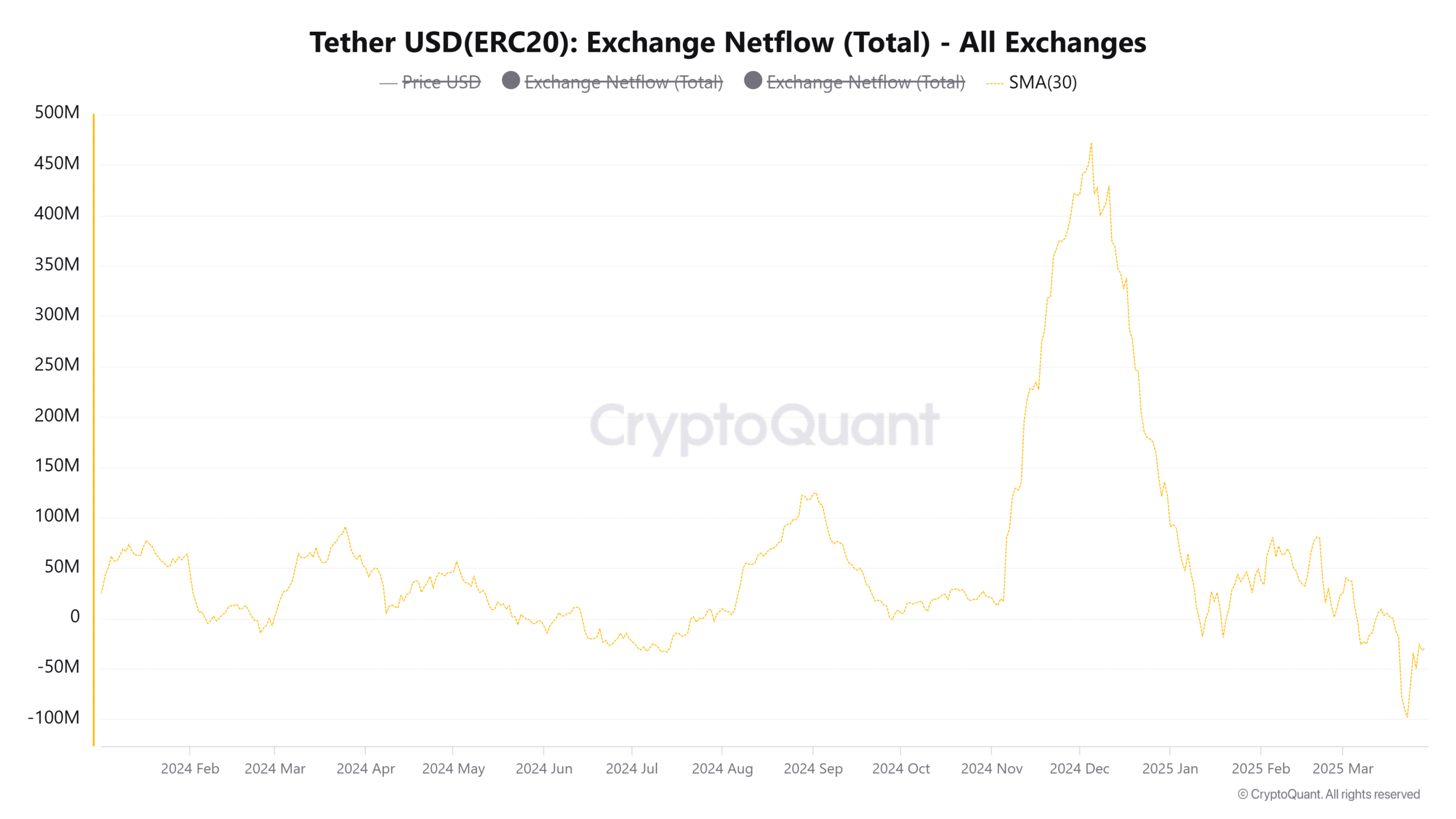

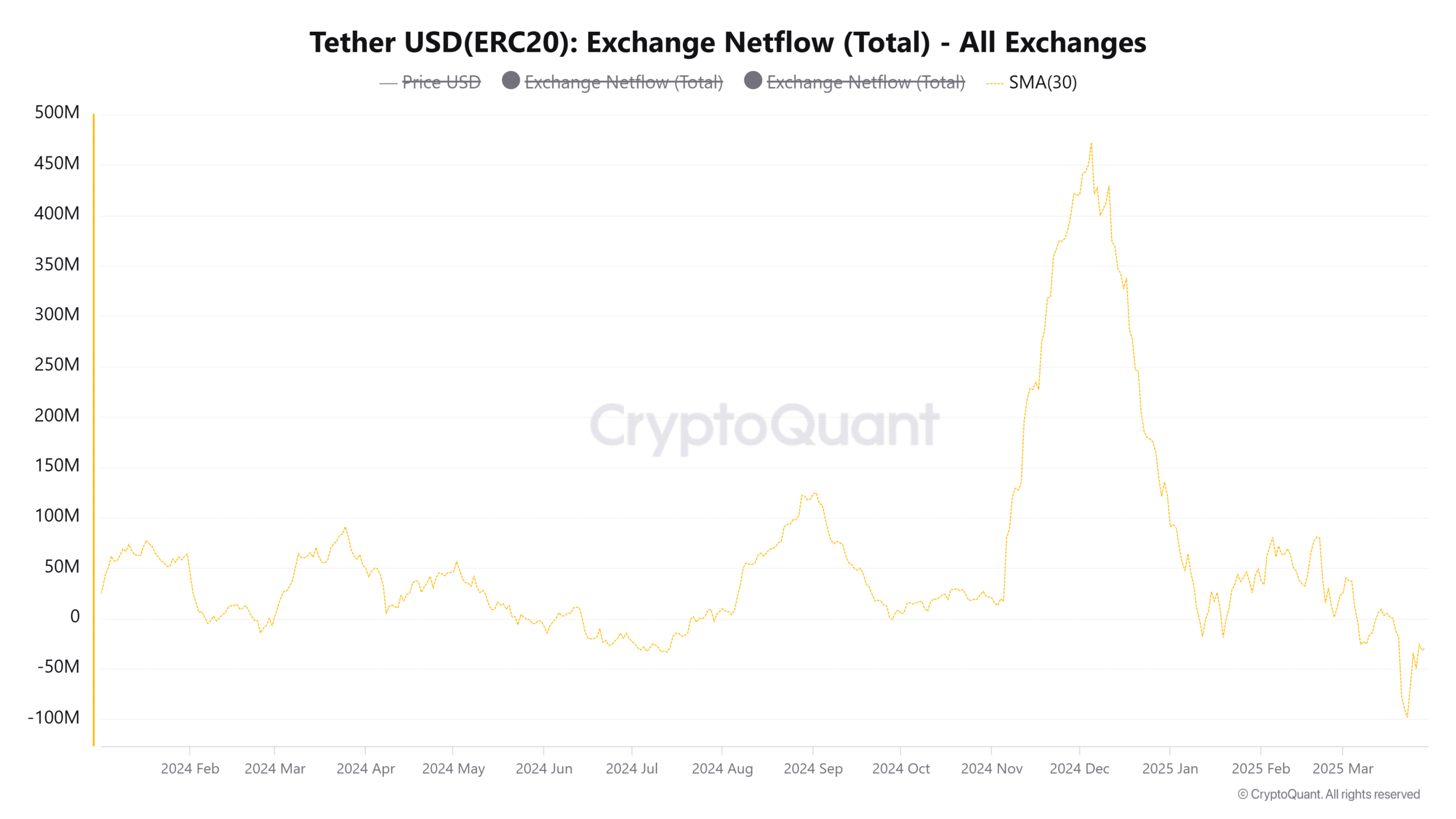

Source: cryptoquant

TETHER (USDT) Netflows Chart emphasized negative investor feelings for the exchange. Metric’s 30 -day moving average shot the sky in November and December. Hiking of stablecoin inflow generally show more purchasing power in the market and briefly explains the strong market sentiment.

As a result of the decline in inflow over the past two months, market participants tended to benefit more. This metrics have reached invisible low during the FTX rupture since November 2022.

Source: Total3 TradingView

The total3 chart tracks the market cap of popular password assets except BTC and ETH. In this way, the trend of Altcoin Market will be clearer. The market cap tends to be south from February.

The $ 75 billion area was used as a support in November and early March. Altcoins’ downward march seems to be tested again.

Considering the weak trend over the past three months, the fall of trading activities and the lack of stability, the market cap is likely to fall below $ 75 billion.