- Render soared 14.08% last week.

- Amid strong positive market sentiment, short sellers lack confidence in a potential downturn.

Since the cryptocurrency market recovered following the Federal Reserve’s interest rate cut, AI-themed coins have seen significant gains on the price charts. AI coins are leading the market surge due to growing optimism and adoption. RENDER is at the center of this growth.

In fact, at the time of writing, Render was trading at $6.47. This represents an increase of 24.87% on the monthly chart and a 14.08% increase in the bullish trend compared to last week.

Since hitting a monthly low of $4.45, the altcoin has maintained upward momentum. Therefore, these market conditions have strengthened Render to absorb liquidation pressure, according to ChainStatsPro analysis.

What Market Sentiment Indicates

In its analysis, ChainStatsPro assumed that renders are experiencing a healthy and strong market as altcoins absorb liquidations and spot CVD remains intact.

Source: ChainStatsPro

What this simply means is that there is no excessive buying or selling pressure that indicates market indecisiveness.

Additionally, the analyst noted uncertainty, which suggests short sellers lack strong confidence in their positions. Therefore, short sellers are unsure of a potential downside and therefore do not judge that the price will fall further.

According to this analogy, the market is strong enough to absorb liquidations without experiencing extreme volatility, and short sellers are not confident of further declines.

What the Render Chart Suggests

The indicators highlighted by ChainStatsPro provide a positive market outlook, but it is important to determine what other fundamentals indicate.

