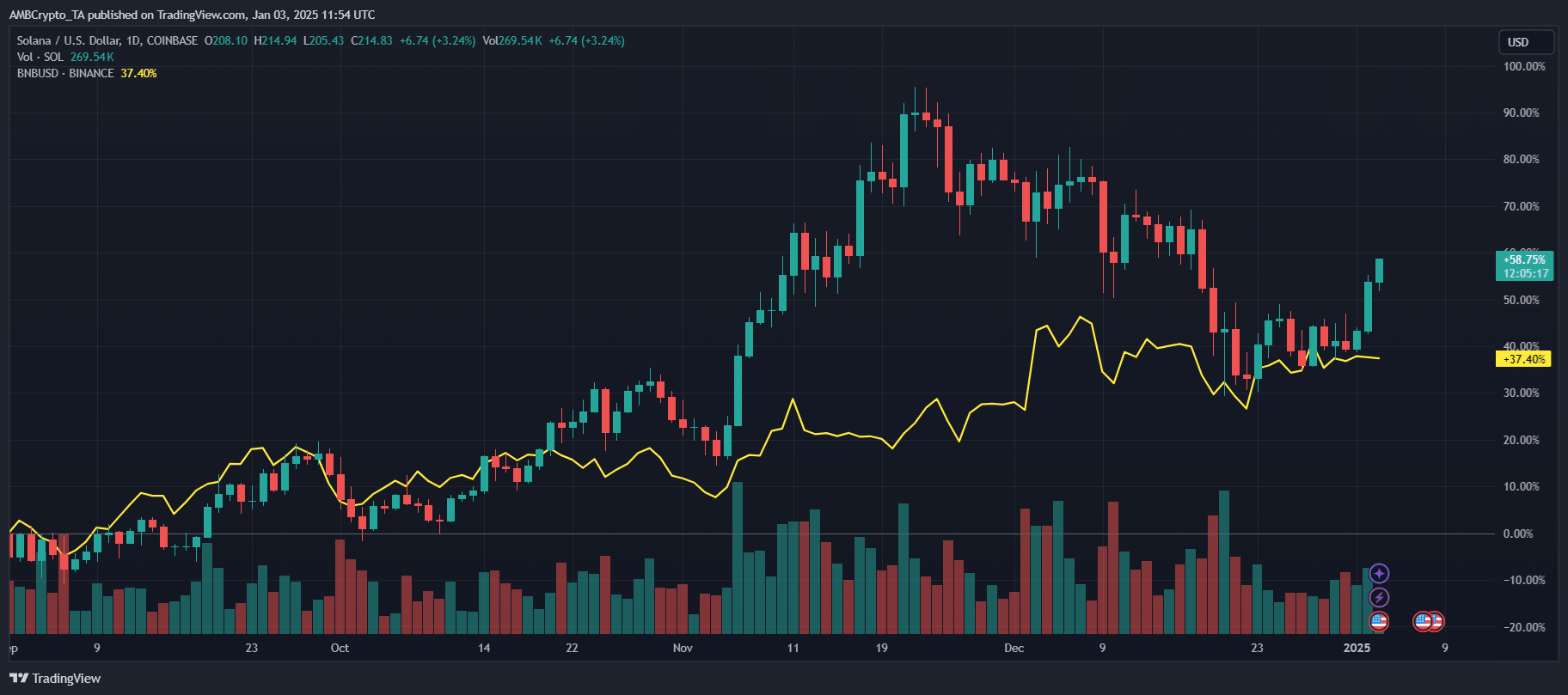

- Solana rose 58.75% to upset the market cap of Binance Coin and could target XRP next.

- XRP is facing a stagnant price trend and mixed on-chain signals.

Solana (SOL)’s impressive performance in recent months has garnered attention in the cryptocurrency world, resulting in notable changes in the rankings of the best digital assets. Kicking off the new year with a milestone, Solana upset Binance Coin (BNB), solidifying its position as a key player in the market.

This rapid rise has sparked discussion as to whether Solana’s momentum can continue to surpass XRP and move it further up the rankings.

Solana Outperforms XRP – A Closer Look

In fact, Solana continues to attract attention with a sharp rise of 58.75% in recent weeks, showing a steady recovery and strong upward trend as shown in the daily price chart. This performance solidifies its position above Binance Coin in market capitalization, raising the possibility of a similar challenge to XRP.

Source: TradingView

In contrast, XRP’s price action has remained relatively calm. XRP has been strong, but its growth trajectory has been overshadowed by Solana’s continued bullish momentum. SOL’s ability to maintain higher trading volume and investor interest is a sign of stronger fundamentals or market sentiment.

As SOL approaches XRP’s market cap, differences in their respective price trends could indicate broader changes in investor preferences. We particularly focus on assets with high scalability and ecosystem development.

Indicators reveal mixed signals amid price stagnation.

