- ETH Staying was turned over to the leak from the outflow that was not released immediately after PECTRA’s release in February.

- Inflowing hints for future upgrades and initial institutional adjustments centered on Ether Leeum’s yield -friendly validation.

Ether Leeum (ETH) lovers are calculated as PECTRA upgrades, and the validity testimony -friendly change is expected to be epidemiologically reconstructed.

But the change began earlier than expected. PECTRA’s roadmap, not on launch, was announced in mid -February.

According to a recent report, ETH steaks were reversed immediately after a few months of leaks immediately after the upgrade.

Now that the PECTRA is officially living, rebound raises a bigger question. Is this a short -term reaction, or is it the first signal that increases institutional trust in Ether Lee’s return and infrastructure story?

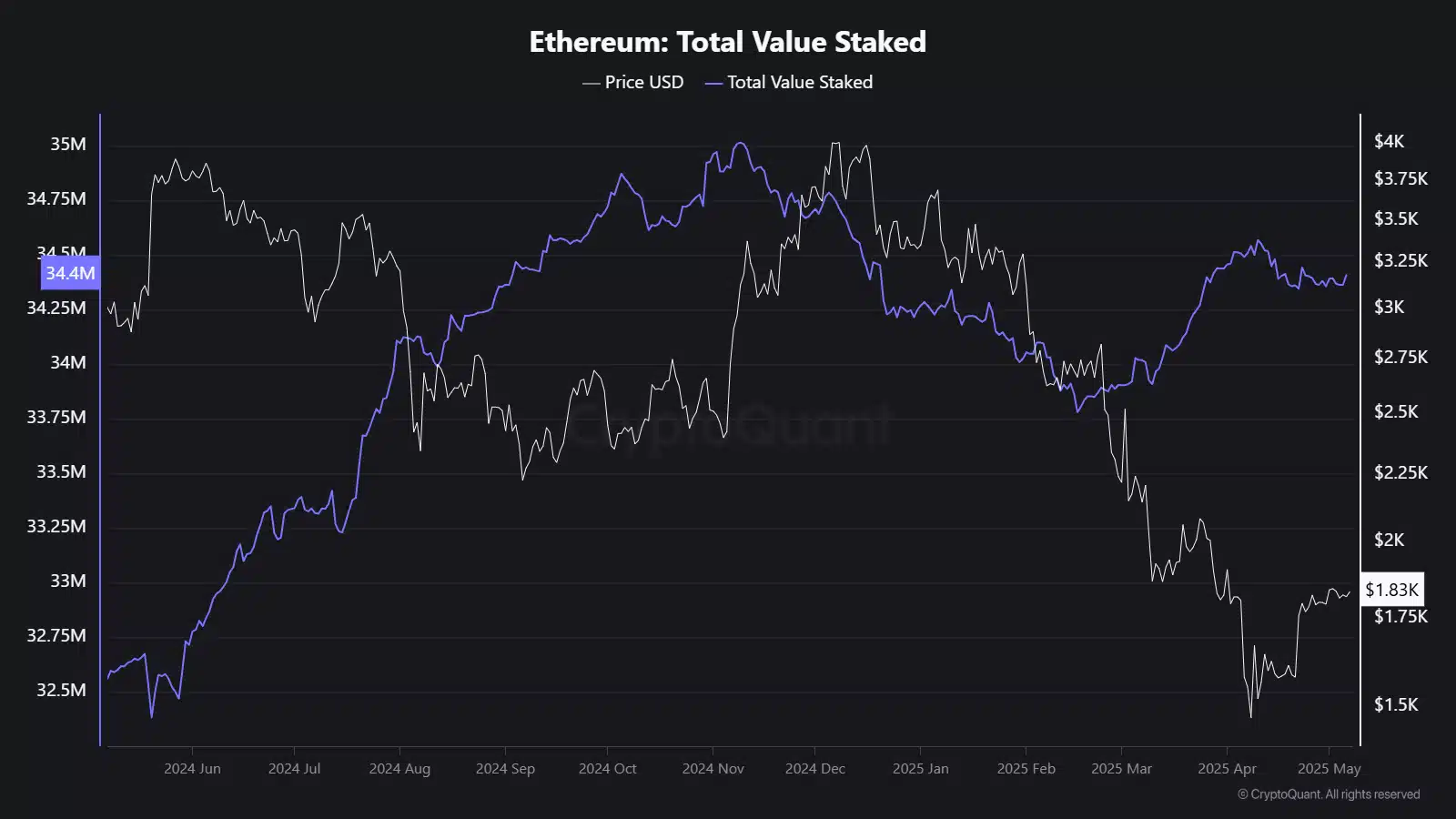

Steaking Time Line

Source: cryptoquant

From November 16 to February 15, the participation in the stage was reduced from about 38 million ETH to 38.6 million ETH.

The 10.2 million ETH leaks reflect the market jitter due to the regulatory pressure and a wider risk feeling that dominated the Q1.

But in mid -February, PECTRA’s announcement changed its trend. From February 16 to May 16 to 16, ETH Stacking rebounded with the net inflow of 627,000 ETH.

