- AI agent tokens are likely to gain public attention in 2025.

- The rapid increase and growth in active addresses demonstrated the aspirations of market players.

Bitcoin (BTC) hit a high of just over $108,000 on Tuesday, December 17th. Altcoin market prices have not moved with BTC in the past six days. While Bitcoin has been on the rise, they have only moved sideways, slowly breaking past previous resistance around $104,000.

Source: CoinMarketCap

The AI sector is slightly ahead of most of the rest of the altcoin market, with gains of close to 110%. AI-related tokens also performed well.

Goatseus Maximus (GOAT)’s growing buzz and rapid rise to $700 million in value has strengthened confidence in the meme coin and AI sector.

GOAT is primarily a meme coin, but which AI agent tokens can you buy and hold to profit from this bull market?

Is AI Agent Coin awakening?

AI Agent Token, listed on CoinGecko, is a cryptocurrency project that harnesses the power of artificial intelligence for its own purposes. This could be a transaction within an AI ecosystem to provide governance rights or become part of a multi-economic system to facilitate interactions between AI agents.

The top two AI agent tokens by market capitalization are Artificial Intelligence Alliance (FET) and Virtuals Protocol (VIRTUAL). Their market capitalizations are $4.2 billion and $2.6 billion, respectively. VIRTUAL is a relatively new token that started trading in 2024 and supports the AI x Metaverse protocol.

On the other hand, the Artificial Superintelligence Alliance token has been on the market for much longer. This is part of a collaboration between Fetch, SingularityNET, and Ocean Protocol.

Those tokens have been merged into FET and all FET tokens will be automatically converted to ASI during Fetch.ai’s mainnet upgrade.

In addition to the two major tokens that will attract attention as large tokens, Humans.ai (HEART) was also selected as a promising AI agent token.