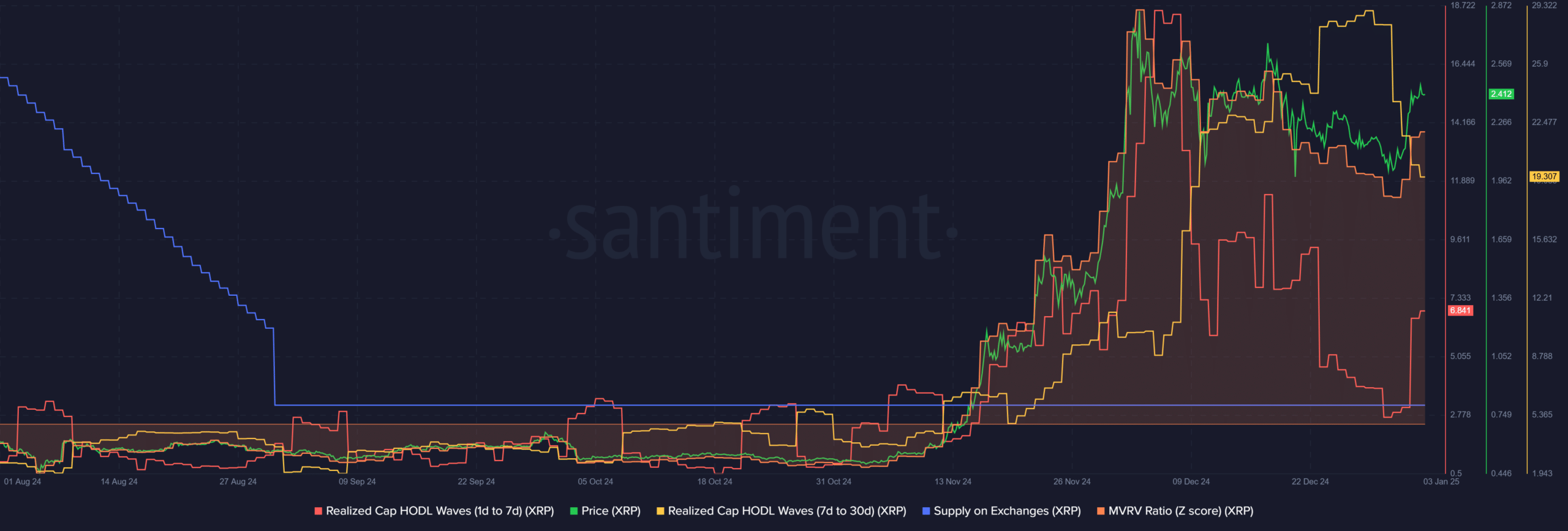

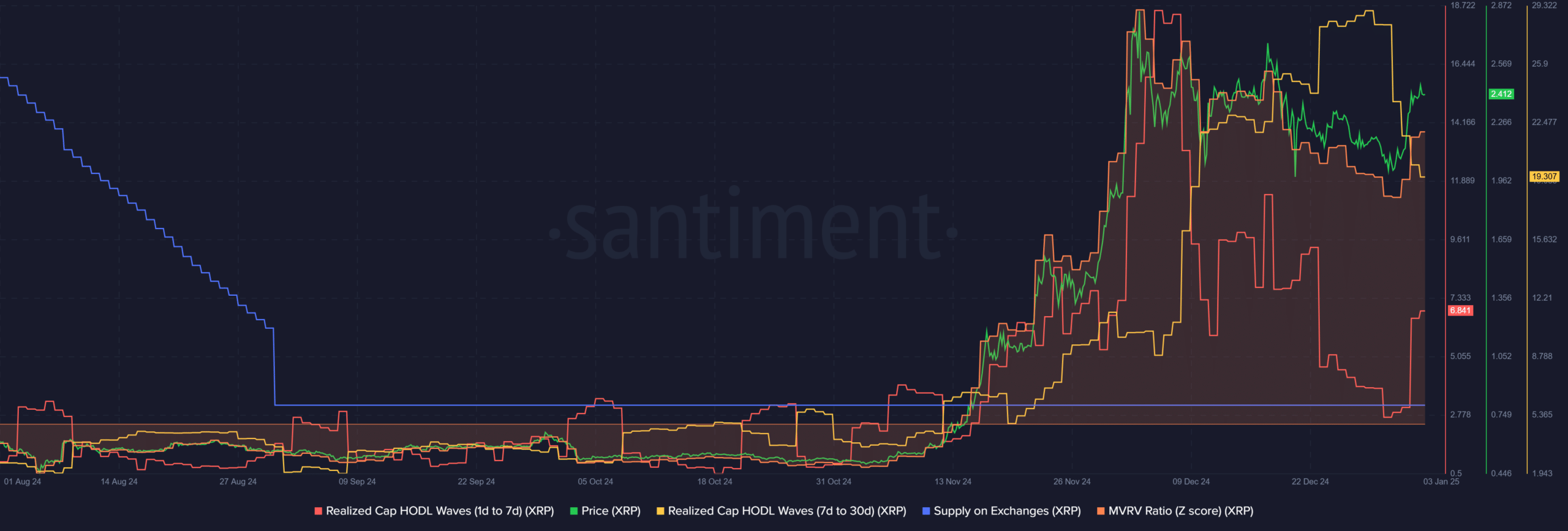

The chart highlighted XRP’s stagnant price action against fluctuating on-chain metrics.

For example, Realized Cap HODL Waves show a significant decline in short holders, suggesting a decline in speculative trading activity. Meanwhile, intermediate-term holders have seen moderate accumulation, indicating some confidence in holding XRP despite limited price momentum.

Source: Santiment

Supply on exchanges also remains high, reflecting potential selling pressure or hesitancy among investors to move tokens off trading platforms. Additionally, the MVRV Z-Score, which measures overestimation or underestimation, seemed to be in the neutral zone. This highlights the lack of definitive sentiment in the market.

These metrics show the situation in the XRP market, with no clear bullish or bearish signals. In contrast, Solana’s more favorable on-chain data and price performance could give it an edge over XRP’s potential market cap turnaround.

Read Solana (SOL) price forecast for 2025-2026

Can SOL overturn XRP?

SOL’s continued price recovery, solid trading volume, and positive on-chain indicators reflected market sentiment leaning heavily towards SOL. Meanwhile, XRP may face headwinds due to stagnant price action and mixed on-chain signals, including increased exchange supply and reduced short-term holder activity.

The outcome of this battle may depend on broader market trends, ecosystem developments, and investor sentiment. If Solana can maintain its upward trajectory and leverage its scalability and network activity, a turnaround for XRP could happen soon.