- Pendle, Lido DAO, and Ethereum Name Service were the biggest winners last week.

- zkSync, dogwifhat, and Notcoin were the biggest losers this week.

PENDLE was the top gainer in a turbulent cryptocurrency week that saw the market swing in that direction.

Meanwhile, zkSync experienced a challenging debut, quickly feeling the effects of market forces in what could be described as a “baptism of fire.”

biggest winner

PENDLE

PENDLE started the week on a positive note, although things didn’t go completely smoothly. It opened at about $5.6 and closed the week at about $6.0.

According to data from CoinMarketCap, PENDLE is up 15.48% over the past week, marking its highest gain of the week.

AMBCrypto’s analysis shows that Pendle’s price fluctuated throughout the week, falling to $4.8 before hitting a high of $6.2.

As of this writing, it is trading at around $6.1, showing a slight increase from last week’s close.

The market capitalization was about $947 million and the trading volume was about $57 million. Notably, trading volume has decreased by 26% in the last 24 hours.

Lido Dao (LDO)

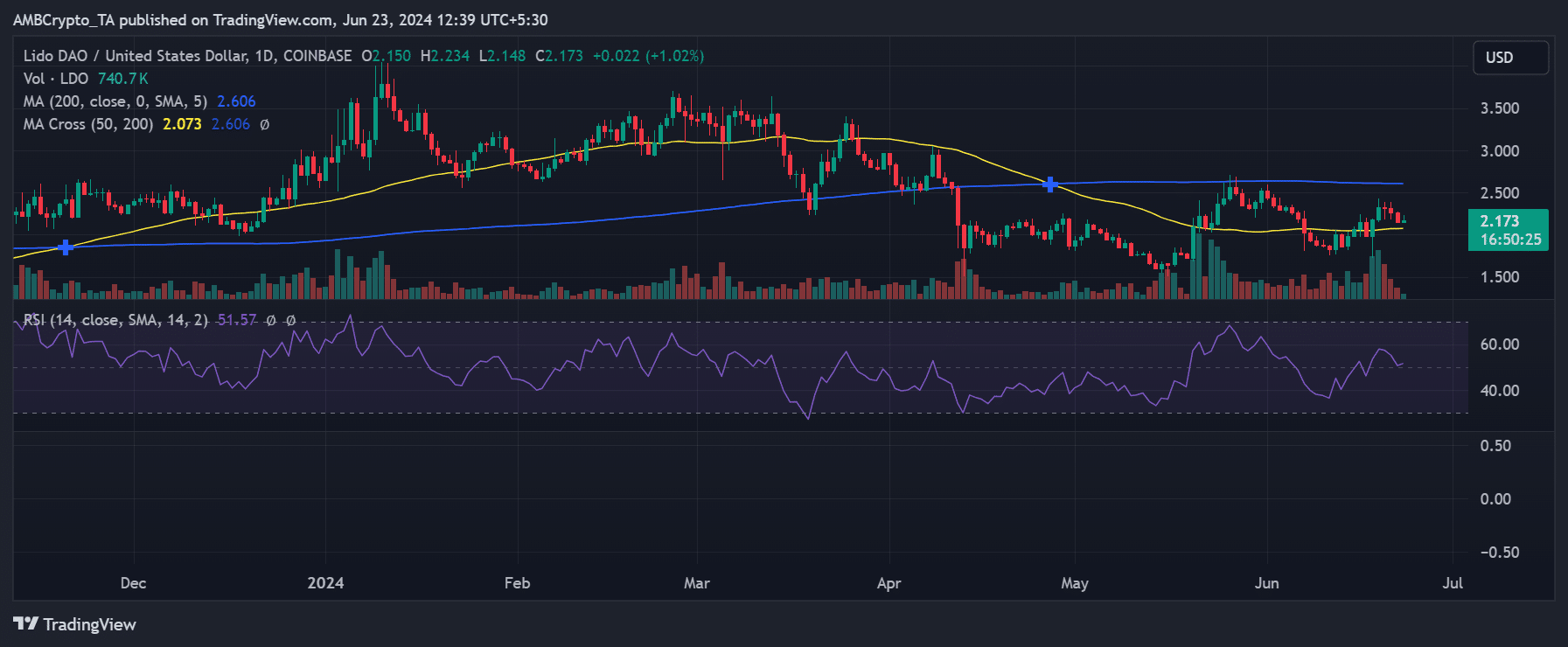

AMBCrypto’s look at Lido DAO (LDO) on a daily time frame shows that it started the week with a 3.81% gain, increasing the price from around $2 to $2.15.

It then experienced a significant decline of over 7% on June 17, bringing the price down to around $1.9. But subsequent gains of about 10% and 6.5% helped the recovery, pushing the price up to $2.30, above $2.

The chart shows that LDO ended the week down 4.9%. However, the price stayed above $2, trading at around $2.1.

According to data from CoinMarketCap, LDO was the second-highest gainer, gaining 7.86% this week despite suffering significant losses during the week.

