Solana (SOL) price has been rising parabolically since October, reaching a yearly high of $79.50 on December 15th.

Despite the increase, there were some signs of weakness during the lower period. Will this lead to a regional high, or will SOL achieve a new high instead?

Solana Breaks Out of the Correction Pattern

SOL price has been increasing within an upward parallel channel since the beginning of the year. Both the channel’s resistance and support trend lines have been verified several times.

In November, SOL broke out of the channel’s resistance trend line and accelerated its upward pace. This led to SOL’s annual high of $79.50 on December 16, an 865% increase since the beginning of the year.

Since November, the rate of increase has been parabolic and follows no clear pattern.

RSI is a momentum indicator that traders use to assess whether the market is overbought or oversold and whether to accumulate or sell. A reading above 50 and an upward trend means the bulls still have an advantage, while a reading below 50 indicates the opposite.

Even though the RSI is above 50, it is starting to show weakness in the form of a bearish divergence (green). This occurs when a decrease in momentum is accompanied by an increase in price.

Read more: 9 Best AI Cryptocurrency Trading Bots to Maximize Your Profits

What do analysts say?

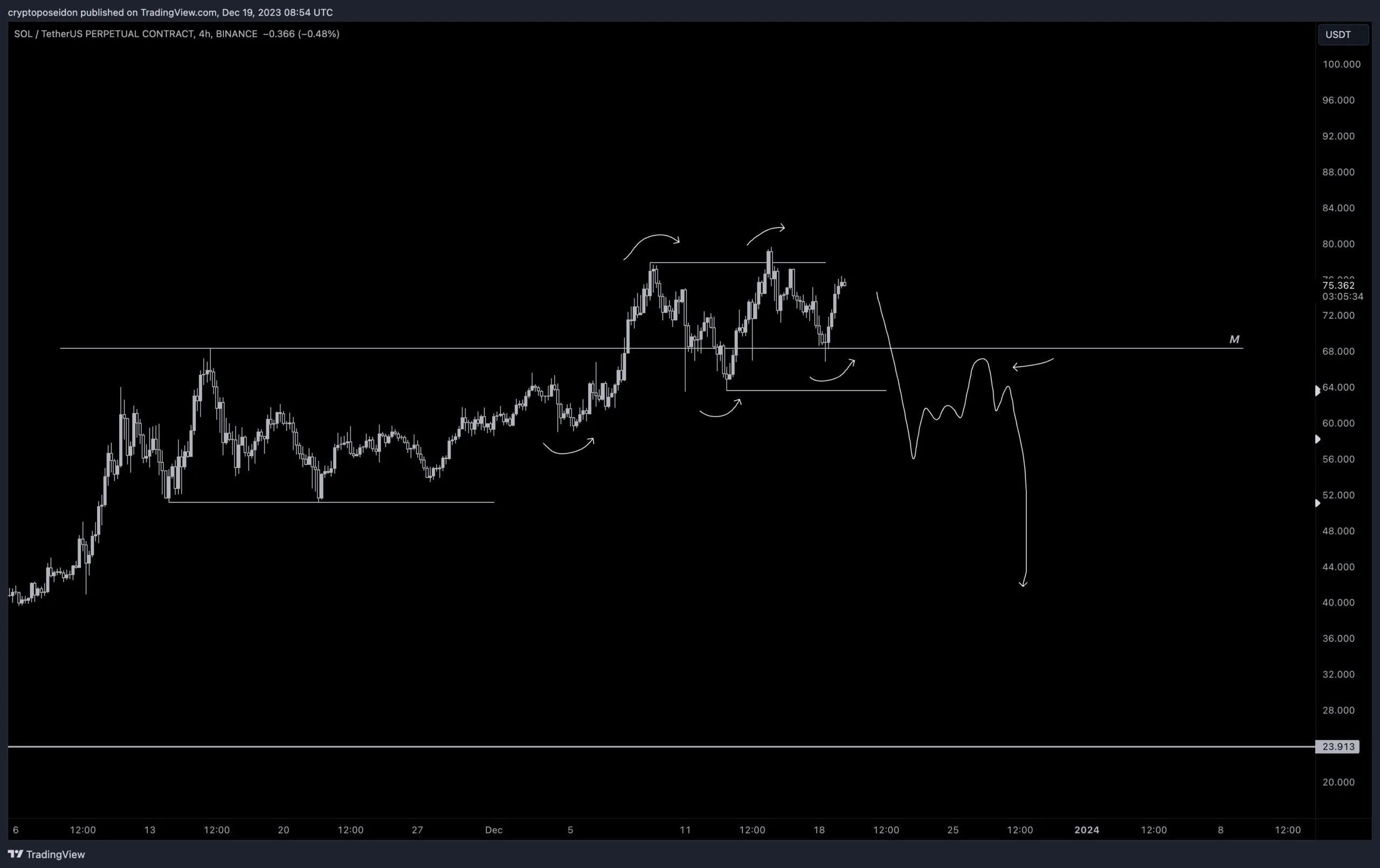

Cryptocurrency trader CryptoPoseidonn believes the summit is near.. He tweeted:

I want to short but the price is still holding the market structure, maybe this is a generation high but I want to wait for a 4 hour trend break first. The trigger will be an arrow once we get it.

CryptoBusy is undecided as the price struggles. It’s around $78. He suggests waiting for a reaction to the levels before making any trades.

Raising the price above $78 still requires one major effort.

If it breaks and confirms above that price of $90, $107 is imminent.

However, the market is still waiting. Be patient.

SOL Price Prediction: Will the region close at the highest price?

Technical analysts use Elliott Wave Theory to identify recurring long-term price patterns and investor sentiment, which helps determine trend direction.

The most likely wave number indicates that SOL is in the third wave of a five-wave upward move. Wave 3 expanded, increasing the length of wave 1 by 2.61 times. So the top can stay in place.

Read more: 9 Best Cryptocurrency Demo Accounts for Trading

This is supported by the daily RSI and the two upper wicks in December (red icons), which created a bearish divergence.

If the calculations prove true, SOL price could see a 25% correction and reach the 0.382 Fib retracement support level at $55.60. A fifth wave could then push the price to new annual highs.

Despite this bearish near-term SOL price forecast, a close above $73 means that the fifth wave will extend further. In this case, the SOL price could rise to the next resistance at $95, which would represent an increase of 25%.

Click here to view BeInCrypto’s latest cryptocurrency market analysis.

disclaimer

In accordance with Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate and unbiased reporting, but market conditions may change without notice. Always do your own research and consult with a professional before making any financial decisions.