The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

This week’s topic

- A colossal SEC failure.

- Bitcoin ETF Multiples

- German economic update

- Taiwan Elections and China’s Response

The SEC’s 2FA failure

Bitcoin is a great teacher. Many of us have studied and followed Bitcoin over the years and learned a lot about not only money, but also about life. Once again, Bitcoin provides a teachable moment regarding the SEC’s hack of the X/Twitter accounts. First, even if you are a normative person who favors highly regulated markets, this event will open your eyes to the fact that regulators themselves have grown into a systemic risk. They pose a risk to the investors they are meant to protect. The SEC is also fighting a battle in the Supreme Court over its in-house quasi-judicial system.

Second, this scandal occurred because the SEC did not use 2FA even after months of warning everyone against using it. This shocking incompetence could wake up many people and spread the use of 2FA. This is long overdue.

The total cost of the SEC’s failure was $30 billion wiped from market capitalization as $90 million worth of open positions were liquidated. Of course, the SEC has not apologized for its failures and will likely face legal consequences. In a provocative twist, this Bitcoin-inspired scandal could not only lead to us getting ETFs approved, but it could also lead to the SEC scrapping the peg.

Bitcoin market capitalization inflow multiple

Bitcoin ETF’s estimated inflows on the first day of trading are expected to be huge. The issuers have publicly stated that they are raising $312.9 million to date. This is a commitment by a private player to immediately create shares to ensure liquidity. This does not include other funds arising from regular transactions.

The fee structure submitted by the issuer this week includes provisions for an introductory period based on inflows of assets under management. For example, ARK offers a 0.0% management fee for the first six months or up to $1 billion in AUM. Invesco offers 0.0% for 6 months or $5 billion AUM. This means that they expect the period and AUM to be realistic expectations. Together, these special fee discounts add up to $13 billion in projected AUM growth over the first 6 to 12 months for just the five issuers. This does not exactly mean inflows as previously purchased Bitcoin will appreciate being added to the AUM.

Source: @JSeyff

Compared to $25 trillion in total issuer AUM, seed funding is small potatoes. If 1% flows into Bitcoin ETFs in the first 12 months, that would be worth $250 billion.

Near the 2021 ATH, Bank of America released a study showing that Bitcoin offers a 118x multiplier to market capitalization inflows. So, for every $1 million in new purchases, the market capitalization increases by $118 million. The multiplier depends on various factors including inflow rate, number of Bitcoins available on the exchange, block reward, etc. Bank of America estimated when there were 2.7 million BTC on exchanges, there are now only 1.8 million, or 607,000 if you only consider the major U.S. exchanges Coinbase, Gemini, and Kraken. This means that this time the multiplier may be greater than 118x.

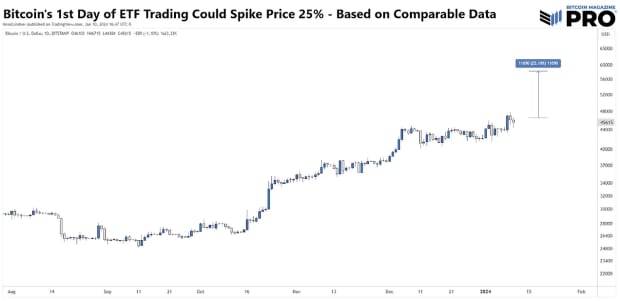

The launch, the largest single ETF in history, brought in $2 billion. The Bitcoin ETF event promises to be bigger than that, as it is a group of 11 ETFs and is a new asset class. So $2 billion is a conservative number, but we’ll use it for our purposes here. $2 billion x 118 means a market value of $236 billion on day one. As of this writing, its market capitalization is $900 billion. That means the first day’s change could be as much as 25%, which would be $58,000.