Source: TradingView

Lido DAO’s Relative Strength Index (RSI) indicates that it is maintaining a bullish trend despite the recent decline. At the time of writing, RSI is hovering above the neutral line.

This means that Lido DAO is still in a bullish trend, but the trend is relatively weak.

As of the latest update, Lido DAO’s market capitalization is approximately $1.9 billion, which has been declining over the past 24 hours.

Additionally, over the past 24 hours, trading volume has decreased by approximately 24% to approximately $106 million.

Ethereum Name Service (ENS)

Ethereum Name Service (ENS) started the week with prices around $24.3 and started off on a positive note with early gains. However, it soon faced a major setback and fell to around $22.7 the next day.

Nonetheless, ENS has experienced significant increases since then and was trading at around $26.8 on June 21.

Despite experiencing a big decline near the end, with the stock falling to around $25, ENS still ended the week up 7.7%.

That performance made it the third-biggest gainer of the week, according to data from CoinMarketCap.

As of the latest update, the market capitalization of Ethereum Name Service (ENS) is approximately $788 million, and the trading volume is approximately $79 million.

In the last 24 hours, market capitalization has decreased by more than 2%, and trading volume has also decreased significantly by more than 40%.

biggest loser

zkSync (ZK)

During its debut week, zkSync (ZK) emerged as the biggest loser, according to data from CoinMarketCap. Data shows that it started the week at around $0.27, but saw a sharp decline throughout the week.

Market forces did not provide the expected favorable response. By the end of the week, the price had fallen to around $0.18.

ZK ended the week with a significant decline of more than 37%, according to data from CoinMarketCap.

As of the latest update, its market capitalization is approximately $673 million, up more than 2% in the last 24 hours.

Trading volume was around $181 million, down more than 38% in the last 24 hours.

Dog We Pot (WIF)

