- Uniswap whales observed selling significant amounts of tokens

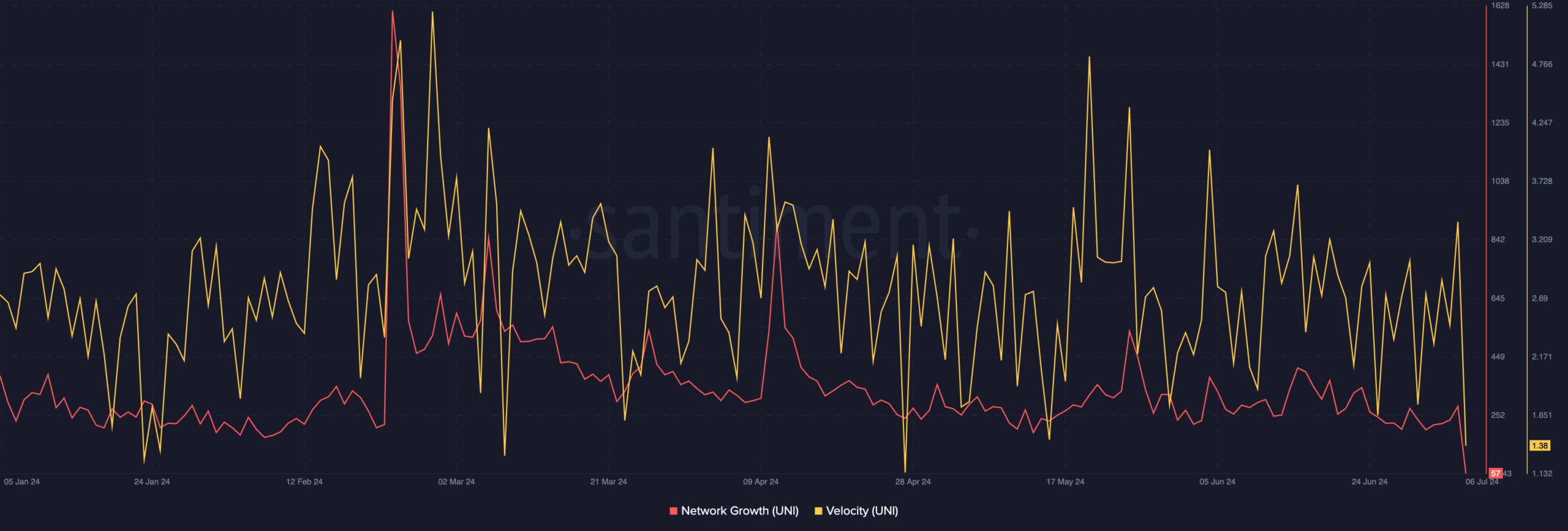

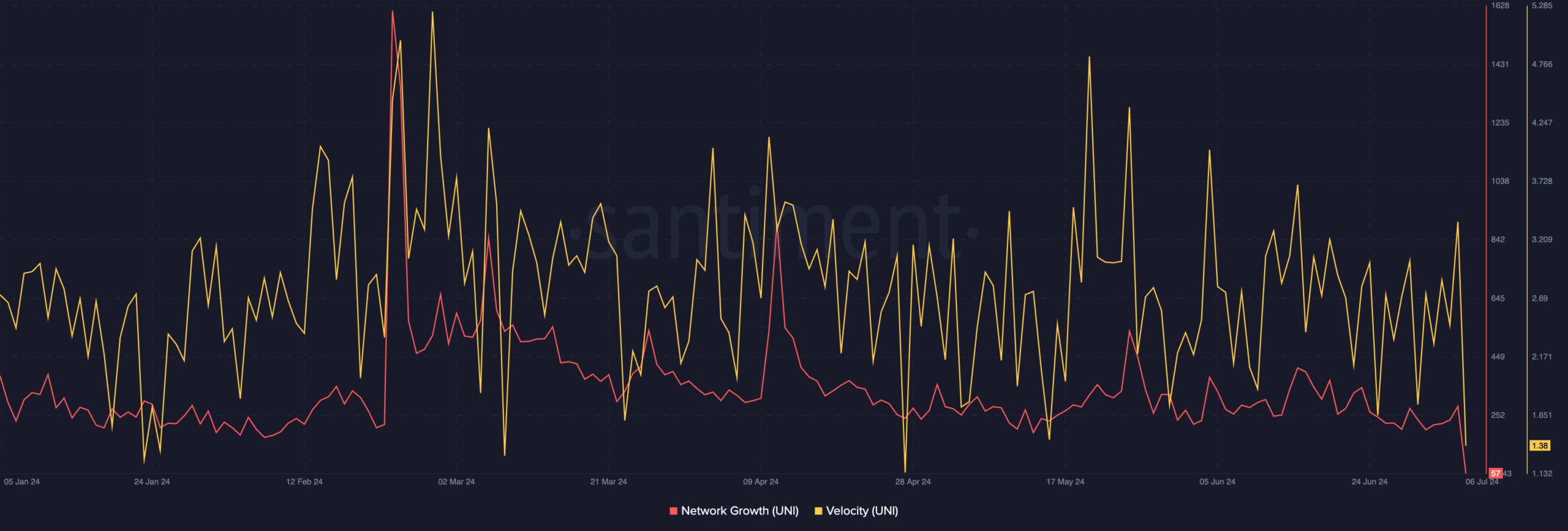

- UNI’s network growth has declined significantly over the past few days.

Uniswap (UNI), one of the largest DEXs (decentralized exchanges) in the crypto space, saw a significant rally earlier this year as bullish momentum built around UNI. However, it is unclear how well the DEX has performed recently, but at the time of writing, interest in UNI seemed to be waning.

The whale swims