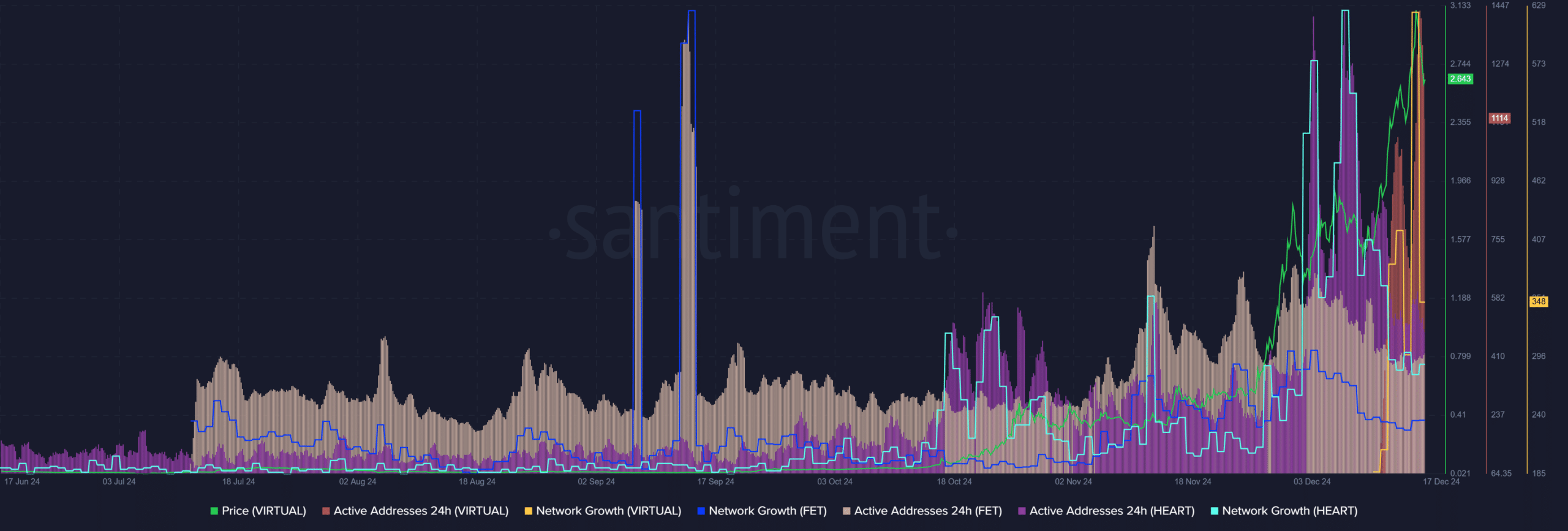

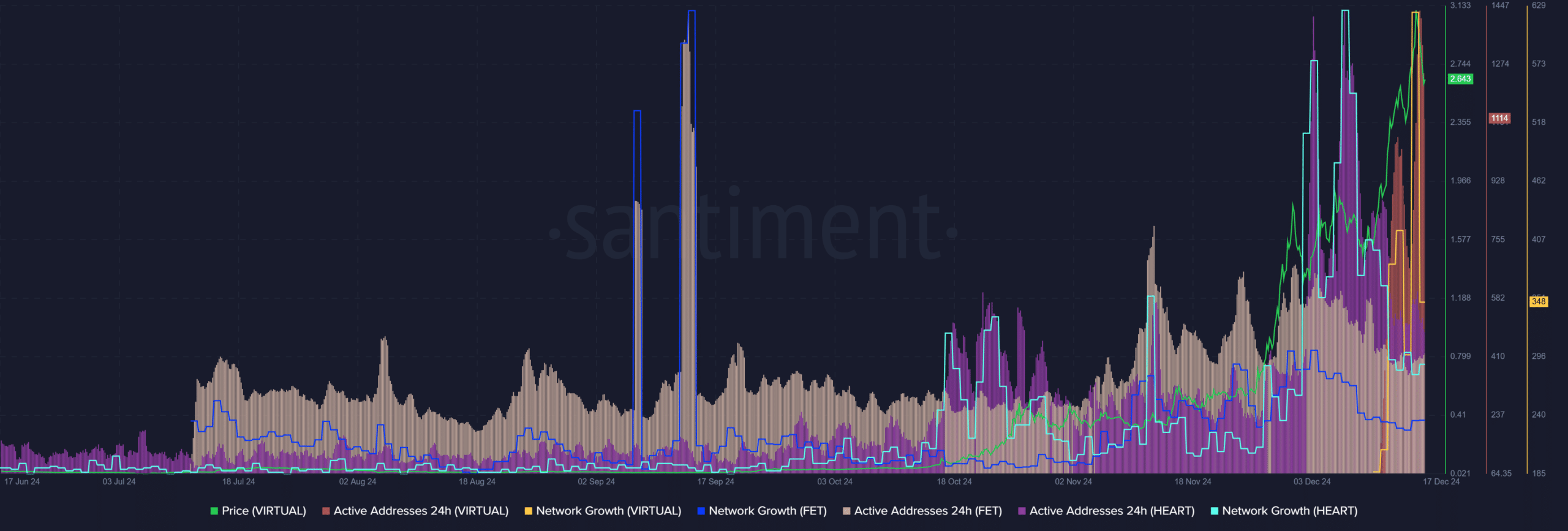

Source: Santiment

AMBCrypto compared VIRTUAL and FET daily active addresses and network growth, noting that FET has consistently had 2,000 to 3,000 active addresses since mid-November. This number has recently begun to decline, reaching 1,500.

Meanwhile, VIRTUAL reached 1,000 a few days ago and was close to 1,500 at press time.

HEART was much smaller than the other two. It hit a high of just over 600 in the first week of December. It was later reduced to 200 people.

Network growth trends followed a similar trajectory. FET saw 1,250 new addresses in early December, while HEARTS saw 313. VIRTUAL reached 623 on December 16th. Even if these numbers drop, if they remain consistent, it could be a positive sign for 2025.

The past two months have seen a flurry of activity as rising prices, bullish sentiment and positive expectations attract new entrants.

HEART and VIRTUAL are strongly bullish, and FET is expected to rebound higher.

