- Network activity decreases, indicating low demand for TON.

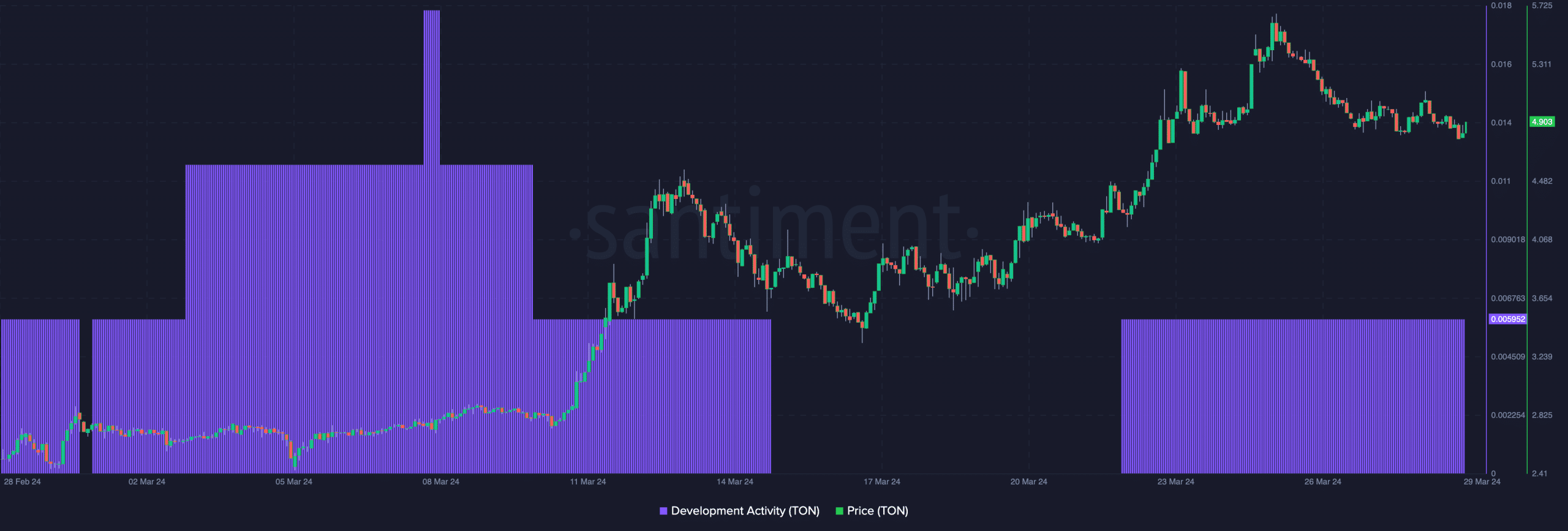

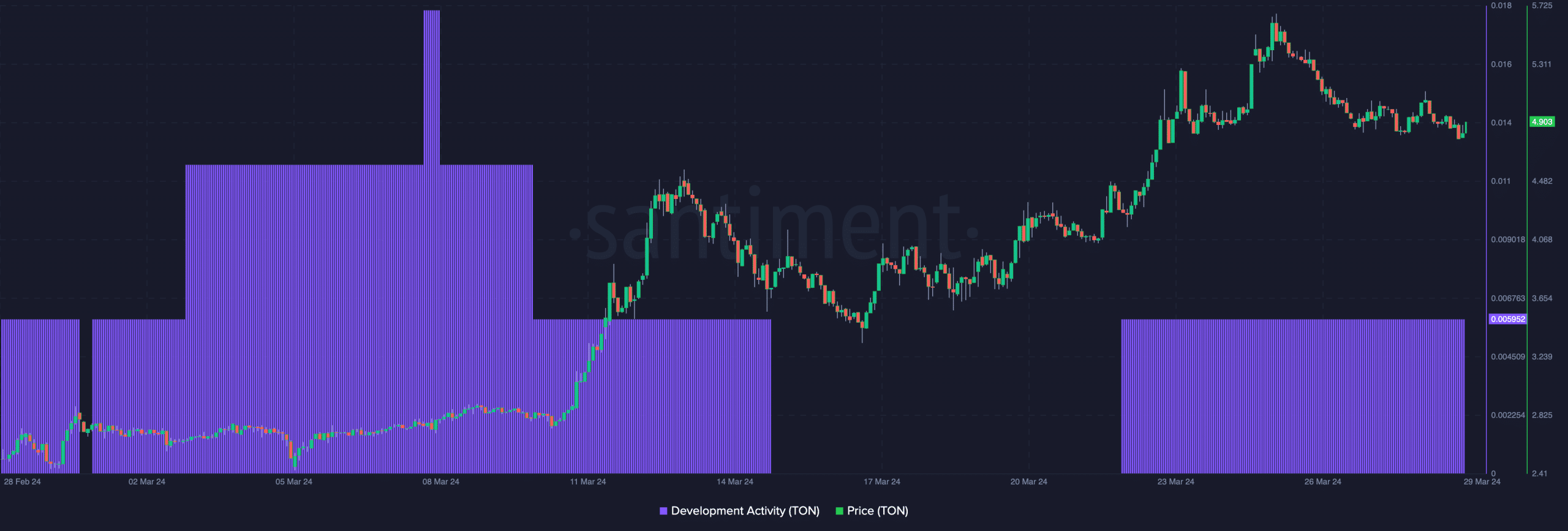

- The high-profile announcement did not have a good impact on Toncoin’s development activities.

