XRP has increased by about 8% over the last seven days. Earlier this week, the world’s first XRP ETF began in Brazil. Despite the positive momentum, XRP is captured in a close range of transactions with major resistance and support levels that define short -term prospects.

Recent indicators, including RSI rebounds and slightly optimistic Ichimoku Cloud structures, refer to careful optimism.

XRP’s RSI rebound: The meaning of price behavior

XRP’s relative robbery index (RSI) rose from 47.34 to 58.36, but still reached 77.7 at 77.7.

This movement is lower than the recent over -condition, but shows a recent recovery.

The recent RSI trends have been re -packed in the short term, but XRP has not regained the same force as marked a few days ago, and it shows more careful feelings among merchants.

The RSI or relative strength index is a momentum oscillator that measures the speed and change of price fluctuations with a scale from 0 to 100.

In general, more than 70 RSIs are signals that assets are excessive and can be caused by modifications, and RSI of less than 30 can be prepared for reactions.

The assets of XRP’s RSI are currently in 58.36, suggesting that there is still room for more benefits without triggering the excess conditions immediately.

If the purchase pressure continues, the steps to gradually move up may be set, but if the strong propulsion can be insufficient, it can lead to a range of transactions.

XRP heads over the clouds with momentum stalls

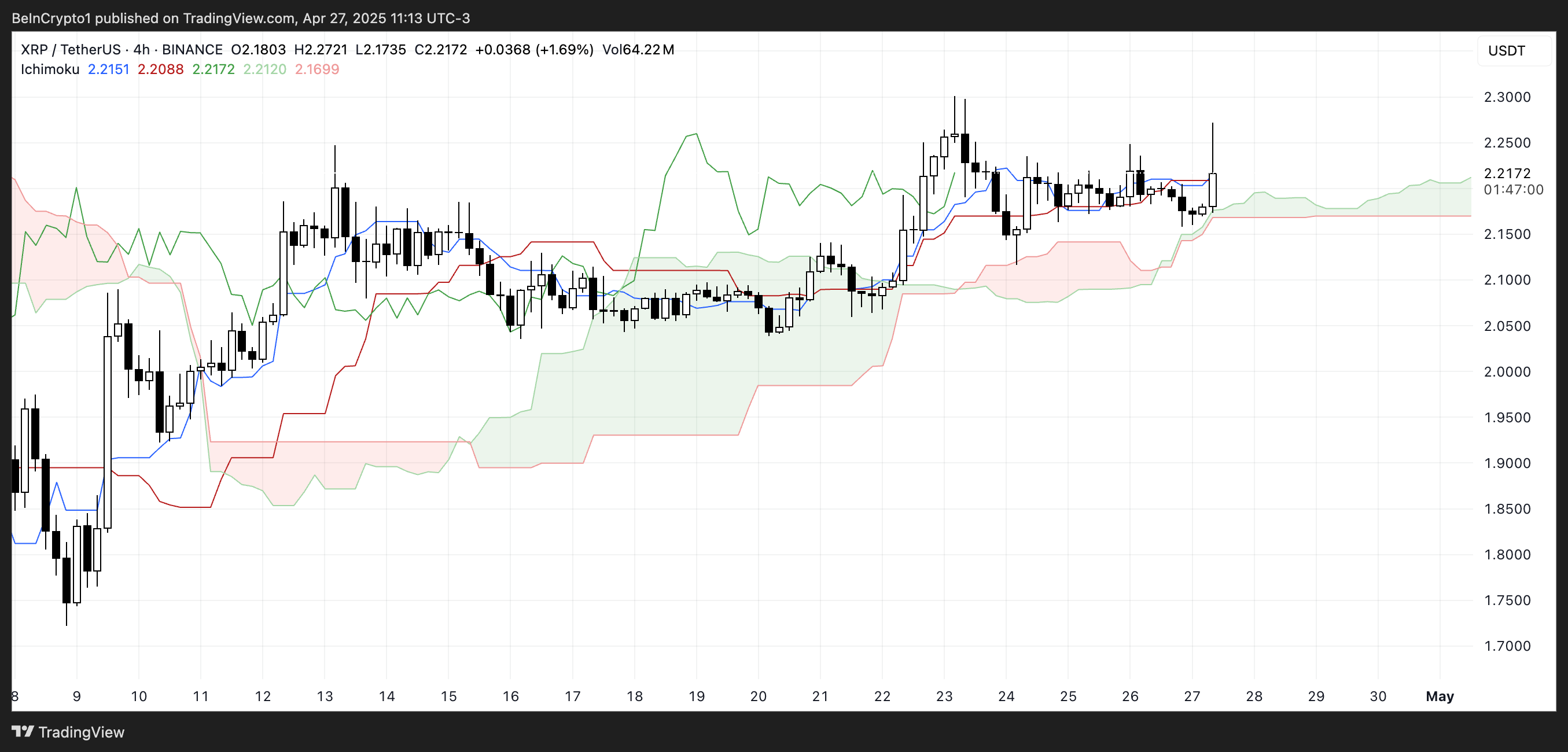

Ichimoku Cloud for XRP provides an optimistic structure and is slightly higher than the cloud.

Blue (Tenkan-Sen) and Red (Kijun-Sen) line reflect markets that are currently close to candles and have some strong bias but no strong propulsion.

The clouds of the future remain green, indicating that the strong conditions are still expected. However, the proximity of the line for the price suggests some hesitation or integration in the short term.