According to Lookonchain, a major whale deposited 561,782 UNI, or approximately $4.38 million, on Binance a few hours ago. This deposit is based on a period of accumulation over the past year, and it is the first time the whale has sold UNI during that period.

What’s interesting is that this whale still holds a significant amount of UNI. The remaining balance is 2 million UNI, which is worth $15.48 million.

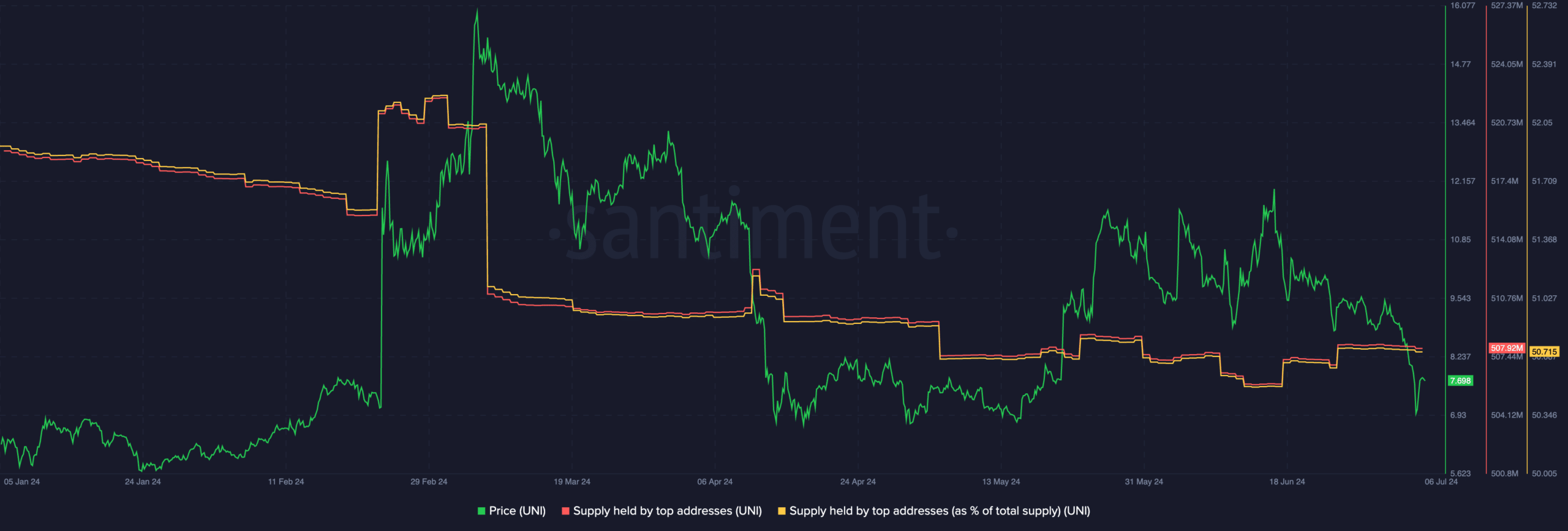

AMBCrypto’s analysis, based on data from Santiment, also shows that the percentage of large addresses holding UNI has decreased, which suggests that this whale sell-off may be part of a larger trend of decreasing whale interest in UNI.