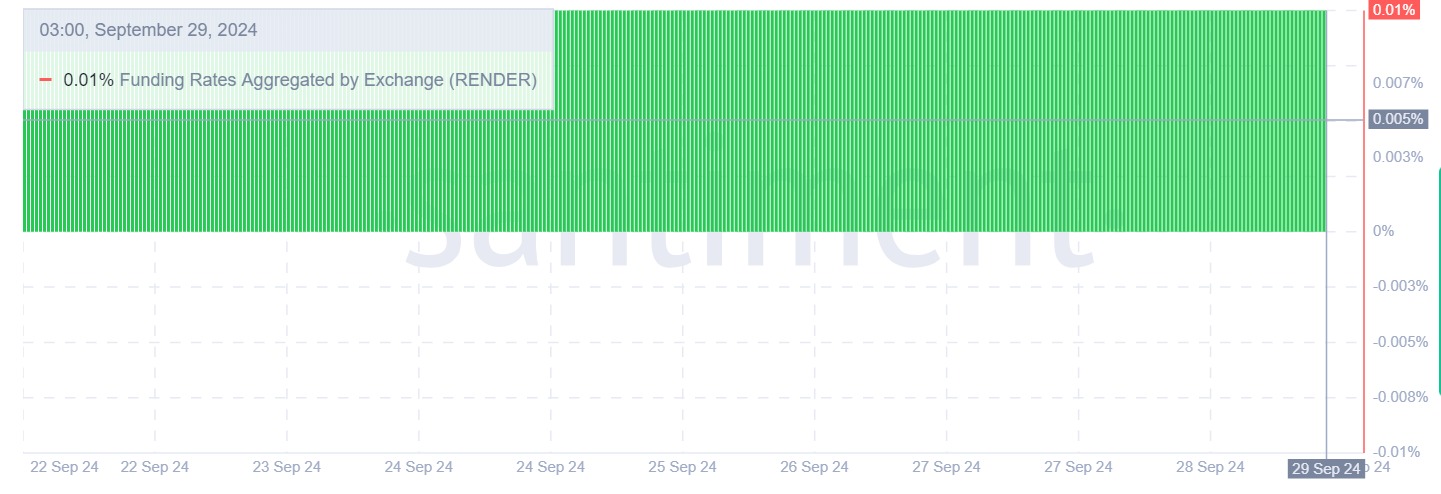

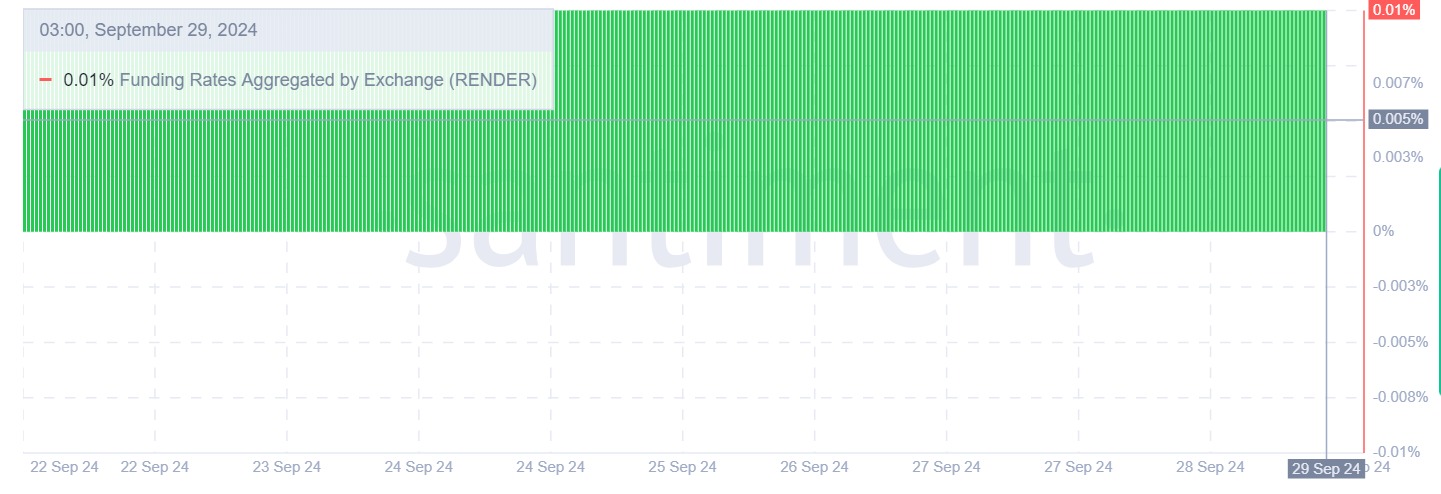

Source: Santiment

First of all, Render’s funding rate, aggregated by exchange, has remained positive over the past week. A positive funding ratio indicates that long position holders are paying short sellers to remain in the trade.

This shows investors’ strong confidence in future price increases.