The Ichimoku system allows you to fully see the trend direction, momentum and support/resistance area.

If the price is higher than the cloud with green clouds, it usually shows a favorable trend. But when Tenkan-Sen and Kijun-Sen hug the price closely, they can indicate that there is a lack of clear conviction of buyers and sellers.

In the case of XRP, the optimistic trend remains the same, but the solid position of the line indicates a fragile upward trend in which the sharp movement in any direction can easily move the structure.

XRP Outlook: Can the bull or bear control?

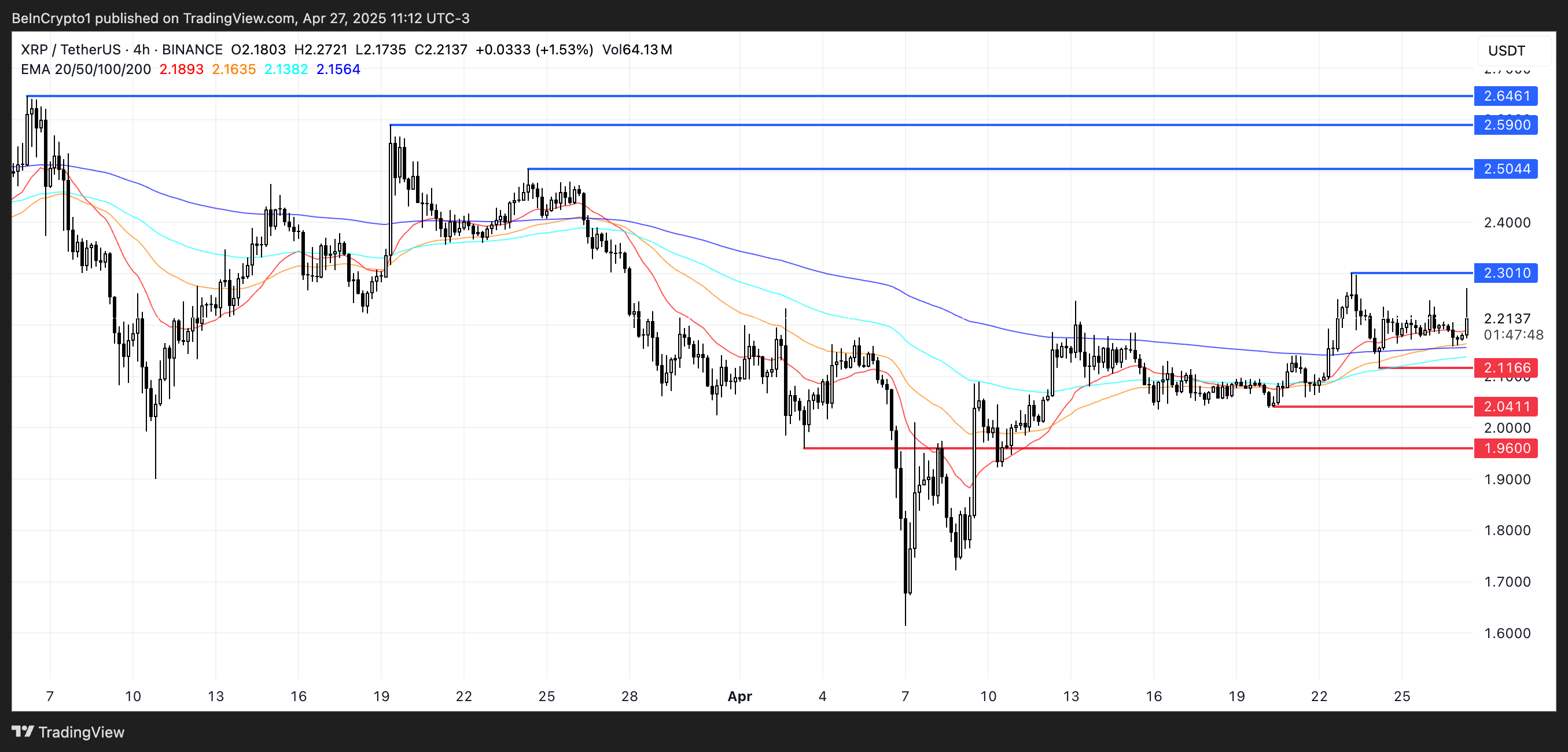

The XRP price is traded within a solid range, and the resistance level is $ 2.30 and the support level is between $ 2.11.

The next movement next to Brazil comes in two days after the world’s first XRP ETF was released, which is a development that can affect market sentiment.

If XRP drops and loses support of $ 2.11, you can decrease to $ 2.04 to the next level.

If the weak momentum is further strengthened, if you go deeper, the XRP test is low at $ 1.96, so it is important for the buyer to defend the current support area.

On the contrary, if the XRP is a strong strength momentum, if you test and stop more than $ 2.30, the next goal is about $ 2.50.

Continuous force can push the price to $ 2.59, and if the buyer maintains control, it can potentially expand to $ 2.64.

disclaimer

According to The Trust Project Guidelines, this price analysis article is used only for information provision and should not be considered financial or investment advice. Beincrypto is committed to accurate and prejudice, but market conditions can be changed without notice. Always do your own research and consult with an expert before making financial decisions. Our Terms and Conditions, Personal Information Protection Policy and Indemnity Clause have been updated.