Source: Santiment

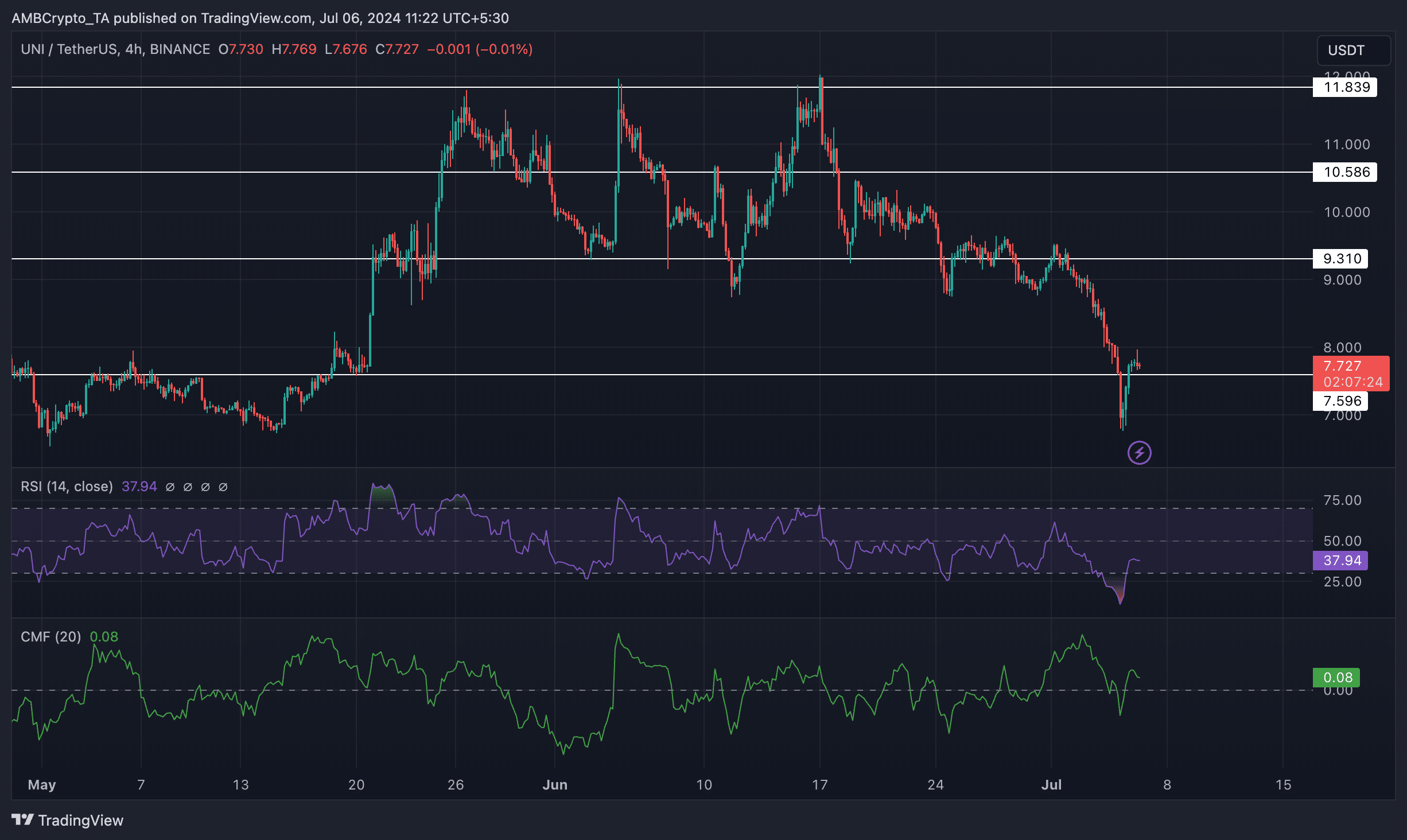

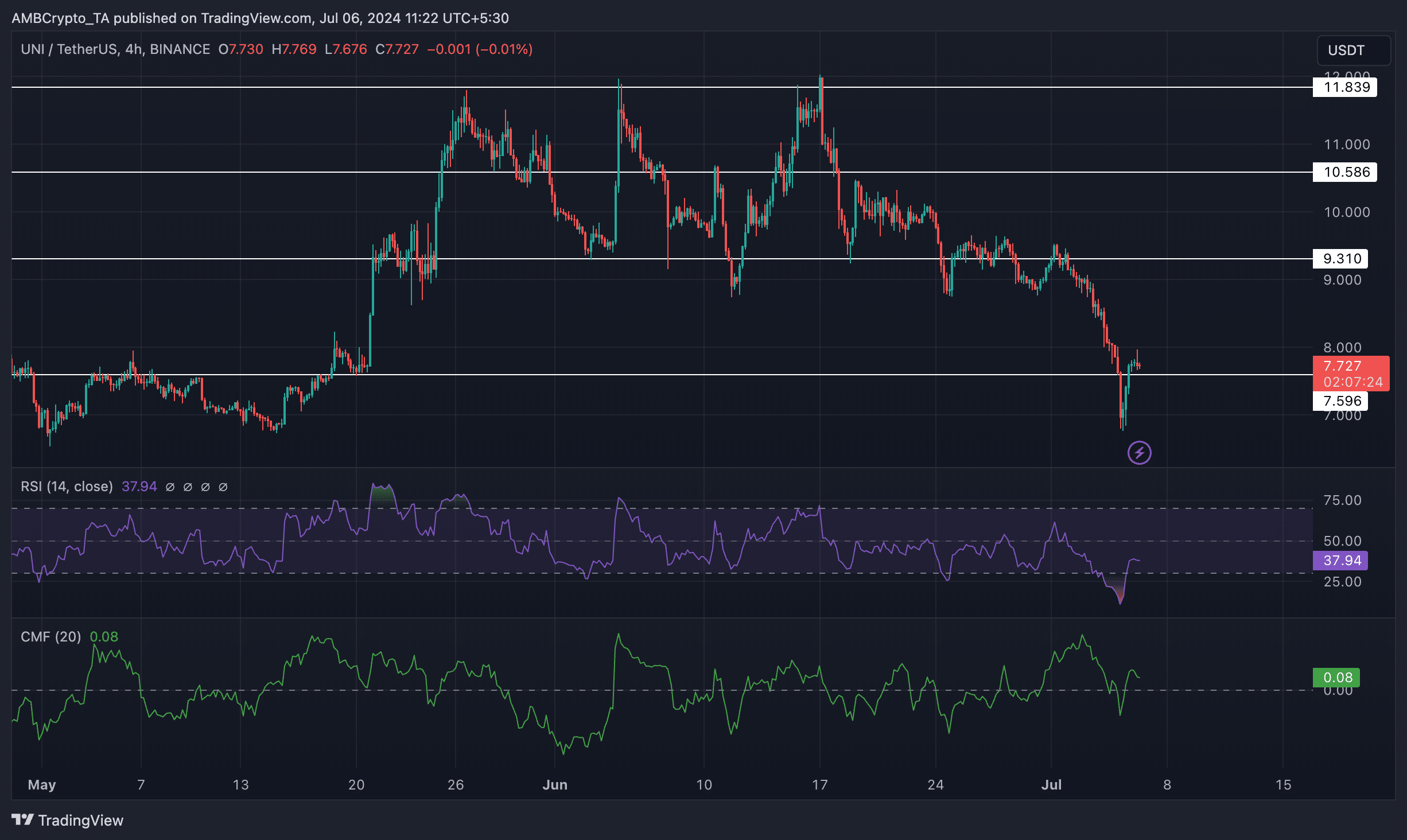

From May 26 to June 17, a triple bottom pattern flashed on the UNI price chart. The token price dropped significantly accordingly. Lower lows and lower highs were highlighted. This indicates a bearish trend. If UNI is to recover in the future, it will have to retest the $9,310 level several times before a reversal is possible.

UNI’s RSI (Relative Strength Index) has also declined to 37.94 over the past few days, indicating that the bullish momentum around UNI has waned.

Additionally, UNI’s CMF (Chaikin Money Flow) has also declined on the charts, indicating that less funds are flowing into the token.

Source: Trading View

What does on-chain data tell us?

Finally, UNI’s network growth has also decreased significantly, which shows that new addresses are losing interest in the token.

Additionally, the price of the altcoin has also dropped significantly over the past few days.

Source: Santiment

The recent Uniswap v4 update could benefit UNI and potentially drive up its price. The key feature of this update is an innovative concept called hooks.

Is your portfolio green? Check out the UNI Profit Calculator

These hooks are essentially small pieces of code designed to run at specific points in the lifecycle of a pool. They can be triggered when a pool is created, whenever a liquidity provider (LP) adds or removes holdings from the pool, or before and after a swap occurs.