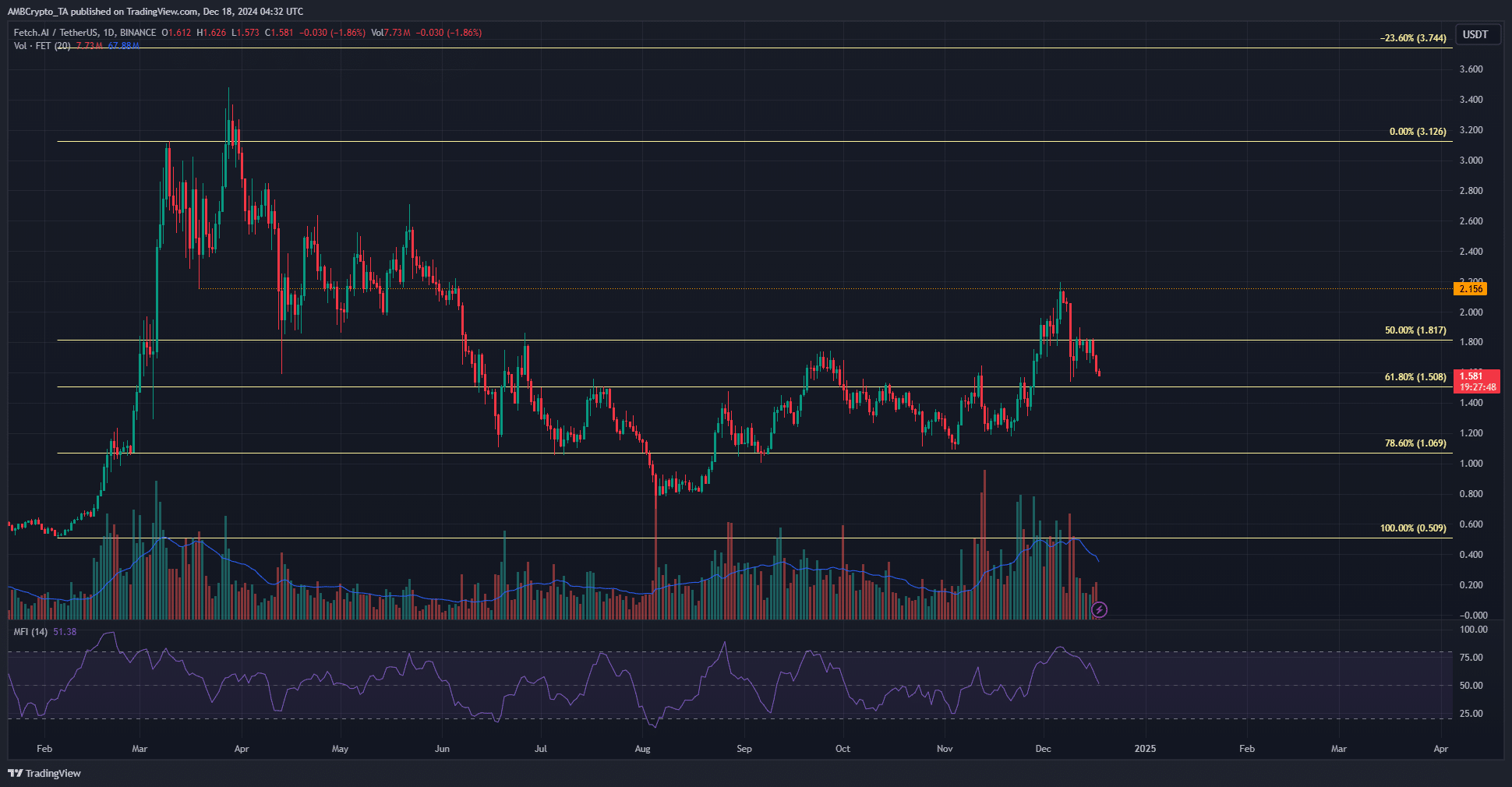

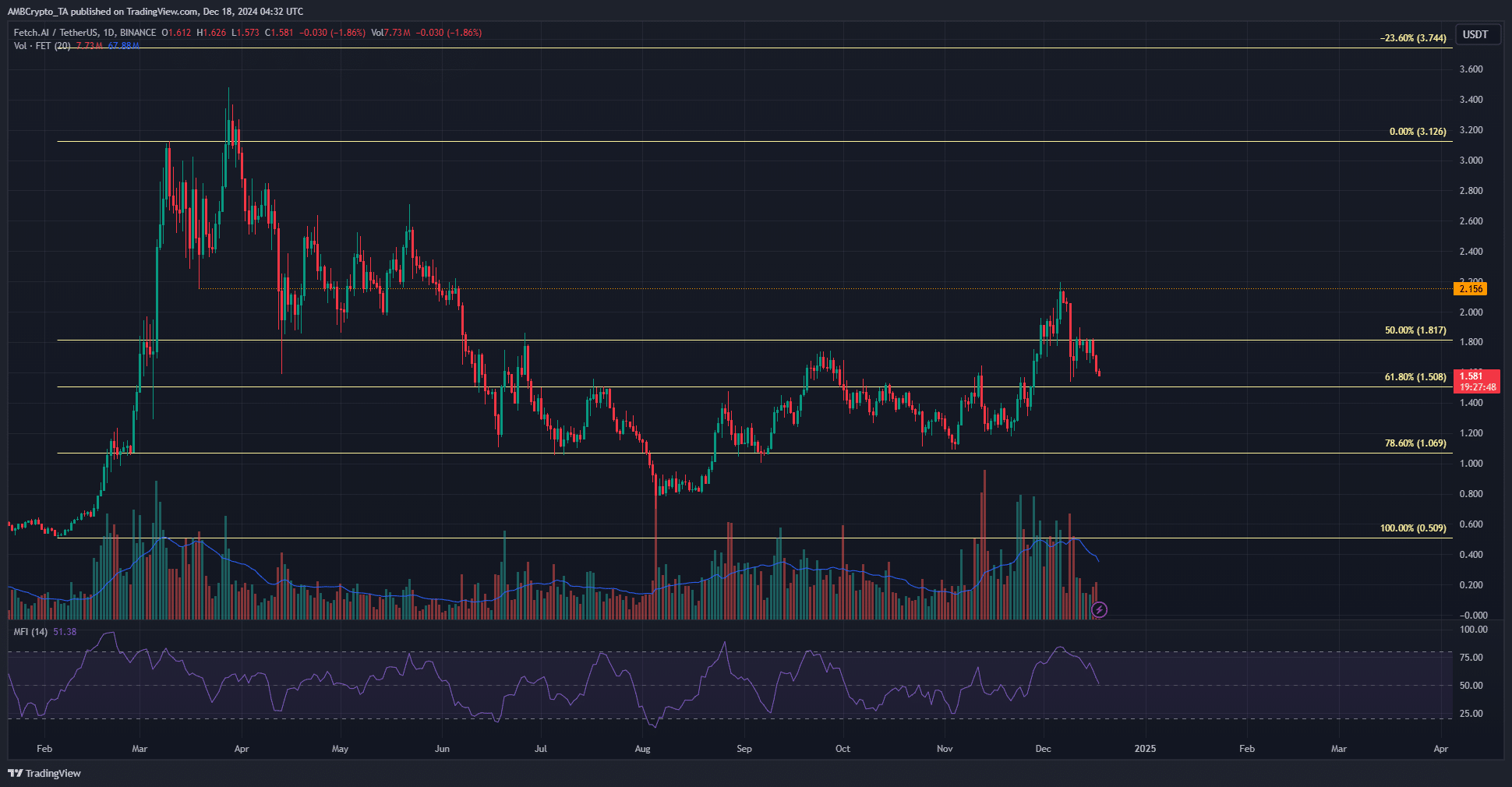

Source: FET/USDT on TradingView

The market structure on the FET daily chart is bearish after falling from $2.15 over the past two weeks. The previous resistance zones of $1.5 and $1.7 from September, when the breakout occurred, were expected to act as support.

Artificial Superintelligence Alliance tokens offer a buying opportunity right now. The strong performance is expected to continue after August. The trend is upward, but the structure shows the potential for more losses.

Beyond $2.15, $2.6 and $3.12 were the next hurdles. The targets for the next 3-6 months were $4.74 and $5.74, 200% and 268% above current prices.

