- Whale activities and falling reserves suggested the possibility of restricted AR sales pressure and rebound.

- The impression of the active address suggests an increase in demand, while the long liquidation indicates the pressure of weakness.

A significant whale activity has been stuck Unkap (UNI) Recent market. In fact, certain whales were disabled for 3.5 months and purchased 290,212 UNI for 1,000 ETH ($ 1.97m). These large -scale transactions are signs of new interest in the UNI and positive emotions throughout the market.

In the press time, the UNI has been traded at $ 6.82 with a slight 0.13% hiking for the last 24 hours. This whale movement is often a sign of market change. This is especially because large players may affect price behaviors.

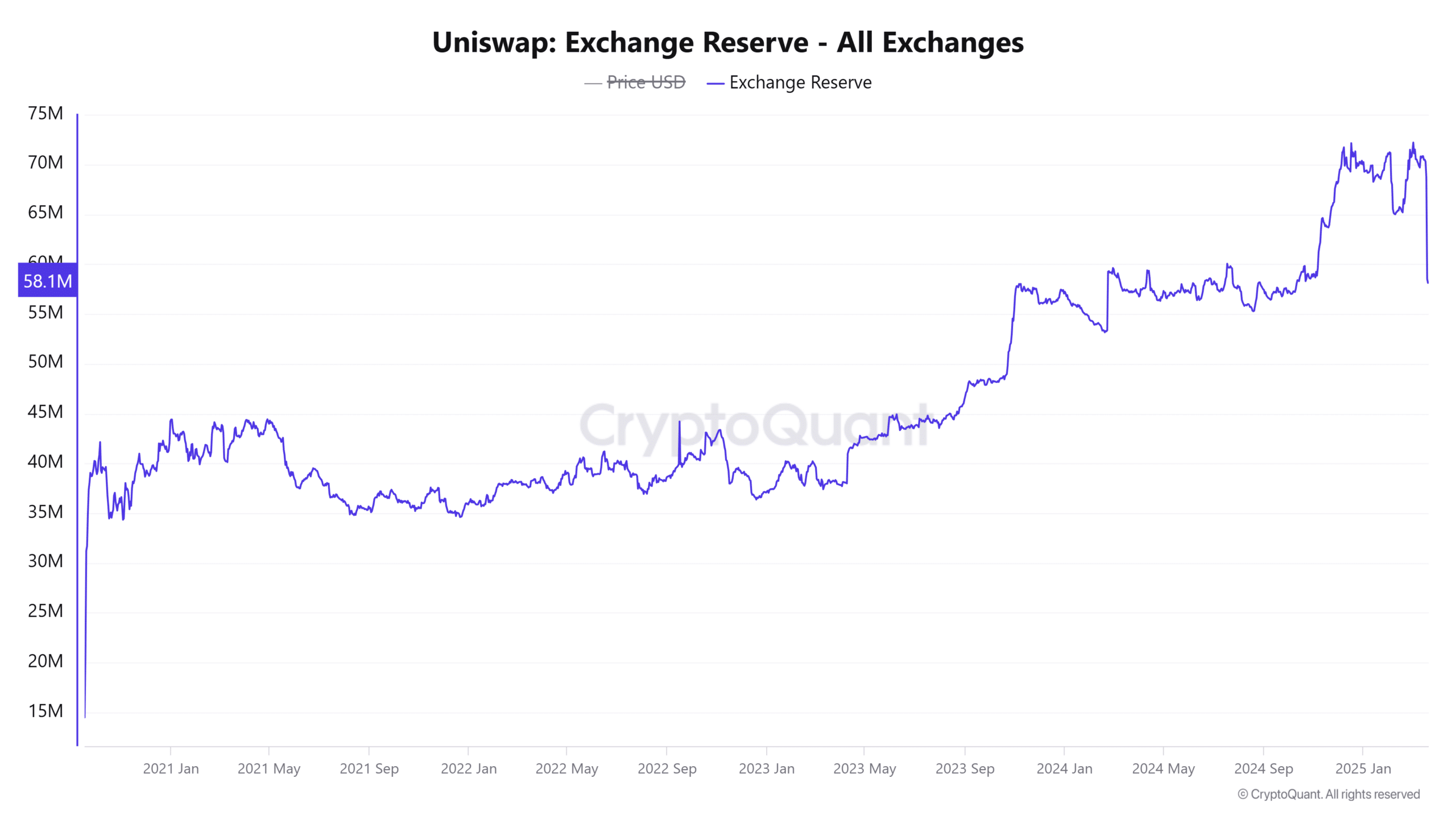

UNI’s EXCHANGE REDERVE has decreased by 15% over the last 24 hours, resulting in a drop in sales pressure. Reducing the coins available for exchange reduces liquidity. This usually reduces the liquidity that supports prices.