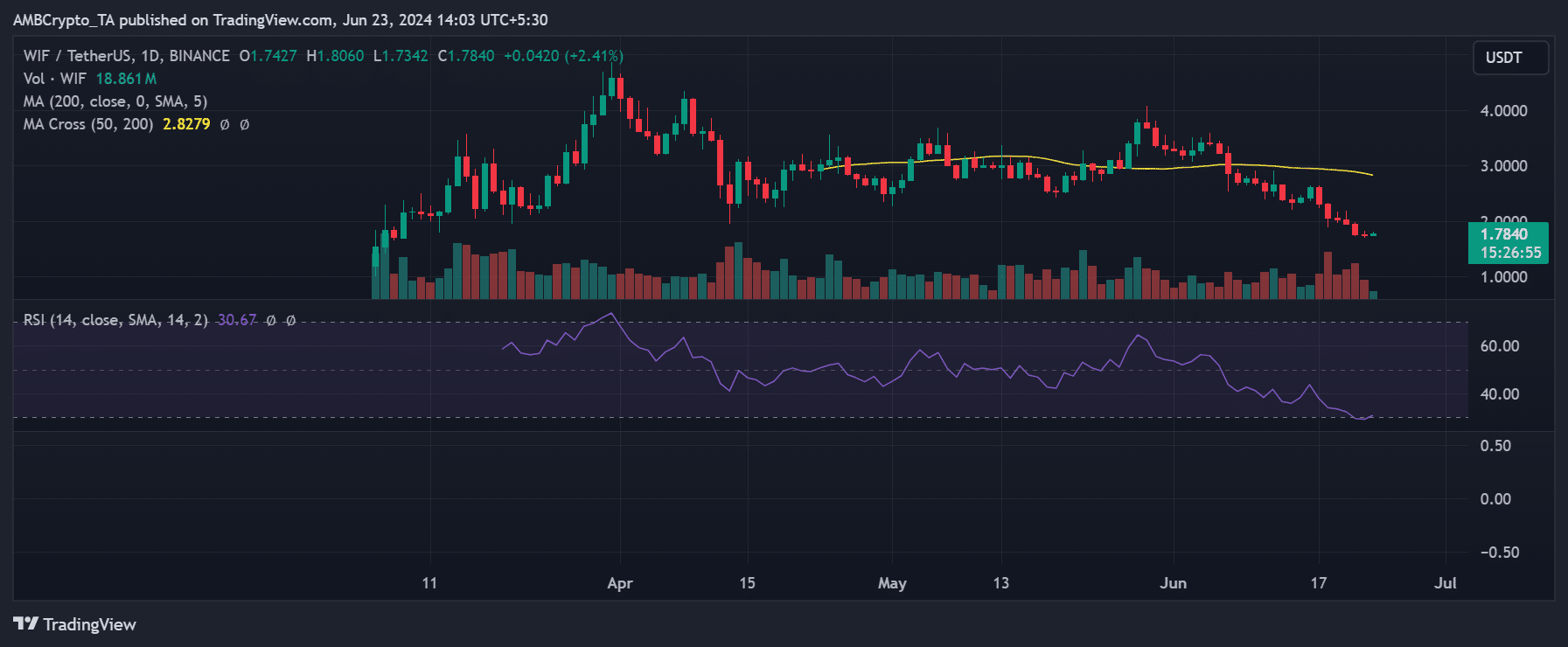

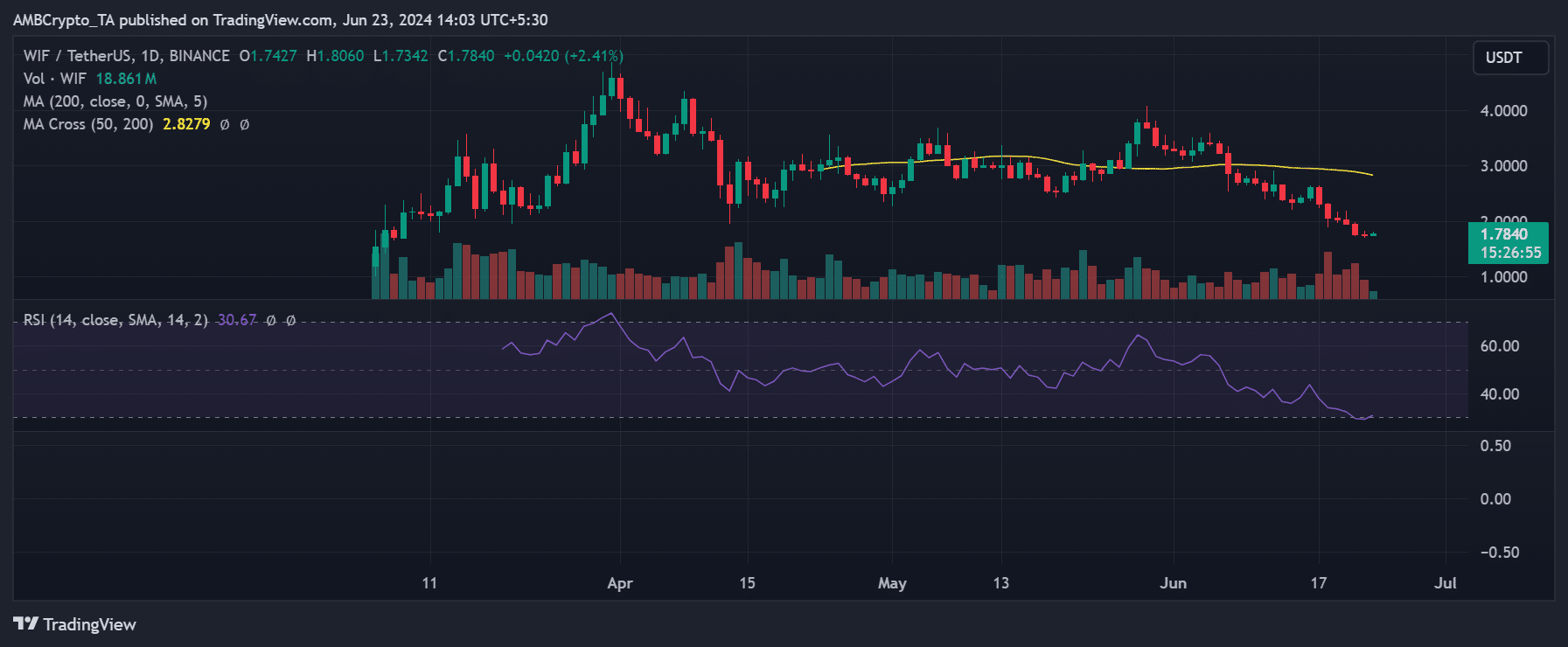

AMBCrypto’s research into Dogwifhat (WIF) shows it is up more than 7% this week, trading at around $2.6.

However, this increase was only a brief interruption to the downward trend experienced last week.

After the first rise on June 16, it continued to decline. By the end of the week, Dogwifhat was trading at around $1.74.

Memecoin had the second biggest decline of the week, down more than 28%, according to data from CoinMarketCap.

The Relative Strength Index (RSI) indicates that the price is firmly entrenched in a strong bearish trend.

Source: TradingView

RSI is barely above 30, which highlights the strength of bearish momentum and indicates we are very close to entering oversold territory.

As of the latest data, Mimcoin’s market capitalization is approximately $1.7 billion.

Trading volume dropped significantly to around $240 million, down more than 40% over the past 24 hours.

Notcoin (NOT)

Notcoin (NOT) had its third biggest decline of the week and is down more than 25% over the past week, according to data from CoinMarketCap.

According to AMBCrypto’s NOT analysis, it started this week with a price of around $0.02, but started falling from the beginning. By the end of the week, the price had fallen to around $0.015.

At press time, its market cap was up more than 3% to $1.5 billion. However, trading volume, which was around $321 million, fell by more than 30% in the last 24 hours.

conclusion

Here’s a weekly recap of who gained the most and who lost the most. It is important to keep in mind the volatile nature of the market, where prices can change quickly.

Therefore, it is best to do your own research (DYOR) before making any investment decisions.