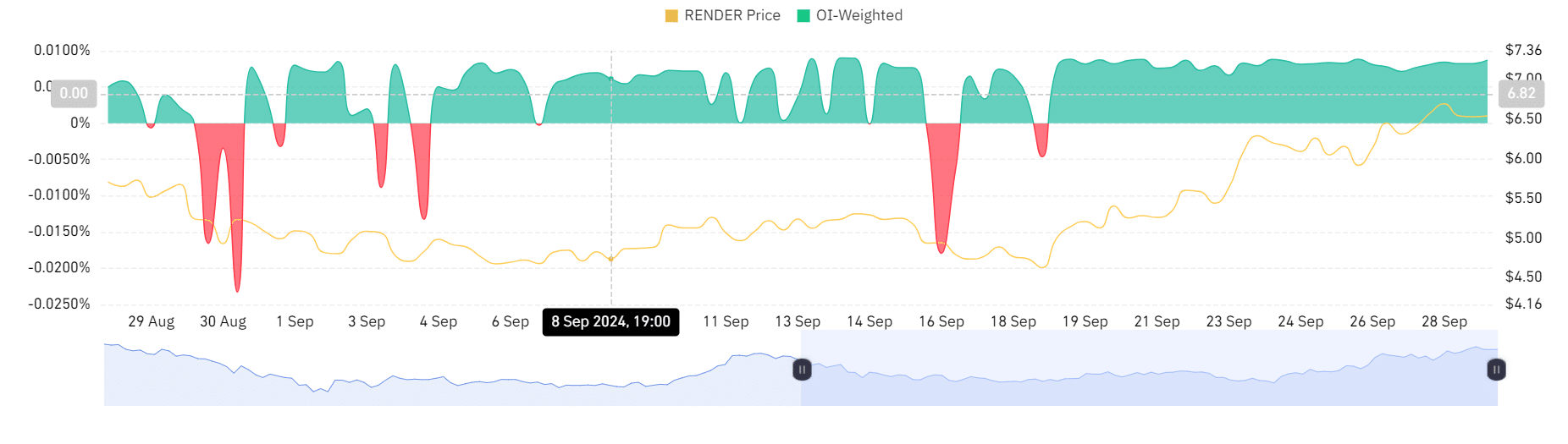

Source: Coinglass

Additionally, demand for these long positions is further supported by positive OI-weighted funding rates. This has been positive over the past two weeks, suggesting that investors are willing to pay fees to short sellers to maintain their positions even during economic downturns.

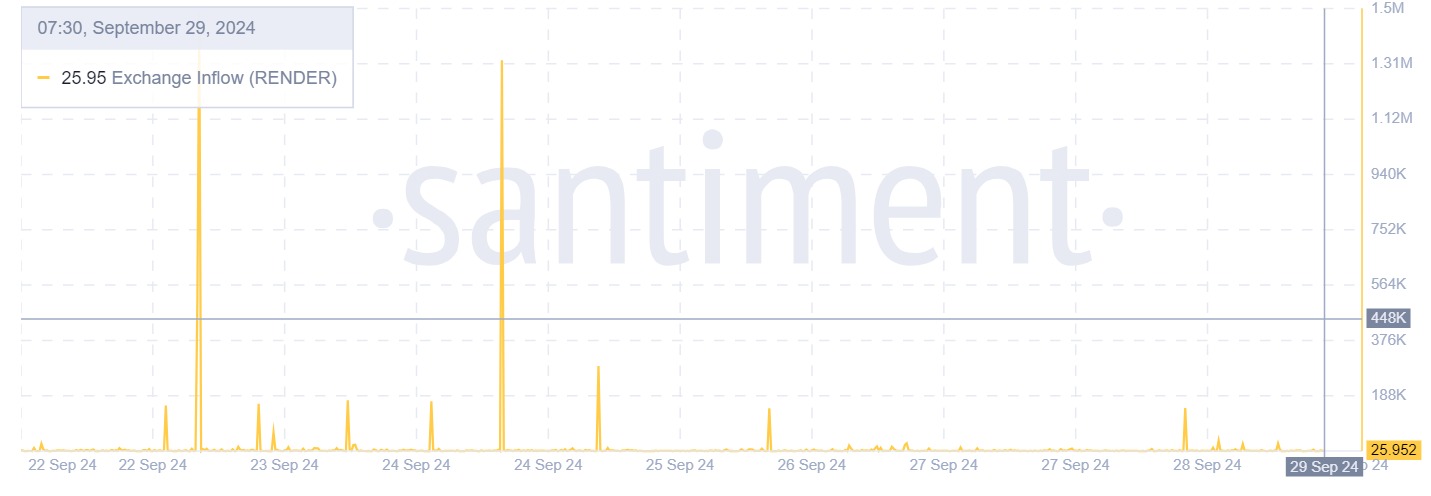

Source: Santiment

Lastly, Render’s exchange inflows have decreased over the past week from a high of 1.48 million RNDR tokens to 25.952 at press time. This shows the holding behavior of investors storing their assets in cold wallets.

This behavior means that investors are not willing to sell because they expect more profits.

Is your portfolio green? Check out our render profit calculator

Therefore, based on these market conditions, AMBCrypto’s analysis shows that Render is experiencing positive market sentiment and investor preference. This market sentiment could set the altcoin up for further gains on the price charts.

If general market conditions hold, the render will break out of the $7.0 resistance level. A break from this level would strengthen the altcoin enough to challenge the June high of $10.5.