The less UNI coins can be sold, so it can help to limit significant downward movement, assuming that demand is consistent. Therefore, reduction in reserves can mean some support for price stability or potential recovery. Especially when demand increases in the entire market.

Source: cryptoquant

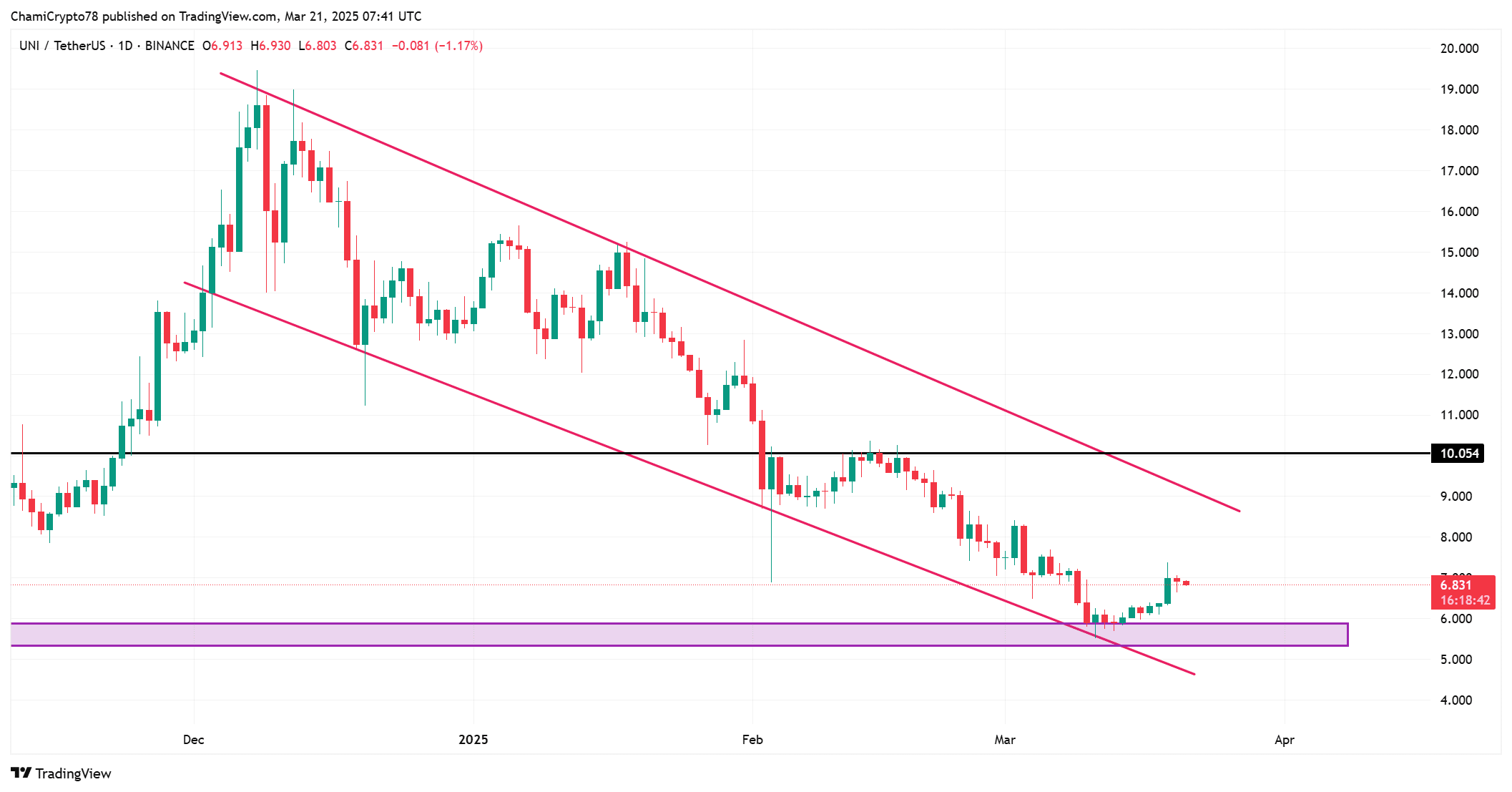

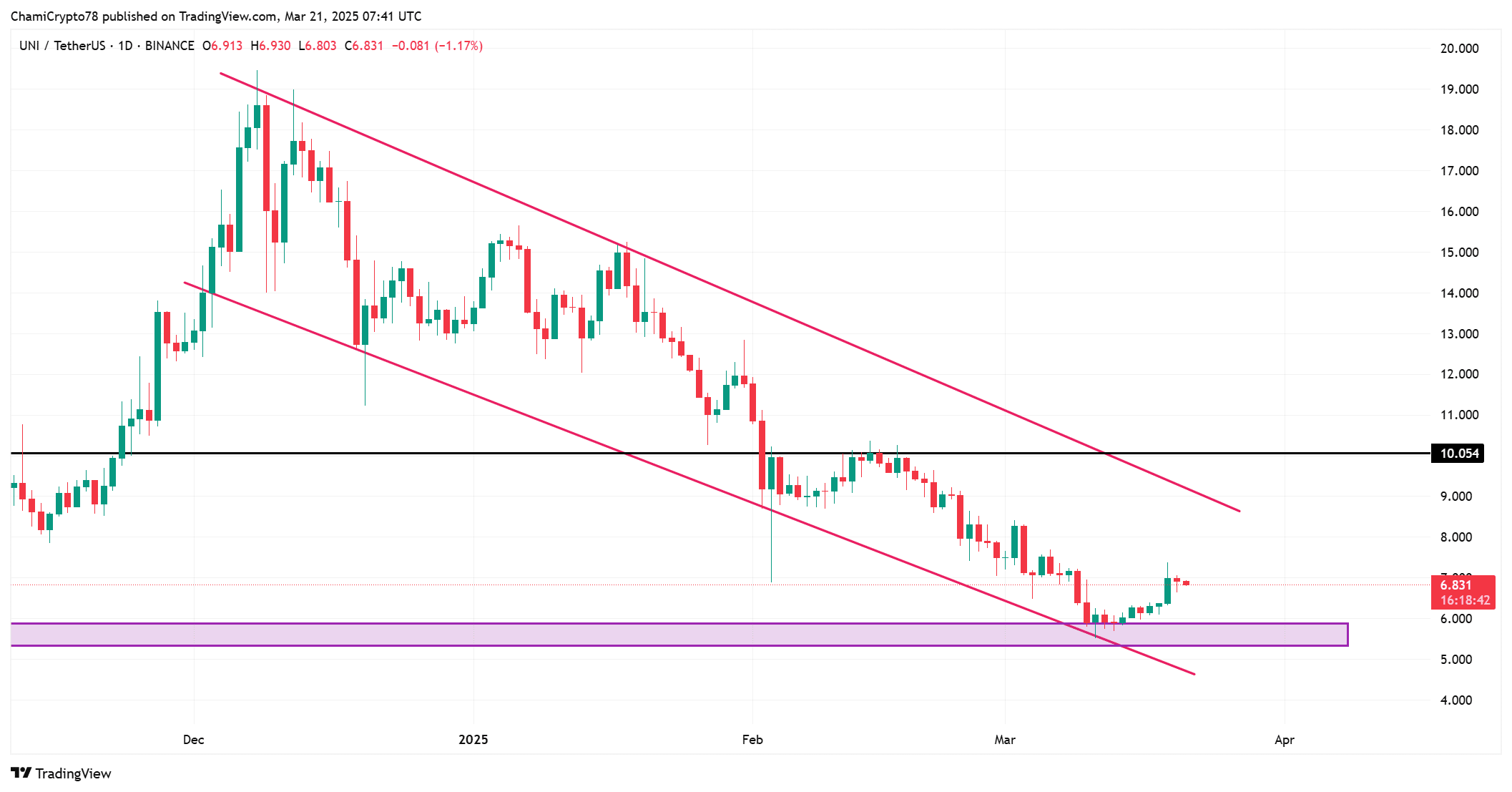

Uni’s price outlook -Is there a rebound on the horizon?