Toncoin’s (TON) native token was one of the cryptocurrencies with eye-catching performance this week. At press time, the price of TON was $4.82, up 8.34%.

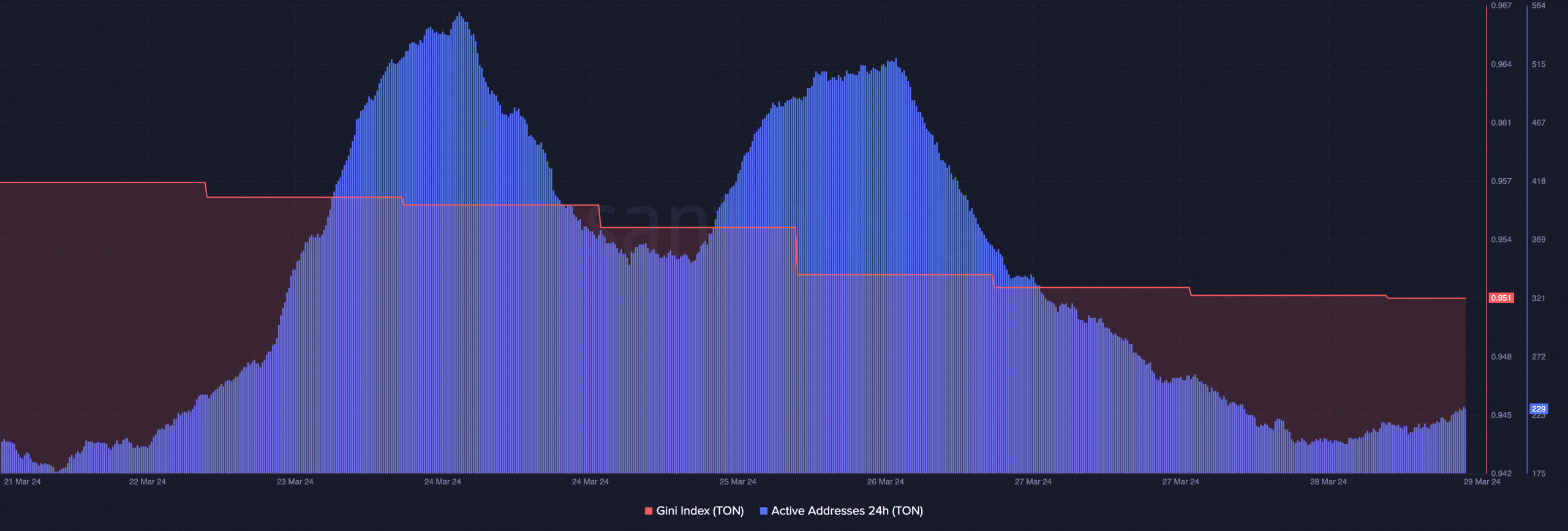

However, AMBCrypto’s analysis shows that the upward trajectory may be collapsing. According to the findings, activity on the Toncoin blockchain reached impeccable levels on March 26th.

TON is stuck in a rut.

However, when we checked the data at the time of reporting, the situation changed. As of this writing, the network’s 24-hour active addresses are nowhere near the peaks mentioned above.

Active addresses represent the daily level at which users interact with your project. As the metric increases, the number of unique addresses involved in a transaction increases.

Therefore, a decrease in network activity means a decrease in demand for TON. On the price side, falling demand is a bearish signal. Therefore, if activity remains low, Toncoin’s price action could be negatively impacted.

Another indicator supporting the bearish thesis was the Gini Index. For the uninitiated, the index measures the distribution of coins across addresses.

Source: Santiment

Typically, a decrease in the Gini index is a sign that token holders are cashing out. On the other hand, increase means accumulation.

At the time of reporting, TON’s index had been declining since March 24th. According to the definition above, this means that participants’ perception of the token is no longer optimistic.

If this lack of trust continues, the price of TON may adjust. However, optimistic sentiments still exist due to recent developments around the project.

It’s network open season

On March 27, 21 Shares, the world’s largest ETP issuer, announced the launch of Toncoin staking ETP. ETP stands for Exchange Traded Products and refers to financial products integrated on an exchange.

According to an official statement, the company noted that Toncoin’s decentralized and open network nature made it a suitable choice. It said,

“With our ETP, investors can now enjoy the benefits of Toncoin staking while leveraging the liquidity and convenience of traditional financial markets.”

Despite the launch, network development activity has stalled. As of this writing, Santiment has a development activity index of uniform 0.0059. This was evidence that Toncoin had not upgraded significantly recently.

Source: Santiment

Is your portfolio green? Check out our Toncoin Profit Calculator

If this remains the same, the price of TON may not reach $5.61 as it did a few days ago. Meanwhile, traders debated the price potential.

In some cases, TON may experience a short-term downward trend. However, on the optimistic side, we believe that the development team can help attract more users and scale up TON’s adoption.