Deindustrialization in Germany

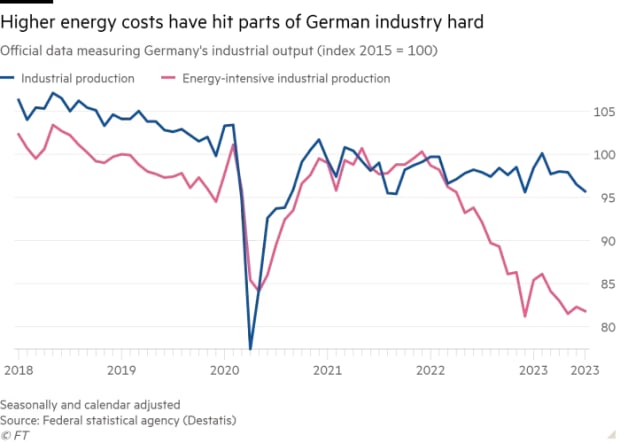

It’s happening because people think it can’t happen. Some Germans are beginning to understand the impact of deglobalization on their economic model and the impact communist climate policies will have on heavy industry. Large companies such as BASF, Linde and Volkswagen all have plans to move out of Germany. Energy-intensive industrial production is being hit the worst. 2024 will be the year of a major global recession.

Source: Financial Times

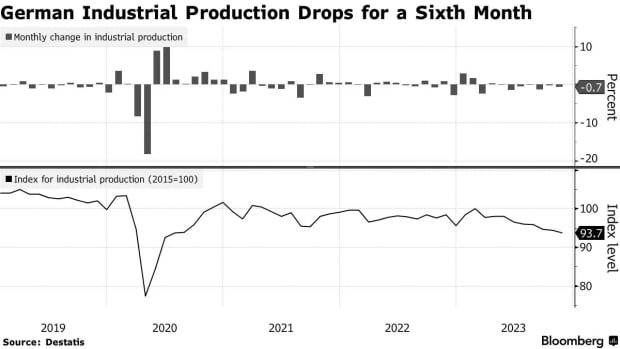

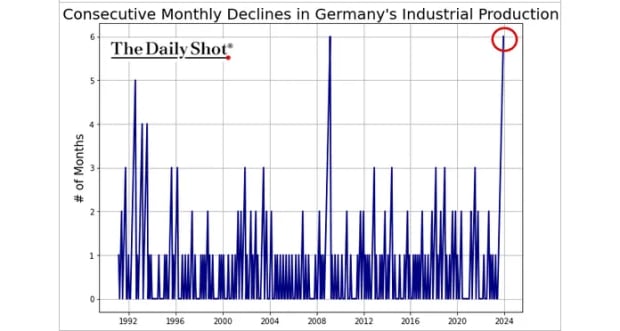

The latest figures for November marked the sixth consecutive month of recorded industrial production, the worst since the financial crisis.

Source: Bloomberg

Source: @SoberLook

Taiwan elections and China’s economic disaster

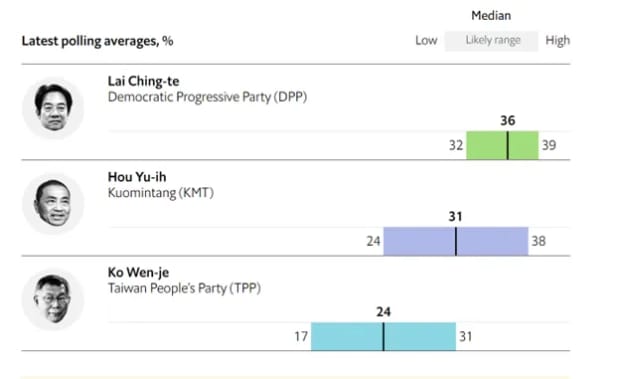

One of the most important elections of the year takes place in Taiwan on Saturday. Currently, it is a three-way presidential primary with Lai Qingde of the Democratic Progressive Party, which has strong anti-China tendencies, as the frontrunner. He is friendly to the United States and will be a thorn in the side of the Chinese Communist Party. To be sure, China invested heavily in stopping him and spreading propaganda within Taiwan. Nevertheless, anti-China candidates are still preferred.

Source: NHK Japan Broadcasting Corporation

Source: Fulcrum Asset Management

This election, as you can imagine, has global consequences. In a Bloomberg article yesterday, they highlighted how Lai’s election could lead directly to conflict with China, potentially costing the global economy $10 trillion.

This is happening as the Chinese economy collapses. Their blue-chip stock market CSI 300 recently hit a five-year low, a stark contrast to US stock markets rising near ATH.

Source: Yahoo Finance

Finally, the 2023 Foreign Direct Investment (FDI) numbers are out and they are a disaster. Money is leaving China at the fastest rate in modern history. All of this means that Taiwan’s election and China’s economic pressure could push the world closer to conflict over Taiwan.

Source: @Geo_papic