- XYO has a bullish structure on the hourly time frame.

- The moving average and $0.0284 were the next support levels for buyers to defend.

The XYO Network (XYO) cryptocurrency rose 185% in 24 hours, with most of the gains occurring in the first 6 hours when bulls reversed a short-term retracement.

As things stand, bulls are dominant, and the $443 million market capitalization asset is likely to rise higher in the coming months.

The $0.02 level provides temporary resistance.

Source: TradingView XYO/USD

On November 18th and 19th, XYO experienced an 81% rally in 24 hours. Following this surge, the token saw a 26% retracement over the next few days but consolidated in the $0.009 region. On December 2nd, while Bitcoin was trading around $95,000, XYO had another rally.

To better understand this move, I plotted two sets of retracement levels on the 1-hour chart. The first set captured the initial shock move from $0.00857 to $0.0199. This is a 131% increase in just 21 hours and trading volume is well above average.

This impulsive move was followed by a retracement towards the $0.0151 level, almost retesting the 61.8% Fibonacci retracement level of the $0.0129 level. XYO then rallied for another northward push, earning a 170% return in 6 hours.

The 50% level of the second retracement level was tested. An hourly close above $0.032 will maintain a bullish market structure. However, a decline below $0.0284 could indicate an early signal of a return below $0.0217.

On Balance Volume (OBV) has increased significantly over the past two days, indicating strong demand. Meanwhile, moving averages and money flow index (MFI) reflected XYO’s bullish momentum.

However, there is a bearish divergence in MFI on the 4-hour chart, which could warn of a near-term price decline.

Has the rally just begun?

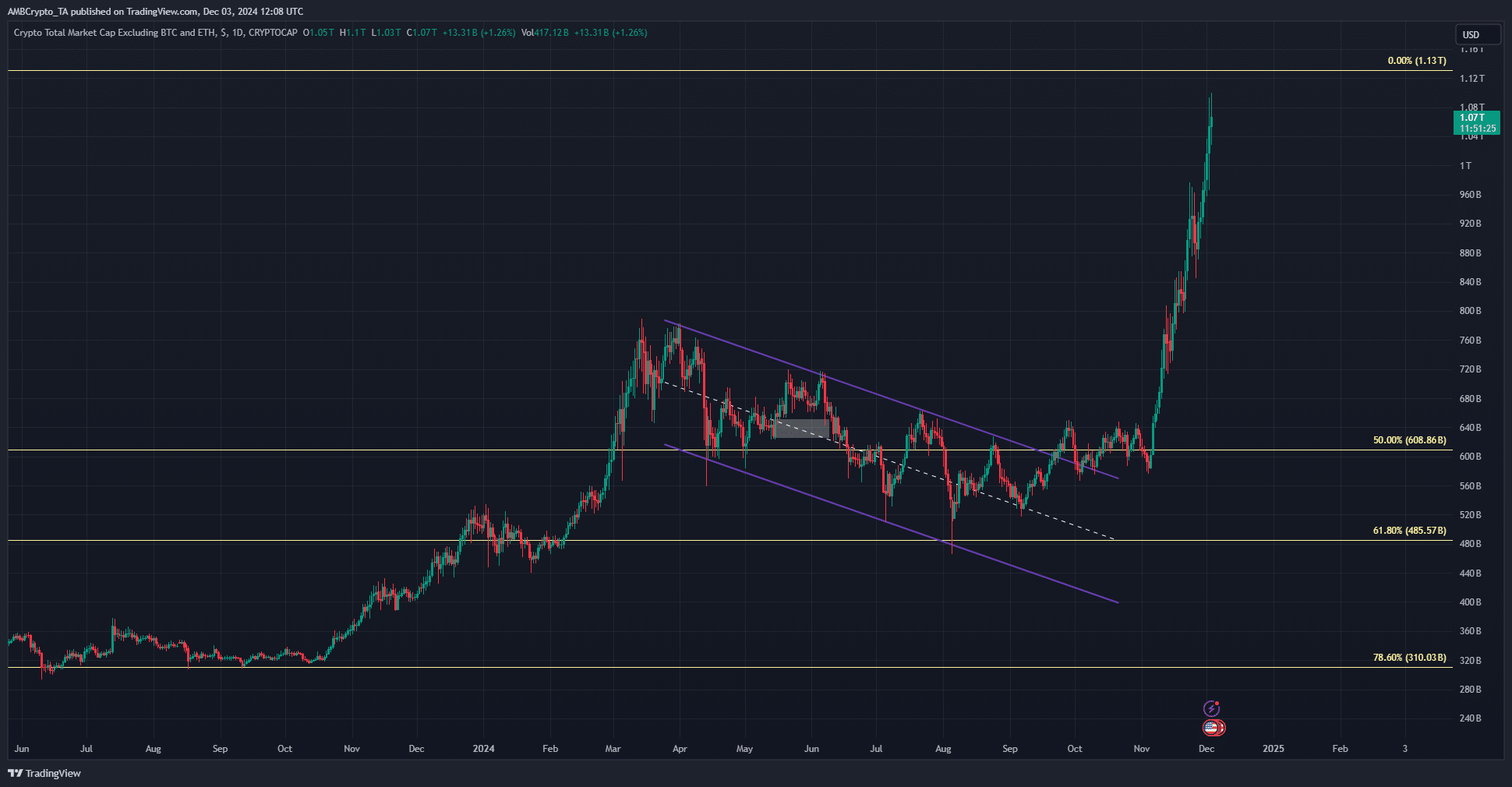

Source: TOTAL3 on TradingView

Altcoin market capitalization has been trending very high over the past month and is close to the all-time high of $1.13 trillion set in November 2021. This follows a breakout of the bearish channel in September.

Read XYO Network (XYO) Price Prediction for 2024-25

Rising altcoin market caps indicate very optimistic sentiment across the cryptocurrency market. More profits are expected overall, but not all tokens will perform equally well.

Current evidence suggests that XYO is poised for further gains and investors should hold on until higher term conditions change.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.