- TON’s 7-day and 30-day realized volatility reached unprecedented lows, indicating rare calm.

- Historically, low volatility in cryptocurrency markets often precedes sharp price movements in either direction.

Calm times in the cryptocurrency market are rare and often signal massive changes just around the corner. Toncoin (TON) I am experiencing such a moment.

Recent data shows that blockchain projects’ 7-day and 30-day annualized realized volatility have plummeted to historic lows, signaling a relatively quiet phase.

To a seasoned trader, this may be more than just statistics. Historically, prolonged periods of low volatility in cryptocurrency markets have served as a precursor to rapid price movements, either upward or downward.

As TON enters this critical moment, all eyes are on whether the current lull will turn into a breakout or collapse.

What is Annual Realized Volatility?

Annual realized volatility measures the actual historical price movements of an asset over a specific period of time, expressed on an annual basis.

This indicator plays a pivotal role in the cryptocurrency market as it highlights periods of stability or chaos and provides traders with insight into potential market behavior.

Phases of low volatility often indicate a market is in balance, but in highly speculative markets such balance rarely lasts long.

Source: CryptoQuant

TON’s 7-day annualized realized volatility shows short-term responsiveness to market movements, while the 30-day indicator captures longer-term trends.

Both indicators are currently at historic lows, signaling that TON’s price action is unprecedentedly quiet. This calmness can precede significant market action, making it an important indicator to monitor.

Source: CryptoQuant

Low Volatility: A Prelude to Market Movement

Low volatility is usually a sign of reduced trading activity or investor interest, often reflecting a market that is consolidating.

For TON, the current historical low represents an equilibrium where neither buyers nor sellers are driving strong price momentum. However, this dormant phase has historically served as the calm before the storm in the cryptocurrency market.

Looking at TON’s history, periods of low volatility often precede sharp price movements. In mid-2022, after a prolonged phase of low volatility, the price of TON surged from $1.30 to over $2.00 in a matter of weeks, an increase of 50%.

Likewise, low volatility led to a breakout in early 2023 that saw the price rise from $2.50 to nearly $4.50, marking an 80% rally.

Broad crypto trends reinforce this pattern. For example, Bitcoin’s consolidation around $6,000 in 2018 led to a steep decline below $4,000. Ethereum saw similar behavior in mid-2020, before the start of the DeFi bull market.

Read Toncoin (TON) Price Prediction for 2025-26

What does the future hold for TON?

