- The price of XRP rose just 1% in the past week.

- Key technical indicators suggest further decline in altcoin values.

Ripple’s native token XRP failed to record significant price gains last week despite an overall market rally.

Cryptocurrency markets as a whole surged during the period, with the price of Bitcoin (BTC) rising above $70,000.

According to data from CoinGecko, global cryptocurrency market capitalization has increased 8% over the past seven days. At press time, this was $2.8 trillion.

XRP is trending in the opposite direction.

At the time of writing, XRP is trading at $0.62. Its value has increased just 1% over the past seven days, according to CoinMarketCap.

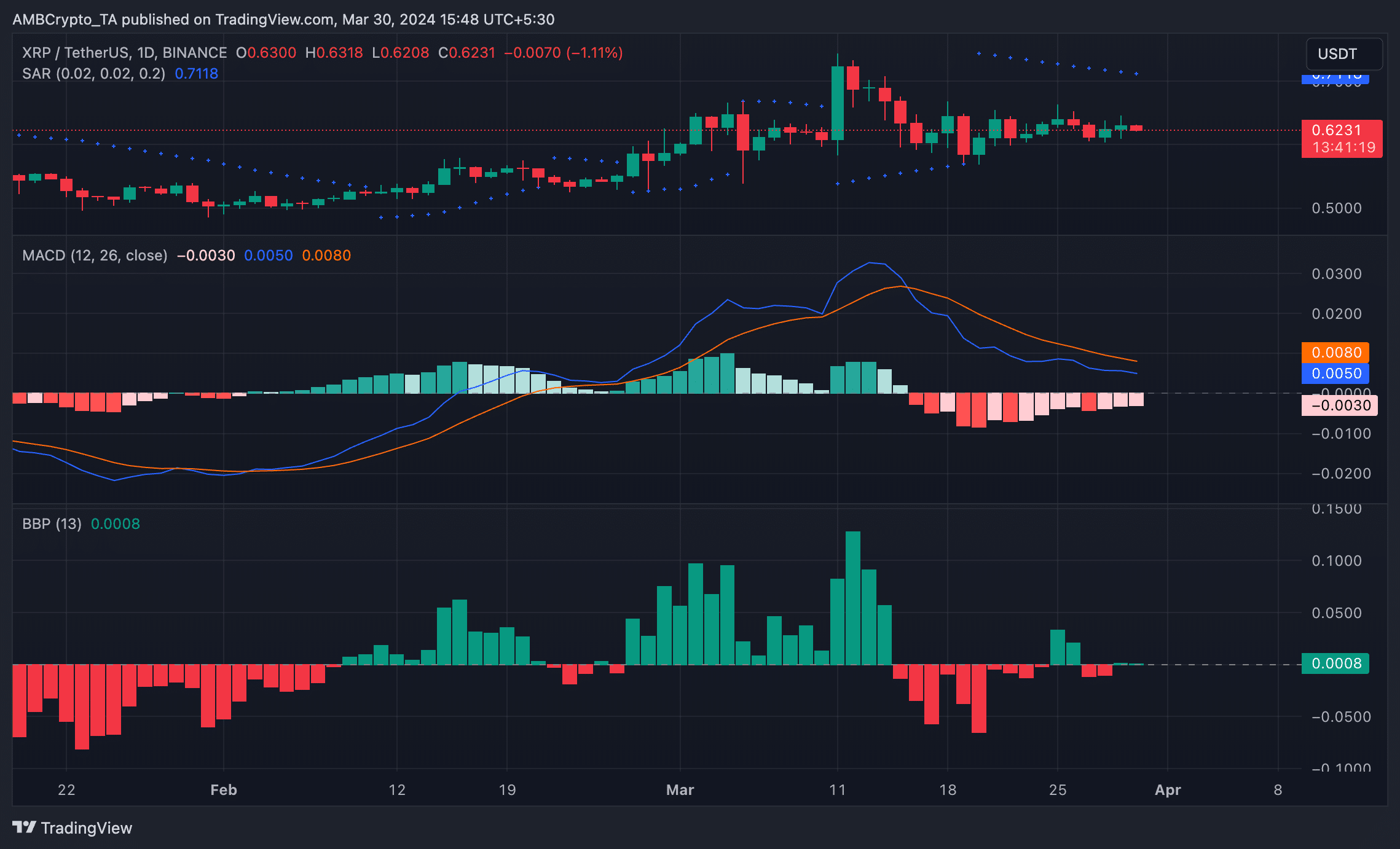

AMBCrypto’s daily chart price action figures hinted at a possible further decline in altcoin values.

First, at the time of writing, the price of XRP is below the parabolic SAR indicator. Traders use this indicator to determine potential reversal points in the price direction of an asset. It consists of points on the chart that are above or below the price of the asset.

If the dot is below the price, it indicates a bullish trend. Conversely, if it is above the price, as is the case here, the market trend is bearish. This also suggests that price declines are likely to continue.

XRP’s MACD line was found below the signal line, confirming the current bearish trend. Starting a bearish cycle, the MACD line crossed the signal line on March 16, and the value of XRP has since fallen nearly 10%.

This intersection is considered bearish as it suggests that the short-term momentum in the asset price is weakening relative to the long-term momentum. Traders often see this as a signal to close long positions and take on short positions.

Additionally, XRP’s Elder-Ray Index, which estimates the relationship between the strength of buyers and sellers in the market, has been quite negative over the past two weeks.

How much is 1,10,100 XRP worth today?

This indicates that selling activity is outpacing cumulative activity among market participants.

Regarding XRP’s performance in the derivatives market, futures open interest has declined slightly by 0.3% since March 13. This means that a significant number of contracts have been terminated as traders exit the market to prevent losses.

Source: XRP/USDT on TradingView