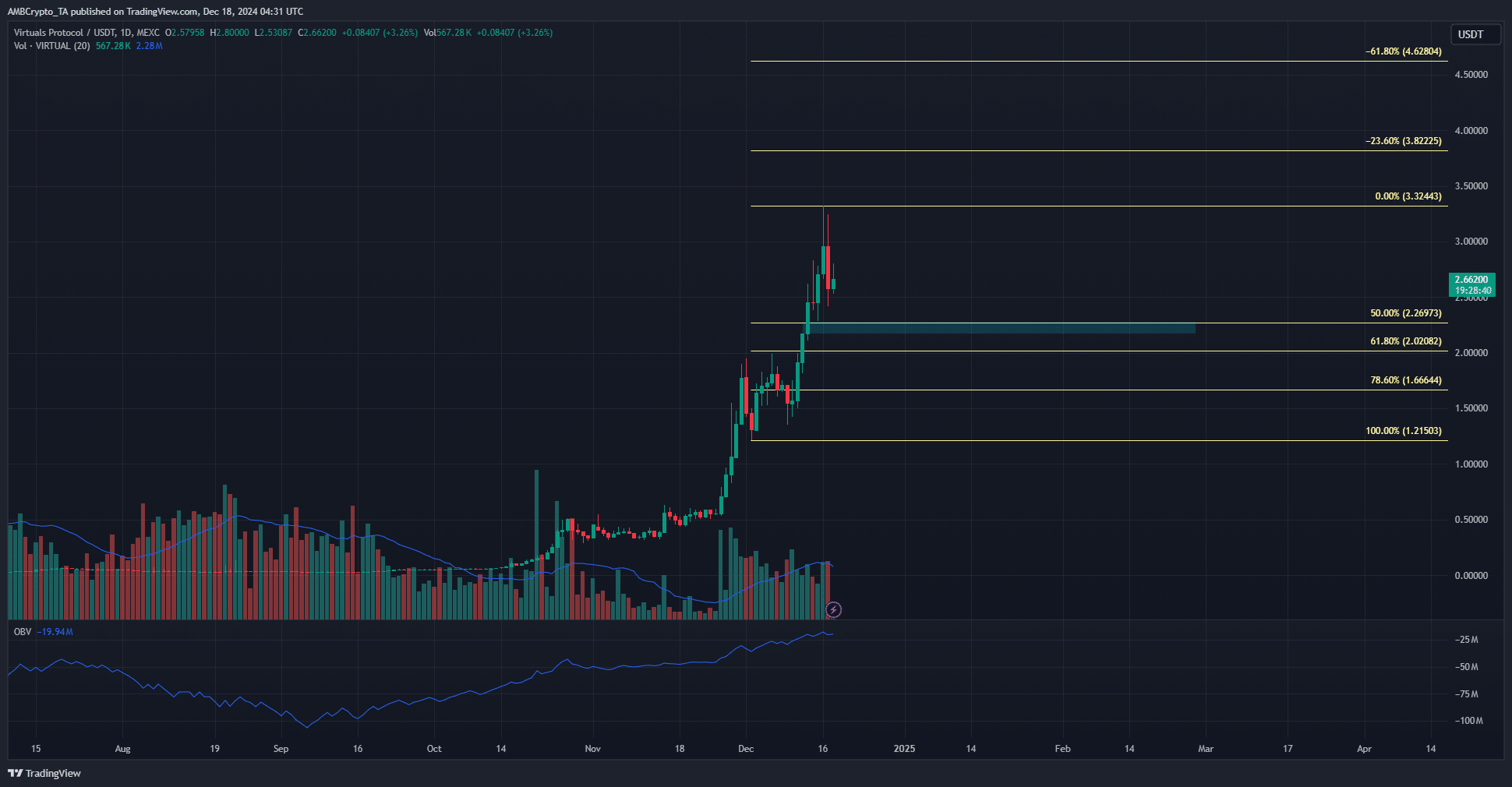

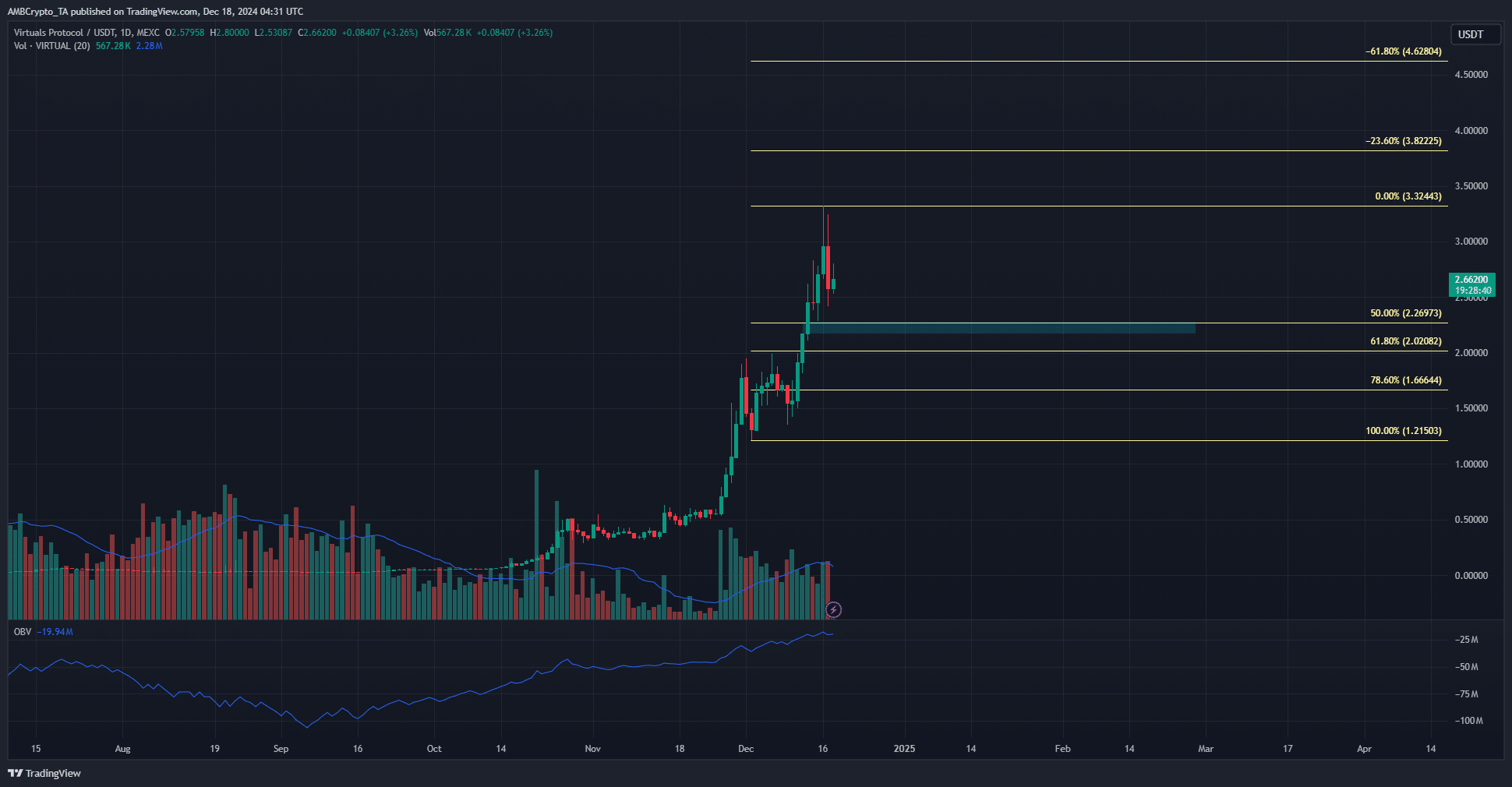

Source: VIRTUAL/USDT on TradingView

The Virtuals Protocol token also had a very optimistic outlook. This AI agent token has been under steady buying pressure since September, as evidenced by OBV.

A retest of the $2.2-$2.3 area could push the hypothetical trend higher to $3.82, $4.62 and $5.43. This represents a profit of 144% over the market price of $5.43.