Ethereum’s effective tester-centered upgrade, including the Ethereum’s valid withdrawal certificate of the EIP-7002, and the ecosystem of the Ethereum’s effective tester, the ecosystem, and the more sophisticated stakeholders can be reassured.

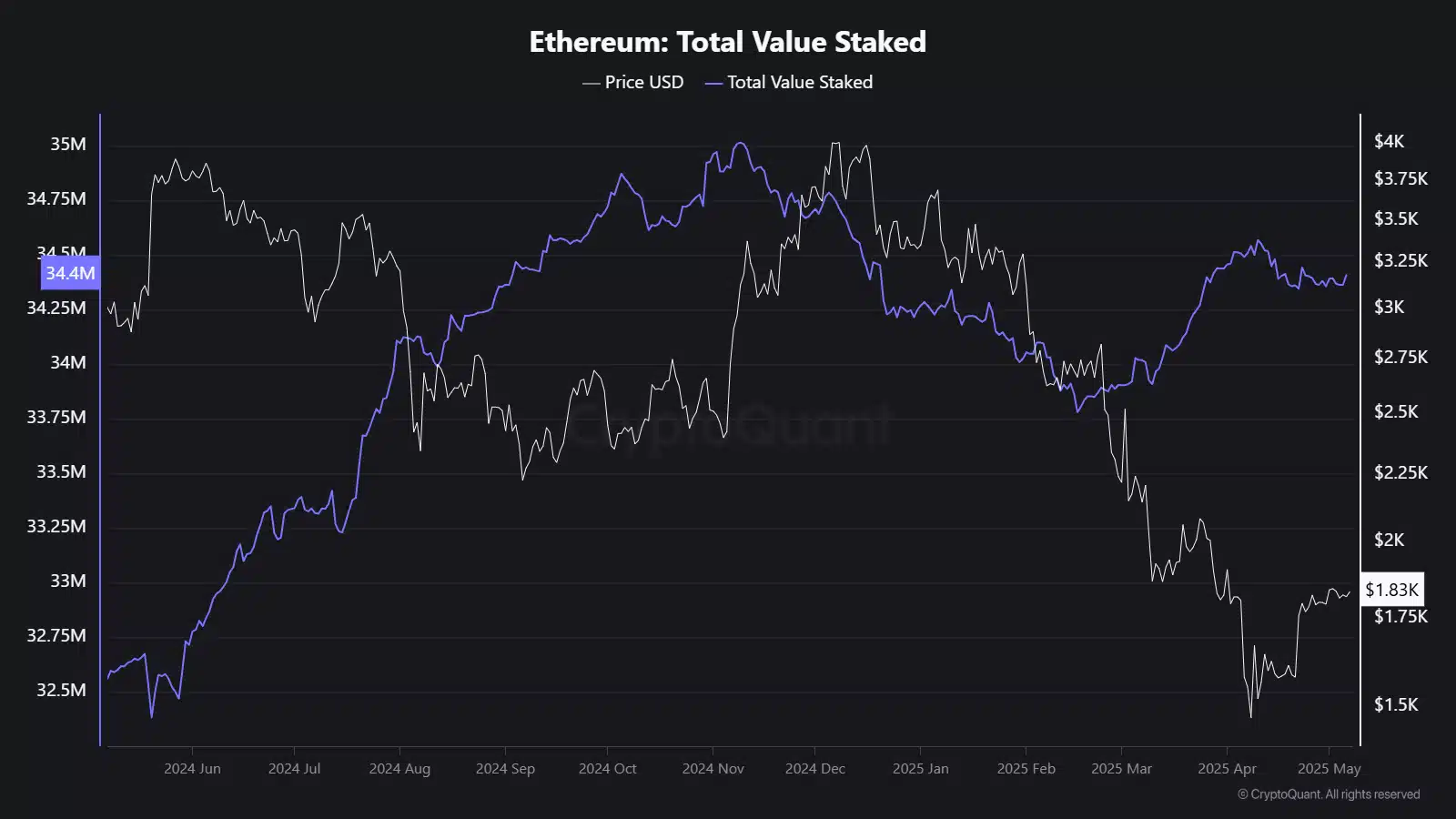

Source: cryptoquant

Inflow inflows can be seen in the increase in institutional trust.

Inflow often reflects changes in behavior. And Ether Lee’s recent trend suggests more than just retail income.

Restoration of trust in Staying systems refers to a change in the change of the organs that explore or prepare a profile after upgrading Ether Leeum.

Major Staying milestones, such as Shanghai and PECTRA upgrades, have historically led ETH flow.

Each of each, we saw the positioning shift a few weeks before the technology roll, and showed the market forecast approach to the market.

With the current ETF play and the staying mechanism becomes more flexible, Ethereum’s design is becoming more and more familiar to large capital allocates.

Yield story

Ether Leeum’s indigenous yields through steaks have always been a central story. Now, if PECTRA is in place, the story gains reliability and structure.

Improvement of protocol levels and reduced operating friction reductions can attract further inflow.

At present, the inflow is not explosive, but is important.

In addition to retail yield farms, the hints ETH’s hints on the revenue potential of the mature and regulatory and ETF compatible yields are slow, but the hints are slow.