Cryptocurrency markets are bracing for potential temporary disruption, with over $2.2 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expiring today.

Could the expiration increase market volatility and impact the prices of the two major cryptocurrencies?

Investigating the imminent options expiration of Bitcoin and Ethereum

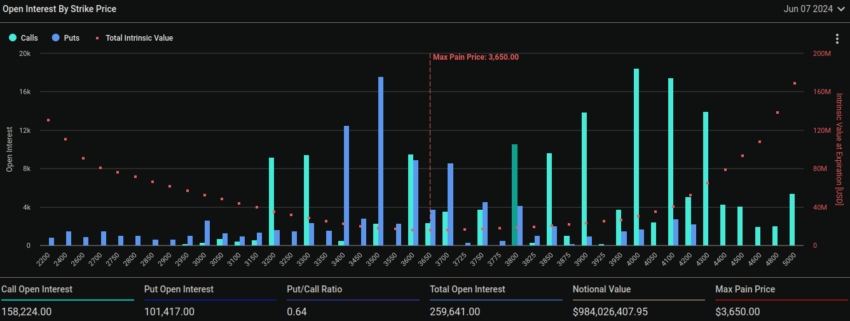

Approximately $1.24 billion in Bitcoin options contracts and $984 million in Ethereum options contracts are scheduled to expire. Depending on how traders react to the event, the expiration of these options contracts could trigger new selling or buying pressure.

According to Deribit data, 17,609 Bitcoin contracts are scheduled to expire, with a put-to-call ratio of 0.67. This ratio indicates that there are more buying options (calls) than selling options (puts).

Read more: Introduction to Cryptocurrency Options Trading

Meanwhile, Bitcoin’s biggest problem is around $70,000. The biggest problem is the price level that causes financial loss to the holders with the most assets.

Analysts at Greeks.Live, a provider of cryptocurrency options trading tools, have offered a positive outlook for Bitcoin and Ethereum prices despite the upcoming options expiration. He explained that the cryptocurrency market, especially Bitcoin, is showing strength following the announcement of interest rate cuts by the Bank of Canada (BOC) and the European Central Bank (ECB).

“U.S. nonfarm employment and unemployment rates have also become more interesting. That’s because expectations of a Federal Reserve interest rate cut are now at the center of macro trading. Short-term (implied volatility) IV is now clearly rising. Weekly (at-the-money) ATM IV is above 50% but still below 50% on the weekend as traders are betting (today). “The data beat expectations with slightly stronger strength,” they noted.

There are 259,641 contracts scheduled to expire in the Ethereum market. The put-to-call ratio is 0.64. Ethereum’s biggest problem is $3,650.

Read more: 9 Best Cryptocurrency Options Trading Platforms

Option expiration may cause temporary market turmoil, but stabilization often follows. Traders must remain vigilant, analyzing technical indicators and market sentiment to effectively navigate the expected volatility.

As the week concluded, Bitcoin and Ethereum showed their resilience. Bitcoin fell slightly after reaching a two-month high of $71,713. On the other hand, Ethereum is showing a slight decline and is trading at $3,805.

disclaimer

In compliance with Trust Project guidelines, BeInCrypto is committed to unbiased and transparent reporting. These news articles aim to provide accurate and timely information. However, before making any decisions based on this content, readers are encouraged to check the facts and consult with experts. Our Terms of Use, Privacy Policy and Disclaimer have been updated.