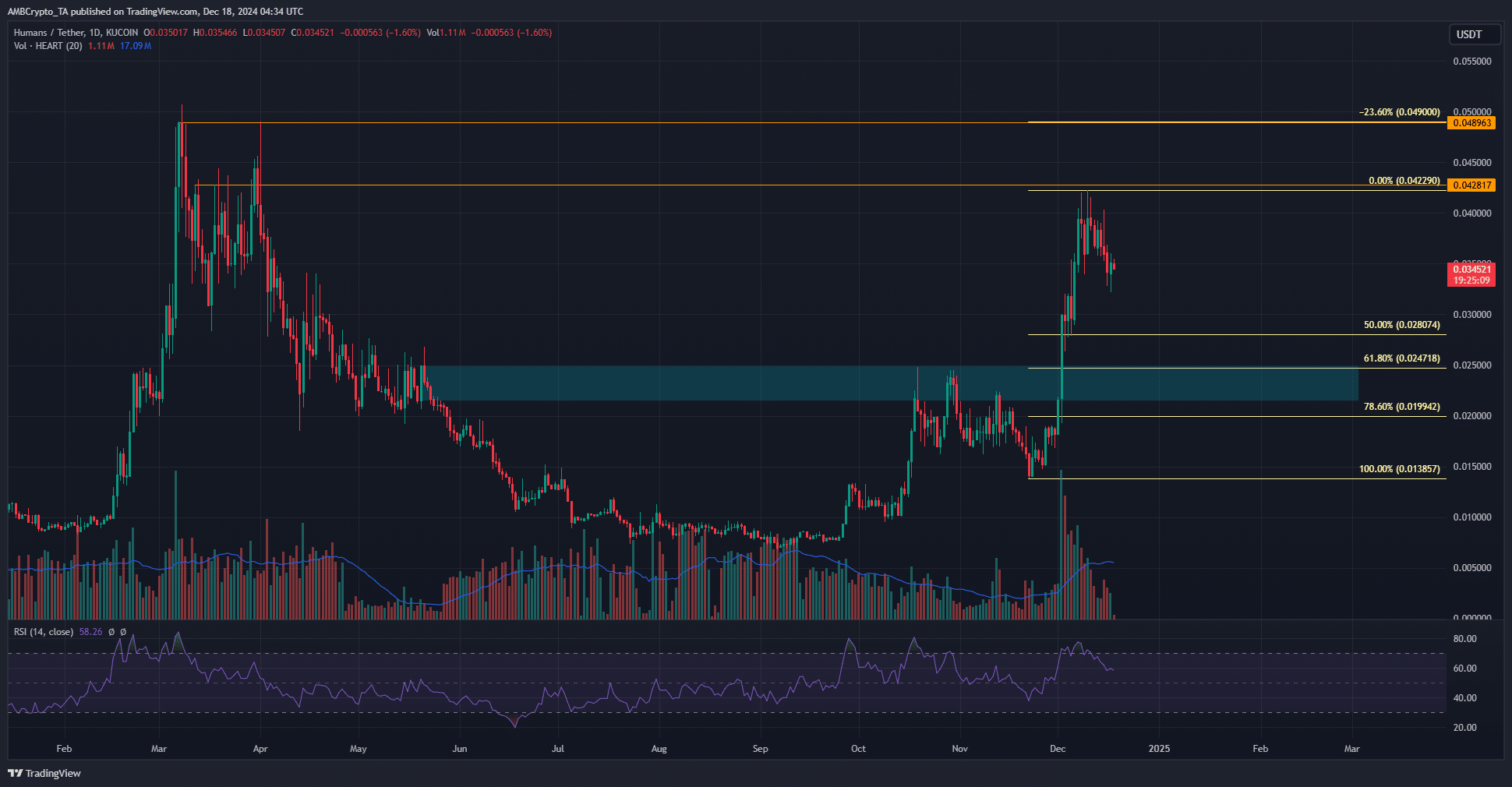

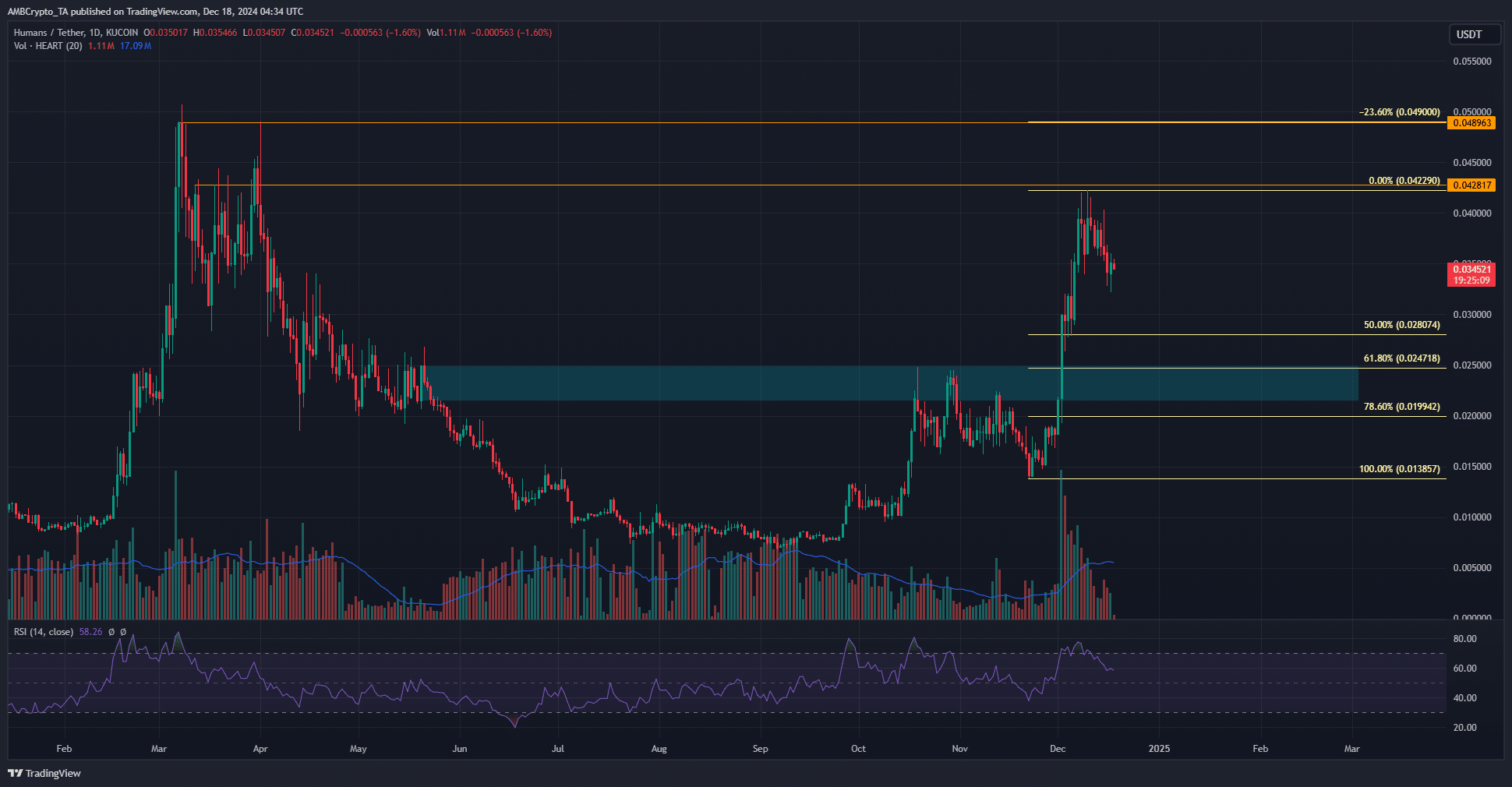

Source: HEART/USDT on TradingView

Small-cap HEART has a market capitalization of $253 million. The strong performance over the past month has sent the token soaring past the local resistance area of $0.025. It quickly expanded to a March high of $0.05 before falling.

Read Bitcoin (BTC) Price Prediction for 2024-25

The daily RSI was 58, showing that the token is poised for the next level of upside. Price action highlighted the $0.03 and $0.024 levels as buying opportunities on retest.

To the north, $0.05 and $0.07 were targets for the coming weeks.