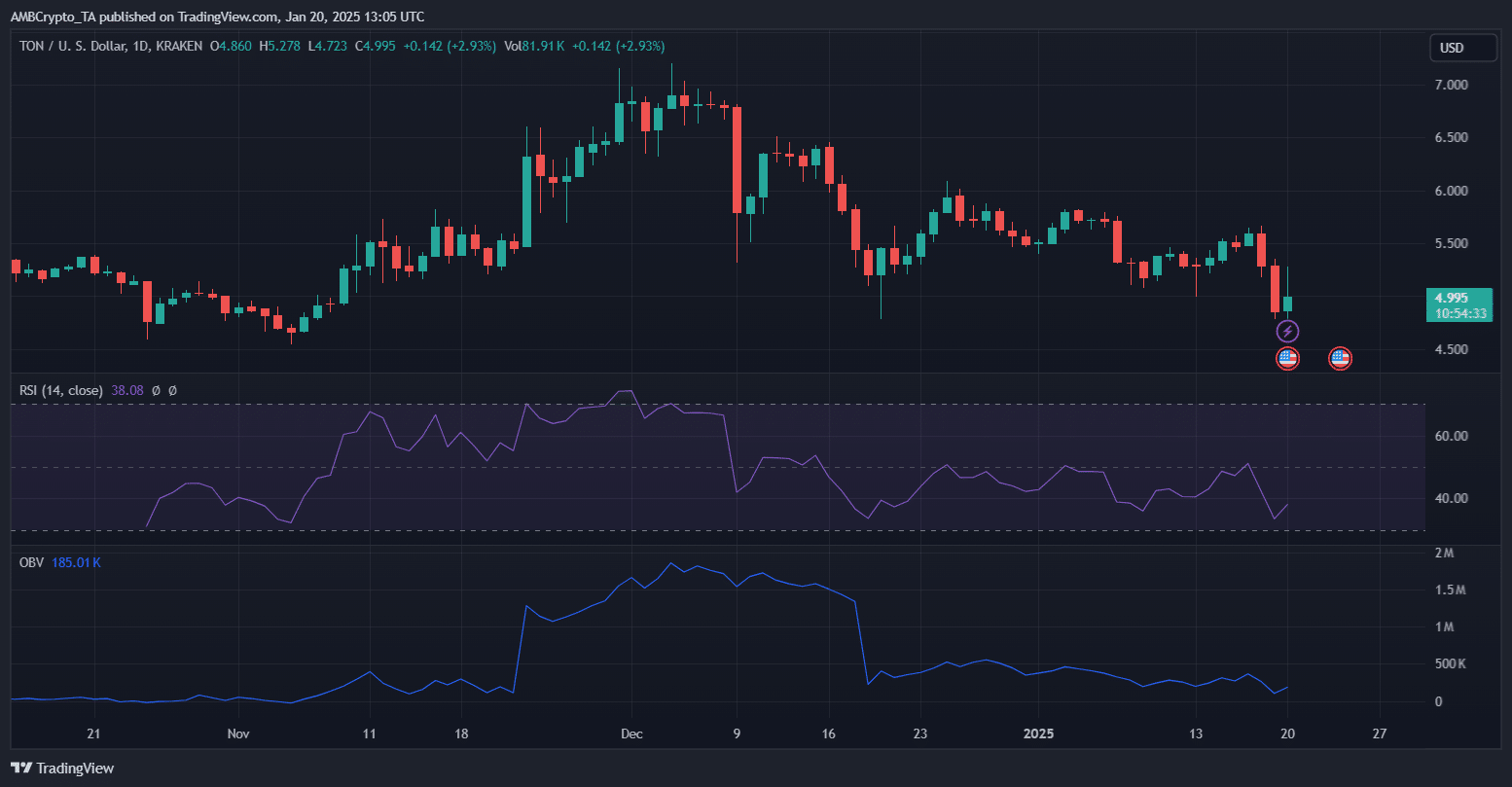

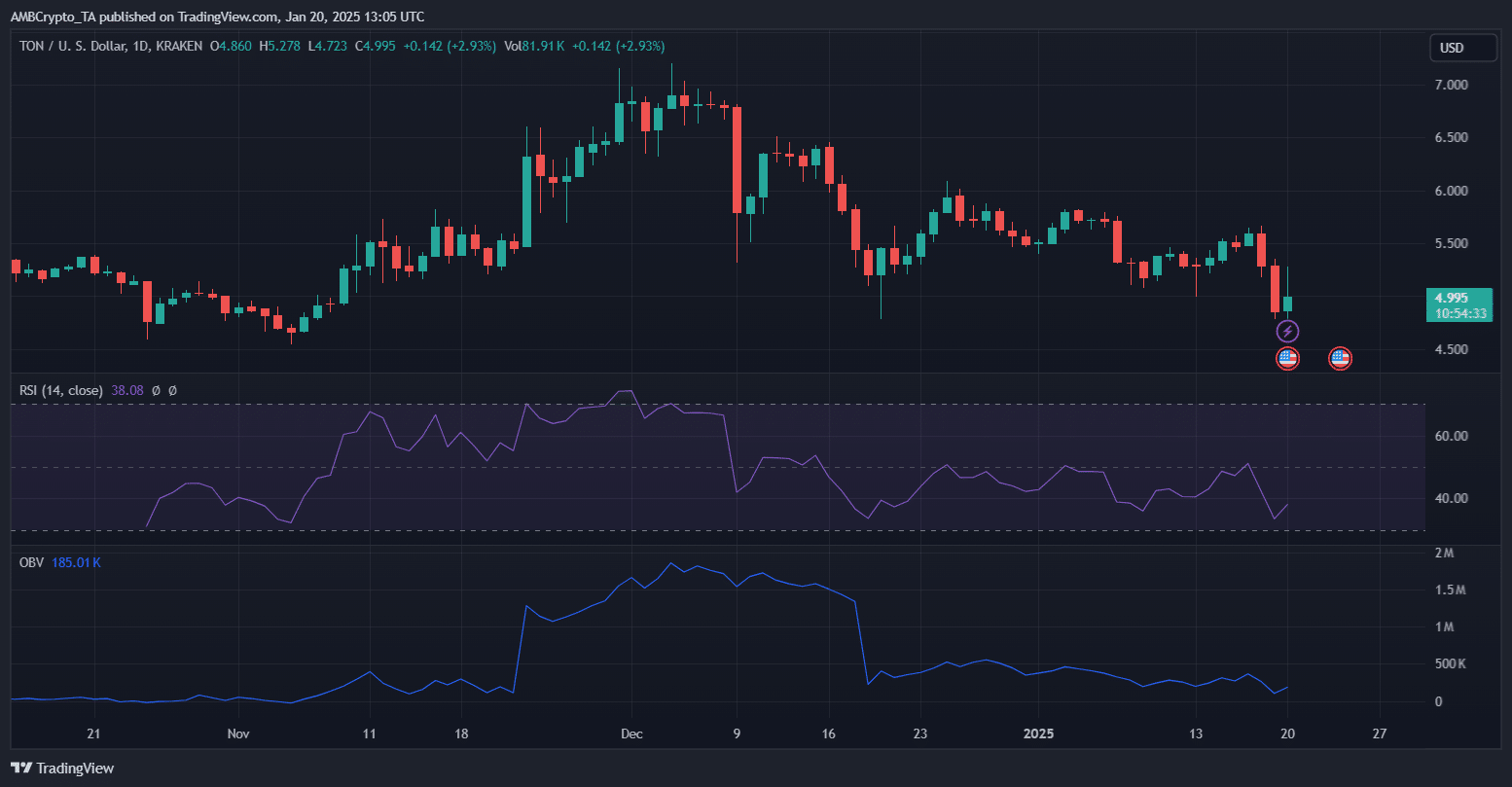

Source: TradingView

TON’s low volatility signals a critical moment. RSI indicates mild bearish momentum, but is not yet oversold. This means that sellers are dominant but exhaustion may be near.

Meanwhile, OBV sees a decline in trading activity, reflecting lower trading volumes. This is a classic low volatility signal.

The upside potential could come from a reversal in the RSI along with renewed buying interest. A break above the $5.50 resistance could spark bullish momentum targeting $6.00 and above.

Conversely, a breach below $4.70 support combined with a persistently low OBV could indicate a further decline towards $4.30.

External factors, such as market trends or ecosystem developments, will likely determine the direction of the impending breakout.