If you look at Uni’s chart, there seems to be signs of potential rebound. The price of UNI has reached important support levels as price behavior has risen over the last few days.

If the price continues to increase the level of press time support, potential migration may occur.

In addition, the price can be tested near the upper boundary of the down channel, and rest of $ 10.05 or higher suggests a stronger trend. Therefore, the market situation may not be clear, but the chart showed promising signs of potential rebounds in the near future.

Source: TradingView

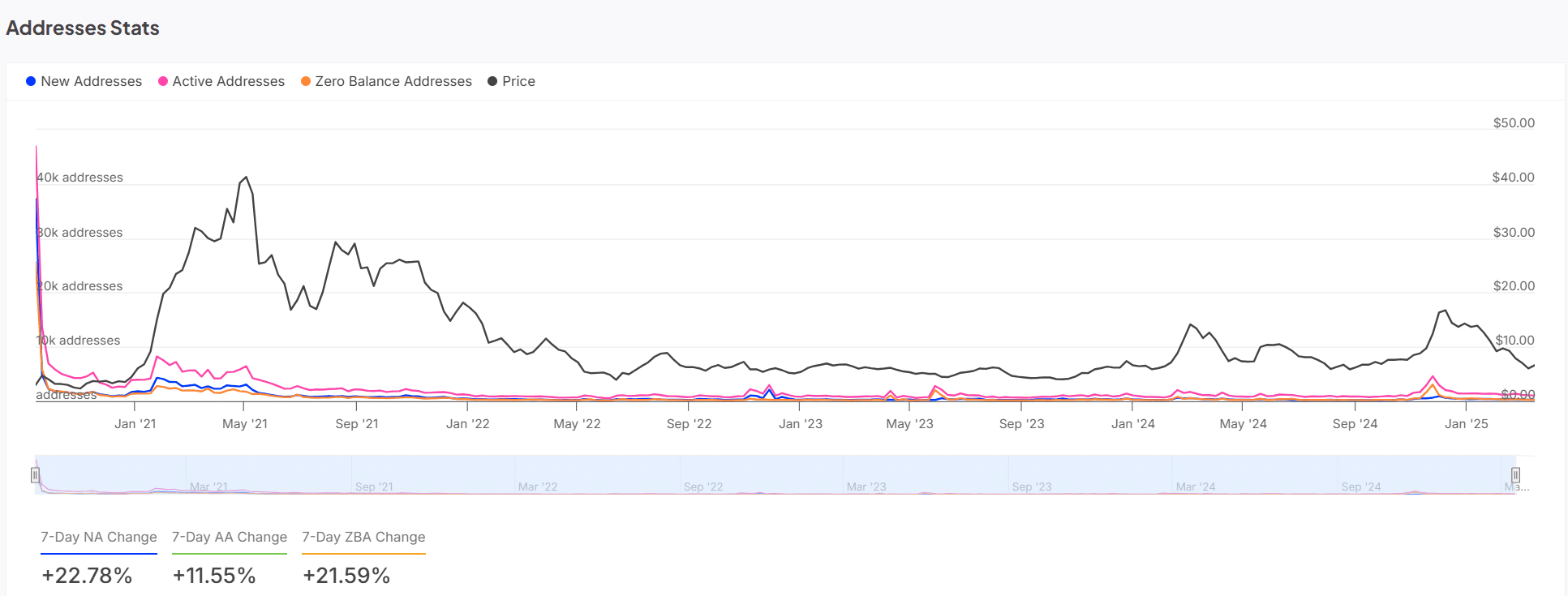

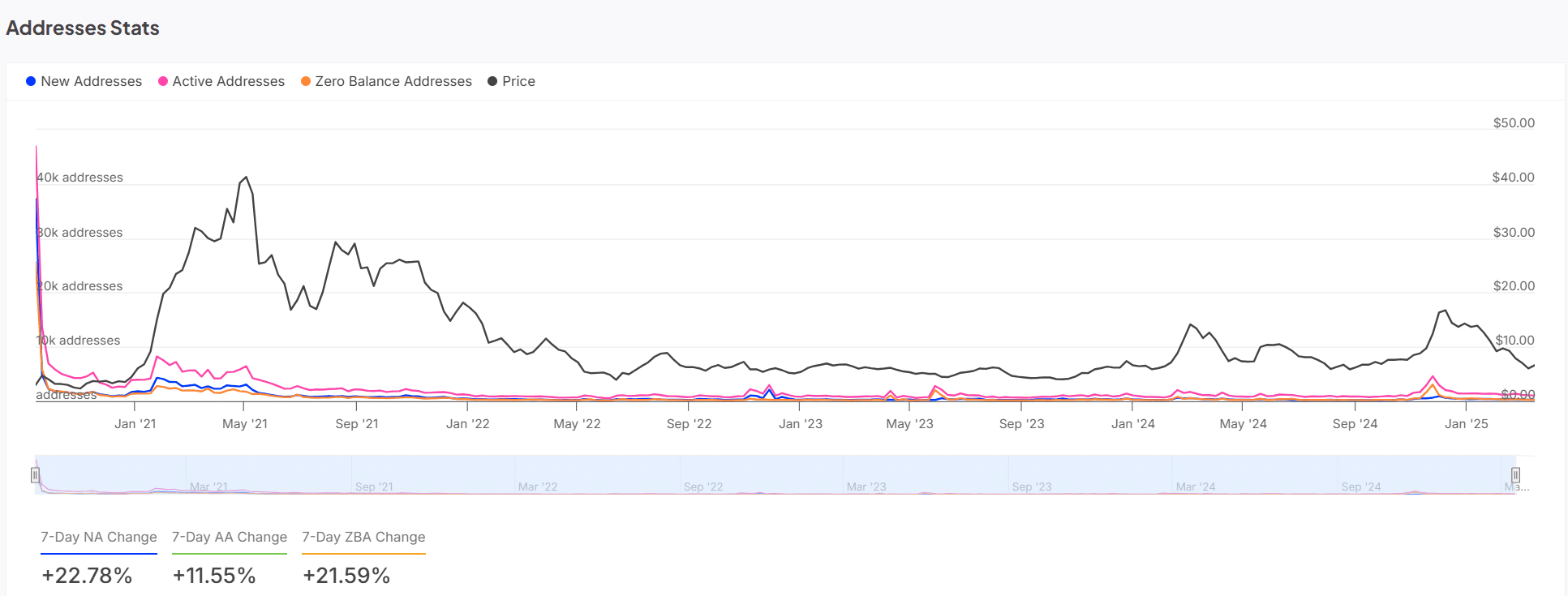

UNI address statistics and analysis

UNI’s address statistics have been further suggested in a positive trend. Over the last week, new addresses have surged by 22.78%, and active addresses have increased 11.55%.

The impression of this active address indicates that more investors are participating in the Uni market. The rise in new speeches and active speeches has shown that demand is increasing. This can borrow the necessary support for the price rebound on the chart.

