Key Takeaways

- Bitcoin had its worst weekly performance due to the strength of the dollar and Trump’s potential tariff plans.

- Despite the short-term challenges, the long-term structural tailwinds for Bitcoin and digital assets remain intact.

Share this article

Bitcoin’s more than 45% rally since the November 5 presidential election has already run out of steam. Analysts expect more disruption ahead as President-elect Donald Trump’s proposed tariff plan and strong employment numbers push bond yields higher, strengthen the dollar and put pressure on digital assets.

“Bitcoin’s problem right now is the strength of the dollar,” Zach Pandl, head of research at Grayscale Investments, told CNBC. “The recent signals from the Federal Reserve have partly helped strengthen the dollar.”

Bitcoin got off to a strong start this week, regaining $102,000 on Monday, according to CoinGecko data. But the rally was short-lived. The flagship cryptocurrency asset fell below $97,000 the next day and continued its downward trend heading into the weekend.

“I think the decline over the past two days is primarily due to the market starting to recognize that not all aspects of Trump’s policy agenda are positive for Bitcoin.” Pandl cited the recent decline and added that Trump’s proposed tariff plan creates uncertainty. To the market.

President Trump is considering declaring a national economic emergency to expedite his universal tariff implementation plan, CNN reported Wednesday. This, combined with relevant economic policies, can lead to a variety of inflationary pressures. However, no final decision has been made on this declaration at this time.

While there was initial optimism about a cryptocurrency-friendly environment under the Trump administration, conflicting signals on the scope of tariffs could cause volatility and negatively impact risky assets like Bitcoin.

continued high interest rates

A stronger-than-expected December 2024 payrolls figure suggests there may be less urgency for the Fed to cut interest rates to stimulate the economy. After the report, investors lowered their expectations of a short-term interest rate cut.