Source: INTOTHEBLOCK

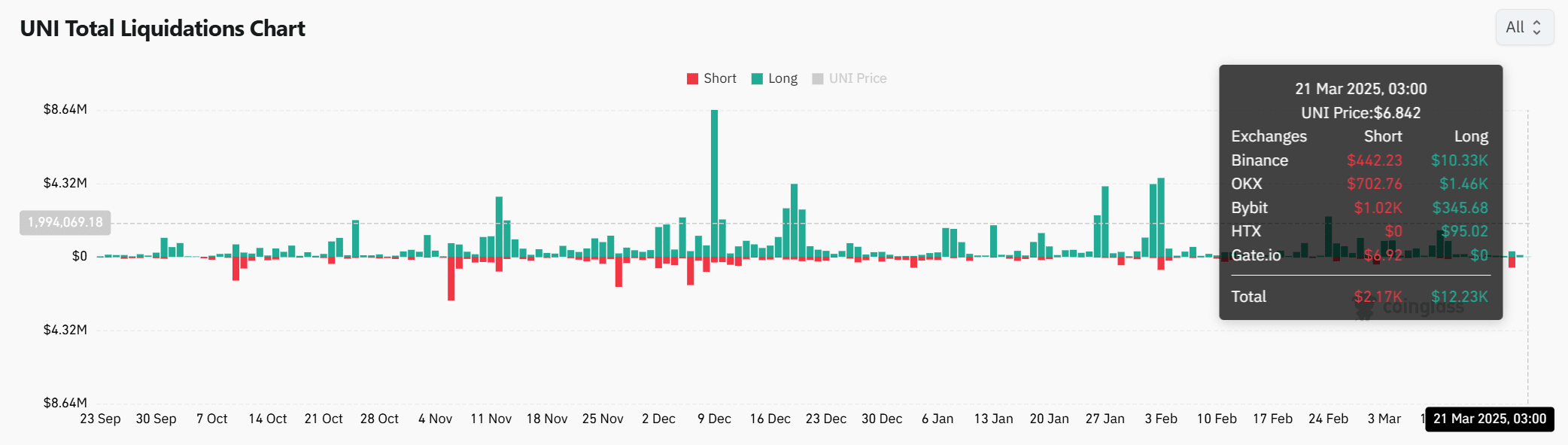

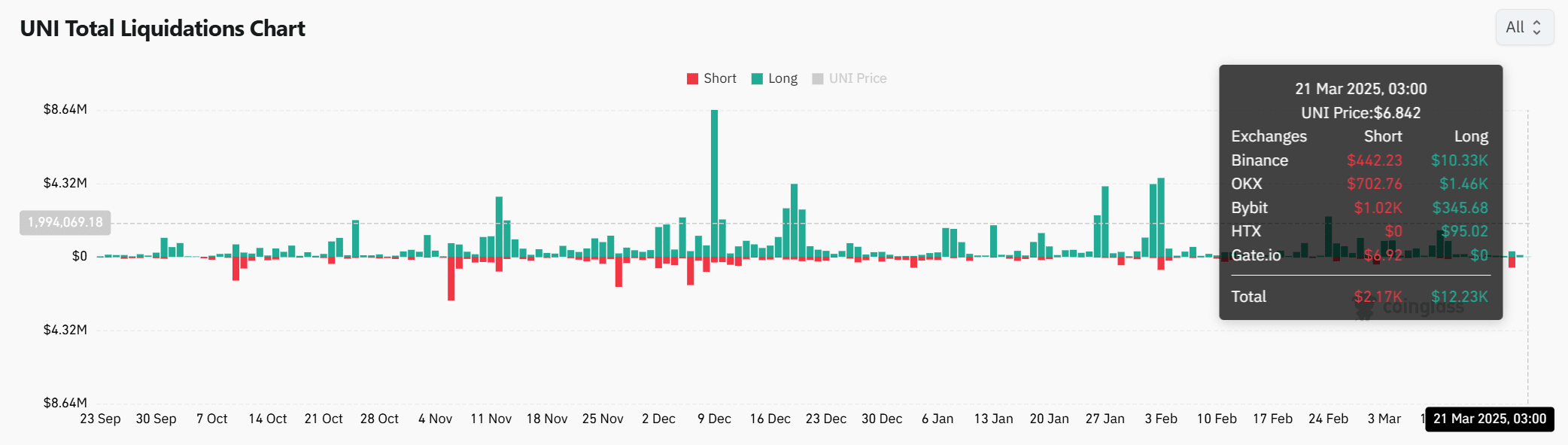

Long liquidation vs. short liquidation -What do you suggest?

Finally, according to the liquidation data, the long position is more pressure than a short position than a short position, and the short liquid is $ 12.23K compared to a short liquid of $ 2.17K. This indicates that market feelings can be crooked towards weakness. In particular, more traders who bet on price hikes must be liquidated.

Although long liquids have been implicitly suggested by potential falling pressure, the impression of active addresses and fall reserves suggests that demand can stabilize prices or even rebound.

Source: COINGLASS

At the time of writing, the UNI seemed to show promising signs of potential rebound, despite the fact that it faced liquidity issues and sold pressure. According to whale activities, address statistics hiking and liquidation data, interest in UNI may be new.

As investors’ participation increases, the level of support is likely to be maintained. This can lead to price recovery in the short term. Therefore, despite the liquidity constraint, there may be uni -uni -the -future migration.