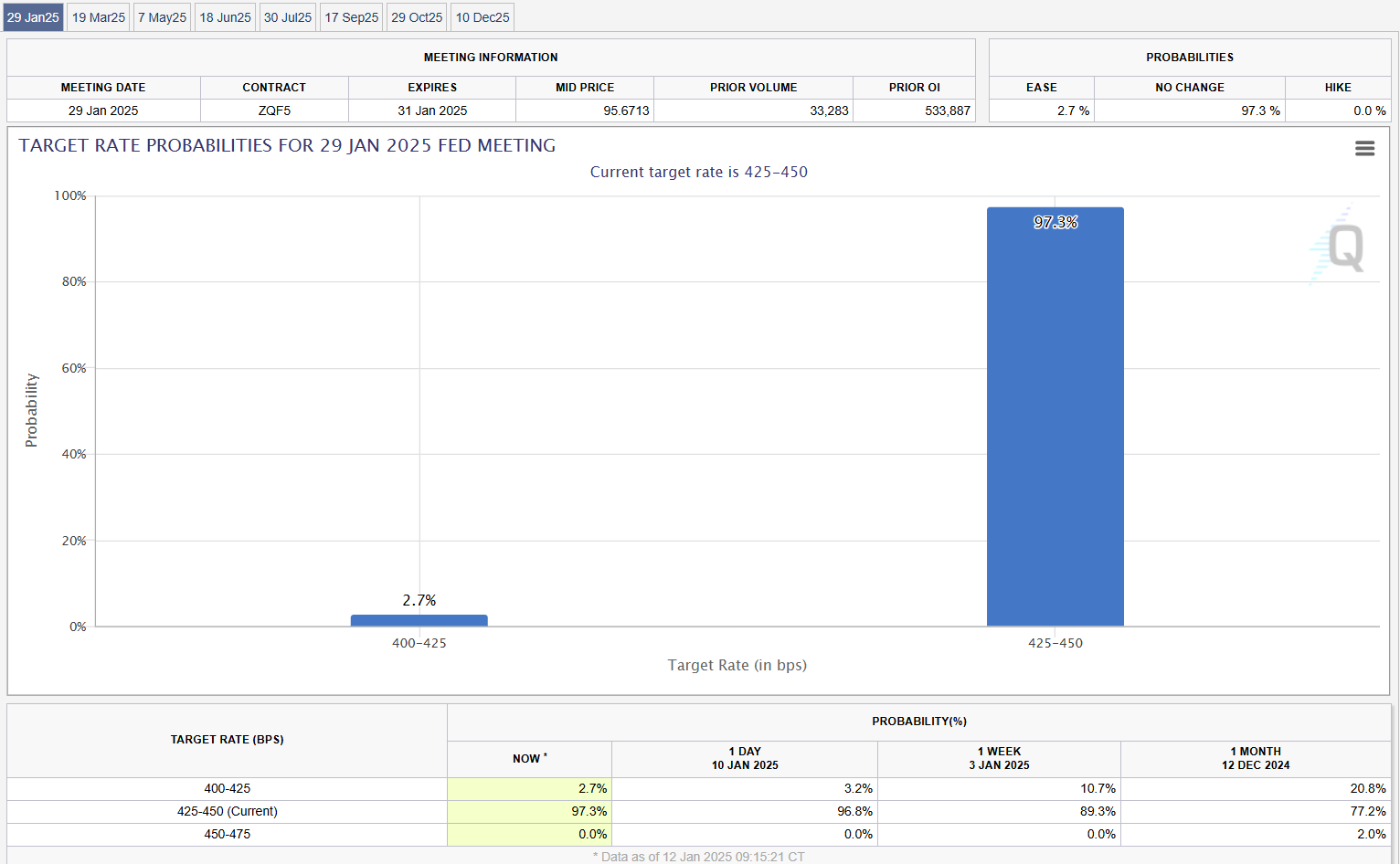

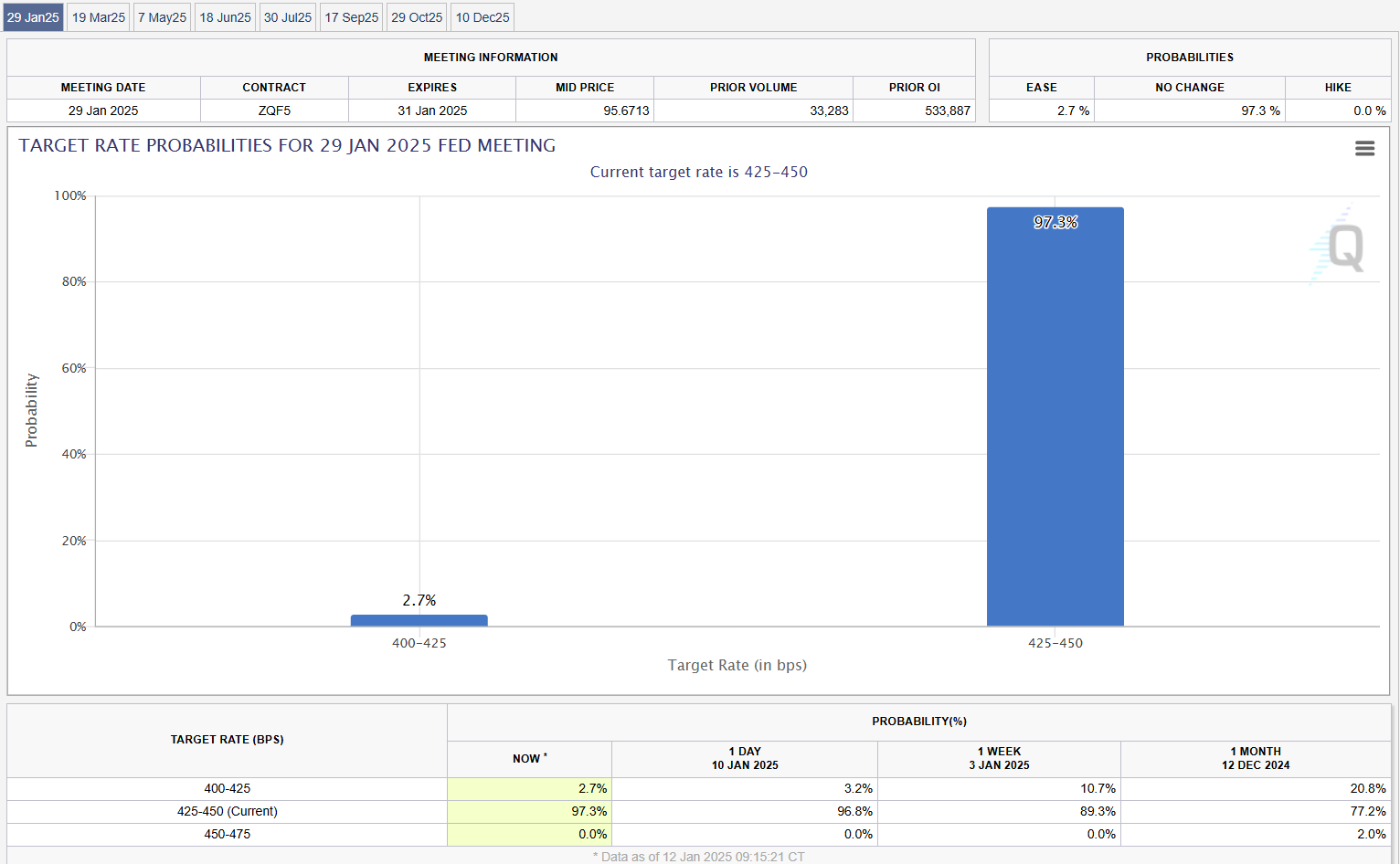

According to the latest data from the CME FedWatch Tool, market participants are leaning toward a 97% probability that the Federal Reserve will keep interest rates on hold when it meets on January 28-29.

The Federal Reserve cut interest rates by 25 basis points last month, but also delivered a hawkish message signaling a cautious approach moving forward. The central bank expected to cut interest rates only twice this year, compared to earlier expectations of further cuts due to persistent inflationary pressures and economic conditions.

Alex Thorn, head of research at Galaxy Digital, said the uncertainty surrounding the cautious Federal Reserve and Trump’s economic agenda means that “despite long-term structural tailwinds for Bitcoin and digital assets, risk assets may face instability in the near term.” “It’s a possibility,” he said. .

Enacting cryptocurrency legislation may take some time.

The potential positive impact of pro-crypto legislation may not be realized quickly, as Congress is expected to prioritize non-cryptocurrency issues over the next three months, according to JPMorgan analyst Kenneth Worthington.

But Washington is confident that Congress will eventually turn its attention back to digital assets and adopt significant cryptocurrency-related legislation, such as stablecoins and a potential framework for market structures.

New York Digital Investment Group (NYDIG) also holds the same view.

In a recent report, Greg Cipolo, head of research at NYDIG, suggested that it is unlikely that cryptocurrency policy will change immediately. He notes that various government processes, such as formal appointments and confirmations, can delay the implementation of new policies.

The analyst also notes that despite the generally positive outlook for digital assets due to Trump’s future appointments, other legislative priorities may take precedence, further delaying cryptocurrency-related initiatives.

Share this article